In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

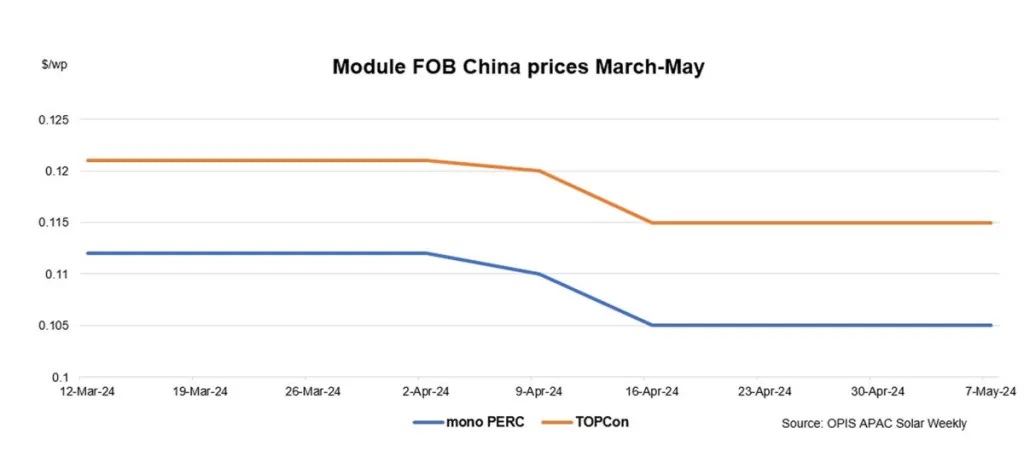

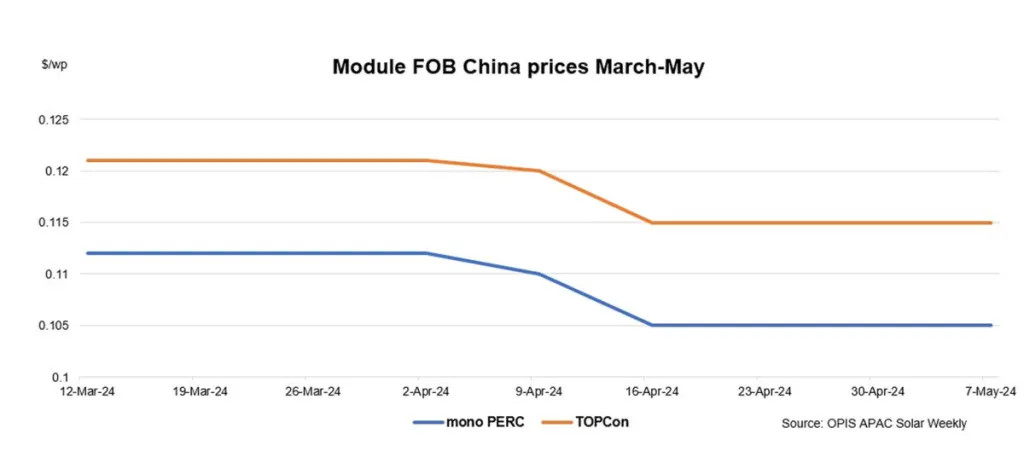

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China and mono PERC module prices held steady at $0.115 per W and $0.105/W, respectively.

Market activity in the Chinese market has yet to pick up although Chinese solar companies have returned after the Labour Day holidays. Trading remained subdued with few buyers in the market and these buyers were mostly bargain hunting, a market source said.

Demand remained weak as upstream prices across the solar value chain had previously extended losses before the Labour Day holidays. Although upstream prices held steady this week in a quiet market, market sources expect prices to fall in the coming days as trading activity resumes.

Module prices are expected to continue a downtrend amid weakness in the upstream sector, concurred many during OPIS’ weekly market survey. However, other market participants pointed out that module prices have already fallen below the cost of production which stands at about $0.126/W, and there is no longer any room for further price declines.

There is the expectation that mono PERC prices will continue to hold steady as supply will gradually tighten with demand shifting towards TOPCon modules. The limited availability of mono PERC modules could result in mono PERC prices trading higher, a market veteran said.

Module manufacturers may reduce their operating rates in May to mitigate falling prices and restore the supply/demand balance in the market. Previously in April, the operating rates of module manufacturers were between 70% and 100%.

The global solar cell and module manufacturing industry is currently operating at a utilization rate of approximately 50%, according to the EIA.

Trading activity for Southeast Asian modules has been limited as uncertainty persists regarding antidumping/countervailing duties (AD/CVD). Buyers are adopting a wait-and-see approach regarding policy development and there are relatively few new contracts signed recently, a Southeast Asian module producer said.

Another market participant noted that module prices will likely rise in anticipation of the potential duties. Nonetheless, these anticipated price increases have yet to impact the market as buyers remain hesitant to secure new contracts due to high inventory levels in the United States.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.