GlobalData analysis of 2023 trends shows that packaging companies are grappling with new technologies and environmental requirements.

Analysis of key trends and indicators in the packaging sector during 2023 reveals an industry driven by geographical expansion and increasing product diversity.

Facing external pressure from consumers and regulatory bodies, companies are grappling with the role of new technologies, and the environmental responsibilities faced by manufacturers.

Trends in mergers and acquisitions (M&A), as well as priorities reflected in hirings, demonstrate that the US packaging industry continues to outperform its global competitors, particularly in the supply chain. However, Italy, Canada, Germany and India remain competitive in the global packaging scene, and the UK has shown itself to be particularly impactful in the digitalization sector.

M&A trends

According to data from GlobalData, Packaging Gateway’s parent company, there were 297 M&A deals completed in the packaging sector in 2023, worth a total of $27.8bn.

Of the packaging trends evident across these 2023 deals, Rory Gopsill, Analyst at GlobalData, explains: “Scaling or expanding business was the most common M&A rational, followed by geographic expansion, growing product portfolios, and restructuring business.”

The prioritization of geographic expansion and restructuring was evident in the biggest deal announced this year: in September 2023, Smurfit Kappa’s purchased Westrock for $19.9bn. The merger – not due to be completed until December 2024 – will look “to build a leading global platform,” according to David Sewell, CEO of WestRock, and to “present a truly comprehensive offering of packaging solutions for customers.”

Geographically, the US was the leading country in terms of packaging M&A volume, with 96 deals made across the year worth a total of $13.3bn. This figure significantly outstrips the UK, for which GlobalData identified the second highest number of deals, with 29 deals worth $60m, and Germany, with 15 deals worth $186m.

The US was followed by the UK, Italy, Canada, Germany and India in number and value of M&A deals across 2023.

AI in packaging

Artificial Intelligence (AI) has been a driving theme across industries, and GlobalData expects the AI market to grow from $81bn in 2022 to $909bn by 2030, with a 35% CAGR across the 2022-30 period. It reports that “generative AI is likely to pose a threat to every business across every sector in the coming years.”

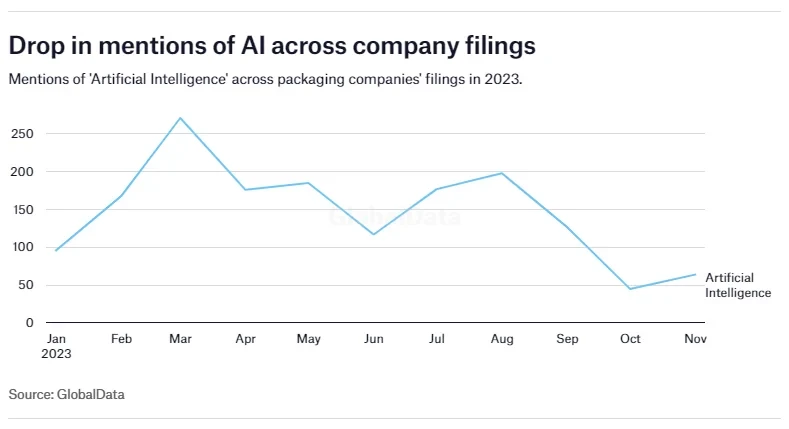

However, Gopsill notes that the impact of the trend in packaging in 2023 was surprisingly minimal: “AI-related hiring, patent publications, and filing discussions by packaging companies all decelerated between 2022 and 2023. This shows recent advances in generative AI have not translated to increased AI investments by packaging companies. This is because no new generative AI use cases have emerged that are yet suitable for broad adoption by packaging companies.”

He explains that this is because AI is not new to the packaging industry; instead it has been incrementally integrated into packaging business: “The key use cases of AI within the packaging sector – data analytics, predictive maintenance, computer vision, robotics, and facility management – have been around for some time, and AI-related hiring and patent publications in the packaging sector have grown over the last five years as these technologies have matured.”

The packaging industry then has seen relatively small disruption around AI but could be set to see change as the area evolves.

Hiring trends

Key developing areas have driven hiring trends across the packaging sector in 2023. In particular, these include the supply chain, which maintained over 2,500 jobs in the US alone throughout the year. Geographically, the supply chain saw the biggest increase in hires in Germany, which jumped from 124 tracked roles in January 2023, to 316 in July.

Environmental, social, and corporate governance (ESG) has also led in hires, as the packaging industry continues to come under pressure to find solutions to the plastic problem. The US again dominated in hires across the sector, peaking at 5,855 active roles in ESG in June 2023, while Canada saw a notable decrease over the year. Starting the year with 425 ESG-related roles, the Canadian packaging sector had only 131 positions still active by November 2023.

Digitalization also proved to be a noteworthy trend in packaging, with the UK consolidating its role as a leader, with 246 active roles in December 2023, significantly above Germany’s 49 and Italy’s 33.

Across all areas, the US was the leading location of new jobs, followed by Germany and the UK.

Having researched which companies were noteworthy within packaging hires, Gopsill comments: “Ball Corp, Avery Dennison, Ardagh Group, Amcor and International Paper were the leading hirers. Maintenance and repair workers were the most common occupation, followed by machinists, miscellaneous production workers, production, planning and expediting clerks, and laborers and material movers.”

Share performance

Some companies have seen a significant percentage growth in share price over the last twelve months. These include the Packaging Corporation of America, Berry Global and Ball Corporation, all of which are in the top twenty largest packaging companies globally.

Also among the top twenty – and having seen noteworthy growth in share price since December 2022 – are Westrock (which announced its plan to merge with Smurfit Kappa in September in the biggest deal of the sector this year) and Crown Holdings, which recently acquired Helvetia Packaging, a beverage can and end manufacturing facility in Saarlouis, Germany.

However, of the top twenty, several also saw a significant drop in share price in 2023. These include Amcor – which agreed to acquire Phoenix Flexibles in August – Ardagh, Silgan, UPM-Kymmene and Stora Enso, which opened a new corrugated packaging production factory in the Netherlands in June.

Source from Packaging Gateway

Disclaimer: The information set forth above is provided by packaging-gateway.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.