In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

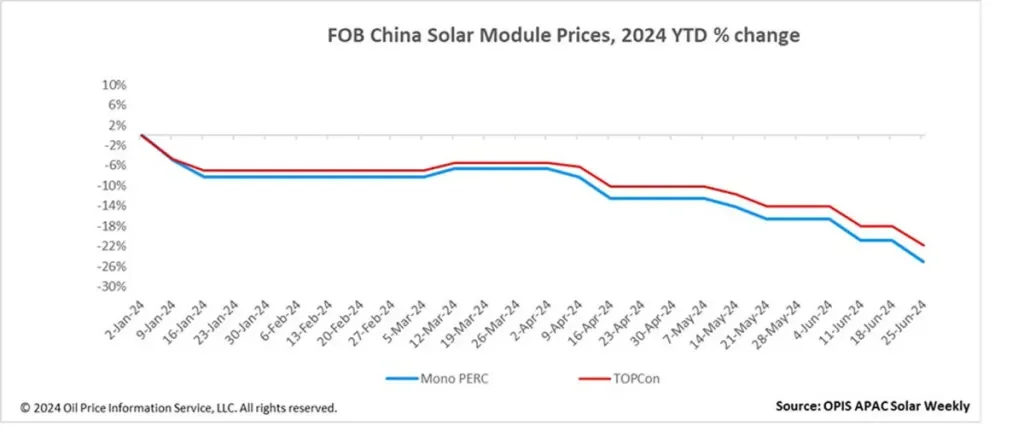

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China was assessed at $0.100/W, down $0.005/W week-to-week. Mono PERC module prices were assessed at $0.090/W, down $0.005/W from the previous week. The new record lows for both prices according to OPIS data comes as market activity remains subdued on low demand.

Module makers have reduced prices in a bid to secure new orders and maintain cash flow with tradable indications for TOPCon modules heard at $0.10/W Free-on-Board (FOB) China.

Solar modules exported to Europe continue to contend with elevated freight rates on matters in the Red Sea. OPIS heard freight rates of about $0.0164-0.0175/W (about high $6,000s-$7,000/FEU) for shipments from Shanghai to Rotterdam. While this has affected shipments, it presents an opportunity for module sellers to reduce their inventories in Europe.

A market observer said that prices during Intersolar did not move and remained around $0.10/W FOB China (+/-0.3cts) and that despite the high installations season just starting, the installation demand for Europe this year did not seem very strong, at least in the utility-scale space.

Latin America continues to look weak with the price competition in this market described as “intense” by a module seller. Prices in the Brazilian market are generally lower than in other markets as buyers are price-sensitive. TOPCon prices to Brazil had fallen to the range of $0.08-0.09/W FOB China with prices at the low end offered by Tier2-3 module sellers, the module seller added.

A buyer noted that current U.S. Delivered Duty Paid (DDP) TOPCon prices have risen to the low-to-mid $0.30/W range. This pricing includes the 201 bifacial tariffs but excludes the new antidumping/countervailing duties. With the exemption set to lapse mid-week, another market source told OPIS that “any new deals would be subject to the 14.25% Section 201 tariffs and will likely push pricing into the mid $0.30s/W in 2024”.

Domestic Chinese demand remained weak amid mounting inventory pressure. Further price cuts in the coming weeks were expected as module sellers clear inventories to generate cash flow. The majority of market participants OPIS surveyed expected TOPCon prices to drop below CNY0.8/W or $0.099/W on a FOB China equivalent, which is the current cost of production for integrated producers.

Although local demand was expected to improve slightly in the third quarter amid the peak installation period, it was anticipated to be insufficient to support any price gains, market participants said.

The operating rates of integrated module sellers remained between 60-80%, according to the Silicon Industry of China Nonferrous Metals Industry Association. Estimates of June module production capacity stood at 50 GW, down from 52 GW previously expected and down 5 GW from May, the association said.

China exported 83.3 GW of modules in the period January-April marking a year-on-year increase of 20%, according to latest data from China’s Ministry of Industry and Information Technology. The total value of the module shipments for the period January-April reached $12.7 billion.

Looking ahead in the FOB China market, broader bearish conditions prevent any upticks in module prices in the short term although continued production cuts into July could give some respite to supply pressures.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.

Afrikaans

Afrikaans አማርኛ

አማርኛ العربية

العربية বাংলা

বাংলা Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch हिन्दी

हिन्दी Bahasa Indonesia

Bahasa Indonesia Italiano

Italiano 日本語

日本語 한국어

한국어 Bahasa Melayu

Bahasa Melayu മലയാളം

മലയാളം پښتو

پښتو فارسی

فارسی Polski

Polski Português

Português Русский

Русский Español

Español Kiswahili

Kiswahili ไทย

ไทย Türkçe

Türkçe اردو

اردو Tiếng Việt

Tiếng Việt isiXhosa

isiXhosa Zulu

Zulu