Shipment volumes are growing in the global solar tracker market as innovation in project development drives demand. Joe Steveni, of S&P Global Commodity Insights, takes a look at the factors shaping the commercial landscape for trackers, from agrivoltaics and undulating terrain to Indian ambition and the United States’ Inflation Reduction Act.

Image: Image: S&P Global Commodity Insights

From pv magazine print edition 7/24

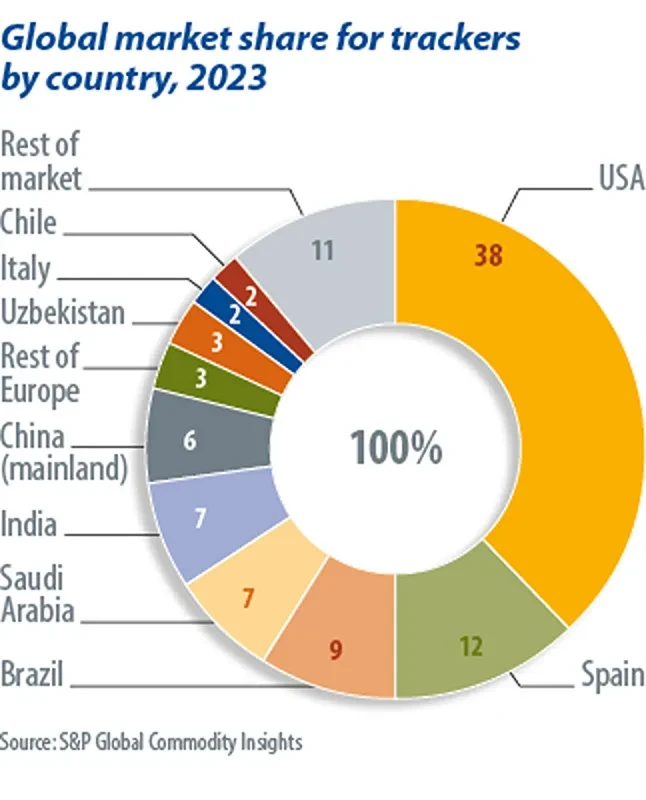

The global solar tracker market reached 94 GW in shipments terms in 2023, which is an increase from 73 GW in 2022. This was driven by growth outside of the three biggest tracker markets: the United States, Spain, and Brazil. The Saudi Arabian and Indian markets in particular saw high year-on-year growth, driven by increased demand from developers and an uptick in utility-scale installations. These markets were ranked the fourth- and fifth-largest for tracker shipments (see chart above).

Most tracker shipments are concentrated within the 45-degree latitude lines. This is because using trackers requires north-south oriented rows which track the sun from east to west. In using trackers instead of fixed tilt systems, you lose the ability to tilt the solar panels north or south toward the sun. Hence, using trackers reduces yield further from the equator.

Two-in-portrait (2P)-oriented tracker products attach twice as many solar modules per length of the tracker row. Approximately 15% of tracker shipments in 2023 were 2P globally but in Europe that number jumped to 30%. This is due to land constraints in certain European markets as 2P requires fewer piles per kilowatt-peak of generation capacity. Some projects also signed contracts a few years ago when 2P products were used more frequently, which helps explain this preference.

Driving innovation

Innovation continues to drive the solar tracker market. In the field of agrivoltaics, it’s common to see projects with tracker rows spaced eight metres to 15 metres apart with a special vertical “harvest” position, so that farming vehicles can access the land. There are added constraints determining the minimum height of trackers. For fruit farms, there are overhead tracker designs which control how much sunlight reaches the product. These consider more inputs, such as the crop, temperature, and evaporation levels and must have a more complex tracking algorithm to match.

Another area of innovation is prefabrication, initially used to reduce labor requirements and improve installation speeds. New products are emerging that require only a few days per megawatt of generation capacity to be installed by 10 to 20 unskilled labourers. These products typically don’t use piles and are designed to fit a precise number of modules into a single shipping container. Importantly, these products can be repackaged into a container and moved to another site. This is extremely useful for off-grid applications where future electricity demand is unpredictable, such as onsite generation at mines.

Tracker suppliers are also releasing terrain-following products which are suited to undulating land. This reduces the amount of cut-and-fill required to level ground and ensures that projects do not need different lengths of foundation piles. This also opens the possibility of developing projects in hilly locations.

Global growth

S&P Global forecasts 752 GW of tracker installations between 2024 and 2030, with an increasing amount coming from the Asia-Pacific and Europe, Middle East, and Africa regions. Mainland China is forecast to slowly increase tracker uptake, shifting from its historic fixed-tilt preference as trust in tracker technology grows. Saudi Arabia already has high uptake of trackers. Strong growth in the utility-scale segment, complemented by potential green hydrogen sites toward 2030, will further drive tracker shipments. India has started to see rising tracker uptake with growing confidence in the technology driven by relationships between major tracker suppliers and local engineering, procurement, and construction companies. India is also close to the equator and has low labor costs which makes it ideal for trackers, due to lower installation and operation and maintenance costs related to labour. However, utility-scale installations in both Spain and Brazil are expected to decrease by 2030, driven by grid challenges and falling power purchase agreement prices, respectively.

S&P Global said the United States will account for 39% of tracker installations throughout the 2024-2030 period (see chart right). Currently, in the United States, the Inflation Reduction Act (IRA) provides incentives in the form of tax credits, often called “adders,” to increase domestic manufacturing. The IRA breaks down approximate cost percentages for different components of a utility-scale solar project. The three main segments are modules, trackers, and inverters; making up 66%, 9%, and 25% of equipment, respectively. These segments are broken down further into subcategories. In order to qualify for a tax adder, developers are required to have 40% of their project equipment manufactured in the United States, a figure which later rises to a higher percentage. To satisfy this new demand from developers, some tracker suppliers have launched “IRA-friendly” products with a higher proportion of their manufacture based in the United States. Nextracker, Array Technologies, GameChange, PV Hardware, FTC Solar, OMCO Solar, and Nevados all have US manufacturing operations.

The solar tracker industry is set to experience strong growth and fast transformation in the coming years. With evolving markets and manufacturing locations, suppliers will need to continuously innovate to make previously unviable projects feasible. This dynamic landscape presents exciting opportunities for the industry to push boundaries and drive the adoption of solar energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.