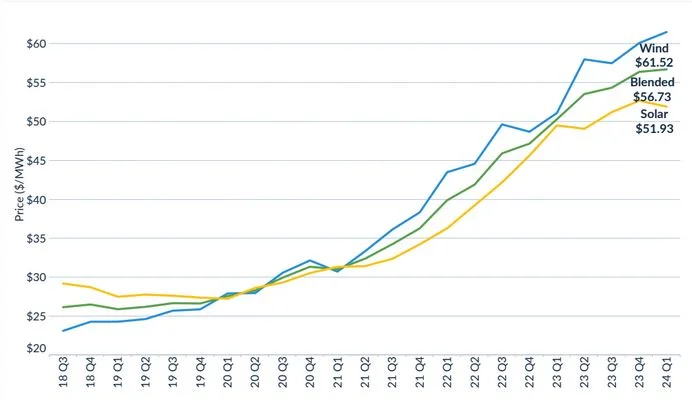

LevelTen Energy says in a new report that solar power purchase agreement (PPA) prices have remained stable in the United States, indicating greater stability after a period of market volatility.

PPA marketplace specialist LevelTen Energy has released a pricing report for the first quarter of 2024, noting greater price stability after years of energy market volatility.

LevelTen Energy reports its data based on P25 pricing, or the 25th percentile of all PPA prices. P25 prices for solar declined by 1.5% over the quarter, while P25 wind prices rose by 2.4%.

Lower natural gas prices from a mild winter and abundant supply of solar modules, combined with market hopes for lower interest rates, allowed developers to offer lower prices in the quarter, according to LevelTen Energy. However, it said that it does not expect this window of opportunity to last indefinitely, as demand from economy-wide electrification and data-center demand continues to ramp up.

“More corporations are entering the PPA buyer pool as 2030 sustainability deadlines approach,” said Sam Mumford, energy modeling analyst for LevelTen Energy. “Trade restrictions could impact pricing soon as President Biden’s two-year tariff moratorium on PV components shipped from certain Southeast Asian countries ends in June. Heightened government scrutiny on the solar supply chain could increase costs for developers – with the potential for PPA pricing impacts.”

LevelTen Energy noted that P25 solar prices in Texas, the largest market for utility-scale solar, declined in the quarter by 1.6%. The company said it continues to see positive pricing trends for the market, with consistent levels of high-value offers paired with favorable future capture prices.

California P25 prices declined considerably in the first quarter of 2024, dropping 12.7%. LevelTen Energy said the price drop was driven by a high volume of competitively priced projects under 50 MW that entered the LevelTen marketplace in the first quarter.

In 2023, LevelTen Energy facilitated 42 PPAs, contracting over 98 million MWh of clean electricity from solar and wind. The company said it expects that figure to grow in 2024.

The company said it sees current prices as a window of opportunity for buyers, as Scope 2 emissions deadlines and competition for PPAs increases, potentially pushing prices higher in the near term. LevelTen Energy has developed an accelerated negotiation process for its customers, bringing the typical 12-month (or longer) PPA negotiations down to about 100 days. The accelerated process, called LEAP, has led to 1.5 GW of renewables procurement in a partnership with Google.

“While prices are relatively stable this quarter, they remain high, and companies need options,” said Mumford. “Bundling PPAs and clean energy tax credits together is an emerging alternative for buyers that can make their procurements more financially sustainable.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.