As solar module prices continue to fall, pvXchange.com founder Martin Schachinger explains the difficulties of rebuilding a solar supply chain from scratch in Europe.

Rebuilding a complete value chain for fairly traded solar modules in Europe is a tempting prospect. Numerous local jobs could be created and Europeans may become independent of imports from regions of the world whose values they do not understand. Unfortunately, it will probably remain an unfulfillable dream for the foreseeable future, a wish on Santa’s list that unfortunately went unheeded again this year.

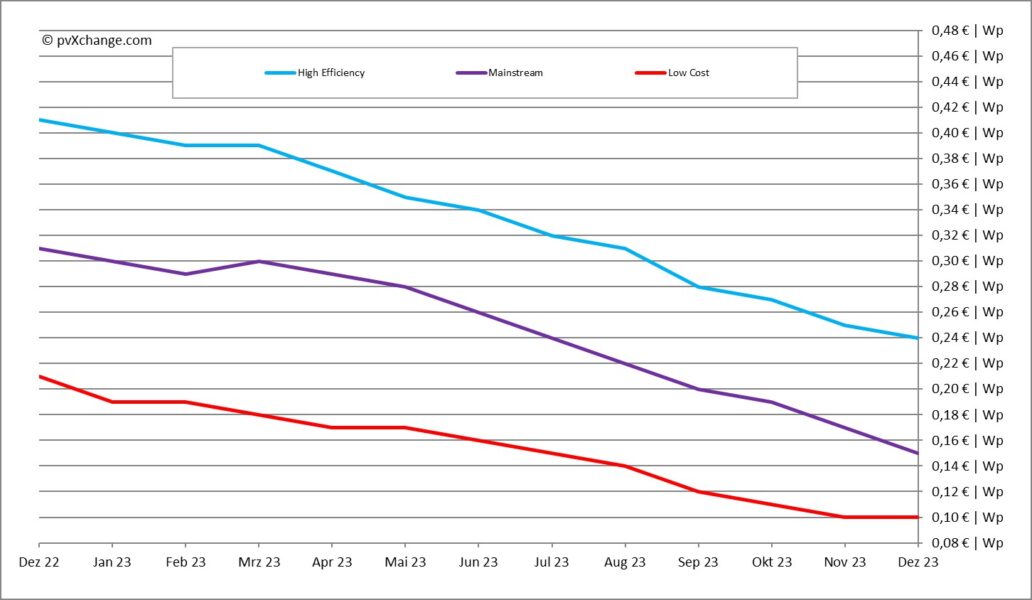

Module prices are too low and show no signs of increasing significantly in the foreseeable future. New goods from the ‘mainstream’ and ‘high efficiency’ sectors have become cheaper again, even if the trend can be seen to be weakening, at least for high-efficiency modules. Delivery and production volumes have apparently been significantly reduced to avoid a further increase in inventories in Europe. For a few products, demand is already exceeding supply, and deliveries are being postponed until next year. However, the situation is different for PERC mainstream modules. Many retailers and manufacturers still have horrendous inventories that need to be reduced. For this purpose, new low-price offers are placed on the market almost every day.

For this reason, one can currently only come to the conclusion that investments in new European production facilities, wherever they should be set up, are not worthwhile in the foreseeable future. In order to be even remotely competitive in terms of price, European products would have to be subsidized for years. Because new production cannot be set up and scaled as quickly as the race against the omnipresent Asian competition would require. The gap with China is already too great and is increasing every day. The concept of economies of scale no longer works here – other ideas are needed.

The costs for such an undertaking would be immense anyway – with an uncertain outcome. If we fail, our situation will be even more disastrous than before the race between unequal opponents began. I therefore advocate a more creative and intelligent approach. Special applications, products adapted to the rules and needs of the construction industry, and multifunctional systems must be developed and brought to market readiness.

The large manufacturers who focus on efficiency and cost savings find this difficult due to the often complex and regionally different requirements. However, there are already numerous such think tanks, these small and flexible manufacturers of special solutions on the continent. Why not take the small but fine manufacturers out of their niche and support and build them up with the already tight budget until they become a truly competitive industry – for intelligently adapted photovoltaic products outside the mainstream?

Overview of the price points differentiated by technology in December 2023 including the changes compared to the previous month (as of Dec. 13, 2023):

About the author: Martin Schachinger studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he set up a business, founding the pvXchange.com online trading platform. The company stocks standard components for new installations and solar modules and inverters that are no longer being produced.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.