Several companies have announced new hydrogen deals in Europe, as Germany moves forward on hydrogen collaboration with Australia and the United Arab Emirates. pv magazine also spoke with Thomas Hillig, managing director of THEnergy, about Europe’s electrolysis capacity.

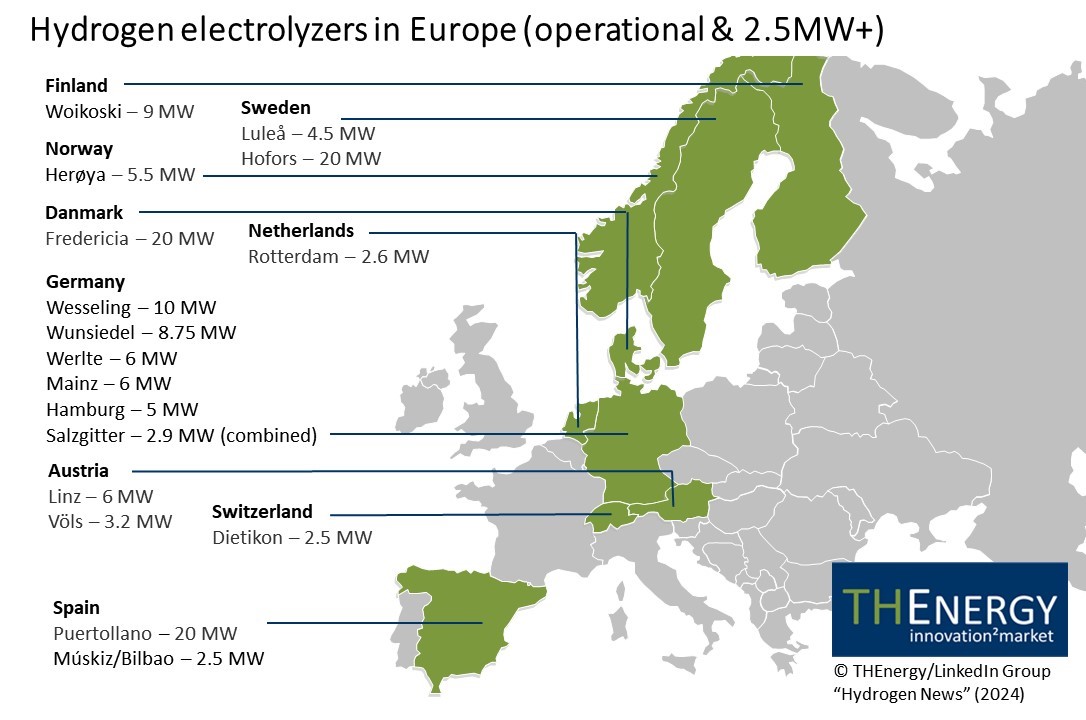

Europe is embracing polymer electrolyte membrane (PEM) electrolysis, prioritizing it over alkaline electrolysis, said Thomas Hillig, managing director at THEnergy. “While many of the older installations were alkaline electrolyzers, now there is a clear predominance of PEM technology,” he told pv magazine. THEnergy recently published an electrolysis capacity map for Europe. “My best guess would be that the map covers 80% of electrolyzers that are used for producing green hydrogen,” said Hillig. “Adding up the installations from the map results in approximately 135 MW. So, the total would be in the range of 170 MW.” He noted that a big wave of new electrolyzers emerged in 2023. “However, many projects are still under realization,” he said. “That also means that the map will look completely different in one year from now.”

Ecoclean has started series production of modular AEL electrolyzers on a megawatt scale. “The robust, low-maintenance electrolyzers from the globally active company are available as scalable standalone solutions and turnkey systems with outputs ranging from 1 to 20 MW,” said the German company. It claimed the systems deliver “high gas quality” and a system pressure of up to 30 bars. “As not every application requires a gas pressure of 30 bars or more, [we are] currently in the process of adding atmospheric-pressure alkaline electrolyzers to [our] product range,” said Ecoclean.

Lhyfe and EDP Renewables have signed a 15-year renewable electricity supply contract. Under their corporate power purchase agreement (CPPA), Lhyfe will buy energy from a 55 MW solar project in Germany developed by EDPR, through Kronos Solar EDPR. The companies expect to connect the installation to the grid during 2025. The CPPA is Lhyfe’s largest such deal to date and secures renewable power supplies for its future green hydrogen production sites in Germany. It is also the first PPA that EDP Renewables has signed with a hydrogen company.

Thyssenkrupp Steel Europe has launched a public tender for the procurement of up to 151,000 tons of low-carbon hydrogen, in order to supply direct-iron reduction facilities it is building at its plant in Duisburg, Germany. The steelmaker is seeking 10-year contracts for green or blue H2 to reduce emissions at Germany’s largest steel mill.

Masdar and Daimler Truck have agreed to explore the feasibility of liquid green hydrogen exports from Abu Dhabi, United Arab Emirates, to Europe by 2030. The aim is to decarbonize road freight transport in the continent. Daimler Truck is pursuing a dual-track strategy with hydrogen- and battery-powered vehicles. The company’s prototype Mercedes-Benz GenH2 Truck recently completed a trip of 1,047 kilometers across Germany with one fill of liquid hydrogen under real-life conditions. Daimler Truck is building a customer-trial fleet of Mercedes-Benz GenH2 Trucks, which is expected to be deployed in mid-2024.

Germany’s National Academy of Science and Engineering has concluded that a feasible German-Australian supply chain exists, as outlined in a new study it has commissioned. The Fraunhofer Research Institution for Energy Infrastructures and Geothermal Energy IEG conducted the study, comparing the economic benefits and technical feasibility of various transport infrastructures, including a hydrogen network, product pipeline, inland waterway vessel, and rail. Acatech President Jan Wörner said that an Australian-German hydrogen bridge promises a stable and mutually beneficial trade relationship between two democratic countries. The study is the final component of the HySupply project, initiated in December 2020 and funded by the German Federal Ministry of Education and Research (BMBF), conducted in collaboration with an Australian consortium led by the University of New South Wales in Sydney (UNSW).

Edison Energy said numerous companies signed green hydrogen deals in Europe in the fourth quarter of 2023, supporting new production facilities. The clarity brought by EU regulations and support mechanisms, including the EU Hydrogen Bank for operating expenses, could spur competition for power purchase agreements (PPAs) if European hydrogen producers successfully address economic and technical obstacles in deploying renewable hydrogen production facilities. Edison Energy said that PPA pricing continued to fall in the fourth quarter across most markets, with Polish and Italian median prices decreasing by 16% and 12%, respectively, compared to the third quarter. In Germany and Spain, fourth-quarter PPA prices remained relatively unchanged from the third quarter, with a shift of around €2 ($2.17)/MWh. Median prices in these countries also fell compared to the fourth quarter of 2022 as volatility eased, it said.

A German–Australian supply chain is feasible, according to a study commissioned by the National Academy of Science and Engineering. The study carried out by the Fraunhofer Research Institution for Energy Infrastructures and Geothermal Energy IEG compares the economic benefits and technical feasibility of various transport infrastructures: hydrogen network, product pipeline, inland waterway vessel, and rail. “An Australian-German hydrogen bridge promises a stable and mutually beneficial trade relationship between two democratic countries,” said acatech president Jan Wörner. The paper is the final part of the HySupply project. Started in December 2020 and funded by the German Federal Ministry of Education and Research (BMBF), the project was carried out in collaboration with an Australian consortium led by the University of New South Wales in Sydney (UNSW).

Firms signed green hydrogen deals in Europe in Q4 that will support new production facilities, according to Edison Energy‘s Q4 Global Renewables Market Update. The clarity brought by EU regulations and support mechanisms also for operating expenses via the EU Hydrogen Bank could spur competition for PPAs if European hydrogen producers successfully manage the economic and technical obstacles to deploying renewable hydrogen production facilities. “Power purchase agreement (PPA) pricing continued to fall in Q4 across most markets. Polish and Italian median price levels decreased by 16% and 12%, respectively, compared to Q3, on the heels of a decline in commodity and power prices. In Germany and Spain, Q4 PPA prices were relatively unchanged from Q3, with a shift of around € 2/MWh. And, as expected, median prices in Germany, Italy, Spain, and Poland fell when compared to Q4 2022, as volatility eased,” said Edison, which operates in Europe as Altenex Energy and Alfa Energy

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.