The UK sportswear market is expected to experience another testing year despite consumers’ intending to be more active in 2024.

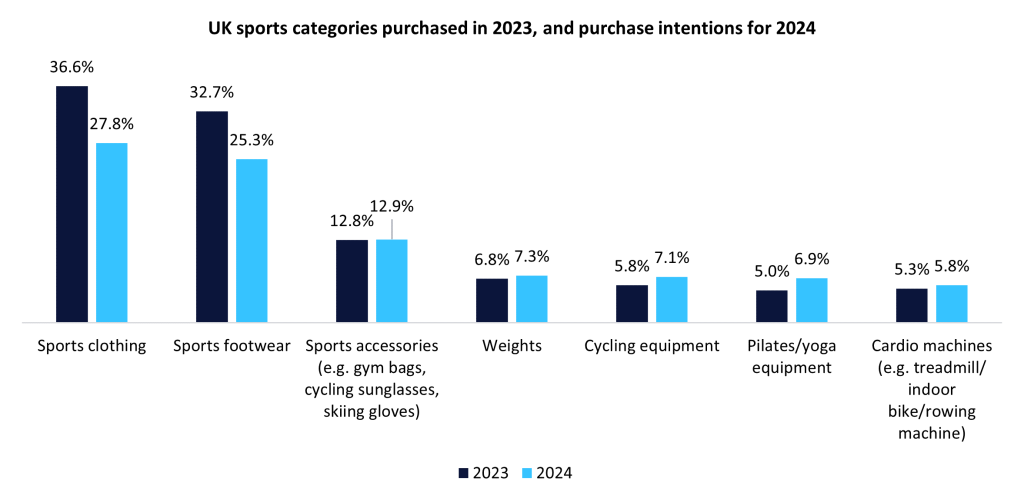

2024 looks to be another challenging year for the UK sportswear market, as despite 71.7% of consumers stating they intend to do more exercise in 2024, significantly less expect to buy sports clothing and footwear than last year, according to GlobalData’s UK monthly survey in January 2024.

This will serve as another hit to market leaders NIKE, adidas and Puma, that already reported slowdowns in sales throughout 2023, however, current intentions will be tainted by the recession dampening consumer sentiment, with shoppers hopefully feeling more positive about their finances as the year progresses.

UK sportswear market still set for growth in 2024

GlobalData forecasts that the UK sportswear market will still experience growth this year of 4.0%, outperforming the total apparel market which is expected to only grow 2.2%, however much of this will be driven by higher prices.

Source: Data is derived from GlobalData’s UK monthly survey of 2,000 nationally representative consumers conducted in January 2024.

Walking, running and swimming will remain some of the most popular forms of exercise in 2024, but yoga and pilates, exercise classes, and weight and strength training are expected to see the biggest uptakes, particularly driven by females.

Just over two thirds (68.9%) of consumers will opt for free or cheaper workouts such as home workouts or running in 2024 due to the higher costs of living, which is reflected by more consumers expecting to buy items like weights, cycling equipment, pilates and yoga equipment, and cardio machines in 2024.

The rise in home workouts also partly explains why less plan to buy sports clothing and footwear as consumers will likely care less about what they wear to work out at home compared to in public, with only 22.1% planning to join a new gym.

Of consumers that expect to buy sports clothing, footwear and/or accessories in 2024, 22.9% expect to spend less than 2023, while 18.0% expect to spend more, and 59.1% plan to spend roughly the same.

Comfort, durability, performance drive sportswear purchases

After strong growth throughout the pandemic, most sportswear shoppers already have what they need, and will mainly buy new items when in need of replacement or looking to follow new trends.

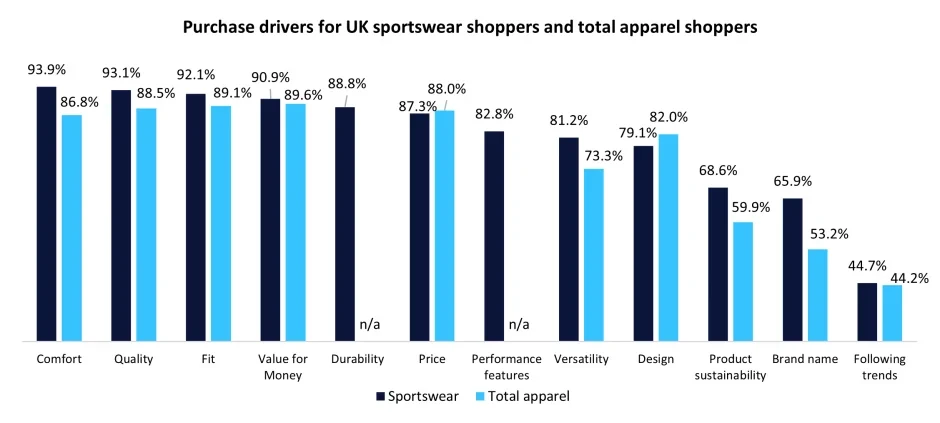

Source: Sportswear responses are derived from GlobalData’s UK monthly survey of 2,000 nationally representative consumers in January 2024 and include those that bought sports clothing, footwear and accessories in 2023.

Comfort is the most important factor driving sportswear purchases, as cited by 93.9% of sportswear shoppers, and 81.2% said versatility is important. These are considerably stronger purchase drivers for sportswear than for total apparel, due to the dominance of the athleisure trend, as many consumers now wear garments such as leggings, joggers and hoodies for their everyday activities.

Price is slightly less important to sportswear shoppers than apparel shoppers, while brand name and quality are more important, as sportswear shoppers are more willing to pay higher prices to purchase from their favourite brands that they can trust.

Durability and performance features are also overwhelmingly important for sportswear shoppers, as consumers expect their garments to last through many rigorous uses and wash cycles, and offer performance features such as moisture-wicking and compression capabilities.

Source from Just Style

Disclaimer: The information set forth above is provided by just-style.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.