Amazon: Expanding influence and adjusting strategies

Amazon grabs 29% of online orders ahead of Christmas: Before Christmas, Amazon’s fast delivery strategy succeeded, seizing 29% of the global online order share, up from 21% at Thanksgiving, per Route’s 55M orders data. CEO Yamartino notes the shift to prioritizing timely delivery.

The firm aims to double same-day hubs in the coming years. Herrington reports Amazon delivered 1.8 billion units to U.S. Prime members in one or two days this year, quadrupling 2019’s rate.

Amazon reportedly outdid UPS in U.S. deliveries for 2022, heading to deliver nearly 6 billion packages by year’s end.

Adobe recorded a record $222.1B in U.S. online holiday spending, up 4.9% YOY, with BNPL contributing $16.6B in 2023, a 14% YOY increase.

Reduction in commission rates for certain apparel: Amazon Global Store has announced that starting January 15, 2024, it will reduce the sales commission for certain clothing items on its U.S. site. For items priced under $15, the commission rate will decrease from 17% to 5%, and for those between $15 and $20, the rate will drop to 10%.

Amazon outperforms Walmart and Target in VMS market: A report by SPINS/ClearCut Analytics shows that Amazon’s sales in the mineral, vitamin, and supplement (VMS) market have surged to $12.6 billion in the past year ending August 2023. The e-commerce giant has surpassed retailers like Walmart and Target, indicating a growing consumer focus on health and wellness products.

TikTok: Increases commission from 2% to 8%, affects sellers and consumers

TikTok has seen considerable expansion in its U.S. shopping platform, partly due to providing minimal seller fees and shouldering significant discount costs. However, the company revealed on Wednesday that it plans to raise the commission it collects on most products from 2% alongside 30 cents for each transaction to 8% in the coming months. This increase in commission is expected to impact both sellers and consumers, potentially altering the competitive landscape of e-commerce on social media platforms. Despite this change, TikTok remains committed to growing its shopping platform and providing a seamless user experience for its content creators and buyers.

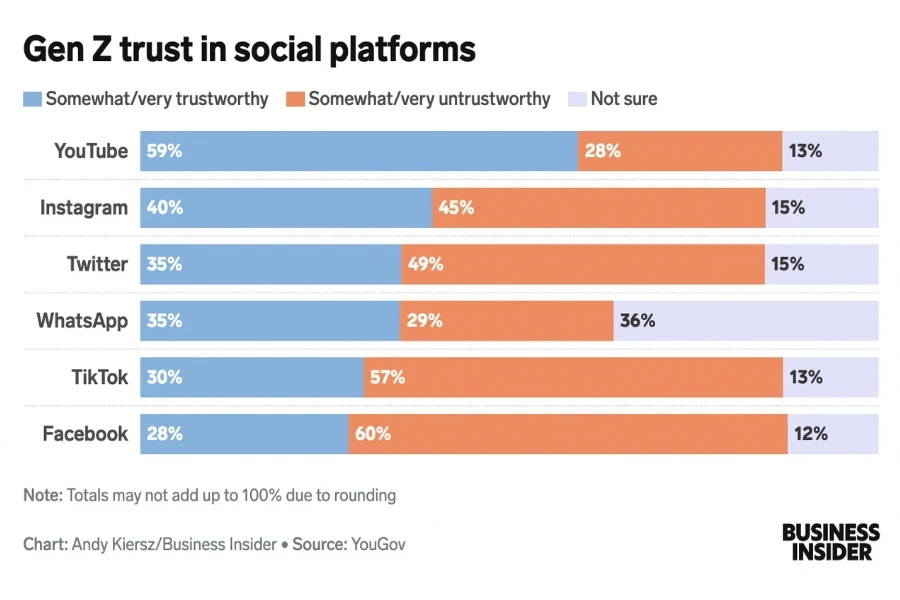

Gen Z’s preferences in social media: Gen Z trusts YouTube more than any other platform

A recent survey by Business Insider and YouGov involving 1800 participants revealed Gen Z’s trust levels in various social media platforms. YouTube emerged as the most trusted platform, with 59% of Gen Z showing full or partial trust. Instagram followed, with 40% trust among the demographic, while platforms like Facebook and TikTok were among the least trusted, indicating a shift in preference and credibility perceptions among younger users.