Key Takeaways

- Cost benefit analysis is a quick and simple way for businesses to assess the value of potential projects and plans

- The outcome of a cost benefit analysis is not always simple and more research may be necessary to maximise the value of investments

- The best way to use a cost benefit analysis is in conjunction with other business tools, such as profitability analysis and competitive intelligence

Resource allocation is the foundation of the economy and when done correctly can be the cornerstone of a successful business. Large or small, all businesses must make good decisions when deciding how to best allocate their resources efficiently to give themselves the best chance of running things well. This is where cost benefit analysis (CBA) can be useful, giving an indication of the merit of new plans and operations.

What is a Cost Benefit Analysis

A CBA is a method of assessing the net outcome of a potential course of action by comparing its benefits and costs. Though some forms of CBA have been done for millennia, the modern CBA method was pioneered by French economist Jules Dupuit in 1848 when assessing the value of constructing a new roads and bridges.

CBA can be used to assess a wide variety of potential actions, such as:

- Deciding whether to employ a new worker

- Evaluating whether or not to buy new capital equipment

- Determining whether to move to a new workspace

Simply put, CBA involves tallying up the benefits and costs of an action and comparing the two values to determine whether it’s worthwhile or not.

For example, in 2012, the UK Department for Transport conducted a CBA to determine if the planned High Speed 2 (HS2) rail project would provide value for money. Key considerations taken into account included the cost of the project, the expected level of demand and key benefits for potential users of the rail line. Ultimately, the UK government gave the project the go ahead.

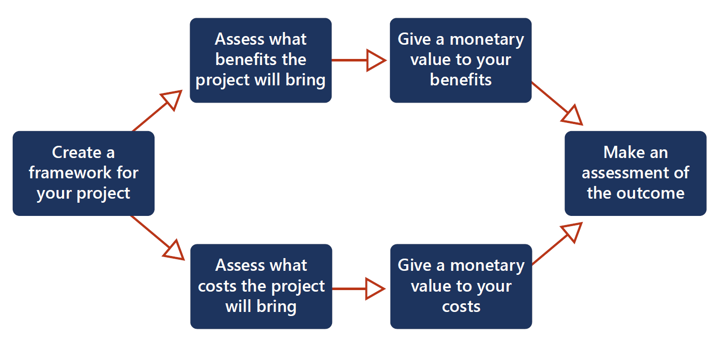

How to apply a Cost Benefit Analysis

A CBA can be done in four stages.

Step 1:

Firstly, it is important to define the overall framework of the action. For example, if you are considering employing new staff, how many? And over what timeframe do you want to measure the merit of the project? If you’re planning on introducing a new product, when do you want it to be ready for launch?

It is important to create a framework first so that down the line when you are assessing costs and benefits, you can make better estimates and assess the outcomes properly.

Step 2:

The second step is to think up as many benefits and costs to the action as possible. These can be wide ranging, from tangible things like new salaries to intangibles, such as employee wellbeing and a positive impact on business processes. This list needs to be comprehensive – try and think of as many factors as possible.

For example, hiring a new employee doesn’t just cost their wages; you must also consider the time it takes to conduct interviews and train the new employee, as well as any potential payments to recruitment firms.

Step 3:

The next step is to apply monetary values to all the benefits and costs. Some of these will be easy – the price of new piece of capital equipment, the rent for a new office space, the wages for a new employee, etc. However, some can be difficult.

To give monetary value to intangibles, you will have to make assumptions based on personal experience and your own research. It can also be difficult to properly forecast future revenues and costs; this can require considerable research.

Step 4:

The final step of a CBA is to assess the result by comparing the overall cost of the action with its overall benefit. If the costs outweigh the benefits, it is probably not worth undertaking the project. If the benefits outweigh the costs, then it may be worth undertaking.

However, some more analysis may be required before committing to an action. For instance, how certain are your benefit predictions? If you’re relying on increasing revenue from a high-risk and volatile industry it may be worth conducting further research.

If the net positive is minor or if it will take a long period of time to recoup the costs, you should consider if there are other actions you can undertake that will yield more value. Because of this, it can be worth carrying out CBAs on a range of different possible actions.

Example of a Cost Benefit Analysis

Calceus Shoes Ltd is a handmade shoe manufacturing company in the UK. The company is currently experiencing high demand and is considering expanding to increase capacity. It wants to move to a larger factory and hire two new employees, including an in-house HR manager. Will this expansion will be worthwhile over a five-year period?

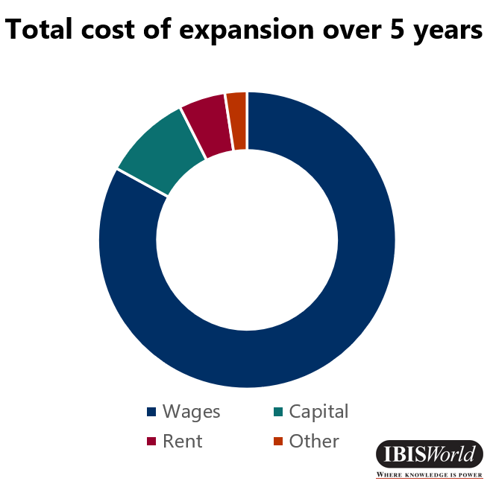

Costs

The company needs to employ two additional workers. IBISWorld estimates that in 2022-23 the average industry wage in the UK shoemaking industry is just under £27,400, but it is projected to increase to around £28,150 by 2027-28. This means that for two new workers, Calceus will spend approximately £277,500 on wages over the five-year period.

New capital investment is also necessary to create and upkeep two additional workstations. There will be an initial outlay of £20,000 and, using IBISWorld’s depreciation data, we estimate the yearly upkeep costs at around £2,400. This will create a total capital cost of £32,000 over the period.

Calceus currently pays the average industry rent of 4.5% of revenue, a total of £22,500. The new lease will be 15% higher, indicating an annual rent increase of £3,375 and a total cost of £16,875 over five years.

The company also needs to consider smaller other costs, including recruitment and training (£3,500), moving costs (£2,000) and legal and administrative fees (£2,500).

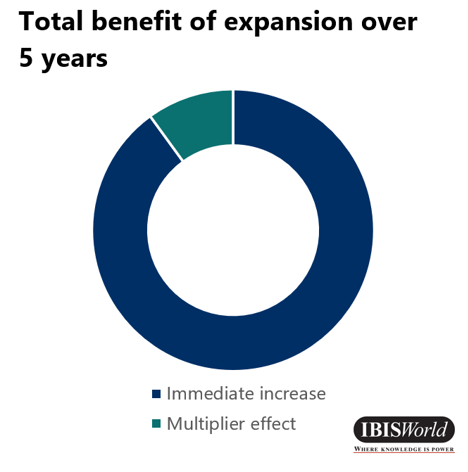

Benefits

Calceus currently has an annual revenue of £500,000, while demand is 20% higher than its output. This means that revenue is expected to initially rise by 20%, or £100,000. Over a five-year period, this will amount to £500,000.

The company also expects there to be a 10% multiplier effect, with higher sales increasing its reputation and creating more demand. This will result in an additional £55,556.

Overall, this means that Calceus Shoes can expect a total benefit of £238,056 to the plan. This is quite a large margin, which will protect from some uncertainty. Because of this, Calceus Shoes should follow the result of the CBA and complete the expansion project.

What are the limits to using a Cost Benefit Analysis?

Assessing a CBA it is not as simple as comparing the value of costs to the value of benefits. Even with a positive long-term return, a high cost in the present can make a project unworthwhile. In the case that the project includes a substantial initial investment, it would be worth considering the net present value of the return. Each action a business takes has an opportunity cost. Any investment made could be used for alternative actions and it is important to consider a range of options before committing to an investment.

When planning a large project that involves many factors it can be almost impossible to evaluate all the indirect outcomes of the project. Because of this, the larger the proposed project, the harder it is the conduct a thorough CBA.

Evaluating costs and benefits, especially when trying to estimate indirect outcomes and future revenues, becomes more difficult the more complex a project is. Without good estimates for the value of your costs and benefits, your CBA can result in a misleading outcome and lead to poor decision making. This is why conducting research having a good understanding of your market is key creating a robust CBA.

CBAs also don’t account for risk. Although all assignments of the future are bound to a degree of uncertainty, the lack of scope to cover risk analysis in a CBA makes it particularly susceptible to uncertain and volatile markets. For example, how would your future benefits be affected by changes to commodity prices? Could demand be disrupted by new technologies?

It is vital that before taking an action based on a CBA you do your due diligence and assess the future risks you are exposed to. One way to elevate this is to conduct best- and worst-case scenarios in your CBA.

Maximising your analysis

Because of the limits to CBA, you should use it in conjunction with other business analysis tools to maximise the value of your assessment.

Profitability analysis is used by businesses to optimise the profitability of various plans and projects. This can help you better understand where your profits come from and therefore better estimate future revenue streams and costs. This can significantly improve the accuracy of a CBA.

When conducting research for a CBA, having a good understanding of the market is very important. With competitive intelligence, you can gain a better understanding of what your competitors are doing, what costs they have incurred and have a better picture of the industry as a whole.

As one of the weaknesses of a CBA is its lack of scope for risk assessment, it may be necessary to create a Risk Management Framework (RMF) for your planned project. RMFs are a method of identifying and measuring potential threats to a business and creating methods to mitigate these risks. This is a vital step in analysing business plans, especially when operating in high-risk industries.

CBA is a useful tool for understanding the strengths and weaknesses of prospective projects. It is a quick way of eliminating unsensible business plans, but should not be used by itself in the approval of future business projects.

Final thoughts

The strength of a CBA is its simplicity. It is quick, easy and anyone can do it without specific training or qualifications. However, its simplicity is also a weakness. Used by itself it, CBA is incapable of taking in all the possible variations of ever-changing market and when used poorly it can lead to bad decision making. However, when used in tandem with other tools, a CBA can be extremely effective.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.