Key takeaways

Companies must ensure they have the resources, capabilities and flexibility to support successful market expansion without straining existing operations.

In-depth market research and industry analysis are essential for developing strategies tailored to the unique challenges of new markets.

Continuous monitoring and adaptation, guided by KPIs and customer feedback, are vital for keeping expansion strategies aligned with evolving market conditions.

Over the decades, market expansion initiatives have transformed. Globalization and the rise of global companies, the internet and converging regulations of major economic blocs have created a more homogenous feel to any new market. Companies often adopt a one-size-fits-all approach, assuming success in one region would seamlessly translate to another. In other words, operational effectiveness and efficiency can win all.

There is an impulse to rush into new markets without thoroughly understanding the external complexities and internal trade-offs involved. This is where companies that boast a deep understanding of their strategic advantages, steered by leadership that is unafraid to make hard choices, can stand out. Maintaining internal purpose while leveraging industry research becomes indispensable to translating that to real-world success.

By tapping into detailed market analyses and consumer insights, businesses can craft well-informed strategies that address the specific challenges and opportunities of each market. Such research serves as the backbone of effective planning, ensuring that companies not only enter new markets but thrive within them.

Assessing readiness for expansion

Market expansion is a strategy that calls for selling existing products or services to new markets or users. There are two common types of market expansion. First, market penetration involves finding new tactics to sell to your ideal customer profile (ICP) and grow market share. Second, market development involves finding new users for your offering, including geographical expansion. I’ll focus primarily on this second type in discussing the market expansion of your existing product and service into new geographies.

Why might a company seek to expand? The trigger for growth varies across industries. For most, the clear answer is to achieve revenue growth and diversify. The assumption within this motivation is that revenue leaders no longer feel that there is sufficient long-term growth in existing markets or that faster growth might be quickly achieved in new markets. They may think that the business’ existing ICP is dwindling as its own market share grows or risks being overtaken by competitors.

The first step in market expansion, then, is to reflect: Are we succeeding in our existing markets—both ‘home’ markets and expansion markets if they exist? If the answer is yes, then expansion discovery can move ahead. Success in your existing markets can validate your strategic strengths and operating effectiveness. Market success provides revenue and profit to help you grow geographically.

If the answer is no then there are bigger questions to answer. Growing market share in existing markets is usually the strategy with the greatest number of synergies and the best potential returns. Geographic expansion has significant opportunity costs and is rarely the first solution to revenue growth problems. New revenue and foreign markets can be an attractive proposition, but this prospect should not blind decision-makers. Market expansion in all forms, but especially international markets, is resource-intensive.

Decision-makers should ensure that there is adequate capacity to achieve the desired outcome. The opportunity costs of expansion should be very clearly articulated to them—what are we foregoing by investing in market expansion?

That said, let’s say you’re choosing geographic expansion from solid strategic foundations. Expansion into new markets doesn’t need to be a shot in the dark, as long as you have a well-researched game plan with defined strategic objectives, an operational roadmap to reach those goals and ongoing tracking of the KPIs necessary to meet those objectives. The opportunities are lucrative: More customers, increased sales and higher profitability.

So, let’s plan properly!

How to craft a market expansion strategy

After conducting internal due diligence, market research is the first port of call for market expansion. You will need to know more about your target geography or compare multiple geographies to decide on the best fit. The criteria below can be applied to each target geography and presented as a scorecard to the decision-maker.

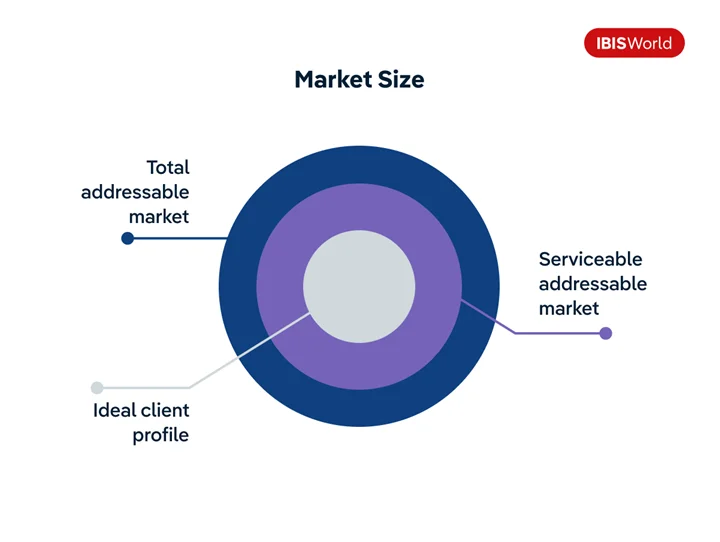

Market size

Market research begins by understanding the size of the total addressable market (TAM) and the ICP within that.

For instance, let’s assume you sell widgets to banks. Market research will readily explain the value of the banking market in a state, region or country, as well as how many companies operate in that market. Research should tell you how many locations each of those businesses has, providing data and ratios that allow you to size those prospects. In this way, the best market research will turn your TAM into an ICP.

Once you understand the potential value of your new market, it’s vital to build an appropriate financial model. Investment in the new market must match the overall size of the future business, the expected ramp-up in market share and the customer lifetime value from that ICP. A financial model is not a pitch document and should assume a sober position with upper and lower confidence ranges based on clearly articulated assumptions.

Porter’s 5 Forces

Once you know the size of the opportunity, it’s time to get your hands dirty. There are many frameworks that will help you navigate the ‘how’ that will allow you to build a solid market expansion plan. The one we prefer at IBISWorld is Porter’s 5 Forces. A 5 Forces analysis can help companies assess industry attractiveness, how trends will impact industry competition, which industries a company should compete in and how companies can position themselves for success.

Competitive rivalry

Your new market almost certainly has incumbents. Your market research should be able to tell you who those companies are and their market share. Thorough research includes getting your hands on the product or service of your potential competitor and seeing what they do well and where there are gaps. How does the product compare to yours? Look at the company website and reverse engineer their marketing messages. What buying personas are they talking to? What features are they promoting? Which clients have given testimonials? What is their price and what is the pricing model? Remember, because you are succeeding in your existing markets, you’re playing ‘offense’ here. Where are your competitor’s weak spots?

What if there are no or few existing competitors? This is possible, but it may be a red flag that the buying personas are not as well developed or that companies solve the problem your product helps with in another way (producing the product or service in-house, for instance). There may be regulations that prevent or limit the product or service you are offering. Good market research will give you the answers to a lot of these questions; good relationships with your clients may well give you some others.

Bargaining power of suppliers

This facet focuses on supply chain dynamics and, obviously, is more suited to the providers of physical goods (as opposed to services). Your entry into a market is going to be harder – and potentially less profitable – if you have to deal with large suppliers in your new market. This increases their negotiating power at the expense of your own. Where supply markets are less concentrated among a few large companies, it is likely that with more choice you have more leverage.

Buyer power

Not all companies need suppliers of physical inputs, but all companies need buyers. Buyers have more power when they have more choice of supplier – often because the product is undifferentiated – or when the costs of switching suppliers are low. The power of buyers in your new market will help inform your modeling of sales velocity and customer churn, as well as pricing strategy as you build your business. When you lack incumbency, brand power and established sales channels, you may find that buyer power is higher than you’re used to in your home market.

Threat of substitutes

This factor refers to the ability of customers to see alternative offerings. When expanding into a new market, ask yourself how is the problem you want to solve currently being solved. If you feel that it is not being solved well, then there is space for expansion.

But how are you going to make the decision to substitute your product or service as easy for customers as possible? Areas you can manipulate include price, quality and/or functionality. When entering a new market you are the disrupter – the substitute. How do you evolve to being the incumbent over time?

Threat of new entrants

This refers to how easily a rival can enter your market. If it takes little money and effort to enter your market and compete effectively, or if you have little protection for your key technologies, then rivals can quickly enter your market and weaken your position. However, if your industry has high entry barriers, you can preserve a favorable position. Some common entry barriers include complex distribution production, high starting capital costs and difficulties in finding suppliers.

Organizational capabilities

Any geographic expansion model needs to account for your own organizational capabilities. New geographies involve the whole enterprise, from finance and legal to sales, marketing and production. Market expansion in all forms, but especially international markets, is resource-intensive. Decision-makers should ensure that there is adequate capacity to achieve the desired outcome. For every meeting and project plan on a new market, the same resources are taken from existing operations.

Measuring success and recalibrating expansion

What is success? It’s a question you should ask before every meeting, every project and certainly when undertaking market expansion.

While you should remain operationally flexible and agile enough to see the pivot point (no business was built on a spreadsheet), you should remain honest about the strategic mission. New markets are hard enough to crack without realizing when reality and theory don’t align. If sales velocity is less than anticipated, for example, the cost structure was built on a possibly erroneous assumption.

A good enterprise insights function can help when undertaking such a large initiative that touches all parts of the business. Reporting belongs under operational capabilities and if not done or done poorly, a turning point is missed – a success not doubled down on, or a failure from which no one learns.

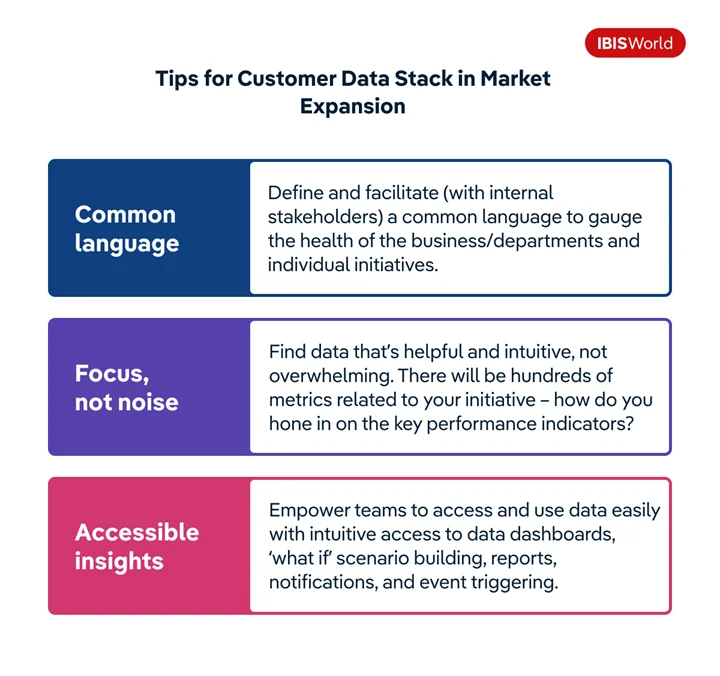

In terms of the customer data stack, I’d recommend from experience that you have a data-literate organization based around:

We always care about the customer’s voice, but in a new market, each comment has a deeper resonance. Capturing that feedback and closing the loop with production and marketing/sales is essential. Many companies make reasonable assumptions that new markets will respond like existing ones and that buyers will respond similarly. Unless your pre-expansion market research tells you otherwise that shorthand is acceptable. However, the assumption should be tested ongoing – ideally with objective user behavior and sentiment data. You should be prepared to make tough decisions about the expansion itself if product-market fit is not what you expected.

All the market research that went into building the perfect plan is in flux. Too often, a geographic expansion plan is seen as final. In reality, for every industry, there are hundreds of microeconomic and macroeconomic ebbs and flows that change your ecosystem, especially in highly competitive spaces.

Final thoughts

Navigating the complexities of market expansion requires a holistic understanding of both internal capabilities and external factors. Companies must remain adaptable, continually assessing the dynamics of buyer power, the presence of substitutes and the threat of new entrants. By leveraging data and fostering a culture of insightfulness, businesses can make informed decisions that support their growth objectives and enhance their competitive edge in a new landscape. Maintaining robust operational flexibility allows organizations to pivot when necessary, ensuring they respond effectively to market realities rather than solely relying on preconceived strategies.

Ultimately, successful expansion into new markets is not just a one-time undertaking but an ongoing journey. As industries are influenced by fluctuating economic conditions and evolving consumer preferences, organizations must embrace the reality of continuous learning. Companies can refine their approach and optimize their offerings by fostering open communication channels that capture customer feedback and leveraging operational insights. This proactive stance bolsters their position in the market and builds lasting relationships with their customers, paving the way for sustained success in diverse environments.

Source from IBISWorld

Disclaimer: The information set forth above is provided by ibisworld.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.