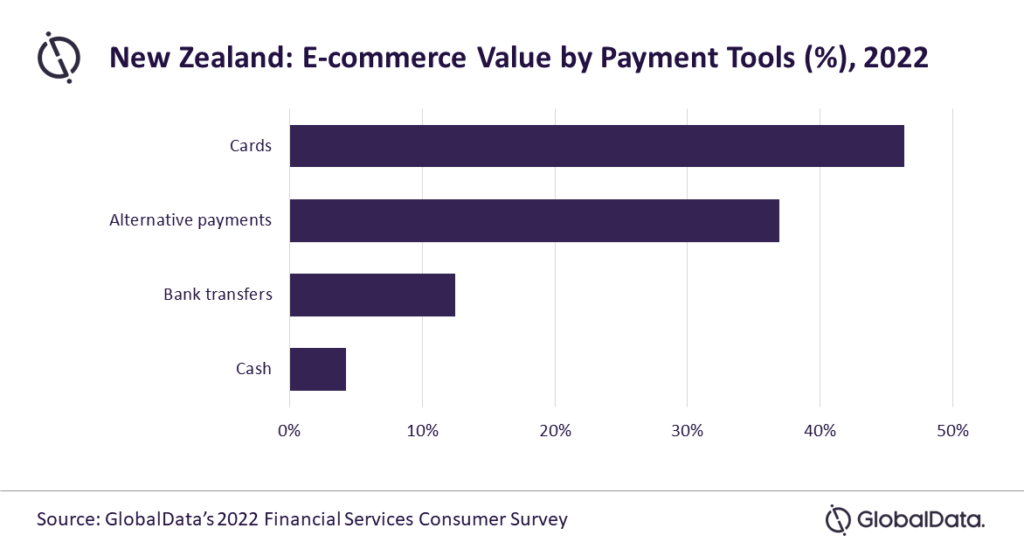

Alternative payment solutions such as PayPal, Apple Pay, and Google Pay are growing in popularity in New Zealand and collectively account for 39.5% of e-commerce spending in the country, says GlobalData, a leading data and analytics company.

The growth in buy now pay later (BNPL) services is one of the factors driving growth in alterative payments in New Zealand. BNPL services are increasingly being used by online shoppers, as they offer a viable short term financing option enabling consumers to split high-ticket purchases into manageable instalments. Afterpay is the leading brand in this space, while other prominent brands include Laybuy, ZipMoney and Klarna.

According to GlobalData’s 2022 Financial Services Consumer Survey*, payment cards together account for 43.8% of total e-commerce spending in New Zealand. This can be attributed to the discounts, cashback, and promotional offers associated with these cards.

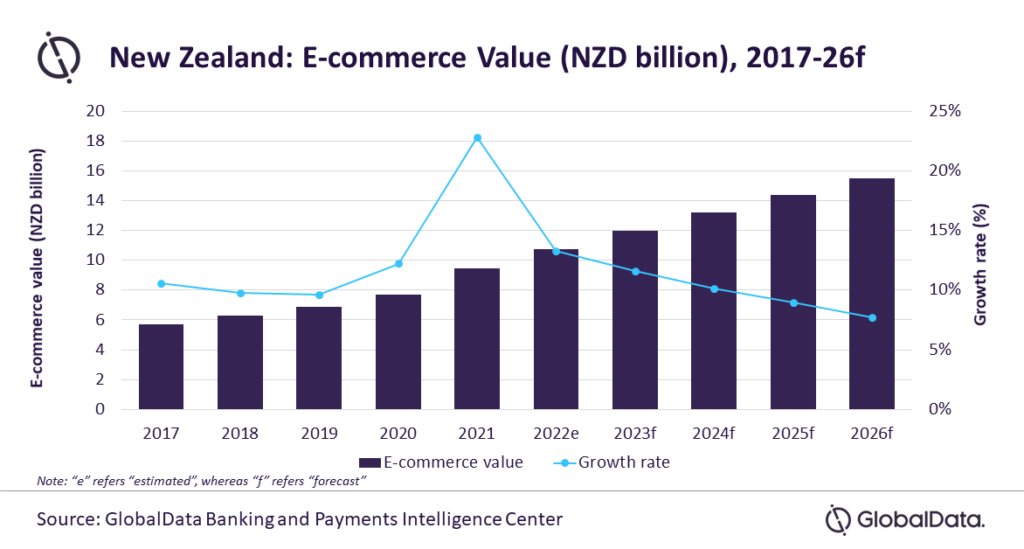

GlobalData’s E-Commerce Analytics reveals that e-commerce sales in New Zealand will increase at a compound annual growth rate (CAGR) of 9.6% between 2022 and 2026 to reach NZD15.5 billion ($10.6 billion) in 2026. The sales were NZD9.5 billion ($6.5 billion) in 2021, growing at a CAGR of 13.5% between 2017 – 2021.

The New Zealand e-commerce market is estimated to register a growth of 13.3% to reach NZD10.7 billion ($7.4 billion) in 2022, supported by a growing consumer shift from offline to online purchasing.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “New Zealand’s e-commerce market is witnessing a consistent growth, driven by strong internet penetration that is encouraging the growing preference among consumers to shop online. In addition, the expansion of online payment infrastructure and logistics services are boosting e-commerce growth in the country.”

Despite the opening of brick-and-mortar stores post pandemic, a large number of consumers in New Zealand still prefer to shop online. According to GlobalData’s Survey, 87% of the New Zealand consumers reported having shopped online in the past six months, while less than 4% indicated that they never shopped online.

Sharma concludes: “The pandemic has brought a shift in consumer buying behaviour, pushing them towards online, a trend that is expected to continue. This coupled with improvements in payment infrastructure, a proliferation of secured payment tools and the availability of new payment options such as BNPL will further push e-commerce payment growth in coming years.”

*GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q1 and Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Source from Global Data

Disclaimer: The information set forth above is provided by Taiyang News independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.