Industry Chain

The textile machinery is a general term for various mechanical devices in all stages of textile technology to process natural or chemical fibers into textiles. Textile machinery is the foundation for the transformation and innovation of the textile industry in China, the key to transforming China’s textile industry from labor-intensive to technology-intensive, and a cornerstone for China’s development from a strong textile country to a powerful textile country.

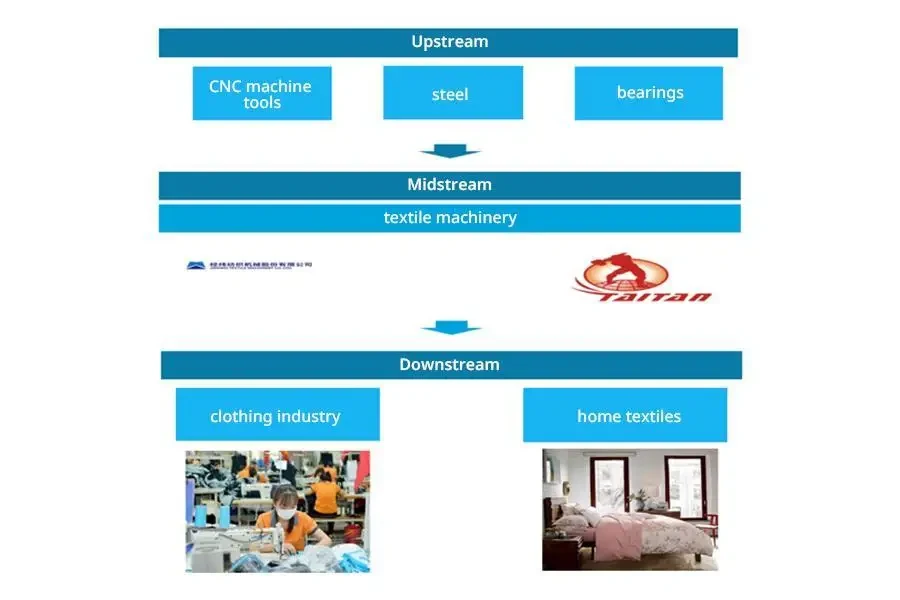

From the perspective of the industrial chain, the upstream of the textile machinery industry chain is mainly divided into CNC machine tools, steel, and bearings. The downstream is the application field of textile machinery, mainly in the clothing industry and home textile industry.

Upstream industry analysis

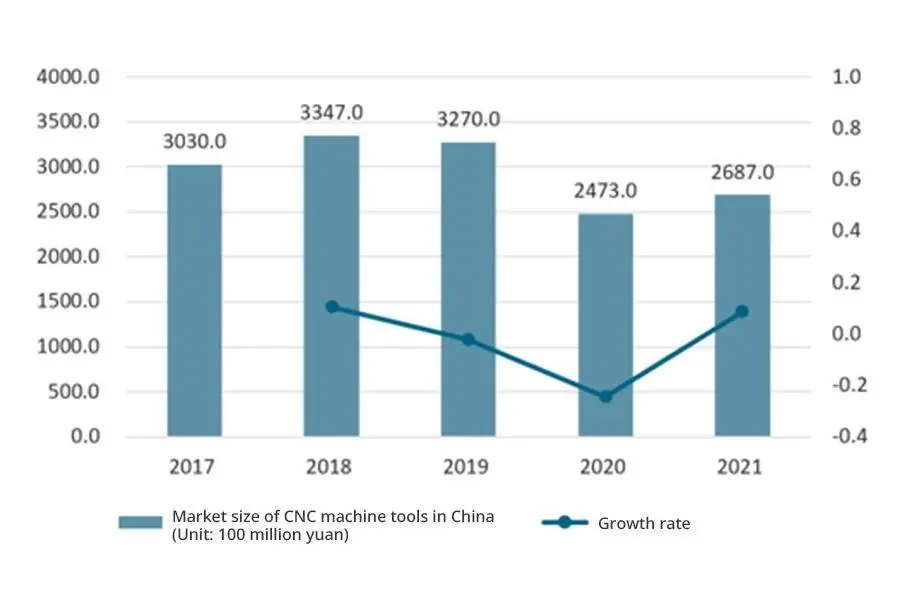

In recent years, the CNC machine tool industry in China has developed rapidly in the context of favorable national policies and the continuous pursuit of innovation by enterprises. According to data, the scale of China’s CNC machine tool industry reached 327 billion yuan in 2019. Due to the impact of the epidemic and energy supply restrictions, the market size of China’s CNC machine tool industry decreased slightly in 2020, with a market size of 247.3 billion yuan, a year-on-year decrease of 24.4%. In 2021, the market size of China’s CNC machine tool industry resumed growth, reaching 268.7 billion yuan.

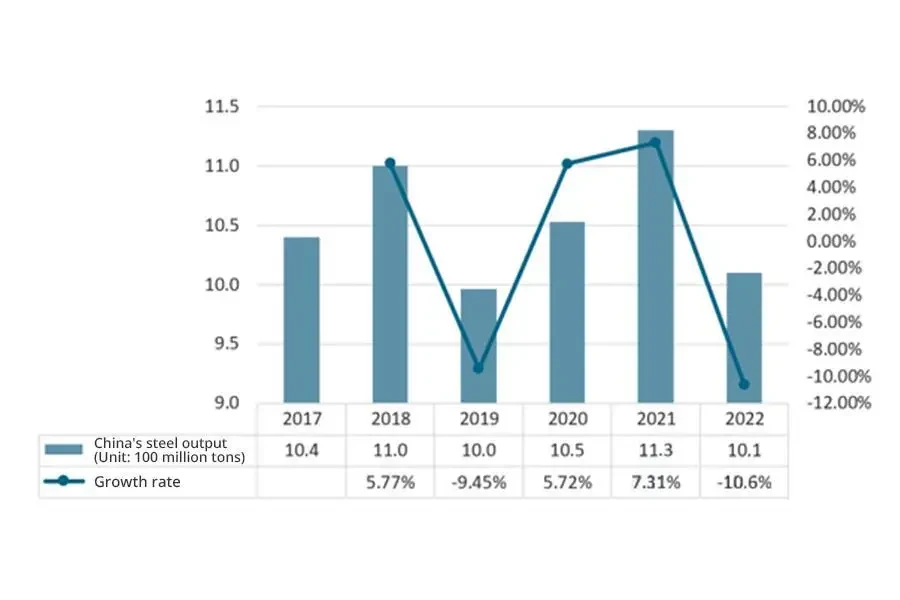

The steel industry is an industrial production activity mainly engaged in the mining and processing of ferrous metal minerals and the smelting and processing of ferrous metals. It includes mineral mining and processing of metal iron, chromium, manganese, etc., iron-making, steel-making, steel processing, ferroalloy smelting, steel wire and its products, and other sub-industries. It is one of the raw material industries in China. China’s steel output was 1.01 billion tons in 2022, a year-on-year decrease of 10.6%.

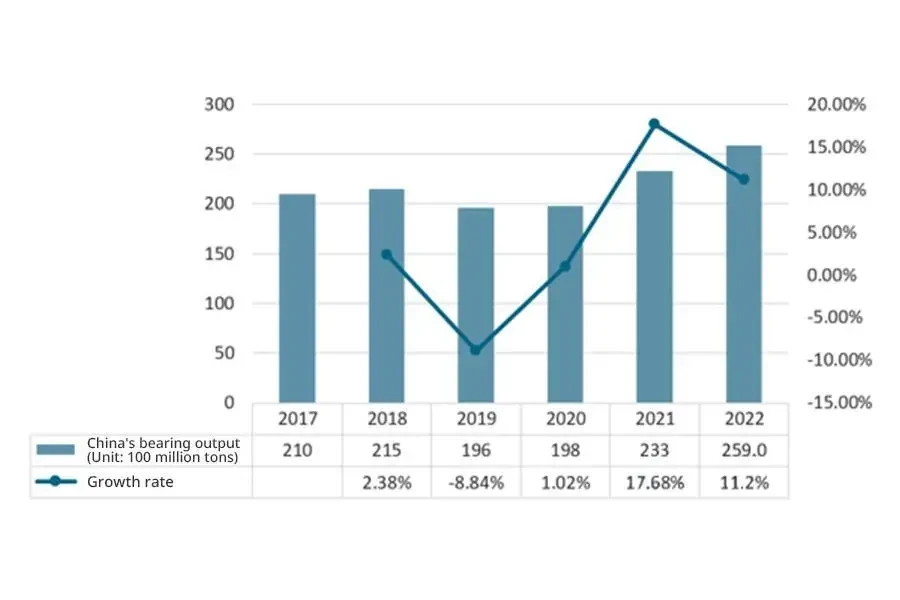

Bearing is a component of contemporary mechanical equipment. Its function is mainly to support the mechanical rotating body, reduce the friction coefficient during its movement, and ensure its rotational accuracy. In 2022, China’s bearing output reached 25.9 billion sets, an increase of 11.2% year-on-year.

Midstream industry analysis

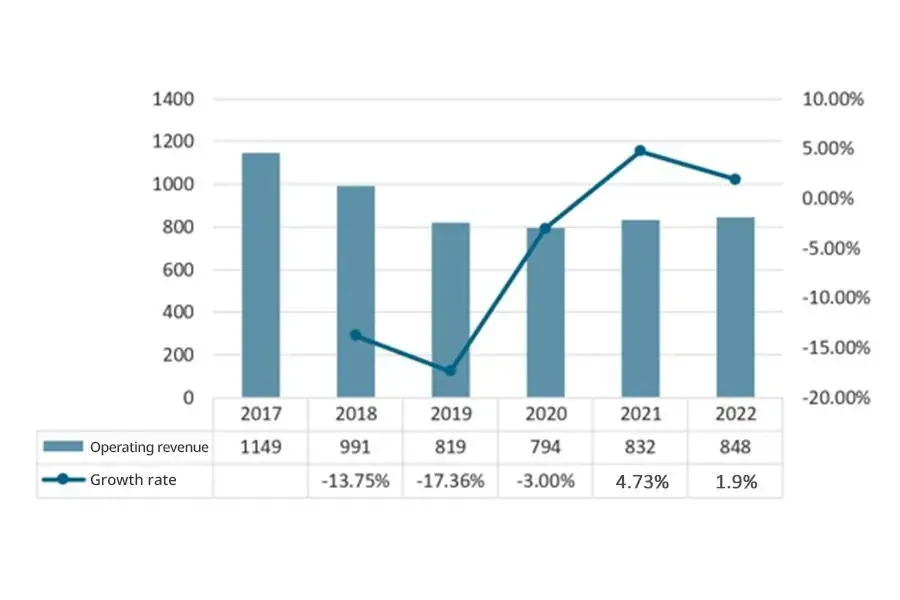

Textile machinery refers to various mechanical devices in all stages of textile technology to process natural or chemical fibers into textiles. Textile machinery is the production method and material foundation of the textile industry, and its technological level, quality, and manufacturing cost are related directly to the development of the textile industry. The revenue of the textile machinery industry in 2022 was 84.8 billion yuan, a year-on-year increase of 1.9%.

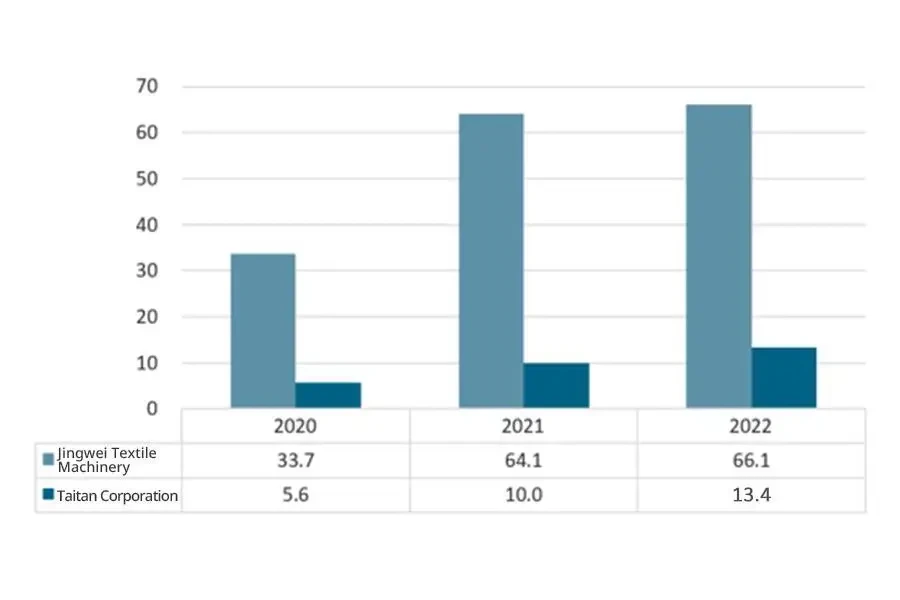

“Green Textile “is a prominent theme in the textile industry development in the 21st century. Therefore, textile equipment that can improve resource utilization, reduce energy consumption, and be environmentally friendly can have a broad market space. Meanwhile, the engine driving the development of the textile and clothing industry has transformed. The production competition mode of production factors in the past has become a comprehensive competition of technological strength. In the future, the textile and clothing industry will no longer be labor-intensive but technology-intensive and creative-intensive with high-tech characteristics. Therefore, innovative, efficient, environmentally friendly, digital, and intelligent textile machinery is the development trend of future textile machinery equipment. From the operating revenue of Jingwei Textile Machinery and Taitan Corporation from 2020 to 2022, the operating revenue of the two enterprises has been increasing year by year, and the revenue of Jingwei Textile Machinery was much higher than that of Taitan Corporation. In 2022, the respective revenue of this business was 6.61 billion yuan and 1.34 billion yuan, respectively.

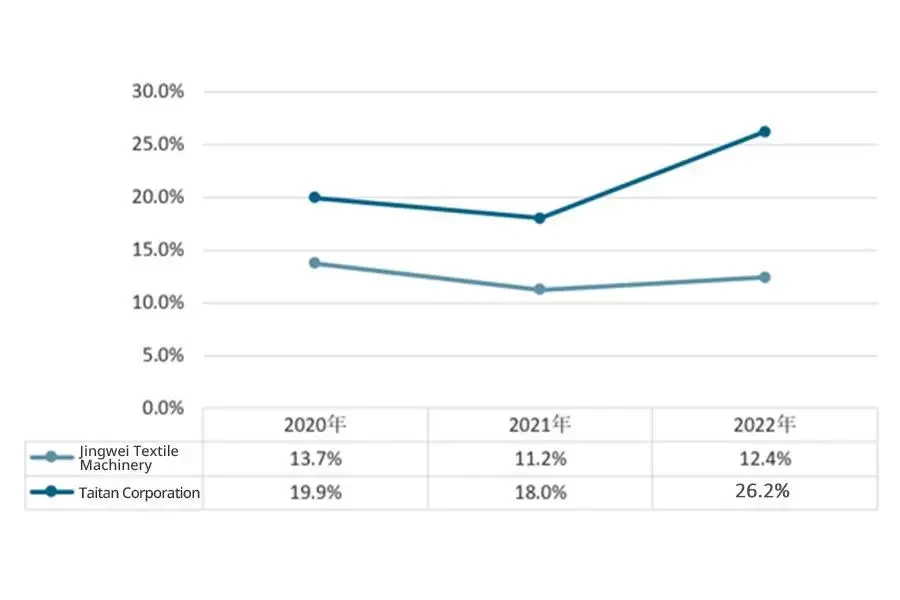

Compared with the gross profit margin in the textile machinery business of Jingwei Textile Machinery and Taitan Corporation, the gross profit margin of both enterprises in the operation decreased first and then increased. In 2022, the gross profit margins of Jingwei Textile Machinery and Taitan Corporation were 12.4% and 26.2%, respectively, and the gross profit margin of Taitan Corporation remained consistently higher than that of Jingwei Textile Machinery.

Downstream industry analysis

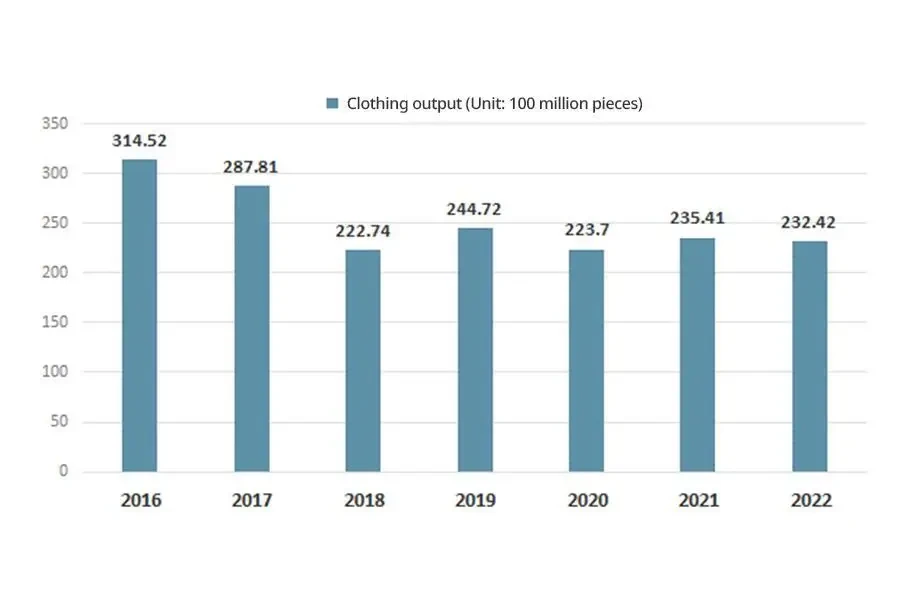

The clothing industry is one of China’s traditional pillar industries and plays a role in the national economy. In 2022, under the influence of risk factors such as weak domestic and international market demand, high raw material costs, and a more complex foreign trade environment, the economic operation pressure of China’s clothing industry increased significantly, and the overall development trend was showing a sustained slowdown. In 2022, enterprises above the designated size in China completed a clothing production of 23.242 billion pieces, a slight decrease compared to 2021.

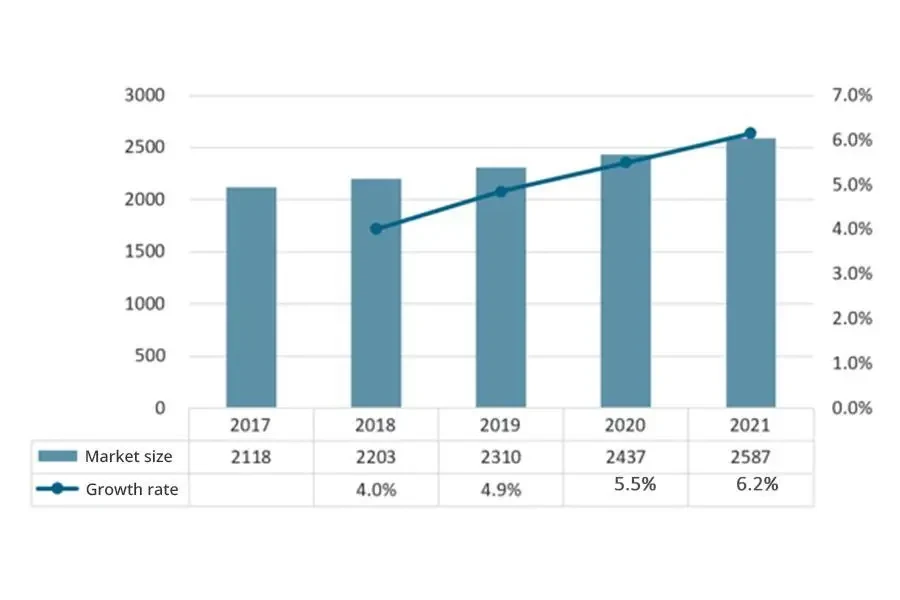

With the gradual improvement of the design and technological level of Chinese enterprises, the consumption potential of the home textile market was unleashed. In recent years, the market size of China’s home textile industry has continued to rise, from 211.8 billion yuan in 2017 to 258.7 billion yuan in 2021.

Source from Chyxx

Disclaimer: The information set forth above is provided by chyxx.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.