Surging commodity prices and easing lockdowns stemming from the COVID-19 (coronavirus) pandemic have boosted Canadian economic expansion in 2022.

Driven by rising consumer and business spending, Canada’s real GDP increased an annualized 3.3% during the second quarter of 2022, outperforming other leading economies. In particular, lifted restrictions increased overall travel, accommodation and food and beverage services, driving economic growth.

However, raging inflation and rising interest rates are anticipated to limit growth during the second half of the year while recession fears intensify.

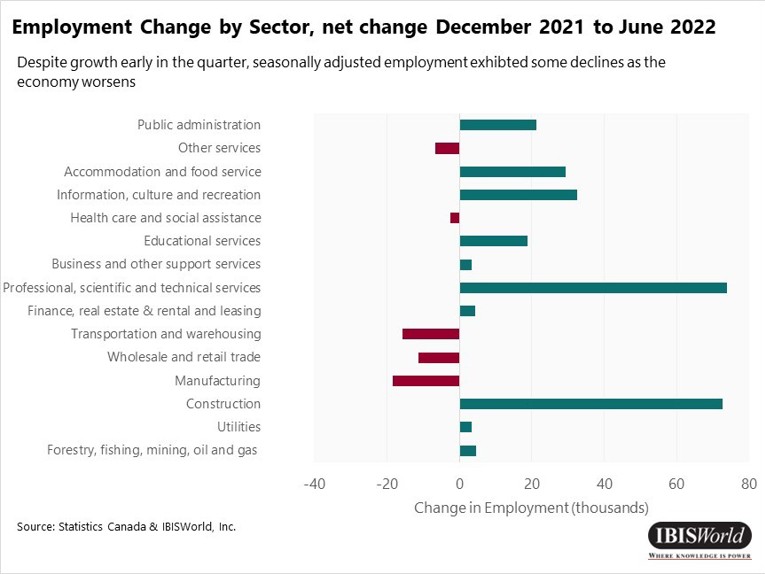

Labor market

- During the second quarter of 2022, the unemployment rate declined to 4.9% as the economy continued to recover from the coronavirus pandemic. However, this trend quickly changed, with unemployment stagnating in July and rising 0.5% to 5.4% in August.

- As the Bank of Canada began to raise interest rates to fight mounting inflation, the labor market cooled down. In the United States, the unemployment rate also increased in August 2022; however, it was mostly due to an increase in the labor force, not a decline in the number of jobs.

- During the second quarter of 2022, total employment increased 0.1% due to economic improvements; however, the number of employees in the economy began to decline in June, which will most likely translate into overall lower employment during the third quarter of 2022.

- The average hourly wage, measured in current dollars, has been relatively consistent and predictable due to the nature of inflation. However, hourly wages experienced a relatively high increase in 2022, primarily due to high inflation, increasing 2.5% since the beginning of 2022.

Consumer spending

- Household consumption expenditure (HCE) in Canada continued to increase during the second quarter of 2022, with consumer spending higher than prepandemic spending during the second quarter of 2019. During the first half of 2022, HCE was up 13.2% relative to the first half of 2021. During the second quarter, year-over-year spending is up 14.8%.

- Increased year-over-year consumption trends during the second quarter were led by spending on clothing and footwear increasing 41.7%, spending on recreation and culture rising 30.8% and spending on furnishings and household equipment growing 27.8%.

- Despite an overall increase in HCE during the second quarter, growth was pressured by spending on education falling 2.5% compared with the first quarter of 2022. Additionally, spending on housing, water, electricity, gas and other fuels decreased 0.9% during the second quarter while year-over-year spending for this category increased 7.8%. Although spending on gas decreased during the second quarter of 2022, this is primarily just in response to the significant increase experienced during the first quarter.

Inflation

- Inflation, measured through the consumer price index including food and energy, increased 7.6% year-over-year as of July 2022. This represents a slight decrease from June 2022, when year-over-year inflation was up 7.7%.

- The deceleration in inflation is primarily driven by a slowdown in rising gasoline prices. Gas prices rose 35.6% year-over-year as of July 2022, following the 54.6% year-over-year increase in June.

- Gas prices decreased as a result of lower demand for oil in the United States and worldwide. Additionally, concerns related to the global economy slowing down contributed to decreased demand and prices.

- Conversely, the price of food increased 9.2% year-over-year as of July 2022, representing a 0.9% month-over-month increase.

- Since energy and food prices are especially volatile, inflation is also measured excluding these items. Not including food and energy, year-over-year inflation was up 6.6% as of July 2022.

- Overall, inflation has continued to increase at a faster rate than hourly wages, which rose 5.2% year-over-year as of July 2022, giving consumers less purchasing power.

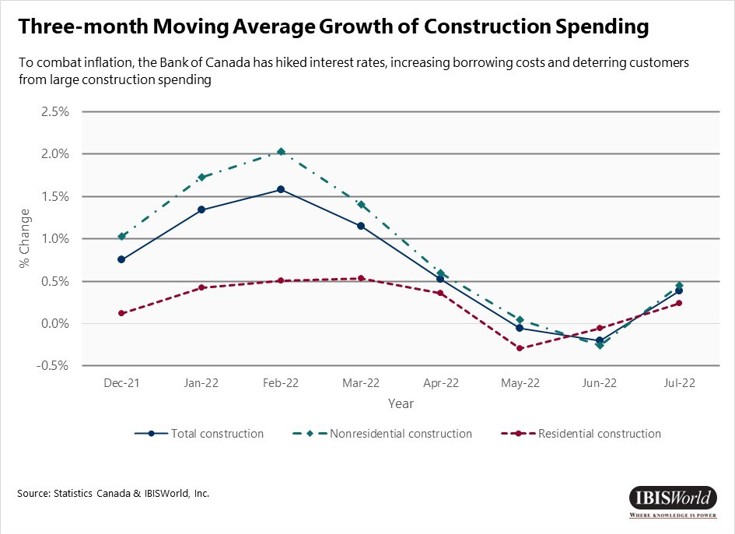

Construction: Canada

- As the Canadian economy has begun to recover from the uncertainty of the coronavirus pandemic, total construction activity increased during the first quarter of 2022, while interest rates remained low.

- However, total construction activity slowed down during the second quarter. This slowdown can be primarily attributed to rising interest rates. This slowdown is expected to continue and even potentially cause construction activity to decrease as interest rates have continued to rise.

- As monetary tightening likely continues, interest rates are forecast to continue climbing to stabilize inflation.

- However, nonresidential construction has performed at a slower rate since its peak in June 2020. Since that peak, nonresidential construction investment has steadily decreased. This trend is primarily a result of macroeconomic uncertainty surrounding the war in Ukraine, record high inflation, lingering coronavirus restrictions and other economic challenges. These economic uncertainties typically deter investors from considering long-term expansion and growth projects.

Construction: Ontario

- As Ontario was more heavily affected by the negative effects of pandemic lockdowns, total construction has declined more rapidly in Ontario than in Canada overall. Over the six months to July 2022, total construction declined 4.6% in Ontario, while construction in the entire country grew 2.8% during the same period.

- This expansion in nonresidential construction activity can be mainly attributed to the rise in government consumption and investment in 2022.

Financial markets

- Current policy interest has increased a total of 2.75%, with the target now at 3.25% as of September 7th. In accordance with the Bank of Canada’s target inflation of 2.0%, aggressive monetary tightening has been enacted with a 100-basis point increase in July, followed by a 75-basis point increase in September. The bank is expected to continue its monetary tightening stance as long as inflation continues to remain high.

- In response to the coronavirus pandemic, the Bank of Canada began an asset purchasing program to have a sufficient amount of credit for consumers and businesses. Due to sustained inflation, asset purchases have stopped as of March 2022. To assist in quantitative tightening, the Bank of Canada has begun to sell assets, such as bonds, to reduce the money supply in the economy.

- Inflationary concerns weighed heavily on the S&P/TSX, resulting in the index declining 11.1% year-to-date. The healthcare segment was the worst performing sector, decreasing 45.8% during the second quarter, likely a result of investor uncertainty regarding biotech investment and drug prices. Biotech companies generally carry a higher risk for investors. As a result of high inflation, investor sentiment turned towards other sectors such as energy. Energy was the best performing sector, returning 2.7% during the second quarter. While demand for oil and natural gas drove gains, readjustments in commodity prices turned major constituents in this sector negative.

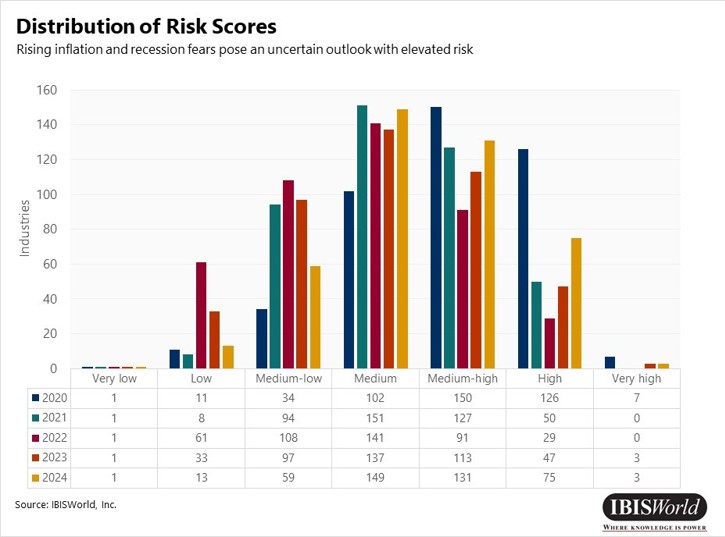

Distribution of risk ratings

- Risk in 2020 was significantly skewed, with 65.7% of industries rated as medium-high or greater risk as a result of the pandemic and related low economic activity.

- While risk in 2021 was more moderate, it was still elevated as many pandemic restrictions remained in place, new variants arose and supply chain disruptions worsened. Consequently, 41.1% of industries are rated as medium-high or greater risk in 2021.

- The risk outlook is expected to improve significantly in 2022 as the economy recovers from the pandemic with 27.8% of industries rated as medium-high or greater risk.

- However, 2023 and 2024 pose some economic uncertainty as inflation remains high and the war in Ukraine continues to threaten global supply chains, driving an increase in risk during the outlook.

Macro outlook

As the Canadian economy has reopened and pandemic-related restrictions have been largely lifted, the economy expanded, with the second quarter of 2022 marking the eighth-consecutive quarterly increase.

Although consumer and business demand has remained steady since the fourth quarter of 2021, this has continued to outpace supply, driving inflation. Despite high prices for oil and natural gas, consumer consumption of oil has not decreased, driven by a lack of alternatives.

While Canada has outperformed other leading economies during the first half of the year, high inflation, a housing downturn and worsening jobs numbers during the third quarter signal the economy is losing momentum, heightening recession concerns moving forward.

The Russian invasion of Ukraine has resulted in increased prices for oil and other commodities, furthered by excess demand from consumers globally. Additionally, the war has increased shipping congestion as businesses navigate the severing of Russian networks.

As global supply chain disruptions have worsened, it is anticipated that Canadian commodity pricing will continue to increase, resulting in a unique opportunity for Canadian companies to have a competitive advantage in energy and commodity sectors, primarily from agriculture. This is expected to benefit trade balance, corporate profits, job creation and the strength of the Canadian dollar.

Canada’s exporters are vulnerable to the economic cycle in the United States. As the US economy has worsened, Canada has been heavily investing in Foreign Direct Investment. This will likely strengthen the relationship with alternative trade partners to decrease the amount of risk associated with exposure to a single large trade partner.

Sector highlights

Accommodation and Food Services – Lifted pandemic-related restrictions have driven tourism activity and consumer spending on food away from home. As a result, the Full-Service Restaurants and Bars and Nightclubs industries have benefited from heightened demand. Additionally, as the economy has reopened to domestic travel and tourism early in the year, the Hotels and Motels and Campgrounds and Recreational Vehicle Parks industries have rebounded.

Finance and Insurance – The Bank of Canada has continued with aggressive interest rate hikes due to surging inflation and the ongoing war in Ukraine. As interest rates rise, banks benefit from a higher cost of borrowing for customers, increasing net interest income and revenue. This raised borrowing cost is expected to continue to benefit the Commercial Banking and Loan Administration, Cheque Cashing and Other Services industries.

Mining – The war in Ukraine has disrupted global supply chains, driving up commodity prices, including oil and gas. Additionally, bans on Russian supply have pushed Canada to increase crude oil supply for the global market. In turn, this has incentivized oil sands production, thus benefiting the Oil Drilling and Gas Extractionindustry.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.