Basic information

The textile machinery is a general term for various mechanical devices in all stages of textile technology to process natural or chemical fibers into textiles. Textile machinery is the foundation for the transformation and innovation of the textile industry in China, the key to transforming China’s textile industry from labor-intensive to technology-intensive, and a cornerstone for China’s development from a strong textile country to a powerful textile country.

Among textile machinery enterprises, Jingwei Textile Machinery Co., Ltd. (Jingwei Textile Machinery) is a core member of China Hi-Tech Group Corporation (CHTC), which is a backbone company of China National Machinery Industry Corporation (Sinomach), one of the world’s top 500 enterprises. Jingwei Textile Machinery engages mainly in textile machinery manufacturing and also operates a financial trust business. While deeply cultivating the main business of textile machinery, Jingwei Textile Machinery continues to standardize corporate governance, actively promotes the combination of production and financing, and its financial business represented by Zhongrong International Trust Co., Ltd. (ZRT) has developed well, effectively promoting the development of textile machinery business.

Zhejiang Taitan Co., Ltd. has independently researched and developed chemical fiber and silk double-twisting machines since 1992, filling the gap in China. Up to now, it has formed five series and more than 20 varieties, including high-speed weaving equipment, intelligent spinning equipment, new twisting equipment, automatic winding equipment, and modern logistics equipment. It has 15 national scientific and technological achievements and 100 and more independent intellectual property rights. The performance indicators of major product equipment have reached the advanced level of similar international equipment.

Basic Information of Jingwei Textile Machinery vs. Taitan Corporation

Jingwei Textile Machinery

- Registered date: March 29, 1996

- Registered capital: 704.13 million yuan

- Registered address: No. 8, Yongchang Middle Road, Beijing Economic Development Zone, Beijing

- Introduction: The general business of Jingwei Textile Machinery is to produce and develop textile machinery, other electromechanical products, office automation devices, and specialized accessories and devices.

Taitan Corporation

- Registration date: August 12, 1998

- Registered capital: 216 million yuan

- Registered address: No. 99, Taitan Avenue, Qixing Street, Xinchang County, Zhejiang Province

- Introduction: The general business of Taitan Corporation includes the production, sales, consulting services, and road freight transportation of textile machinery and accessories, mechanical equipment and accessories, textile equipment, household appliances and accessories, rubber ball machinery, and hardware products.

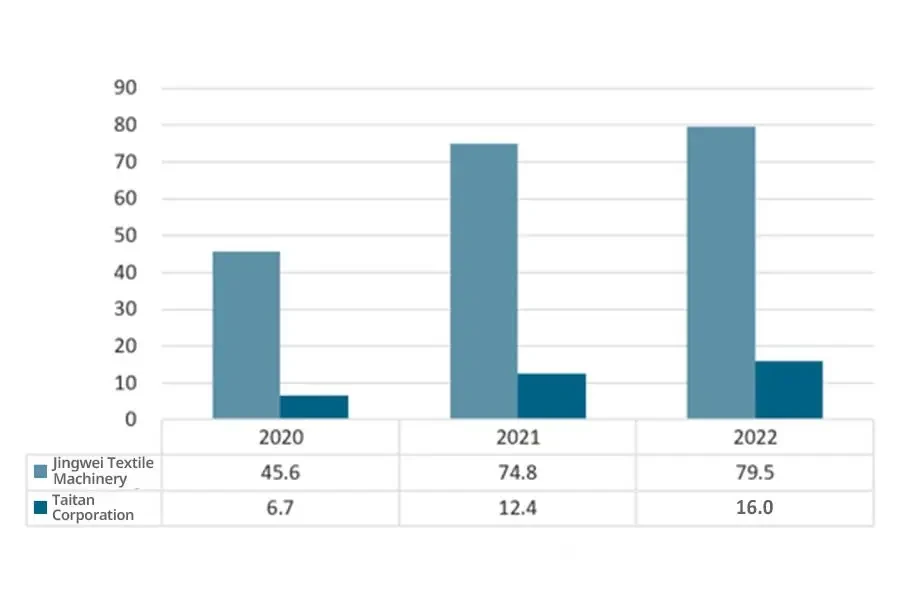

Business situation

China is the largest producer and exporter of textiles and clothing in the world, with a complete industrial chain layout. The textile industry is a pillar of China’s national economy and the livelihood industry. Now, China’s fiber processing volume accounts for over 50% of the world’s total, and the textile industry scale ranks first in the world. The development of the textile industry has driven the development of the textile machinery industry. There is a large-scale textile machinery industry in China, which has formed a relatively complete industrial chain layout. After China’s economy enters a new normal of development, the textile industry is also in a critical period of transformation from old to new growth models. The only way to implement the transformation is to rely on scientific and technological innovation to drive development. Textile machinery is the equipment and technology foundation of China’s textile industry. Focusing on the structural adjustment requirements of the textile industry, developing high-end textile equipment technology, and improving the manufacturing level of domestic textile equipment is a great foundation and key for China’s textile industry to transform from strong to powerful. From the total revenue of the two enterprises in recent years, their total revenue has steadily increased, and the total revenue of Jingwei Textile Machinery is much higher than that of Taitan Corporation. In 2022, the total revenue of Jingwei Textile Machinery and Taitan Corporation was 7.95 billion yuan and 1.6 billion yuan, respectively.

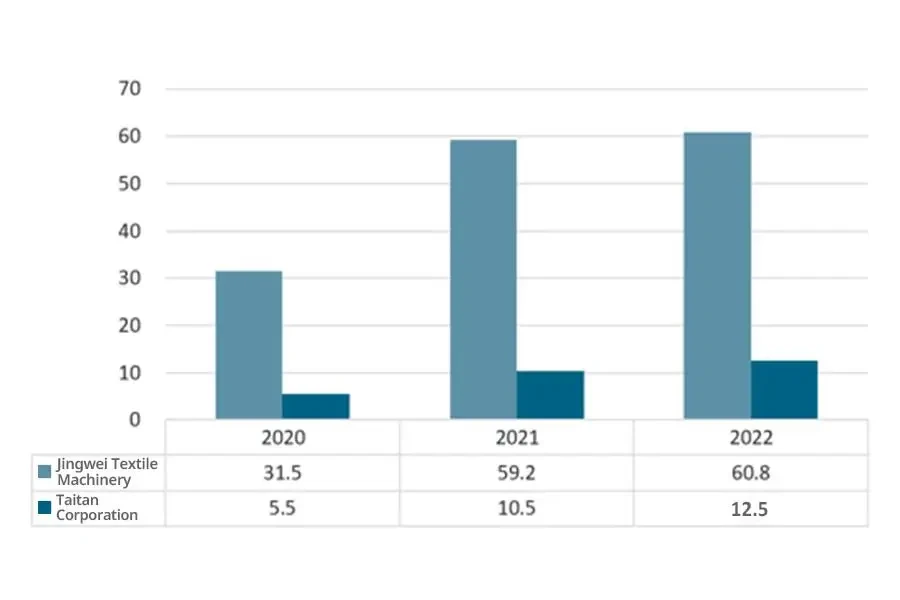

From the perspective of the respective operating costs in recent years, the total operation costs of Jingwei Textile Machinery and Taitan Corporation have been increasing year by year. The total operating cost of Jingwei Textile Machinery increased from 3.15 billion yuan in 2020 to 6.08 billion yuan in 2022, and the operating cost of Taitan Corporation was 1.25 billion yuan in 2022.

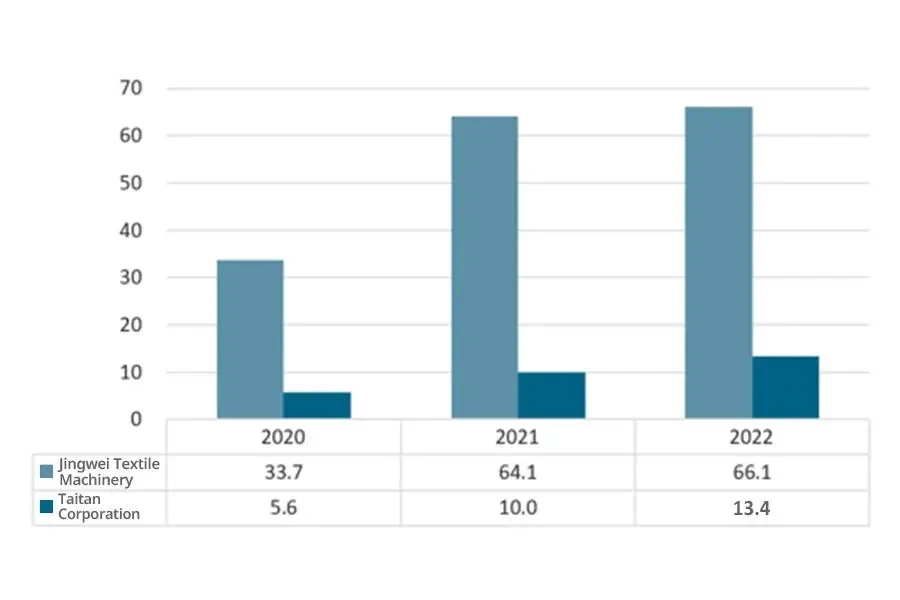

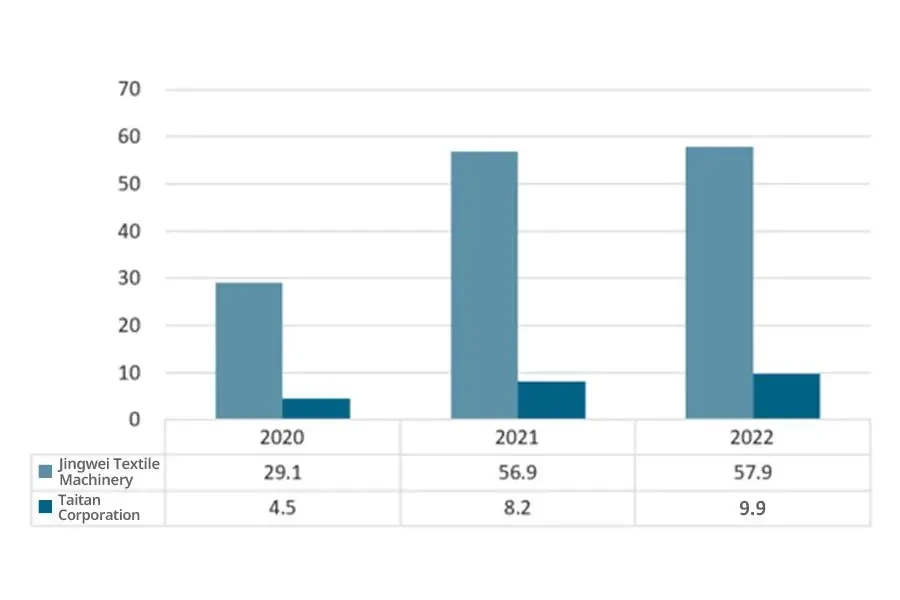

“Green Textile “is a prominent theme during the development process of the textile industry in the 21st century. Therefore, textile equipment that can improve resource utilization, reduce energy consumption, and be environmentally friendly can have a broad market space. Meanwhile, the engine driving the development of the textile and clothing industry has transformed. The production competition mode of production factors in the past has transformed into a comprehensive competition of technological strength. In the future, the textile and clothing industry will no longer be labor-intensive but technology-intensive and creative-intensive with high-tech characteristics. Therefore, innovative, efficient, environmentally friendly, digital, and intelligent textile machinery is the development trend of future textile machinery equipment. From the operating revenue of Jingwei Textile Machinery and Taitan Corporation from 2020 to 2022, it can be shown that the business revenue of the two enterprises has been increasing year by year, and Jingwei Textile Machinery revenue is much higher than that of Taitan Corporation. In 2022, the respective revenue of this business was 6.61 billion yuan and 1.34 billion yuan, respectively.

The textile machinery operating costs of Jingwei Textile Machinery and Taitan Corporation from 2020 to 2022 were consistent with the changes in their respective business revenues. Their textile machinery operating costs were 5.79 billion yuan and 9.9 billion yuan in 2022, respectively.

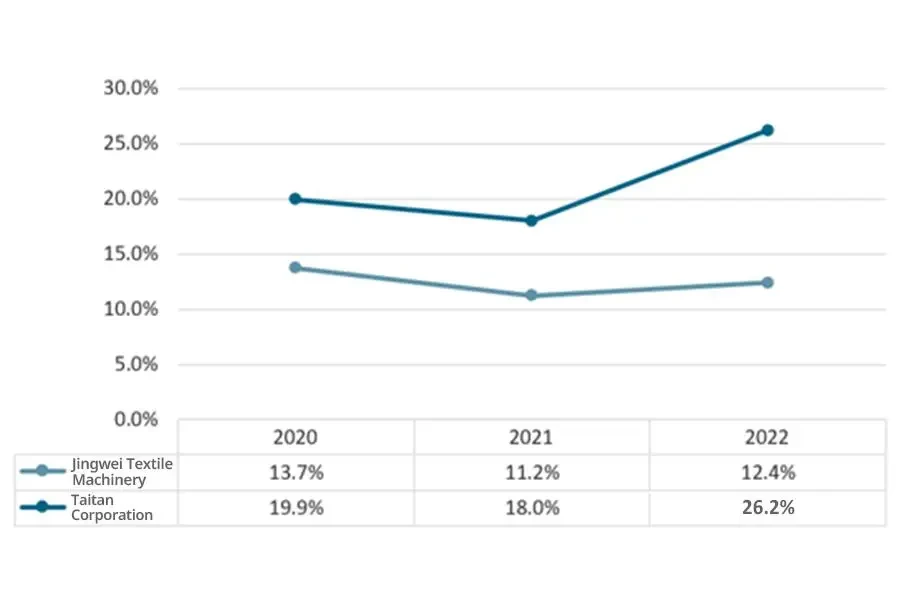

Compared with the gross profit margin in the textile machinery business of Jingwei Textile Machinery and Taitan Corporation, the gross profit margin of both enterprises in business decreased first and then increased. In 2022, the gross profit margins of Jingwei Textile Machinery and Taitan Corporation were 12.4% and 26.2%, respectively, and the gross profit margin of Taitan Corporation remained consistently higher than that of Jingwei Textile Machinery.

Production and sales

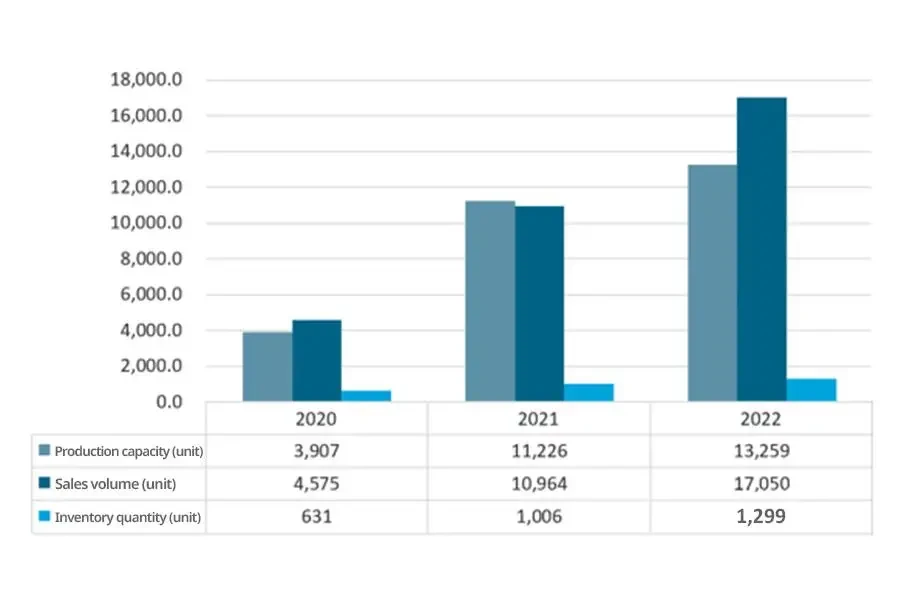

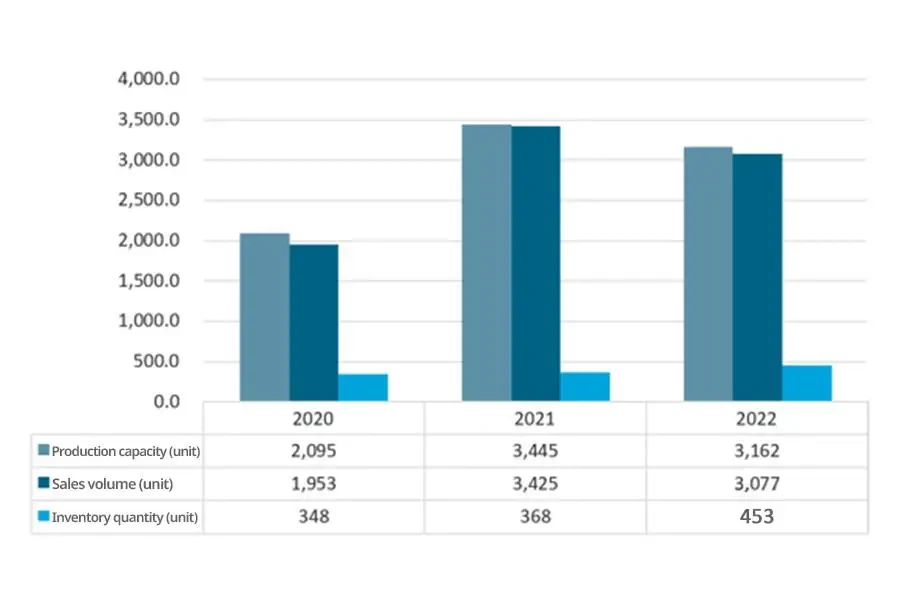

From the perspective of the production & sales of textile machinery by the above two enterprises, the production & sales of Jingwei Textile Machinery have steadily increased, with 13,259 units and 17,050 units in 2022, respectively. The production & sales of Taitan Corporation were 3,162 units and 3,077 units in 2022, respectively.

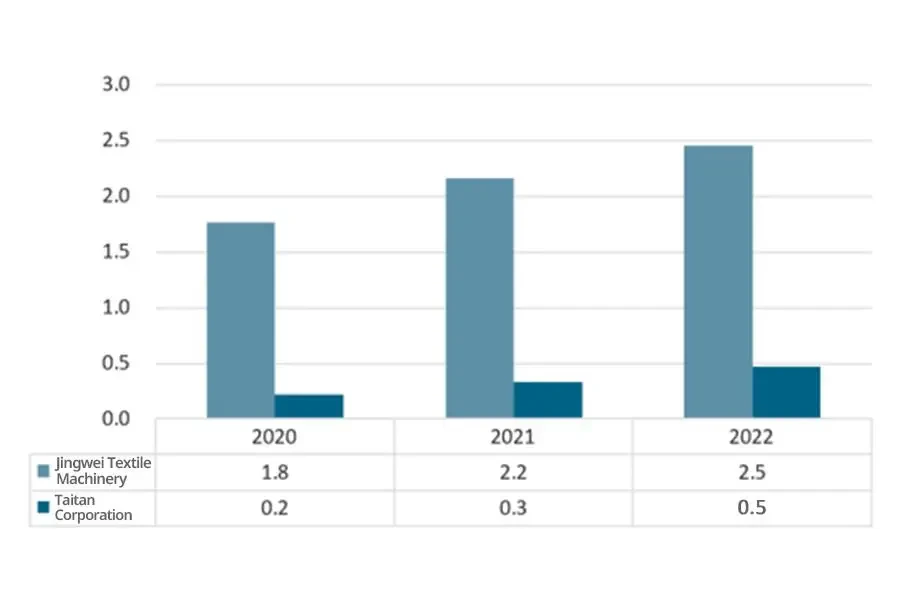

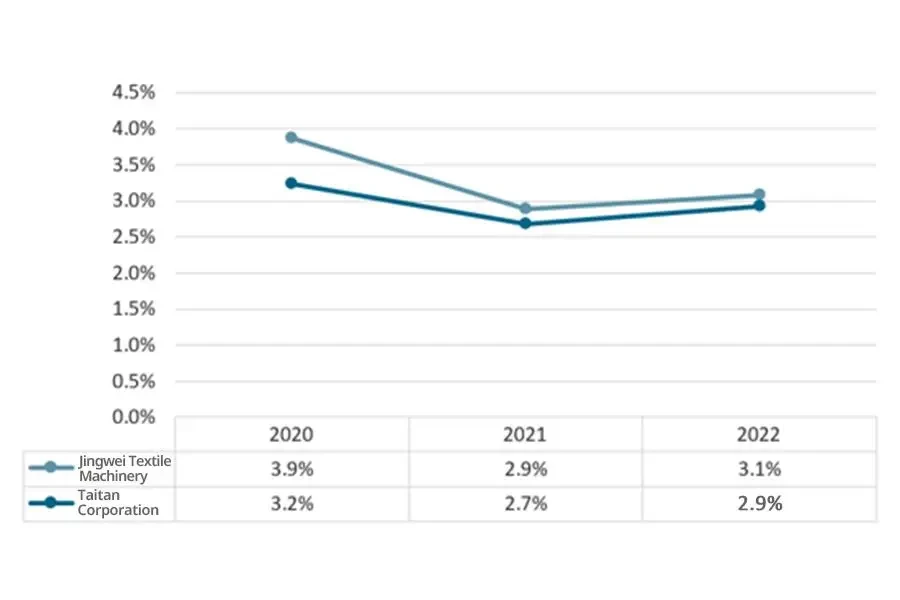

Research and development investment

From the perspective of the R&D investment amount, the R&D investment of the two enterprises has been increasing year by year, with their R&D investment amounts of 250 million yuan and 50 million yuan in 2022, respectively. From the proportion of R&D investment, the R&D investment proportions of the two enterprises were 3.1% and 2.9% in 2022, respectively.

Conclusions

From the perspective of various business indicators, the textile machinery operating revenue of Jingwei Textile Machinery is higher than that of Taitan Corporation, and the gross profit margin of Jingwei’s textile machinery is lower than that of Taitan Corporation. The R&D investment amount and production & sales volume of Jingwei Textile Machinery in 2022 are higher than those of Taitan Corporation.

Source from Chyxx

Disclaimer: The information set forth above is provided by chyxx.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.