1. General information

Sany Heavy Industry has become a leading enterprise in China’s construction machinery industry, specializing in producing and selling concrete, road, and excavation machinery as its core business. Its independently developed series of construction machinery products led to China’s high-end manufacturing. XCMG Machinery is a pioneer in China’s construction machinery industry and ranks among the top in revenue. Its core products cover engineering lifting machinery, concrete machinery, and earthmoving transportation machinery, and it also has a global marketing network layout. As a leading enterprise in producing construction machinery equipment in China, Zoomlion Heavy Industry is dedicated to developing, manufacturing, and selling construction and agricultural machinery. Its current key products include concrete machinery, high-altitude operation machinery, and fire-fighting machinery. Below is the comparison of basic information on 3 key Chinese construction machinery enterprises

Sany Heavy Industry

- Date of establishment: 1989

- Registered capital: 8.491 billion RMB

- Registration location: 5th floor, Building 6, No. 8 Beiqing Road, Changping District, Beijing

- Introduction:

The company mainly conducts research and development, manufacturing, sales, and service of construction machinery. The company’s products include concrete, excavating, lifting, pile driving, and road construction machinery. Among them, concrete equipment is the world’s leading brand, and the leading products such as excavators, large-tonnage cranes, rotary drilling rigs, and road construction equipment have become China’s first brand.

XCMG Machinery

- Date of establishment: 1993

- Registered capital: 11.82 billion RMB

- Registration location: No. 26 Tuolanshan Road, Xuzhou Economic and Technological Development Zone, Jiangsu Province

- Introduction:

The company primarily conducts research and development, manufacturing, sales, and service of lifting machinery, earthmoving machinery, compaction machinery, road machinery, pile driving machinery, fire-fighting machinery, sanitation machinery, and other engineering machinery and spare parts. The company’s products include wheeled cranes with the world’s highest market share and truck cranes, crawler cranes, road rollers, bulldozers, pavers, horizontal directional drilling rigs, rotary drilling rigs, high-altitude fire trucks, bridge inspection vehicles, and aerial work vehicles. Many of these core products have the highest market share in the domestic market.

Zoomlion Heavy Industry

- Date of establishment: 1999

- Registered capital: 8.678 billion RMB

- Registration location: No. 361 Yinpen South Road, Yuelu District, Changsha, Hunan Province

- Introduction:

The company mainly researches and manufactures high-tech equipment, such as construction and agricultural machinery, and is a globally oriented enterprise focusing on continuous innovation. The company produces 11 major categories, 70 product series, and over 568 leading products with fully independent intellectual property rights, making it the complete engineering machinery enterprise in the global production chain. The two major business segments of the company, concrete machinery, and lifting machinery, both rank among the top two globally.

2. Comparison of business models

Key Chinese engineering machinery enterprises have unique advantages in their business models. Sany Heavy Industry and XCMG Machinery have established long-term cooperative relationships with suppliers, greatly reducing procurement costs and giving them a cost advantage over their peers. Zoomlion Heavy Industry has accelerated the intelligent upgrading of its production and manufacturing, constructing intelligent parks, factories, and production lines. It has also applied intelligent manufacturing technology to improve production efficiency and established smart systems and operations for efficient coordination. These factors give it unique advantages in production mode. Below is the comparison of business models of the 3 key Chinese construction machinery enterprises

Sany Heavy Industry

- Sales model: There are mainly two sales models: direct sales model and distributor sales model.

- Procurement model: The companies have certain price advantages in procuring components by establishing long-term cooperative relationships with suppliers. The procurement prices are determined according to the signed procurement contracts.

- Production model: Not entirely adopting a made-to-order production model.

XCMG Machinery

- Sales model: Two sales models: direct sales and distribution.

- Procurement model: The companies ensure a certain price advantage by establishing long-term cooperative relationships with suppliers. For large-tonnage products, procurement is arranged according to the order quantity.

- Production model: Annual production plans are developed based on annual budget targets, which are adjusted in response to market conditions. For some high-volume products, production is scheduled according to the number of orders.

Zoomlion Heavy Industry

- Sales model: Credit sales, installment sales, and financing leasing sales

- Procurement model: The integration of common materials procurement across multiple categories and strategic procurement of key materials.

- Production model: Tower cranes, mobile cranes, and aerial work platforms are produced using a localized manufacturing model, resulting in a global network of manufacturing facilities. The production process has achieved intelligent, automated, and flexible manufacturing capabilities.

3. Comparison of operating conditions

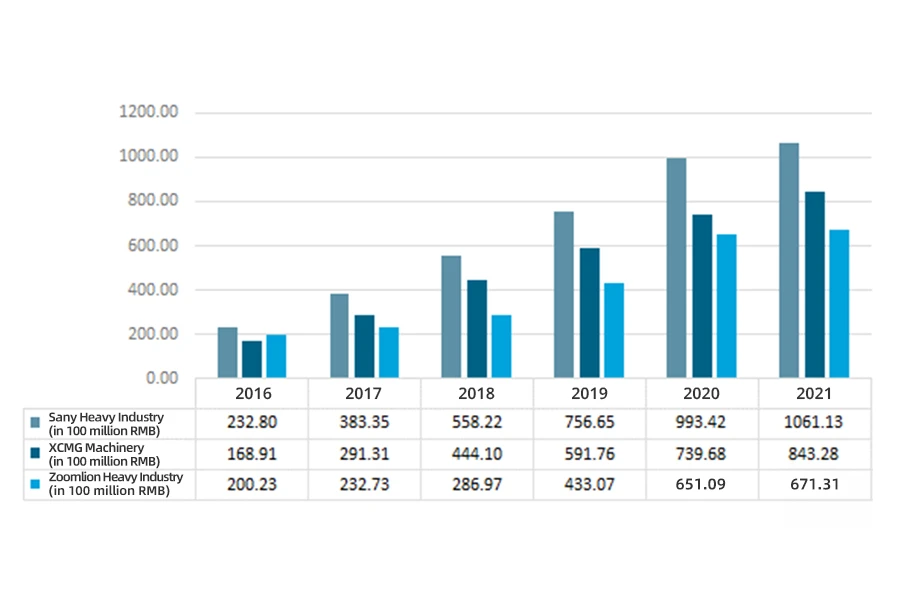

3.1 Overall revenue situation

Looking at the overall revenue of China’s construction machinery industry, Sany Heavy Industry’s operating income is higher than that of XCMG and Zoomlion. In 2021, Sany Heavy Industry’s operating income was 106.113 billion RMB, a year-on-year increase of 6.8%. XCMG and Zoomlion’s total operating income was 84.328 billion RMB and 67.131 billion RMB, respectively.

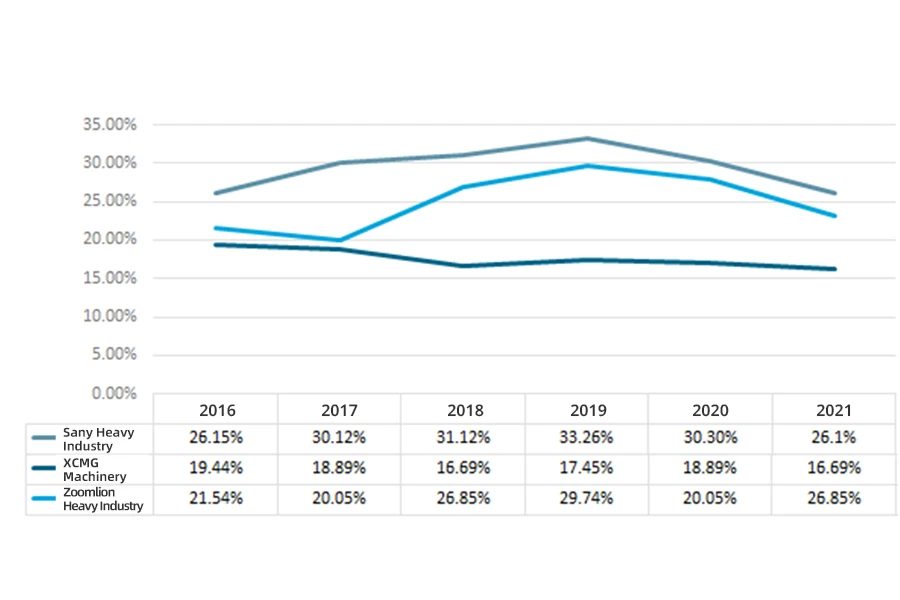

The gross profit margin of construction machinery equipment has generally declined in the past three years. China’s construction machinery industry has gone through its golden decade of high-speed development and has gradually entered a transformation period amidst a slowdown in macroeconomic growth. Among the gross profit margins of construction machinery companies, Sany Heavy Industry has the highest gross profit margin, which was 26.1% in 2021. Zoomlion followed with a gross profit margin of 23.24%, while XCMG had a gross profit margin of 16.24%.

3.1.1 The revenue and gross profit margin of Sany Heavy Industry’s construction machinery products

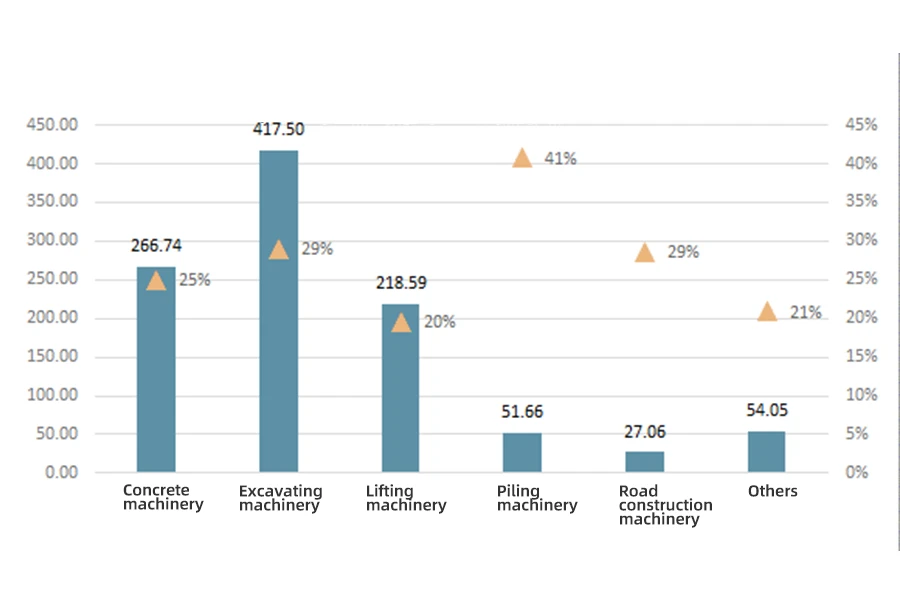

Sany Heavy Industry’s products include concrete, excavating, lifting, piling, and road construction machinery. Among them, concrete equipment is the world’s leading brand, with an operating income of 26.674 billion RMB and a gross profit margin of 25%. Leading products such as excavators, large-tonnage cranes, rotary drilling rigs, and complete sets of road equipment have become the first choice in China. Among them, excavators have an operating income of 41.75 billion RMB, and piling machinery has a high gross profit margin of 41%.

3.1.2 Revenue and gross profit margin of XCMG’s construction machinery products

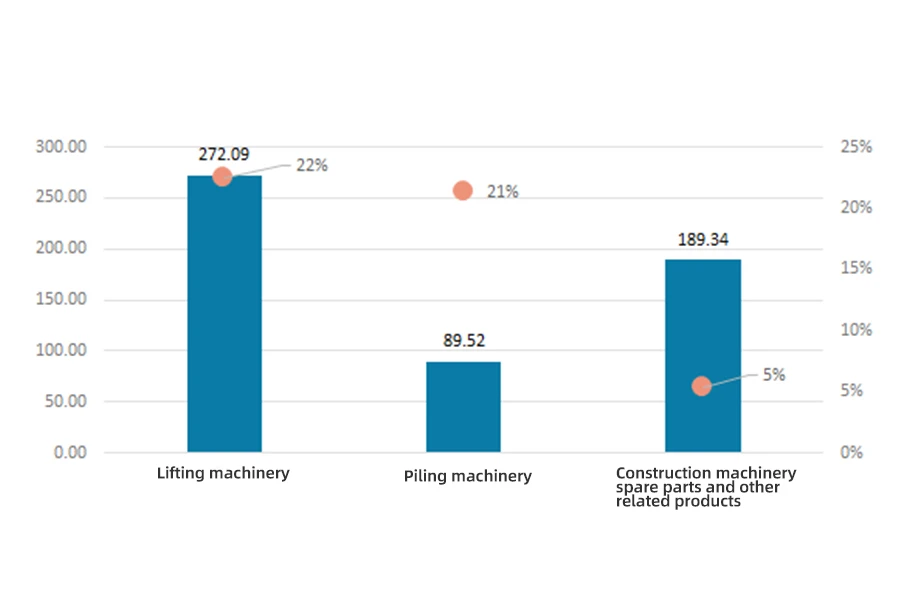

In XCMG’s product lineup, their cranes, mobile cranes, and horizontal directional drills are ranked first globally, while their truck cranes are ranked third globally. Their 12 main product categories, including pavers, rotary drilling rigs, and crawler cranes, are among the top in the domestic industry. The revenue of XCMG’s crane machinery was 27.209 billion RMB, and the gross profit margin was 22%.

3.1.3 Revenue and gross profit margin of Zoomlion’s construction machinery products

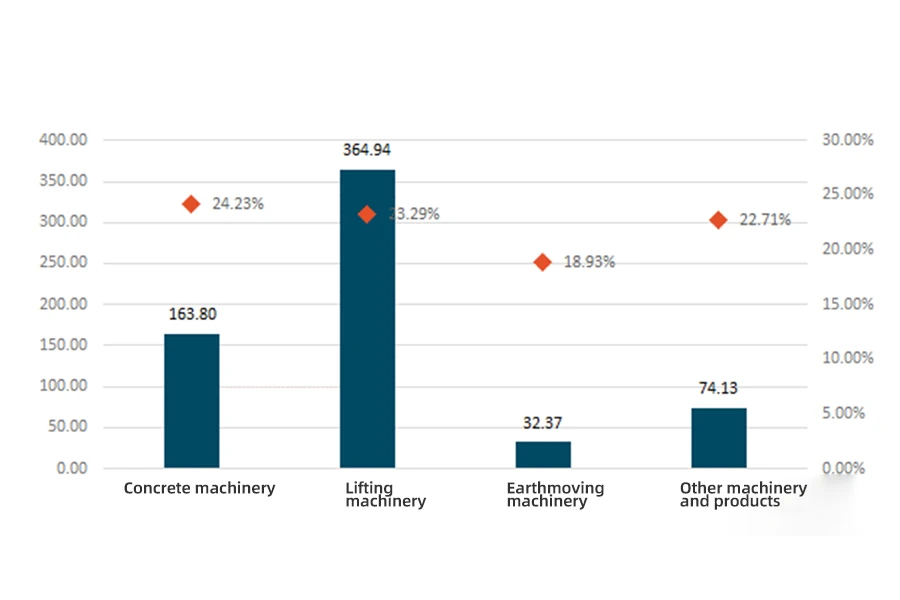

In 2021, Zoomlion’s three major products, including concrete machinery, engineering cranes, and building cranes, strengthened its competitiveness and maintained its market position. Their truck cranes continue to lead the market, with sales of truck cranes of 30 tons and above ranking first in the industry and sales of large-tonnage truck cranes growing by over 30% year-on-year. Their large-tonnage crawler cranes have the largest domestic market share. The sales of building cranes have reached a historical high, and their sales scale ranks first globally. The smart manufacturing bases in Changde, Hunan, Jiangyin, East China, Weinan, Shaanxi, and Hengshui, Hebei have all been put into operation, covering the whole country and significantly shortening the transportation distance, resulting in a noticeable increase in customer response speed. In 2021, the revenue of Zoomlion’s crane machinery was 36.494 billion RMB, and the gross profit margin was 23.29%.

Zoomlion’s concrete machinery market share, including long-boom truck-mounted concrete pumps, truck-mounted concrete pumps, and concrete mixing plants, still ranks first in the industry. Their lightweight concrete mixer trucks have advantages in the market, ranking among the top three in the industry. The revenue of their concrete machinery was CNY 16.38 billion, with a gross profit margin of 24.23%.

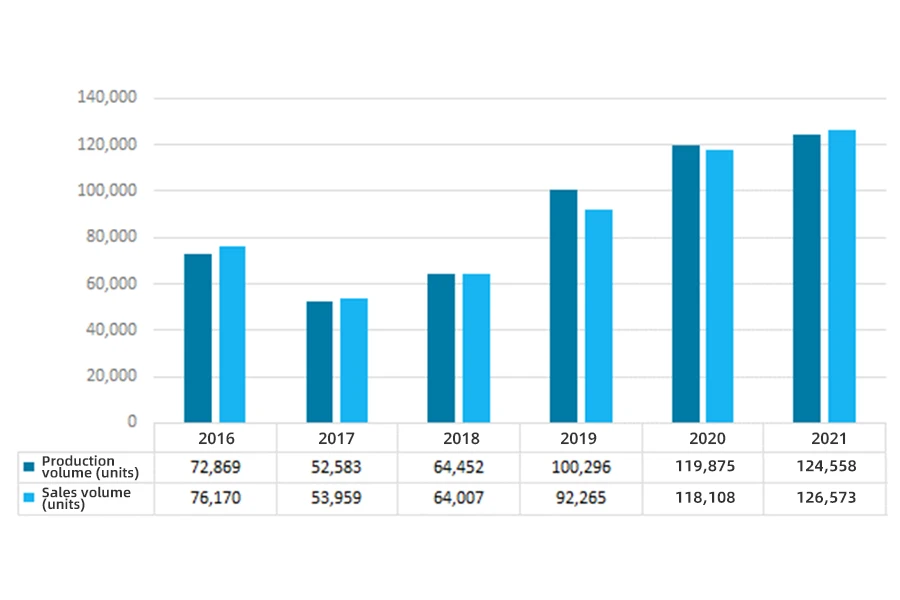

3.2 Production and sales situation

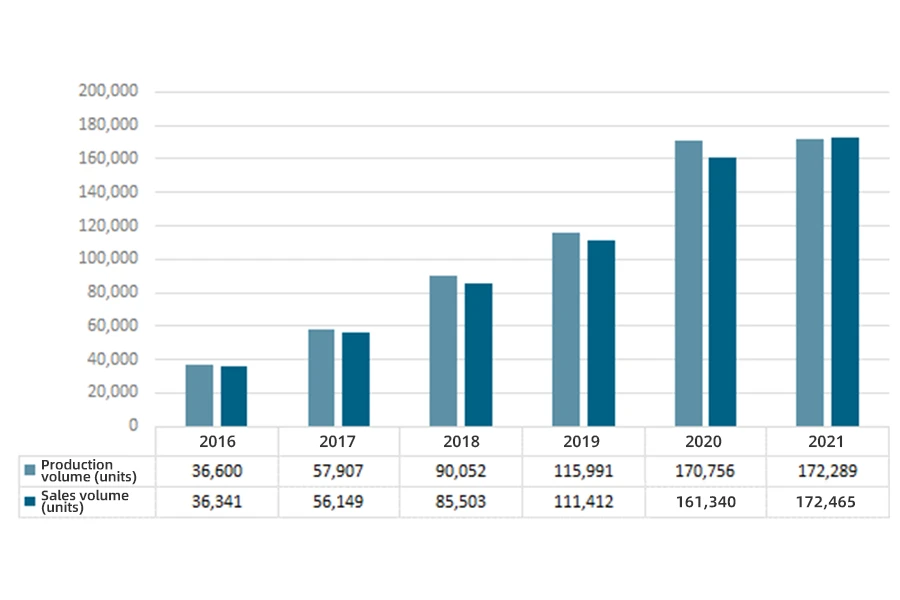

Sany Heavy Industry’s construction machinery production and sales volume ranked first and showed an upward trend year by year. In 2021, the production volume was 172,289 units and the sales volume was 172,465 units.

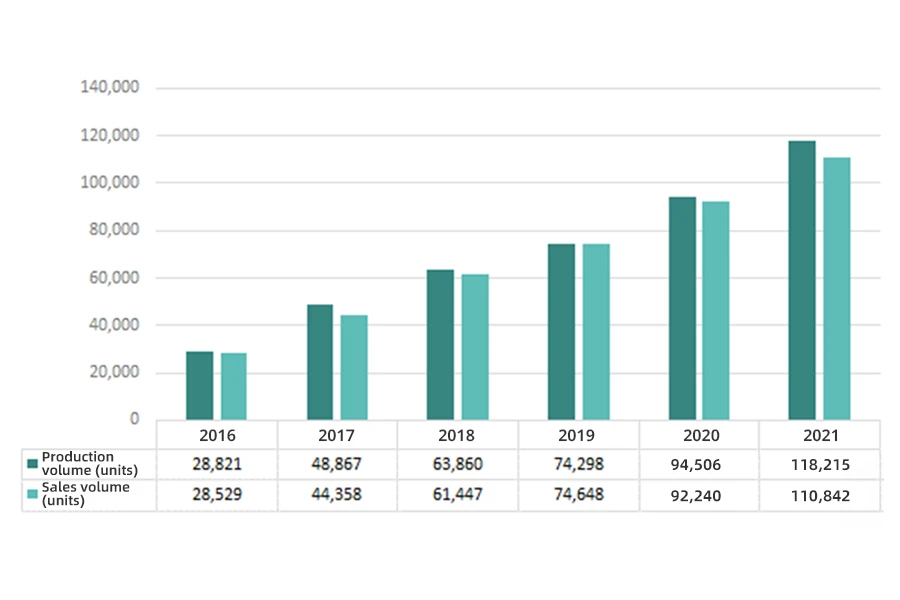

XCMG’s machinery production and sales volume also showed an upward trend, with a production volume of 118,215 units and a sales volume of 110,842 units in 2021.

In 2016, Zoomlion experienced the most difficult period in its corporate history, with a net loss of 930 million RMB, marking the first time the company suffered a loss since its listing on the A-share market 17 years ago. At the same time, the total number of Zoomlion’s employees also decreased from 19,000 to 15,000. The operating losses in 2016 were mainly due to the resolution of stock risks in the engineering machinery segment, strict control of new risks, increased staff compensation for departures, and strategic investment in transformation and upgrading. Among them, the traditional engineering machinery segment’s revenue was 10.55 billion RMB, down 14.6%. In contrast, the environmental and agricultural segments maintained an upward trend, contributing approximately 9 billion RMB in total sales revenue. Management hoped to offset the continued decline in the engineering machinery segment’s revenue with the growth of the environmental and agricultural machinery segments. As the environmental and agricultural segments continued to grow, the proportion of the construction machinery segment’s revenue to Zoomlion’s total revenue declined year by year. Some employees from the original construction machinery segment were transferred to the company’s environmental or agricultural machinery segments, while others chose to leave Zoomlion. The number of personnel in production, sales, and R&D departments all decreased to varying degrees, resulting in a decline in Zoomlion’s overall production and sales volume in 2017.

With the government actively expanding effective investment this year and continuing to strengthen major projects such as “iron, public, and infrastructure,” coupled with the peak period of updating and iterating stock construction machinery equipment, the domestic engineering machinery industry will continue to recover. In 2021, the production volume was 124,558 units and the sales volume was 126,573 units.

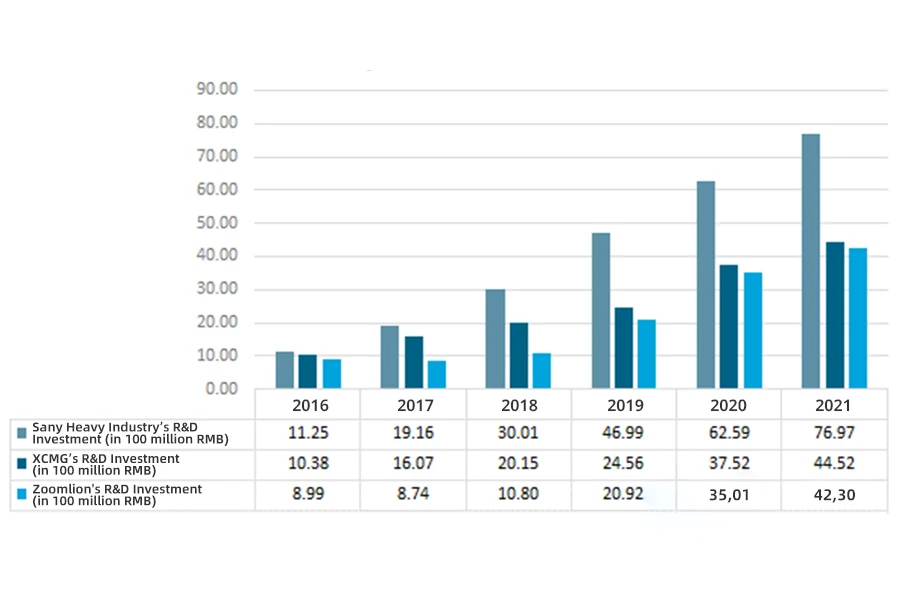

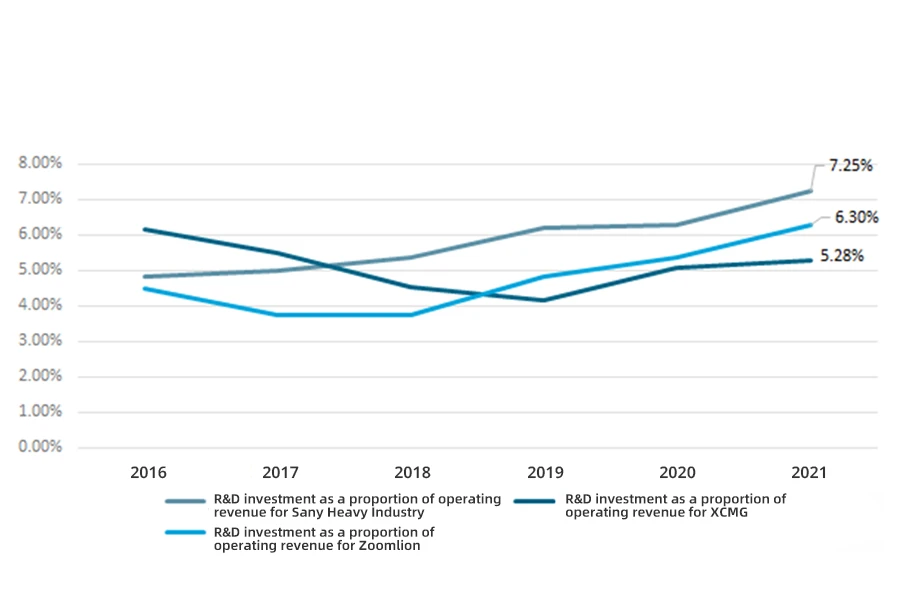

4. Research and development (R&D) comparison

Regarding R&D investment, Sany Heavy Industry has the highest R&D investment and the fastest growth rate. In 2021, Sany Heavy Industry established the “Two News and Three Transformations” strategy, adhering to long-term, increasing R&D investment in new products and technologies, promoting intelligence, electrification, and internationalization comprehensively, and achieving positive results. The R&D investment in 2021 was as high as 7.697 billion RMB, accounting for 7.25% of the operating income.

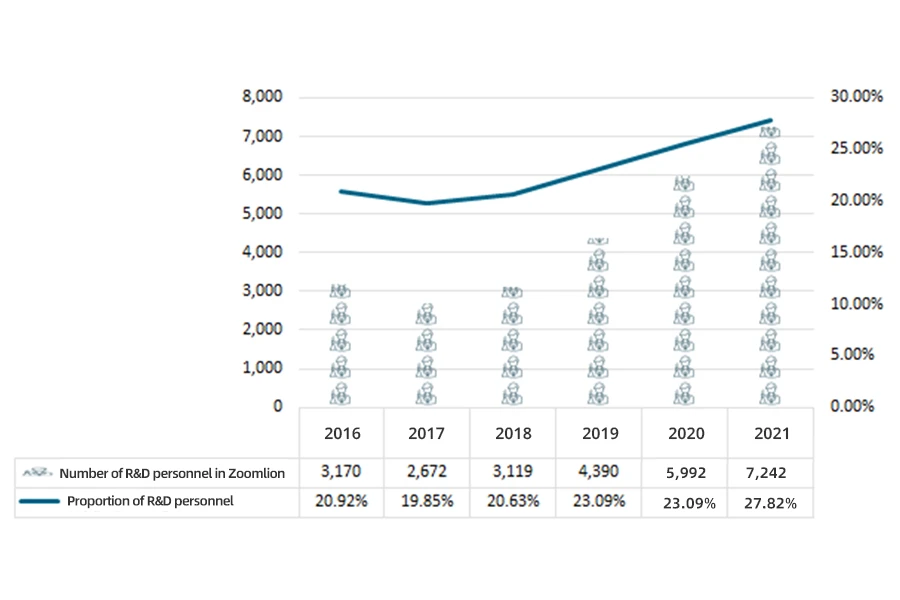

Zoomlion was the first to apply “5G+ Industrial Internet” to tower crane R&D, developing numerous high-performance products and winning several national-level scientific and technological progress awards. Zoomlion has been leading the industry in technology and product development. As of the end of 2021, Zoomlion has accumulated 12,278 patent applications and 9,407 authorized patents. The R&D investment in 2021 was 4.23 billion RMB, accounting for 6.3% of the operating income.

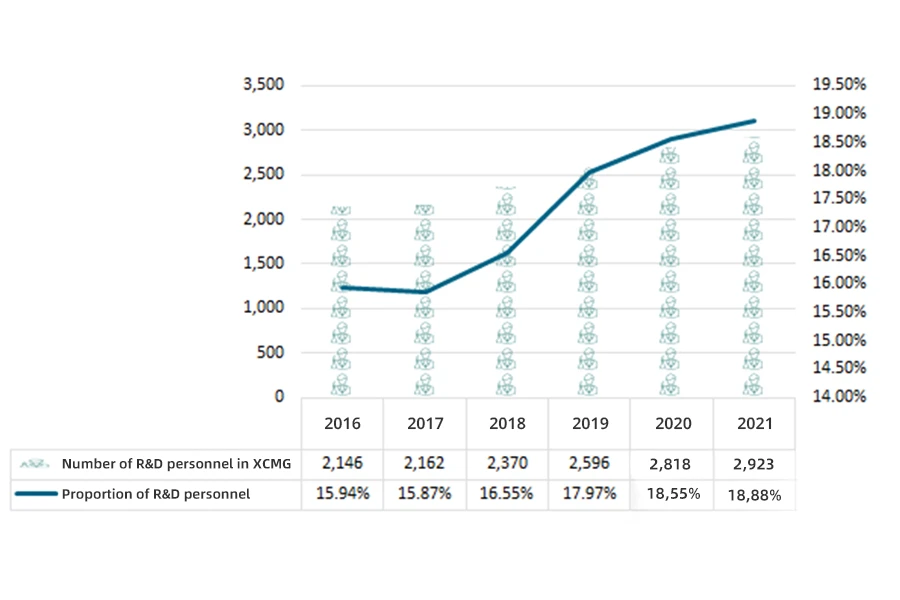

In recent years, XCMG has continued to increase R&D investment, with over half dedicated to key core technology research and major testing equipment and facility construction. As of the end of 2021, the listed company has accumulated 6,337 authorized patents, including 1,670 invention patents.

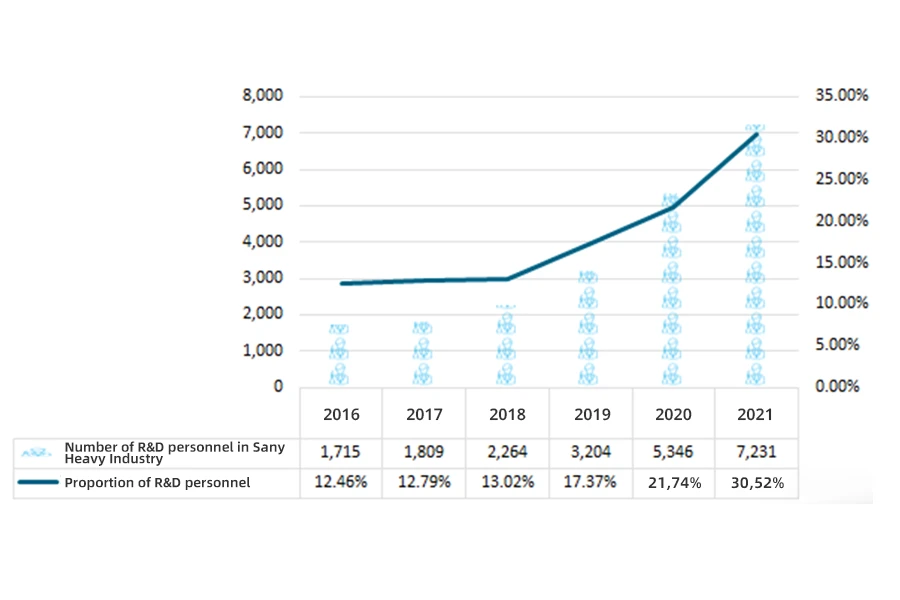

Sany Heavy Industry’s R&D personnel have grown rapidly, with 7,231 R&D personnel in 2021, accounting for 30.52% of the total number of employees, including 137 PhDs and 3,322 master’s degree graduates. Most of them are in the age group of 30-40.

In 2021, XCMG had 2,923 R&D personnel, accounting for 18.88% of the total number of employees, including 11 PhDs and 1,238 master’s degree graduates. Most of them are in the age group of 30-40.

In 2021, Zoomlion had 7,242 R&D personnel, accounting for 27.82% of the operating income, including 51 PhDs and 1,522 master’s degree graduates. The R&D personnel are relatively young, most under 30 years old.

5. Development plan

5.1 Sany Heavy Industry’s development strategy

Firmly implement the strategies of digitization, electrification, and internationalization:

- Digitization strategy: With the construction of the “Lighthouse Factory” as the core, Sany Heavy Industry focuses on data acquisition and application, industrial software application, and process upgrading to achieve refined control, data-driven decision-making, and scenario-based applications. By building intelligent products, Sany Heavy Industry aims to become a pioneer in intelligent manufacturing and a data-driven company.

- Electrification strategy: Electrification is the most important strategic area for the company. Sany Heavy Industry is fully promoting the electrification of engineering vehicles, excavating machinery, loading machinery, and lifting machinery, accelerating the layout of key components and technologies, and leading the way in thorough and positive electrification.

- Internationalization strategy: Sany Heavy Industry is implementing a global strategy, developing a scientific globalization layout, optimizing supply chain logistics, and developing the best product strategy to surpass traditional models.

5.2 XCMG’s development strategy

- Strengthen strategic leadership, focus on strengthening the main business of engineering machinery, accelerate the development of key core components, achieve self-control of key components, and ensure the safety of the industrial chain.

- Strengthen innovation-driven development, focus on original technology, and build a world-class technology innovation system.

- Strengthen international layout and comprehensively promote internationalization.

- Accelerate the layout of intelligent manufacturing and build an intelligent enterprise.

- Continuously promote change and accelerate the transformation and upgrading of service-oriented manufacturing.

5.3 Business measures of Zoomlion Heavy Industry in 2022

- Continuously strengthen scientific research and innovation, focus on greenification, digitalization, and intelligentization, and maintain the leading edge in product technology and performance.

- Steadily and surely achieve market breakthroughs.

- Accelerate the development of overseas business.

- Consolidate and strengthen the industrial lineup.

- Accelerate the digital transformation and establish a future-oriented digital management system by integrating research, production, supply, sales, and service end-to-end.

- Strengthen the construction of the talent team and build a good career platform for talent.

- Speed up the construction of a smart industry city.

6. Conclusion

From the selected indicators for comparison, Sany Heavy Industry is the industry leader in various indicators in the construction machinery industry. At the same time, Zoomlion Heavy Industry has a stronger advantage in research and development capabilities compared to XCMG Machinery. Both companies are leading enterprises in the construction machinery industry and have a broad development blueprint.

Source from Intelligence Research Group (chyxx.com)