1.Overview of agricultural machinery policies

The “14th Five-Year Plan” National Agricultural Mechanization Development Plan sets clear goals for developing agricultural mechanization. By 2025, the total power of agricultural machinery nationwide will stabilize at around 1.1 billion kilowatts, the configuration structure of agricultural machinery will tend to be reasonable, the operating conditions of agricultural machinery will be significantly improved, a socialized service system for agricultural machinery covering pre-production, in-production, and post-production of agriculture will be basically established, significant results will be achieved in energy-saving and emission reduction of agricultural machinery, the support of agricultural machinery for green development of agriculture will be significantly enhanced, the integration of mechanization, information technology, and intelligent technology will be further promoted, the ability of agricultural mechanization to prevent and reduce disasters will be significantly enhanced, and the safety of agricultural machinery data and production will be further strengthened.

2. The current situation of agricultural machinery

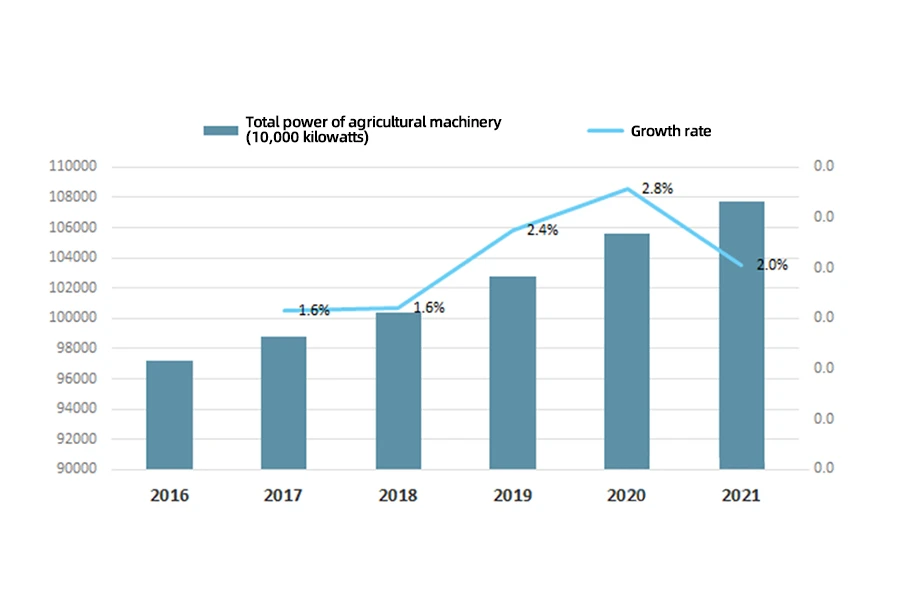

Implementing the agricultural machinery purchase subsidy policy has greatly improved the level of agricultural machinery equipment and mechanization in China. Among them, in 2021, the total power of agricultural machinery in China was 1,077,680,200 kilowatts, an increase of 2% compared to the previous year.

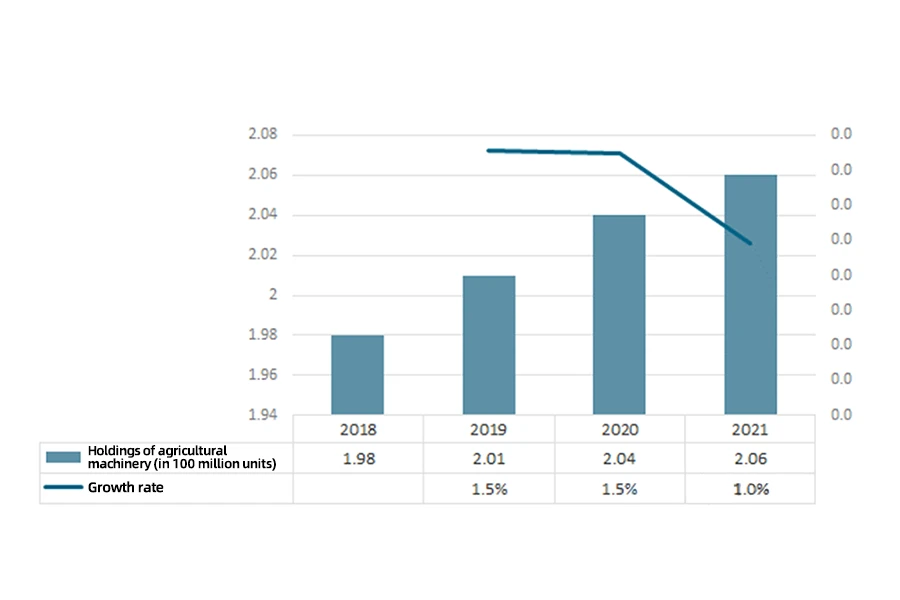

In recent years, the number of agricultural machinery in China has increased year by year, among which the number of agricultural machinery in China in 2021 was 206 million, an increase of 1% compared to the previous year.

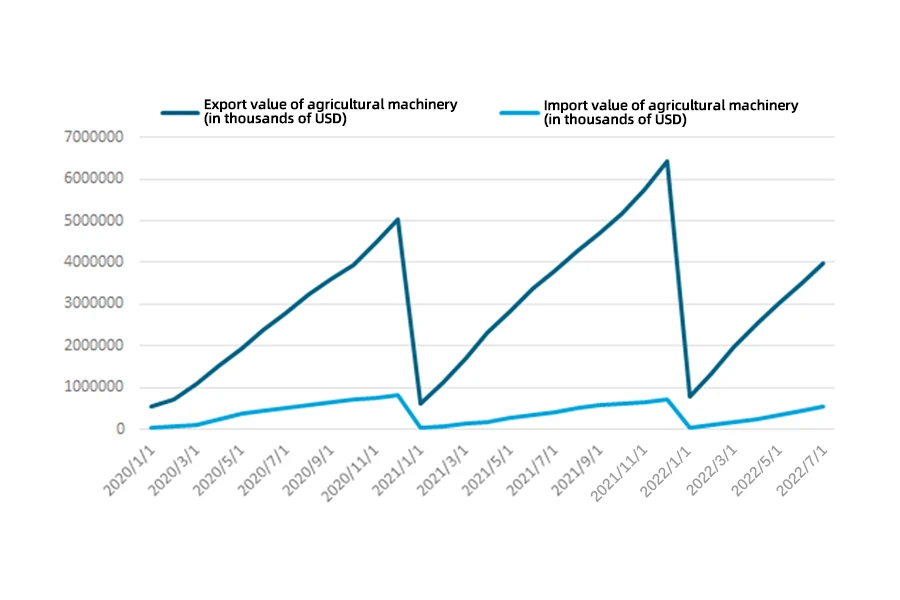

Looking at agricultural machinery’s import and export value, there have been significant fluctuations in the export value of agricultural machinery from 2021 to 2022, while the import value has remained relatively stable. In 2021, China’s agricultural machinery import value was 703 million USD, a decrease of 14.4% year-on-year, while the export value was 6,429 million USD, an increase of 28.2% year-on-year.

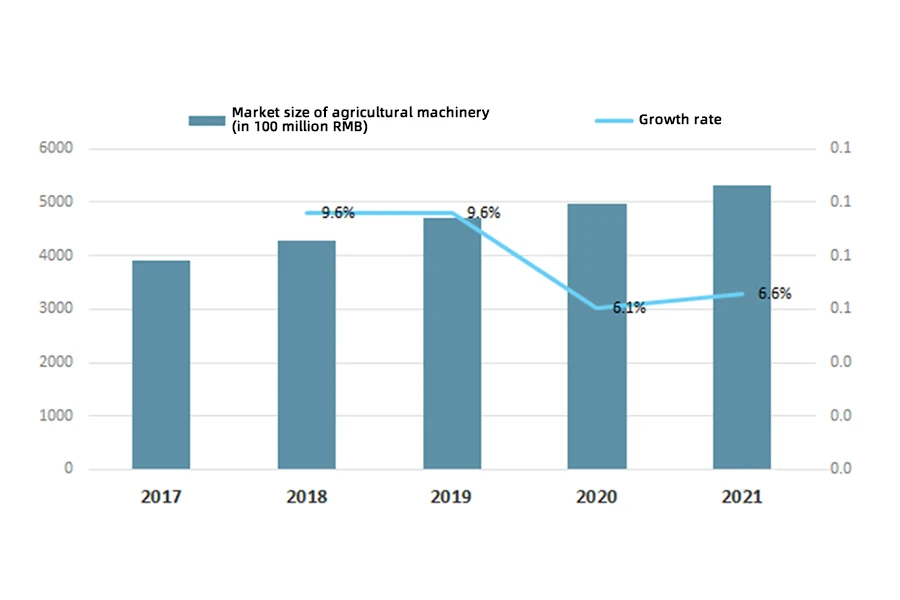

3. Market size of agricultural machinery

In recent years, the market size of agricultural machinery in China has been continuously expanding, and the mechanization foundation supporting various agricultural industries has gradually become more solid. Among them, in 2021, the agricultural machinery market size in China was 531 billion RMB, a year-on-year increase of 6.6%.

4. Comparison of agricultural machinery enterprises

At present, China is in a stage of rapid development of agricultural mechanization. The rapid advancement of industrialization and urbanization has led to a large number of farmers leaving their hometowns for work. The shortage of labor and the aging of the population has made the dependence of agricultural production on agricultural machinery increasingly evident, and the industry’s growth momentum is steady. Below is an overview of major agricultural machinery enterprises

First Tractor Company Limited

- Listing date: 2012

- Registered capital (in 100 million RMB): 11.24

- Registered address: No.154 Construction Road, Luoyang, Henan Province

- Company introduction:

Its leading products cover multiple categories, including the “Dongfanghong” series of crawler and wheeled tractors, diesel engines, harvesting machinery, specialized vehicles, and more. With its product and technology advantages, it has always maintained a leading position in the domestic market for large-wheeled tractors and non-road power machinery products. It has successfully sold its products to more than 140 countries and regions worldwide, making outstanding contributions to China’s agricultural machinery industry, agricultural mechanization, and rural revitalization.

Zoomlion Heavy Industry

- Listing date: 2000

- Registered capital (in 100 million RMB):86.78

- Registered address: No. 361 Yinpen South Road, Changsha, Hunan Province

- Company introduction:

Founded in 1992, Zoomlion Heavy Industry Science & Technology Co., Ltd. is mainly engaged in the R&D and manufacturing of high-tech equipment such as construction and textile machinery. Its leading products cover nearly 600 varieties in 11 major categories and 70 product series. Zoomlion Heavy Industry has pioneered the integration of overseas resources in China’s construction machinery industry; leveraging capital leverage, it has integrated high-quality assets globally, achieved rapid expansion, and built a global manufacturing, sales, and service network.

Gifore Agricultural Machinery

- Listing date: 2009

- Registered capital (in 100 million RMB): 3.802

- Registered address: 219 Gongtong North 2nd Road, North Industrial Park, Chengdu Modern Industrial Port, Pixian District, Chengdu.

- Company introduction:

Gifore Agricultural Machinery officially started operating in 1998 and gradually grew from a regional agricultural machinery dealer to a chain sales and service enterprise across multiple provinces in Southwest China. It currently represents over 1,000 domestic and foreign mainstream agricultural machinery brands, offering over 4,000 products. It has nearly 200 self-operated stores and more than 2,000 township dealerships in 20 provinces (municipalities and regions) across the country, making it a leading enterprise in China’s agricultural machinery sales and service industry.

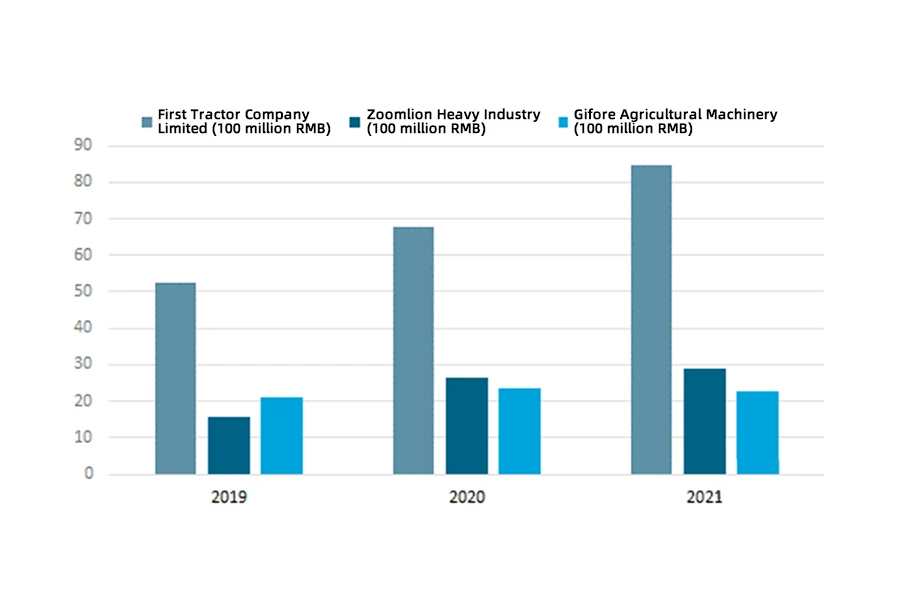

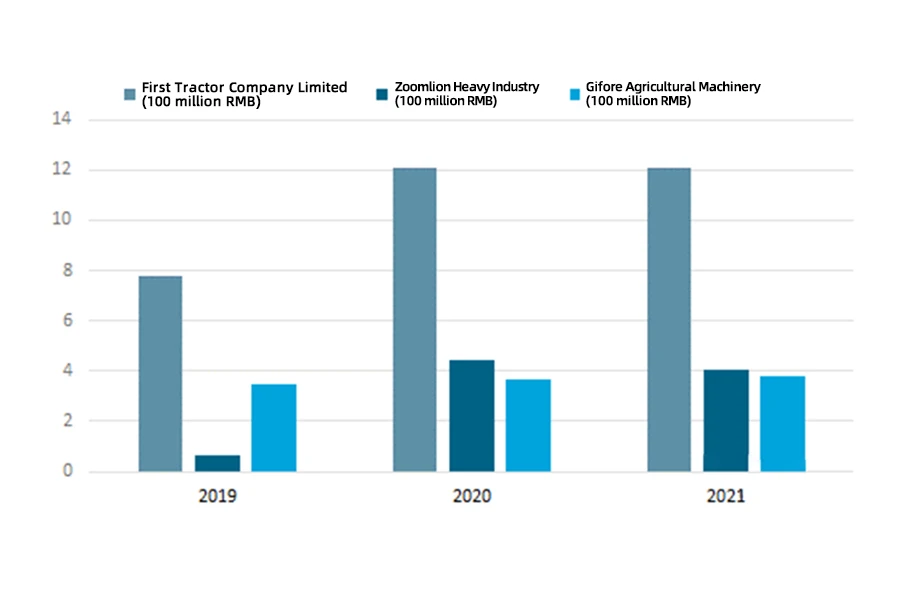

Among them, First Tractor Company Limited had agricultural machinery operating revenue of 8.462 billion RMB in 2021, a year-on-year increase of 24.6%; Zoomlion Heavy Industry had an agricultural machinery operating revenue of 2.907 billion RMB, a year-on-year increase of 9.9%; Gifore Agricultural Machinery had an agricultural machinery operating revenue of 2.289 billion RMB, a year-on-year decrease of 3.7%.

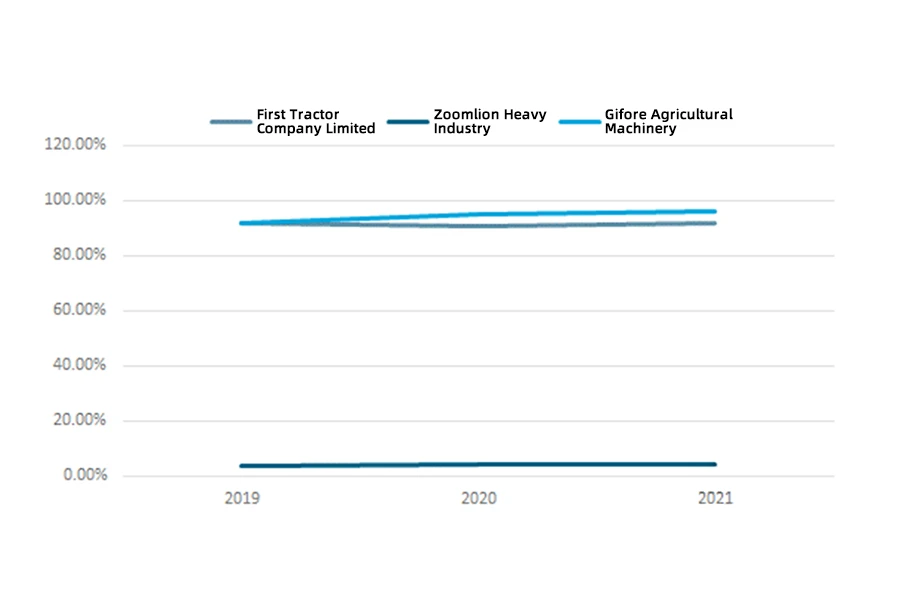

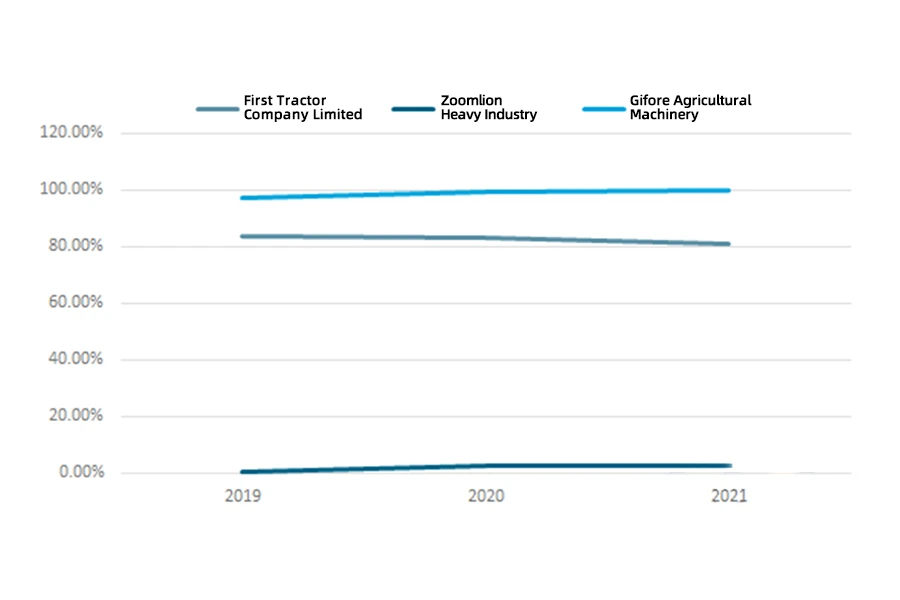

In 2021, agricultural machinery revenue accounted for 91.89% of First Tractor’s operating revenue, 4.33% of Zoomlion’s operating revenue, and 95.94% of Gifore’s operating revenue.

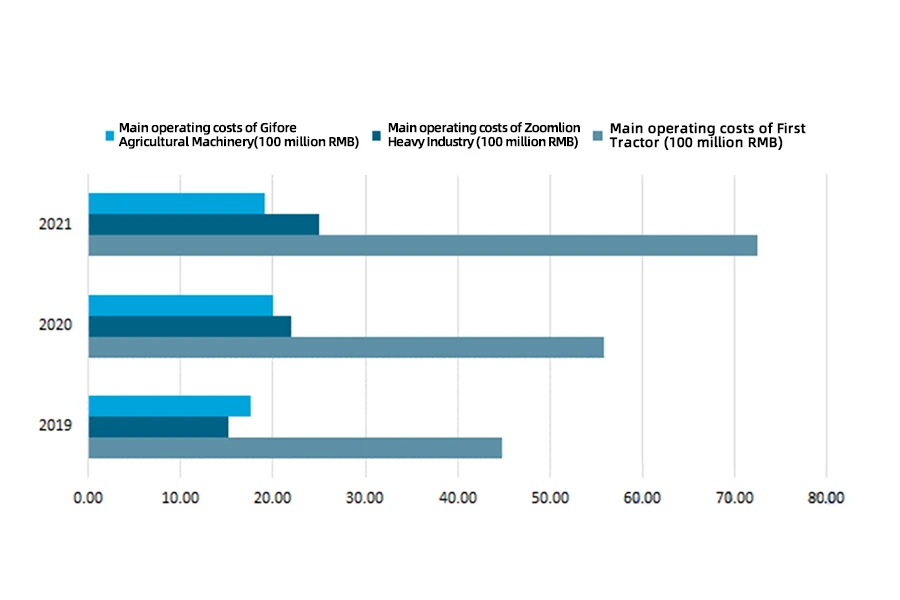

In 2021, the agricultural machinery operating costs of First Tractor was 7.254 billion RMB, an increase of 30% year-on-year; the agricultural machinery operating costs of Zoomlion were 2.502 billion RMB, an increase of 13.7% year-on-year; and the agricultural machinery operating costs of Gifore were 1.908 billion RMB, a decrease of 5% year-on-year.

In 2021, the main operating profit of agricultural machinery of First Tractor was 1.208 billion RMB, a decrease of 0.2% year-on-year; the main operating profit of agricultural machinery of Zoomlion was 404 million RMB, a decrease of 8.9% year-on-year; the main operating profit of agricultural machinery of Gifore was 381 million RMB, an increase of 3.2% year-on-year.

In 2021, the proportion of agricultural machinery profits of First Tractor was 80.75%, 2.55% for Zoomlion, and 100% for Gifore.

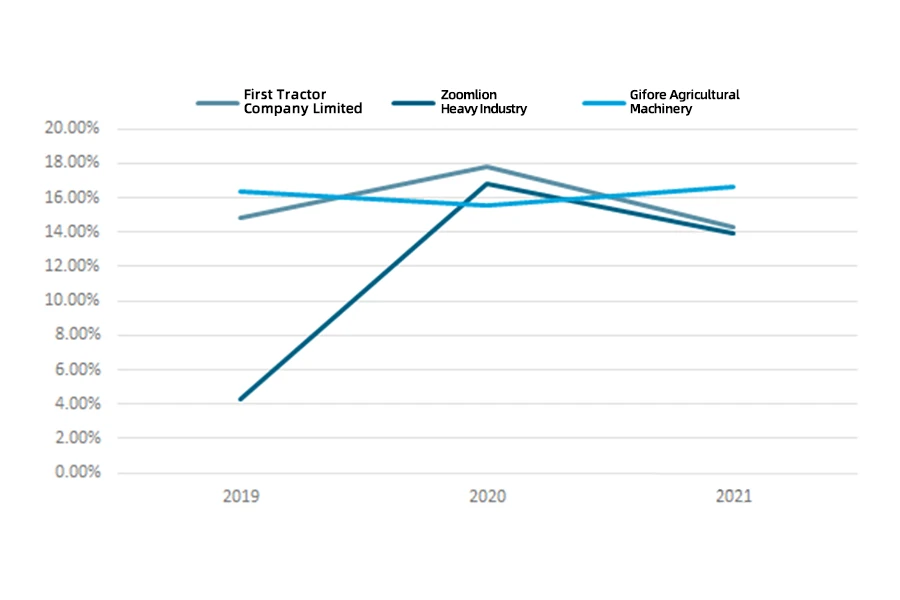

In 2021, the gross profit margin of agricultural machinery of First Tractor was 14.28%, 13.92% for Zoomlion, and 16.65% for Gifore.

5. Development trends in the agricultural machinery industry

The Chinese agricultural machinery market presents a small, fragmented, disordered, and weak pattern, with a large total market size but many segmented categories, multiple manufacturers, scattered sales markets, and low industry concentration. However, some foreign enterprises have been leading in the high-end machinery market segment.

Source from Intelligence Research Group (chyxx.com)