In today’s fast-paced global economy, cash and checks just don’t cut it for large-scale transactions or international payments. That’s where electronic funds transfer (EFT) payments come in. This payment system offers a seamless, secure solution for moving money, whether vendors receive payments globally or handle significant sums.

While EFT may be widespread for businesses worldwide, many don’t know what it actually means. This article will explore EFT payments and highlight seven types retailers can use today.

Table of Contents

What are EFT payments?

How do EFT payments work?

How do EFT payments benefit businesses?

7 types of EFT payments retailers can use for their businesses

Final words

What are EFT payments?

Remember how people pay for things with credit cards, ACH, and wire transfers? Those are all forms of electronic funds transfer payments, or EFTs. EFT payments allow anyone to move money digitally to different recipients—and they don’t have to use the same bank.

EFT payments don’t need bank employees or paper documents to oversee the process. For this reason, anyone can send and receive money from anywhere. Think of EFTs as a bank-approved, secure way to transfer funds, almost like mailing them between accounts.

Even better, EFTs are incredibly easy to set up. Businesses of all sizes can use them, removing the need to send/receive physical cash or checks. This is why EFT payments are so widespread in today’s digital economy.

How do EFT payments work?

All EFT payments happen on a specific network, like the Automated Clearing House (ACH) in the U.S. This system links all financial institutions in a country, from big banks to small credit unions. Typically, EFT payment needs two parties: one to send money and another to receive it.

The sender must provide key details like the recipient’s bank name, account number, account type, and routing number. For example, an employer might use EFT to pay a contractor, or a customer might pay a utility bill through EFT. Utility companies often use EFTs for automatic payments, making it convenient for the company and the customer.

After the sender completes the transfer, it travels through digital networks to reach the receiver’s bank via the Internet or payment terminals. EFTs processed on the ACH network happen in batches, meaning the system collects multiple transfers and processes them together. This process usually clears payments within a few days.

How do EFT payments benefit businesses?

Convenience and flexibility

Electronic funds transfers (EFTs) are incredibly flexible, making them useful for all transactions. Whether businesses withdraw cash, pay employees, or send money to overseas suppliers, there’s an EFT option for nearly every situation.

Enhanced security

Recent technological advancements have greatly improved the security of EFTs for businesses. In the past, debit cards relied on magnetic strips that revealed the card number, making transactions more susceptible to fraud. Today, newer payment methods like EMV chips and contactless NFC payments use encrypted codes instead of card numbers, offering much better protection.

Widespread acceptance

While digital wallets and newer EFT methods are still catching on worldwide, most options, such as debit cards, wire transfers, ACH transfers, and ATMs, have become essential parts of the global economy. No matter where retailers are, what industry they are in, or what kind of money transfer they need, there’s likely an EFT option that fits perfectly.

Easily retain accounts

EFT payments are swift and automated. They can help retailers save time by avoiding the hassle of manually updating accounts. They’re also handy when dealing with expired cards or fraudulent payments.

Reduced business costs

EFT payments are budget-friendly, especially for big transactions. They also help avoid expensive human errors and cut down on costs like postage, paper, and other expenses tied to traditional payment methods.

Better cash flow management

Businesses can set up electronic payments automatically, making managing cash flow easier and keeping bills paid on time. Retailers won’t have to worry about missing a deadline.

Improved customer experience

EFT payment simplifies the payment process for customers, making it easier for them to pay and boosting their satisfaction and loyalty.

7 types of EFT payments retailers can use for their businesses

1. ACH transactions

The Automated Clearing House (ACH) is a key network for transferring money between bank accounts across the U.S. It handles ACH debit and credit payments, managed by NACHA and partly operated by the Federal Reserve.

Unlike the private-company-run credit card networks, the ACH network focuses more on efficiency and security. ACH payments typically settle within two to three business days. Additionally, while all ACH payments are a form of EFT, not all EFTs go through the ACH network.

2. Direct deposit

When businesses deposit their employees’ salaries directly into their bank account, that’s an electronic funds transfer (EFT). Direct deposit is a convenient way to pay employees without the hassle of paper checks. Moreover, a third-party service often handles this process: the employer schedules each employee’s pay with the provider, who automatically takes care of the rest.

3. Credit and debit cards

Everyone uses their credit or debit card to move money between accounts, make purchases, or pay bills. All these transactions fall under EFT payments, and businesses can use them to buy goods and services.

4. Wire transfers

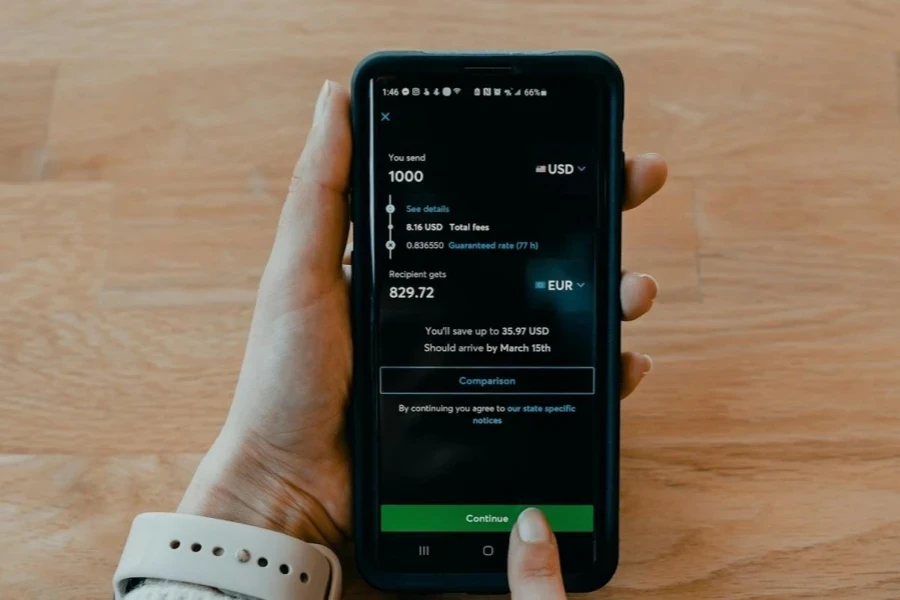

Wire transfers are popular for moving large sums of money, like a down payment on a house. When individuals or businesses need to handle big transactions beyond regular purchases, they often use wire transfers. Many trust this EFT method for its efficiency and reliability.

5. Pay-by-phone systems

Though less common today, phone-based systems are still great for electronic funds transfer. Some use these systems to pay bills or move money between bank accounts. The process involves turning the payment request into a format that computers can understand and execute.

6. Electronic checks

E-checks are like traditional checks but without the paper. Businesses can use them by entering their routing and bank account numbers into an EFT payment service to complete the transaction.

How long do EFT payments take?

Each EFT type requires different durations to complete a transaction. Here’s a closer look:

- P2P transfers can complete transactions in an instant or take a few minutes.

- ACH transfers can take up to 3 business days to complete a transaction. However, businesses can use same-day options if necessary.

- Domestic wire transfers usually reach the recipient on the same business day (up to 24 hours).

- International wire transfers can take 3 to 5 business days, depending on the target location.

Final words

Since the Federal Reserve introduced the Electronic Funds Transfer Act in 1978, finance has gone digital. Nowadays, money is more like computer data than physical cash. EFT payments are essential for completing transactions in this global digital economy because they’re fast, secure, and easy to access. From restocking goods from online suppliers to getting paid for products, businesses can easily choose the EFT payment method that works best for them.