Many customers find wholesale prices and wonder why their favorite retailer sells things at a much higher price. They don’t know that retail prices differ from wholesale prices for various reasons. Wholesale pricing is more like an investment for businesses, while retail prices are the final costs seen on shelves after retailers calculate what they need to make a profit.

More importantly, anyone new to e-commerce will need a solid grasp of retail prices to avoid losing ROI. Here’s what to know about retail prices, how they compare to wholesale pricing, and how to calculate them.

Table of Contents

Wholesale vs. retail: What are the differences?

A closer look at why the gap between wholesale and retail can be big

The different ways to figure out the retail price

1. Cost-plus pricing

2. Keystone pricing

3. Competition-based pricing

4. Value-based pricing

5. MSRP

How to calculate retail pricing with an example

Rounding up

Wholesale vs. retail: What are the differences?

The best way to describe wholesale pricing is the ” behind-the-curtain” price. Retailers pay a rate usually lower than what everyday customers see in a normal store when they buy stock. It’s designed to be lower because wholesalers depend on them buying in bulk.

They’d rather sell a thousand units at a discount than bother with one or two at a time. They aren’t concerned with fancy in-store displays, marketing campaigns, or providing daily customer service for end-users—that’s all up to the retailer.

Contrast that with retail pricing, which is what people see as regular shoppers in-store or online. This price is inevitably higher than wholesale because it has to account for more than the cost of acquiring the product. It also includes the money the retailer needs to spend on rent, décor, staff salaries, website upkeep, social media ads, and everything else that makes products available and appealing.

On top of all that, the retailer wants to make a profit. Otherwise, they’d just be spinning their wheels. It may seem obvious, but you’d be surprised how many first-time sellers just plop a random number on their product and call it a day. Many budding online sellers forget to add shipping expenses or sales platform fees to their calculations. That’s why it’s important to understand how retail pricing should work.

A closer look at why the gap between wholesale and retail can be big

Often, when people see a retailer pay $5 wholesale and then turn around and charge $20 at retail, they might jump to calling it “price gouging.” But the truth is that markup covers more than just “pure profit.” They should think about the real cost of doing business.

Let’s say you run a small boutique selling artisanal soaps. You pay your wholesaler $2.50 per bar of soap. By the time you add in packaging, shipping fees, store rent, staff wages, insurance, and your marketing budget, each bar of soap might need to absorb, let’s say, an additional $2 of overhead.

That’s a $4.50 total cost. If you decide to sell that soap for only $5, you’re making a meager 50 cents of profit per bar—maybe that won’t even cover your monthly rent. So, you must push that price to $8 or $10 to keep your business afloat.

Many retailers miss that part. It’s more than what they pay for the item; it’s also about everything else that has to be paid before retailers can pocket a single dime. Depending on the niche (fashion, electronics, homemade crafts, etc.), those “extra” costs can pile up fast.

The different ways to figure out the retail price

What goes into setting a retail price? There are several popular methods, and most businesses blend several approaches depending on their situation.

1. Cost-plus pricing

This one is straightforward. Retailers take their total cost (wholesale + direct expenses) and add a certain percentage as their profit margin. If their total cost per item is $10 (this might include the wholesale price, shipping, packaging, and a share of the overhead), retailers can decide a 50% markup is right for them. Then, their retail price would be $10 + ($10 × 0.50) = $15.

What’s nice about this is that it’s easy and ensures e-commerce businesses always cover their costs with a targeted profit margin. The downside is that this method can ignore important factors like competition or how unique the product is.

All your competitors might sell a similar item for $12, so your $15 price might be too high, or you won’t know you could charge $18 if you’re offering something superior. Nevertheless, it’s the most reliable way to get consistent retail pricing.

2. Keystone pricing

Keystone pricing means retailers double their costs. So if it costs them $10 to get that item on their shelf, they’ll sell it for $20. Some industries rely heavily on this method. For instance, bookstores often double the wholesale price of a hardcover book, while boutique owners sometimes do it on clothing.

It’s a rough rule of thumb; it doesn’t necessarily reflect real overhead or brand positioning. It’s like a handy shortcut when you’re pressed for time, but depending on the costs and market expectations, the margins can wind up being too slim or fat.

3. Competition-based pricing

This pricing strategy involves extensive research to determine what others charge for similar products before deciding the final list price (which could be slightly higher or lower than the average to stay competitive).

Competitive-based pricing helps retailers see where they fit in that lineup (are they offering better quality, a more curated collection, or an identical product?) and adjust accordingly. However, the main pitfall might tempt businesses to engage in a price war or settle for smaller margins if they see their competition’s lower price.

4. Value-based pricing

This strategy sometimes works best for truly unique products or brands that have cultivated a premium identity. A great real-world example might be a hand-poured candle business that invests in gorgeous, eco-friendly packaging, exclusive scents, and an artisan story.

Although the cost per candle may be only $5, because the brand appeals to people’s desire for a luxurious, eco-conscious product, it might reasonably charge $25 or more, assuming the market perceives the candle as worth that amount.

The key is that your customers have to agree that you’re worth it; otherwise, they’ll just buy a cheaper candle at the grocery store.

5. MSRP

MSRP (manufacturer suggested retail price) is also straightforward. Retailers buy straight from the manufacturer and get retail price suggestions from them. For instance, if the manufacturer’s price is $9, they may recommend selling the product for $20. One thing about this method is that retailers can follow it or go lower to one-up competitors selling at that MSRP (but only if they’ll still make a profit).

How to calculate retail pricing with an example

Using the same example of a candle business, let’s see what they would consider :

- Wholesale and direct costs: Let’s say the wax, wicks, jars, fragrance oils, and shipping to your home studio total $4 per candle. Then, the owner spends another $1.50 on packaging (box, label, and maybe a thank-you card), bringing their cost to $5.50.

- Overhead: Even if the owner runs this little side hustle out of their home, they will still have Etsy or website fees and shipping materials (plus the time spent). Let’s assume retailers approximate these overhead costs to around $300 a month and plan to sell 100 candles monthly—an additional $3 per candle.

- Base cost: Each candle effectively costs the business owner $5.50 + $3.00 = $8.50.

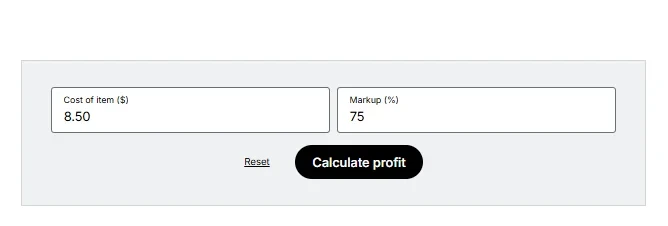

Now that retailers have their gross cost for each candle (this is just an example, as actual costs can be way higher or lower), they can use a simple product pricing calculator. It helps to see how different margins (using the cost-plus method) can affect the business.

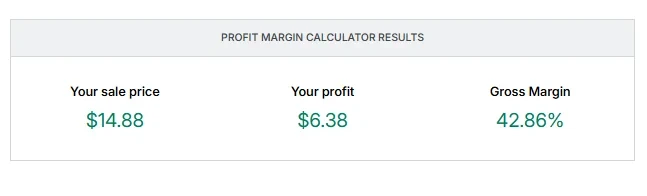

Here’s what it will look like for the example above with a 75% markup.

Here’s what the retail price would look like for this candle business:

Note: You can easily switch the profit margins to get the perfect price your target consumers would be willing to pay.

Rounding up

Now that you know how to determine retail pricing, it’s also worth noting that pricing is rarely “set it and forget.” Costs change over time because suppliers might raise their rates, shipping can get more expensive, or you might invest in better packaging. If retailers don’t re-check their retail price periodically, they could slowly lose margin and not realize it.

Conversely, you could refine your manufacturing process or buy in bigger quantities, and your costs drop. That could open the door to increasing your profits or offering a slightly better price to outcompete others. So, remember to check your retail price every few months (especially early on).