Key Takeaways:

- A sharp increase in the price of crucial material and energy inputs, such as timber, steel and coal, is driving up inflationary pressures on manufacturing and construction businesses.

- As the price of key inputs has increased, the cost of production has also risen. The firms that have fared best are those that can pass on rising costs to their customers.

- Inflation’s broader economic effects also challenge manufacturing and construction firms, as the increased cost of borrowing and a tight labour market can constrain productivity and increase financial pressures on both sectors.

Construction and manufacturing businesses face broadly similar challenges during periods of inflation. As input prices rise, production costs must also increase. The existing inflationary pressures on Australian industries are best described as ‘cost-push’ inflation. This term means that rising prices have stemmed from a shortage in the aggregate supply of raw materials, which has pushed up prices as demand has outstripped supply.

Recent price rises have therefore been challenging for the construction and manufacturing sectors, primarily since they tend to be energy- and material-intensive. Many construction and manufacturing firms have struggled to pass on rising prices to consumers, which has affected revenue and profitability in both sectors.

Aside from the problems that material and energy costs are causing, the construction and manufacturing sectors also tend to be capital- and labour-intensive. These factors are likely to further increase production costs and constrain demand for the sectors’ products and services. These intersecting dynamics have meant that construction and manufacturing firms have faced complicated and wide-ranging problems.

As many manufacturing industries directly supply major construction projects, these problems are also interconnected. The extensive supply chains attached to both sectors have meant that their problems have expansive implications for the Australian economy overall.

Delving deeper into rising prices’ effects on these two sectors will provide an insight into the current inflationary pressures many businesses are experiencing. This information may also point businesses to the areas that require focus as cost pressures rise.

However, not all businesses have experienced a general rise in prices, and some have fared better than others. Reflecting on these sectors’ varied performance can help firms determine how to manage a difficult trading environment.

Material-intensive: rising key input costs

Rising prices of materials have caused considerable stress for operators in the construction and manufacturing sectors. However, not all inputs have risen at the same rate, meaning that pressure on businesses has varied across the sectors, depending on both the supply chain and demand elasticity in the sector.

The House Construction industry and its extensive supply chainhave experienced severe difficulties stemming from rising input costs. These challenges partly stem from fixed-price contracts, which have constrained many businesses’ ability to pass on rising prices to their customers.

Other segments of the construction sector have also struggled with the rising cost of production, including Commercial and Industrial Building Construction and Multi-Unit Apartment and Townhouse Construction. The prices of key material inputs that are crucial in most construction projects, especially timber and steel products, have increased significantly.

Other segments of commercial construction have fared better, as these firms are often far better placed to pass on rising prices to customers. For example, IBISWorld estimates that the Heavy Industry and Other Non-Building Construction and the Road and Bridge Construction industries grew in the 2021-22 financial year, as many of the construction sector’s other segments struggled. These sectors often build key pieces of infrastructure, meaning that they tend to have inelastic demand and can therefore pass on rising prices without significantly reducing turnover.

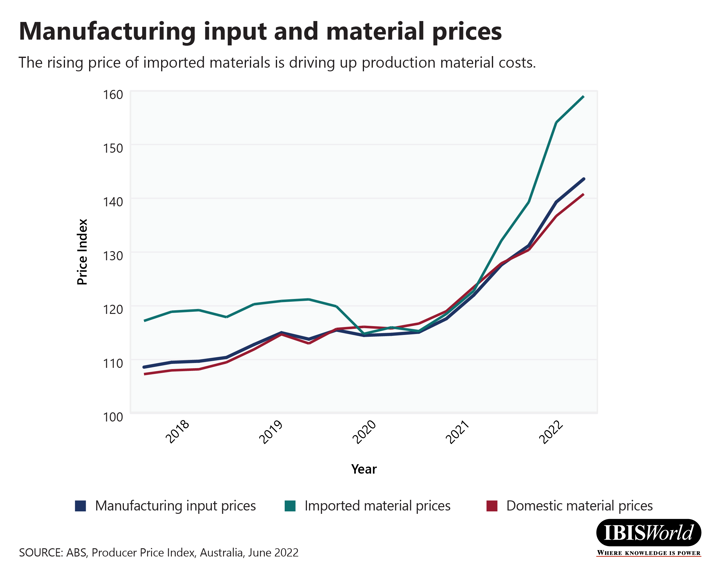

Manufacturing industries are particularly susceptible to pressure from input price rises. These industries have limited pricing power, and have thus struggled to pass on rising costs to customers. According to the ABS, the manufacturing sector’s average output price index trailed the average input price index for the entire 2021-22 financial year. Global conditions have driven these increases, as the price of imported materials have risen faster than the price of domestic materials. This trend demonstrates global supply chain disruptions’ effects on increasing input prices.

These trends also point to the potential benefits of onshoring an increasing proportion of the supply chain. Following the COVID-19 pandemic, many businesses are increasingly re-evaluating supply chain risks related to sourcing supplies offshore. The COVID-19 pandemic demonstrated the importance of building supply chain resilience, particularly in a country that is as geographically isolated as Australia. Supply shortages can affect both revenue and profitability, as production slowdowns can decrease revenue.

Surety of supply is equally crucial for construction firms, as major construction projects usually operate on tight deadlines with an extensive supply chain. Supply delays can often be far more costly than the savings accrued from sourcing supplies offshore. Onshoring the supply chain of key construction materials could also benefit key manufacturing industries, such as the Structural Steel Fabricating and Fabricated Wood Manufacturing industries.

Energy-intensive: rising operating costs

Supply chain shortages of key energy commodities have been central to recent price rises, and these trends have left energy-intensive industries more vulnerable. Global conditions have exacerbated the situation for Australian producers, as disruptions in the global supply of coal and gas have caused the domestic price of energy to increase sharply.

The rising price of energy affects the entire Australian economy, but it is especially damaging to segments of the manufacturing sector that rely on high amounts of energy to process products. For example, metalworking industries, especially smelting and forging industries, require significant heat to process metal ore into metal products. Profitability in the Iron and Steel Forging industry has suffered from the rising cost of energy, particularly a sharp rise in coal and gas inputs.

The rising price of energy has not negatively affected all manufacturing industries. Petrol refineries have recovered spectacularly, as the varied global supply conditions for energy commodities and recovering demand conditions have significantly benefited Australian refineries. The price of crude oil has remained largely stable, particularly as global supplies have been released. However, the price of petroleum products has risen sharply, which has contributed to profitability and revenue gains for the Petroleum Refining and Petroleum Fuel Manufacturing industry.

In the short term, firms that rely on coal and gas for their energy supplies should look to cut unnecessary costs, or renegotiate their supplies to better navigate energy inflation’s effects. A more long-term strategy should consider diversifying the energy source that businesses rely on, as disruptions in the global supply of particular commodities are often unforeseen, and it is difficult to transition to a new energy source in the short term.

Capital- and labour-intensive: beyond input costs

Aside from the rising price of inputs, other factors threaten manufacturing and construction businesses’ performance. The responses to surging inflation have also presented new challenges. In particular, the RBA has responded to surging inflation by lifting the interest rate at consecutive monthly meetings for the first time in over a decade. The sharp rise in interest rates has decisively shifted the financial environment for construction and manufacturing firms as the cost of borrowing rises, and public and private investment is likely to be affected.

Capital expenditure is particularly crucial for the construction sector. New construction projects require significant private and public investment, which inflationary pressures and rising interest rates threaten. The rising cost of borrowing is likely to limit private investment in new capital projects. These trends affect construction firms in all of the sector’s segments, as commercial and domestic construction both rely heavily on private investment.

The extensive construction supply chain also relies on private investment in new construction projects to maintain revenue and profitability. For example, the Land Development and Subdivision industry significantly relies on high private investment, and the rising cost of borrowing is likely to reduce demand for their services.

Inflationary pressure may also limit capital expenditure by the public sector, as governments seek to avoid contributing to rising prices. The commercial construction sector relies heavily on public capital investment, particularly on large-scale transport, bridge and road projects. However, critical infrastructure projects are less susceptible to these short-term pressures, which can shield some commercial construction firms from inflationary pressures’ effects.

The increased cost of borrowing can also affect the firms themselves, particularly those that require significant borrowed capital to invest in equipment and machinery. Manufacturing firms are especially vulnerable to these pressures, as productivity increases are essential to offsetting rising input costs. Investment in new machinery is a vital tool for achieving productivity gains and economies of scale in a manufacturing business.

In the short term, companies should consider reviewing their debt position or seek to renegotiate terms with lenders to enhance flexibility during a volatile period for cost pressures. In the long term, companies should adjust their strategies to account for structurally higher interest rates.

Borrowing costs are likely to be higher for the foreseeable future. Companies should ensure that their cost base is sustainable and that cashflow is in a strong position to reduce overall risk, and to leave firms in a better position when negotiating with lenders.

Wages are not driving the current inflationary crisis. In most cases, wages are trailing the rising price of inputs, although the RBA expects that wage increases will occur in the second half of 2022. The current Australian labour market is also very tight, with unemployment reaching 50-year lows. Both manufacturing and construction are highly labour-intensive, and both sectors significantly rely on a skilled workforce.

During periods of low unemployment, hiring new employees becomes even more difficult. Therefore, construction and manufacturing employers should focus on retaining current workforce and reducing labour turnover by providing competitive wages, incentives for employees to advance and expanded employee benefits that improve working conditions.

Conclusion

The construction and manufacturing sectors are particularly susceptible to inflationary pressures. The increased cost of energy, materials, borrowing and labour are all potential issues for firms in these sectors. As costs increase throughout the supply chain, the firms that are likely to benefit are those with the pricing power to pass on rising prices and attain higher revenue and profitability.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.