In the competitive landscape of modern business, understanding and optimizing Customer Acquisition Cost (CAC) is crucial for sustainable growth. CAC represents the total expense of acquiring a new customer, encompassing sales, marketing efforts, and related costs. By mastering CAC, businesses can ensure their acquisition strategies are cost-effective, driving profitability and long-term success. In this article, we will explore the significance of CAC, methods to calculate it, and effective strategies to reduce and optimize this vital metric.

Table of Contents

1. Understanding Customer Acquisition Cost (CAC)

2. Importance of CAC in Business

3. Calculating CAC: Methods and Formulas

4. Strategies to Reduce CAC

5. The Role of Customer Lifetime Value (CLV) in CAC

6. Practical Tips for Optimizing CAC

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is a critical metric that quantifies the cost associated with acquiring a new customer for your business. It includes all expenses related to marketing and sales efforts, such as advertising costs, salaries of sales and marketing personnel, software tools, and any additional overheads. By calculating CAC, businesses can better understand the effectiveness of their acquisition strategies and ensure that they are investing their resources wisely.

Definition of CAC

At its core, CAC measures how much a company spends to gain a new customer. This metric is essential for assessing the efficiency of marketing campaigns and sales processes. A high CAC can indicate that a company is spending too much on acquiring customers, which can impact overall profitability.

Components of CAC

Several components contribute to the total Customer Acquisition Cost:

- Marketing Campaign Costs: Expenses related to online and offline marketing campaigns aimed at attracting new customers.

- Sales Expenses: Salaries and commissions of sales personnel involved in converting leads into customers.

- Software and Tools: Costs of marketing automation tools, CRM systems, and other software used to streamline marketing and sales efforts.

- Professional Services: Fees paid to consultants and other professionals who assist in marketing and sales activities.

- Overhead Costs: General administrative expenses that are indirectly related to customer acquisition.

Understanding these components allows businesses to identify areas where they can optimize costs and improve their CAC.

Importance of CAC in Business

Customer Acquisition Cost (CAC) is not just a metric; it’s a vital indicator of a company’s overall health and growth potential. Understanding CAC helps businesses make informed decisions about their marketing and sales investments, ensuring that these efforts contribute to sustainable profitability.

Why CAC is a Critical Metric

CAC is crucial because it directly impacts the bottom line. If the cost of acquiring a customer is too high, it can erode profit margins and hinder the company’s ability to grow. By monitoring CAC, businesses can gauge the efficiency of their customer acquisition strategies and adjust them as needed to ensure they are getting a good return on investment.

CAC’s Impact on Profitability and Growth

High CAC can indicate inefficiencies in marketing and sales processes, which can limit profitability. Conversely, a lower CAC means that a company is acquiring customers more cost-effectively, freeing up resources to reinvest in other areas of the business. By maintaining a balance between CAC and Customer Lifetime Value (CLV), companies can achieve a healthy growth trajectory. This balance is crucial because if CAC exceeds CLV, the company may struggle to sustain its operations in the long term.

Calculating CAC: Methods and Formulas

Accurately calculating Customer Acquisition Cost (CAC) is essential for understanding the true cost of your marketing and sales efforts. There are both simple and complex methods for calculating CAC, each offering different levels of insight.

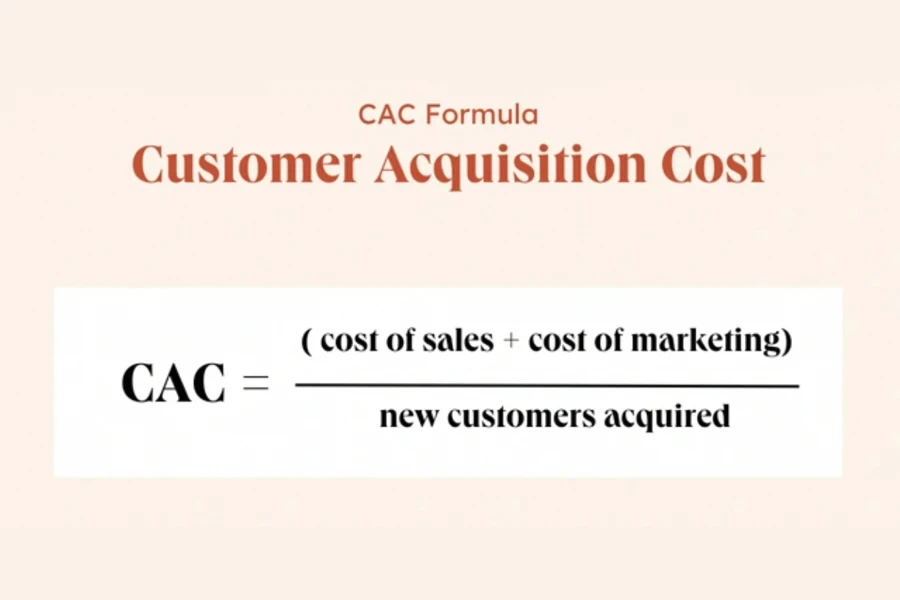

Simple Method of Calculating CAC

The simple method provides a straightforward way to calculate CAC by dividing the total marketing and sales expenses by the number of new customers acquired during a specific period. The formula is:

Strategies to Reduce CAC

Effectively reducing Customer Acquisition Cost (CAC) is essential for improving profitability and ensuring sustainable growth. Here are several strategies that businesses can implement to lower their CAC while maintaining or even enhancing customer acquisition rates.

Knowing Your Customer

One of the most effective ways to reduce CAC is by gaining a deep understanding of your target audience. By identifying their needs, preferences, and pain points, you can tailor your marketing efforts to resonate more effectively with potential customers. This targeted approach not only increases the chances of conversion but also reduces the costs associated with broad, unfocused marketing campaigns.

Engaging Customers Early

Early engagement with potential customers can significantly lower acquisition costs. By capturing their interest early in the buying journey through tactics such as content marketing, email nurturing, and social media engagement, businesses can build relationships and guide prospects through the sales funnel more efficiently. Early engagement helps in creating a connection with the customer, making them more likely to choose your product or service when they are ready to purchase.

Enhancing Customer Retention

Retaining existing customers is often more cost-effective than acquiring new ones. By focusing on customer satisfaction and loyalty, businesses can reduce churn rates and increase the lifetime value of each customer. Strategies to enhance customer retention include providing exceptional customer service, offering loyalty programs, and regularly seeking feedback to improve products and services. A positive customer experience encourages repeat business and can also lead to referrals, further lowering CAC.

The Role of Customer Lifetime Value (CLV) in CAC

Customer Lifetime Value (CLV) is a crucial metric that, when considered alongside Customer Acquisition Cost (CAC), provides a comprehensive view of a company’s profitability and growth potential. Understanding the relationship between CLV and CAC helps businesses make informed decisions about their customer acquisition strategies.

Relationship Between CAC and CLV

The interplay between CAC and CLV is fundamental to assessing the efficiency of customer acquisition efforts. While CAC measures the cost of acquiring a new customer, CLV estimates the total revenue a customer will generate over their entire relationship with the company. A high CLV relative to CAC indicates that the investment in acquiring new customers is yielding substantial returns, contributing positively to the company’s bottom line.

Using CLV to Guide CAC Strategies

Businesses can leverage CLV to optimize their CAC strategies. By focusing on acquiring customers with higher lifetime values, companies can ensure that their marketing and sales efforts are directed towards the most profitable segments. This can be achieved by:

- Segmentation: Identifying and targeting customer segments that have higher CLV.

- Personalization: Tailoring marketing messages and offers to meet the specific needs and preferences of high-value customers.

- Retention Programs: Implementing strategies that encourage repeat purchases and long-term engagement, thereby increasing CLV.

Incorporating CLV into CAC analysis enables businesses to allocate their resources more effectively, ensuring that acquisition efforts are both cost-efficient and profitable.

Practical Tips for Optimizing CAC

Optimizing Customer Acquisition Cost (CAC) involves continuous assessment and strategic adjustments. Here are some practical tips to help businesses reduce CAC and improve overall profitability.

Tips for Reducing Marketing Costs

Efficient marketing is key to lowering CAC. Here are some strategies to consider:

- Leverage Content Marketing: Create valuable, relevant content that attracts and engages your target audience. This approach can be more cost-effective than traditional advertising.

- Utilize Social Media: Organic social media strategies can enhance brand visibility and engagement without the high costs associated with paid campaigns.

- Optimize for SEO: Improving your website’s search engine ranking can drive more organic traffic, reducing the need for paid advertisements.

Leveraging Data to Optimize Acquisition Strategies

Data-driven decision-making can significantly enhance the efficiency of customer acquisition efforts:

- Track and Analyze Metrics: Regularly monitor key metrics such as conversion rates, customer behavior, and campaign performance to identify areas for improvement.

- A/B Testing: Experiment with different marketing strategies and tactics to determine what works best for your audience.

- Customer Feedback: Collect and analyze feedback to understand customer preferences and refine your marketing approach accordingly.

Continual Assessment and Adjustment of CAC

Optimizing CAC is an ongoing process that requires regular evaluation and adjustment:

- Review Costs Periodically: Regularly review all costs associated with customer acquisition to identify any unnecessary expenses.

- Benchmarking: Compare your CAC with industry standards to gauge your performance and identify opportunities for improvement.

- Iterate and Improve: Use insights gained from data analysis and customer feedback to continually refine and enhance your acquisition strategies.

By implementing these practical tips, businesses can effectively manage and optimize their Customer Acquisition Cost, driving better results and sustainable growth.

Conclusion

Managing Customer Acquisition Cost (CAC) is essential for any business aiming for sustainable growth and profitability. By understanding and calculating CAC accurately, businesses can make informed decisions about their marketing and sales investments. Implementing strategies to reduce CAC, such as knowing your customer, engaging them early, and enhancing retention, can significantly lower costs and improve efficiency. Additionally, leveraging Customer Lifetime Value (CLV) to guide acquisition strategies ensures that resources are allocated effectively, maximizing returns. Continuous assessment and adjustment of CAC through data-driven insights and practical tips will help businesses stay competitive and thrive in the long run.