Overview: The market demand base for forestry machinery products in China is relatively large. Due to factors such as global economic development, population and family growth, popularization of horticultural culture, and promotion of new products, the market size has maintained a long-term growth trend. According to statistics, as of 2022, the scale of China’s forestry machinery market is approximately 56.28 billion yuan.

Keywords: forestry machinery industry chain, forestry machinery market size, forestry machinery output value, forestry machinery sales revenue, forestry machinery import and export amount

Overview of the forestry machinery industry

Forestry machinery refers to the machinery and complete equipment applied in forestry production and forest product processing to improve production efficiency. The development of forestry mechanization is serious for China’s forestry development process, promoting the process of forestry modernization. Since the founding of China, forestry machinery has made significant achievements gradually. Forestry machinery is the core productivity in the process of forest cultivation, production, and utilization, as well as the main content and sign of forestry modernization, making significant contributions to forestry development in China. According to the different objects and purposes of operation, forestry machinery mainly includes five categories: forestry machinery, mining and transportation machinery, garden machinery, wood processing machinery, and artificial board machinery.

Classification of forestry machinery in a broad sense

- Silvicultural machinery: Silvicultural machinery is the assembly of various power machinery and operating machinery used in the forest cultivation process. It mainly includes tractors, internal combustion engines, electric motors, and other power machinery, as well as forest seed collection machinery, seed processing machinery, seedling raising machinery, forest clearing machinery, land preparation machinery, afforestation machinery, young forest tending machinery, forest logging machinery, forest protection and fire prevention machinery, and pest prevention and control machinery.

- Logging and transportation machinery: It is a machinery and equipment assembly for forest logging, timber transportation, and log yard operations. It mainly includes wood-cutting machinery, lifting and conveying machinery, transportation machinery, and combined machinery for operation in logging areas

- Landscape machinery: Landscape machinery refers to mechanical equipment for landscaping, construction, and maintenance, such as chain saw, edge cutting machine, edge trimmer, hedge machine, shrub cutter, grass comber, high branch machine, leaf suction machine, lawn mower, and lawn trimmer.

- Wood processing machinery: Wood processing machinery refers to equipment and tools specifically for wood cutting, crushing, trimming, forming, bonding, drying, and other processes. The mechanical equipment includes operating units that can be adjusted and configured according to different requirements and wood processing techniques. The wood processing machinery can improve the wood processing efficiency and product quality so that the original wood can be fully utilized and converted into various wooden products, such as furniture, building materials, flooring, etc.

- Artificial board machinery: Artificial board machinery is a general term for the production process equipment of artificial boards. It includes engineering equipment such as peeling, material preparation, drying, gluing, hot pressing, forming, packaging, and handling of artificial boards.

Policies related to the forestry machinery industry in China

The State Council, the National Development and Reform Commission, the Ministry of Commerce, and other government departments have issued the “Catalog of Industries, Products, and Technologies Encouraged and Developed Mainly in China” (revised on July 27, 2000), which includes “advanced and applicable agricultural machinery and equipment manufacturing” and “development of forestry machinery and equipment manufacturing technology” as encouraged products and enjoys preferential policies according to corresponding regulations. Meanwhile, a series of policies such as “Several Opinions on Increasing Reform and Innovation Efforts to Accelerate Agricultural Modernization Construction”, “Made in China 2025”, “Outline of the 12th Five-Year Plan for National Economic and Social Development”, “12th Five-Year Plan for National Agricultural and Rural Economic Development”, and “Development Plan for Agricultural Machinery Industry (2011-2015)” have been proposed clearly for promoting the research and development of plant protection machinery.

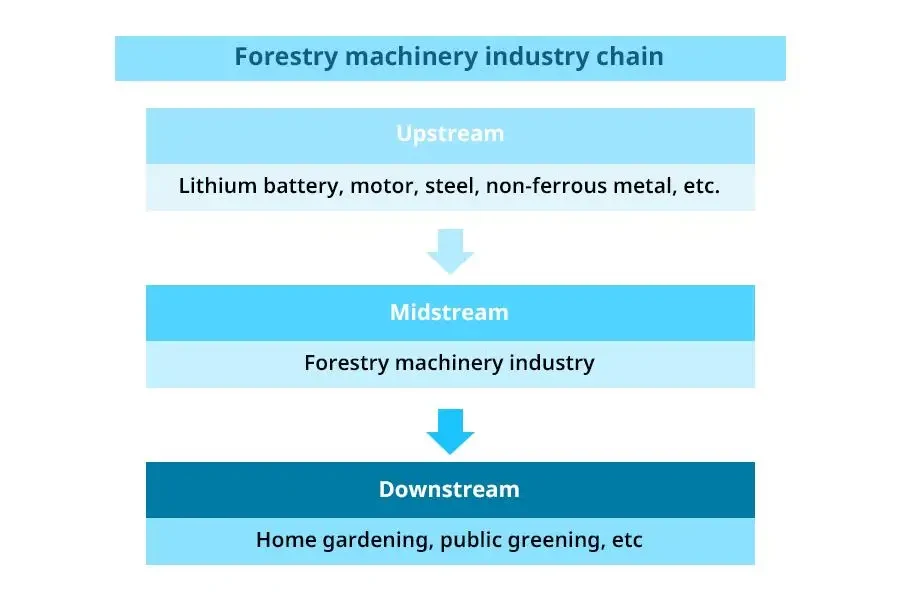

Forestry machinery industry chain

The upstream of the forestry machinery industry chain includes raw materials and components such as lithium batteries, motors, steel, and non-ferrous metals. Meanwhile, the downstream mainly includes household gardening, public greening, etc. The technological level, supply capacity, and price fluctuations of upstream raw materials impacted the operation of this industry. The technical level and processing accuracy of engines, motors, and gearboxes affect the quality of products in this industry. The price of steel and plastic particles fluctuates periodically, directly affecting the production cost of garden machinery. With the development of the world economy, the growth of population and family size, and the popularization of horticultural culture, more families will invest time, energy, and material resources in home gardening. Meanwhile, the area of public greening and professional grasslands will increase, which will bring sufficient power to the development of the forestry machinery industry and also encourage forestry machinery manufacturing enterprises to continuously enhance their research and development capabilities and improve product technology and quality.

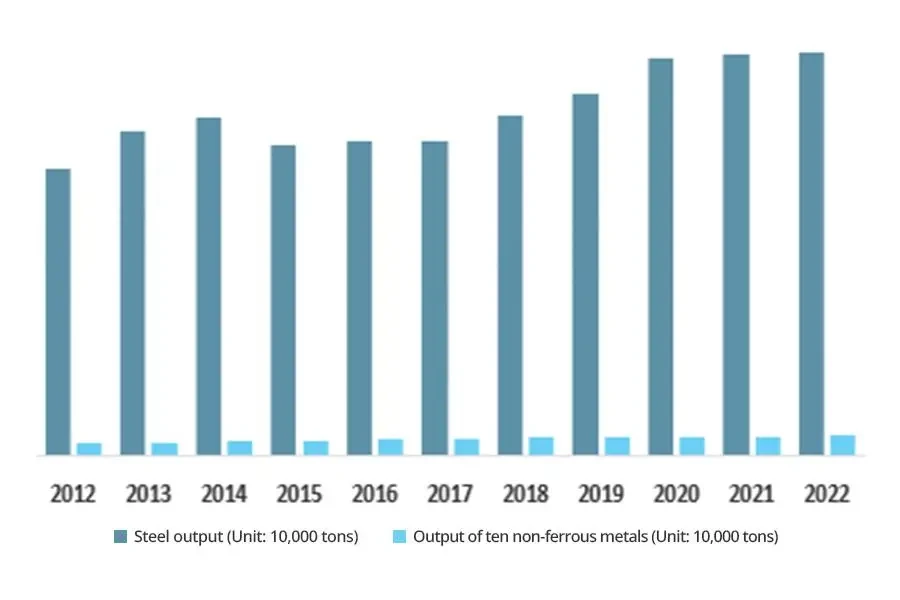

As a bulk commodity, steel is greatly affected by fluctuations in the macroeconomic environment. Due to the impact of the global economy, the steel market prices in China have fluctuated significantly in recent years, which has impacted the industry’s profitability. From the perspective of steel production in recent years, steel production in China has been increasing continuously from 2012 to 2022, with a steel production CAGR of 3.44%. In 2022, the non-ferrous metal industry overcame the adverse effects of repeated epidemics, seized the opportunities for domestic and international market recovery, continued to deepen the structural reform of the supply side, ensured the supply of the industrial chain and supply chain, accelerated the promotion of traditional industries’ intellectualization, greening, and high-end and the overall operation of the industry was stable. As of 2022, the output of ten non-ferrous metals in China was 67.936 million tons, with a year-on-year increase of 4.89%.

Analysis of the development status of the forestry machinery industry in China

The development of forestry machinery was rarely mentioned before the founding of the People’s Republic of China. Forestry production operations mainly rely on manual labor, and only after the founding of the People’s Republic of China did they embark on a path of rapid and stable development exploration. After more than 70 years of development after the founding of the People’s Republic of China, forestry machinery has made significant progress, significantly improving its technological level, industry scale, industrial structure, product level, and international competitiveness, as well as making many contributions to a stable development of forestry industry in China. The demand base for forestry machinery products in China is relatively large. Also influenced by factors such as global economic development, population and family growth, popularization of horticultural culture, and promotion of new products, the market size has maintained a long-term growth trend. According to statistics, as of 2022, the market size of forestry machinery in China is about 56.28 billion yuan.

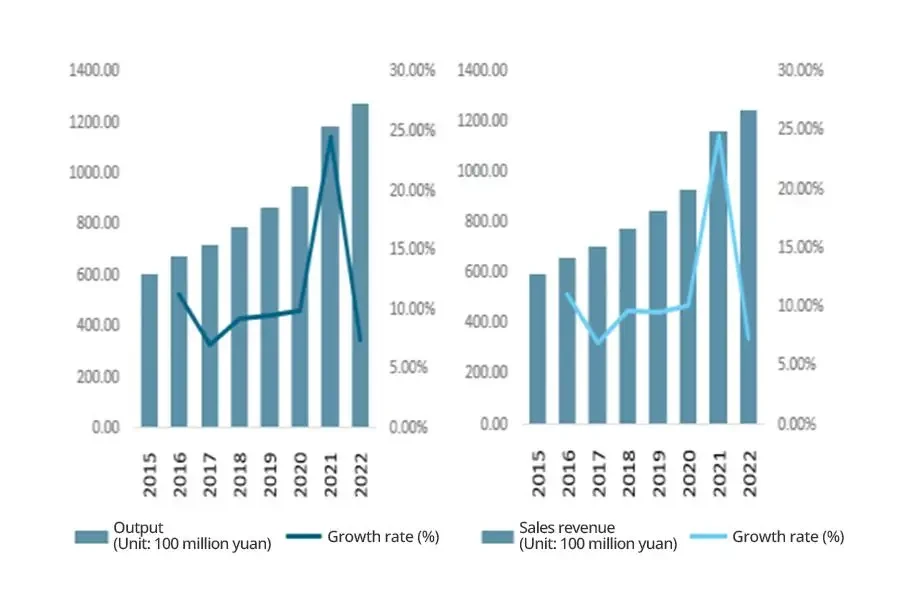

The development of forestry machinery in China has gone through four main historical stages, including initial development, stagnation and hesitation, recovery and revitalization, and rapid leap after three different historical periods, including economic recovery, construction, and reform and openness in China. In recent years, the output value and sales revenue of the forestry machinery industry in China have grown rapidly. As of 2022, the output value of the forestry machinery industry was about 127.15 billion yuan, and the sales revenue was about 124.98 billion yuan.

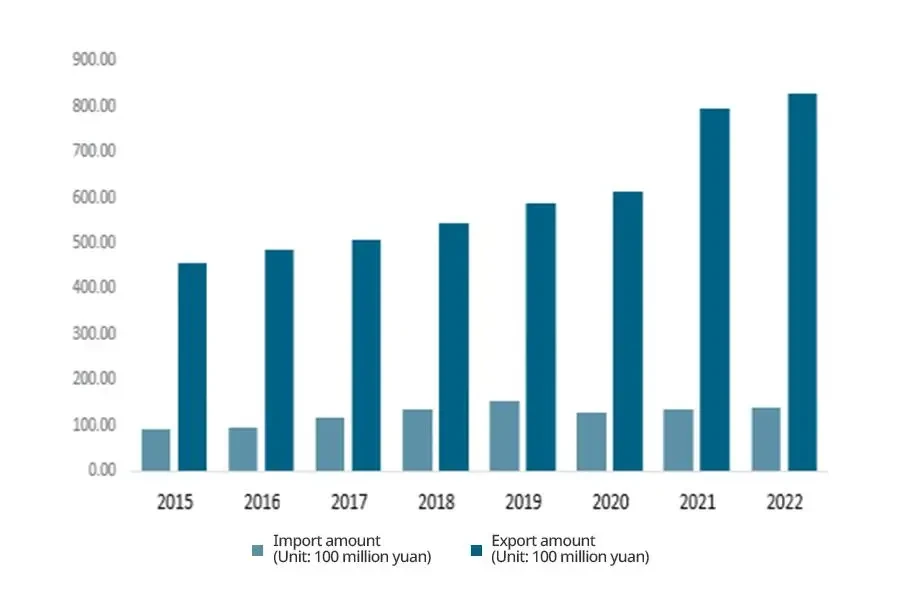

With the continuous improvement of production processes by manufacturers in China, the gradual improvement of product quality, and the enhancement of management capabilities, the quality and technical standards of Chinese garden machinery products have been able to meet the European and American access requirements. The main products have been sold globally, and they are used mainly for export. In the future, the net export volume of Chinese garden machinery will expand further as the industry shifts further and the market share of high-end products increases. According to statistics, as of 2022, the import amount of China’s forestry machinery was about 13.89 billion yuan, and the export amount was about 82.59 billion yuan.

Analysis of competition pattern of the forestry machinery industry in China

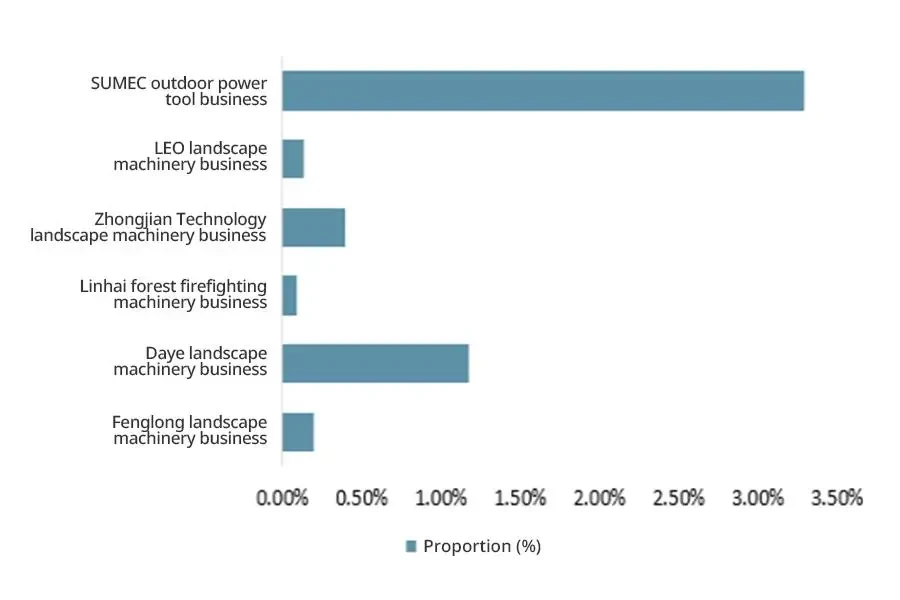

The competitors of forestry machinery enterprises include not only Chinese counterparts but also foreign enterprises. Compared to domestic counterparts, foreign competitors are more advantageous because their capital, technology, management, and brand power are generally superior to the former. In addition, some domestic forestry machinery enterprises have gained a market share and a relatively stable customer base after years of operation. Therefore, the current level of fierce competition in China’s forestry machinery industry is still very high. Overall, the operating revenue of major related companies in the forestry machinery industry accounted for a relatively low proportion of the industry’s total revenue in China in 2022. Among them, SUMEC’s outdoor power tools mainly include lawn service robots, lawn mowers, scarifiers, electric saws, pruning shears, and other devices with small motors or engines and gasoline generators. According to statistics, SUMEC’s outdoor power tools (OPE) business revenue was 4.111 billion yuan in 2022. The proportion of forestry machinery sales revenue is 3.29%, indicating that the concentration of forestry machinery industry enterprises is relatively low in China, and the industry competition degree and disorder may be high.

Prospects for forestry machinery industry in China

During the 14th Five-Year Plan period, the development of forestry machinery and equipment in China faced more challenges and opportunities, and there have been efforts and breakthroughs made in the following areas.

In terms of policy, increase the special financial funds to support the development of forestry mechanization and establish a diversified investment mechanism led by government investment, with collaborative investment from enterprises, forestry farmers, and others. Arrange special projects for the revitalization and technological transformation of the forestry equipment industry in the newly added central investment, establish a risk compensation mechanism for using the first domestically produced equipment in China, and introduce corresponding supporting policies.

In terms of management, clarify the administrative department or institution responsible for forest and grass equipment, establish a “top-down” forestry machinery management system, form a coordinated promotion mechanism with government guidance, financial support, and project drive, and strengthen management and technical transformation.

In terms of systems, strengthen the construction of scientific and technological support systems and implement the “unveiling and commanding” of forest machinery. Increase the construction of forestry equipment service systems, cultivate technology personnel for forestry equipment promotion, and rely on the “Internet+” to build a high-level remote technology service platform.

In terms of technology, fully apply electronic information and other technologies to improve the level of forestry equipment technology, focus on the research and development of multi-functional power chassis and economic forestry fruit harvesting and other forestry machinery equipment, highlight innovative designs, strengthen the integration of industry, academia, and research, develop the forestry equipment modernization that is suitable for national conditions in China, and provide powerful equipment supports for ecological construction and forestry modernization development in China.

Source from Chyxx

Disclaimer: The information set forth above is provided by chyxx.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.