Policy: continuously promoted by national policies for safeguarding high-quality industry development

Construction machinery is a component of the equipment industry and plays a role in China’s economic construction. In recent years, China has issued a series of policies to promote the development of the construction machinery industry, mainly to promote continuous technological innovation in the construction machinery industry. In addition, China also requires the construction machinery industry to strengthen renovation and promote green and efficient development. In the Implementation Opinions on Supporting Private Enterprises to Accelerate Reform, Development, and Transformation and Upgrading (NDRC Reform [2020] No. 1566), China mentioned promoting high-quality development of the mechanical equipment industry, safe, green, and efficient development of the petrochemical industry, and promoting the renewal and renovation of old agricultural machinery, engineering machinery, and old ships. By central policies, every province and city has also introduced corresponding measures to promote the continuous development of the industry.

Development status: Continuous technological breakthroughs to expand export scale

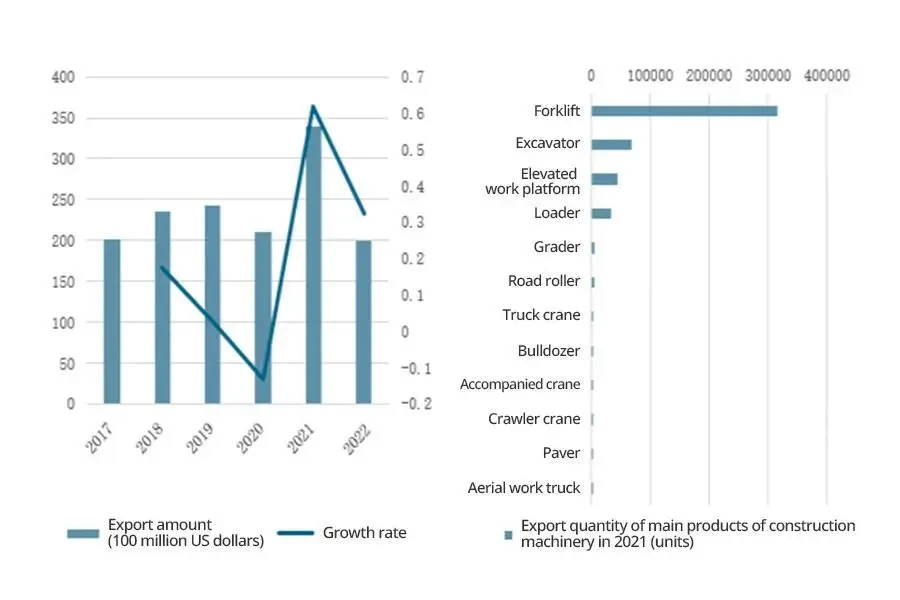

Engineering machinery has a wide range of applications, mainly used in raw material industry construction and production, agriculture, forestry and water conservancy construction, industrial and civil construction, urban construction, environmental protection and other fields for national defense construction projects, transportation construction, energy industry construction, and production, mining, and others. In recent years, the Chinese product genre has formed overseas with the rapid development of China’s construction machinery industry and continuous breakthroughs in product and technology research and development. Chinese products have been widely used and recognized in overseas markets, further enhancing their international influence. According to statistics, the export value of construction machinery decreased in 2020 due to the impact of COVID-19. In 2021, the economy recovered gradually, and the export value increased to $34 billion. In the first half of 2022, the export value reached 19.89 billion US dollars, a year-on-year increase of 32.3%.

Enterprise pattern: Competition among enterprises is relatively fierce, and product output and sales continue to increase

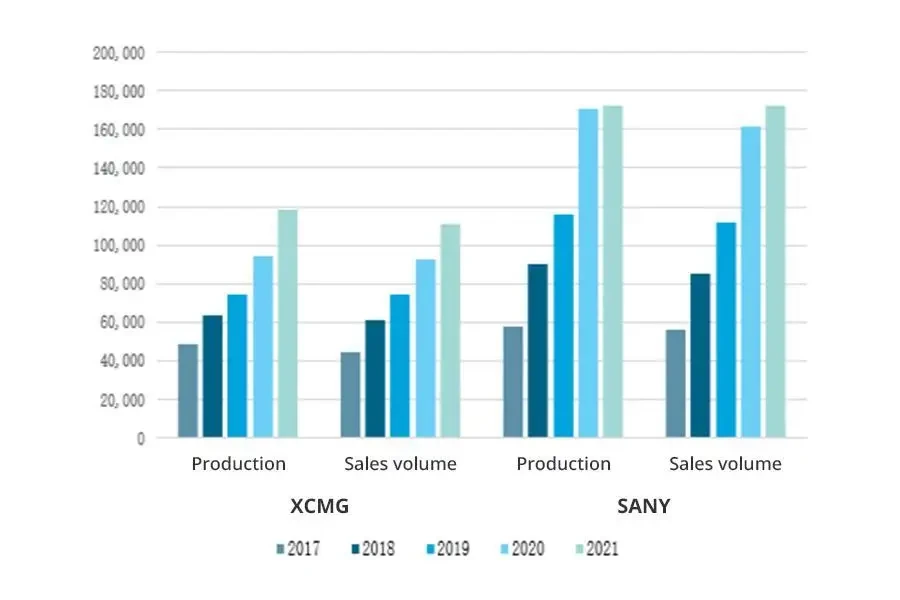

The construction machinery industry plays a crucial role in the manufacturing industry and has international competitive advantages in China. Currently, the construction machinery industry has a high level of maturity and fierce competition, with related enterprises mainly including XCMG, SANY, ZOOMLION, and so on. From the perspective of the production and sales of engineering machinery in the enterprise, the production and sales of XCMG and SANY have shown an overall growth trend between 2017 and 2021. In 2021, the output of XCMG reached 118,215 units, with sales reaching 110,842 units, and that of SANY reached 172,289 units, with sales reaching 172,465 units.

Development trend: The construction machinery industry will develop towards internationalization, greening, and digitization

For the continuous improvement of technology in China’s construction machinery industry, related products are favored gradually by overseas markets, and their penetration rate overseas is increasing gradually. In the context of sustained high demand in overseas markets, relevant manufacturers are also actively expanding into overseas markets. Meanwhile, as non-road mobile machinery such as excavators and loaders switches from the “State III” emission standard to the “State IV” emission standard, green development plays a crucial role in the construction machinery industry. In promoting China from being great to powerful in manufacturing, digitization is also a new track for the future development of the industrial machinery industry.

Keywords: construction machinery, export amount, production and sales volume, digitization

Policy: Continuously promoted by national policies for safeguarding high-quality industry development

Construction machinery is a component of the equipment industry and plays a role in China’s economic construction. In recent years, China has issued a series of policies to promote the development of the construction machinery industry. The Implementation Plan for Expanding Domestic Demand during the 14th Five-Year Plan released on December 15, 2022, mentions the promotion of innovative development in industries such as shipbuilding and marine engineering equipment, advanced rail transit equipment, advanced power equipment, engineering machinery, high-end CNC machine tools, pharmaceuticals, and medical equipment. The Notice on Consolidating and Revitalizing the Industrial Economy mentions the implementation of major technological equipment innovation and development projects, optimizing and strengthening advantageous industries such as information and communication equipment, advanced rail transit equipment, engineering machinery, power equipment, and ships, and promoting the innovative development of industries such as CNC machine tools, general aviation and new energy aircraft, marine engineering equipment, high-end medical equipment, and cruise ship and yacht equipment. In addition, China also requires the construction machinery industry to strengthen updating and transformation and promote green and efficient development. The “Action Plan for Carbon Peak before 2030” proposes to promote the high-quality development of re-manufacturing industries such as automotive parts, construction machinery, and office equipment. The Implementation Opinions on Supporting Private Enterprises to Accelerate Reform, Development, and Transformation and Upgrading (NDRC Reform [2020] No. 1566) also mentions promoting high-quality development of the mechanical equipment industry, safe, green, and efficient development of the petrochemical industry, and advancing the renovation and renovation of old agricultural machinery, engineering machinery, and old ships.

In response to the call, each province and city has introduced relevant measures to promote the development of the construction machinery industry. In November 2022, the Development and Reform Commission of Guangdong Province released the “Implementation Plan for the Development of Circular Economy in Guangdong Province (2022-2025)”, which aims to improve the re-manufacturing level of automotive components, engineering machinery, office equipment, and other emerging fields such as shield tunneling machines, aviation engines, and industrial robots, and promote the application of common key re-manufacturing technologies such as non-destructive testing, additive manufacturing, and flexible processing. The Detailed Rules for the Implementation of Provincial Financial Equity Investment in Enterprise Technological Transformation in Shandong Province focuses on supporting the technological transformation projects under construction in industries such as new generation information technology, high-end equipment, advanced materials, high-end chemical industry, medicine, engineering machinery, light industry, shipbuilding and marine engineering equipment, new energy, textile and clothing, agricultural machinery equipment, etc. The “Implementation Measures for Encouraging the Expansion of Supporting Policies in the Automobile and Construction Machinery Industry in Hunan Province” proposes to promote the development of the automobile and construction machinery industry in Hunan province, encourage automobile and construction machinery manufacturing enterprises to adopt provincial supporting parts actively, focus on improving the level of supporting components in the province, increase the supporting rate of advantageous industries in the province, and promote the healthy development of advantageous industrial clusters.

Development status: Continuous technological breakthroughs to expand export scale

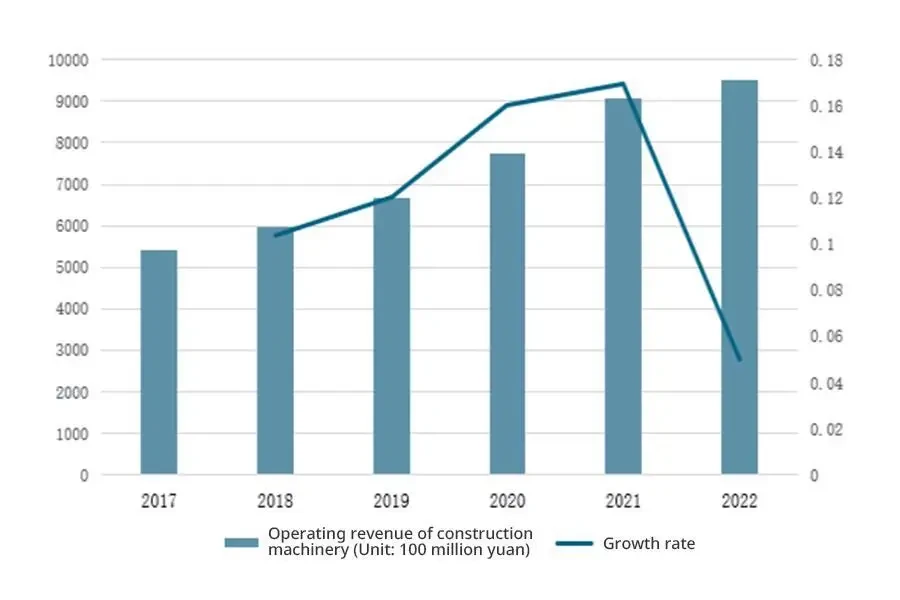

Engineering machinery has a wide range of applications, mainly used in raw material industry construction and production, agriculture, forestry and water conservancy construction, industrial and civil construction, urban construction, environmental protection and other fields for national defense construction projects, transportation construction, energy industry construction, and production, mining, and others. It can be seen that there is a strong demand for construction machinery. According to data from the China Construction and Machinery Association (CCMA), the operating revenue of construction machinery showed a continuous growth pattern from 2017 to 2021. In 2021, the operating revenue exceeded 900 billion yuan for the first time, and it expects that the operating revenue of construction machinery will reach 952.1 billion yuan in 2022, an increase of 5.03% compared to 2021.

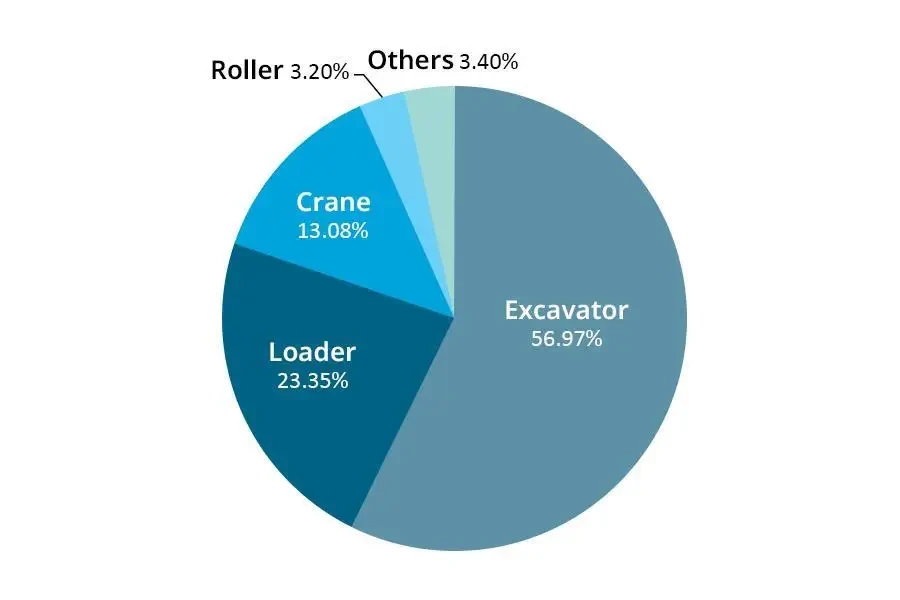

According to data from CCMA, construction machinery-related products in 2021 mainly include excavators, loaders, cranes, rollers, etc. Among them, excavators account for more than 50%. Loaders followed closely, accounting for 23.35%. Cranes rank third, accounting for 13.08% of the construction machinery market.

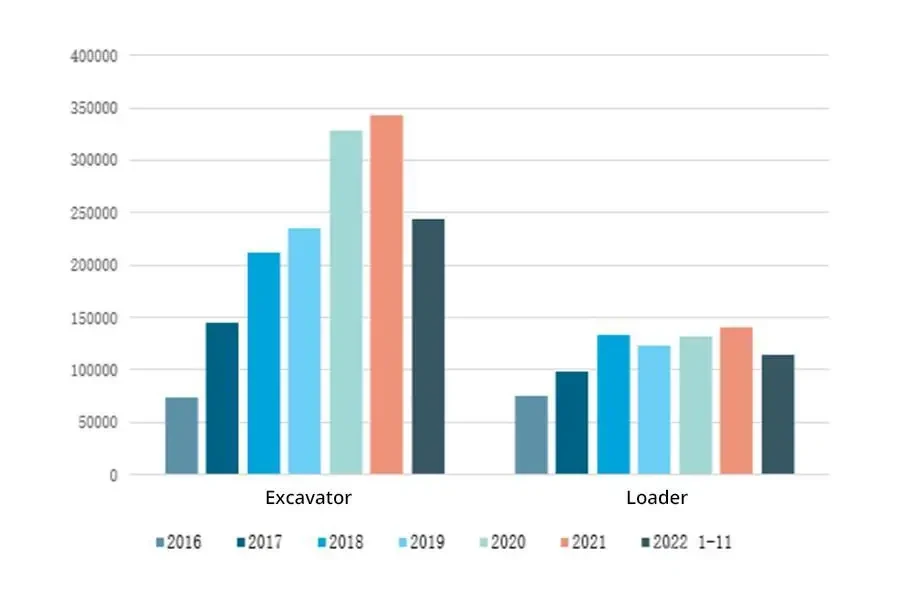

From the sales of excavators and loaders, the sales of excavators in 2021 reached 342,784 units, an increase of 4.6% compared to 2020. The sales of loaders in 2021 reached 140,509 units, an increase of 7.1% compared to 2020. From January to November 2022, a total of 244,477 excavators were sold with a year-on-year decrease of 23.3%, and a total of 114,938 loaders were sold with a year-on-year decrease of 12.7%.

In recent years, the Chinese product genre has formed overseas with the rapid development of China’s construction machinery industry and continuous breakthroughs in product and technology research and development. Chinese products have been widely used and recognized in overseas markets, further enhancing their international influence. According to statistics, the export value of construction machinery decreased in 2020 due to the impact of COVID-19. In 2021, the economy gradually recovered, and the export value increased to $34 billion. In the first half of 2022, the export value reached 19.89 billion US dollars, a year-on-year increase of 32.3%. From the perspective of the export product quantity, the export quantity of forklifts is far greater than that of excavators ranked second. Among them, the export quantity of forklifts is 315763 units, and the export quantity of excavators is 68427 units, with a difference of 247336 units between the two products.

Enterprise pattern: Competition among enterprises is relatively fierce, and product output and sales continue to increase

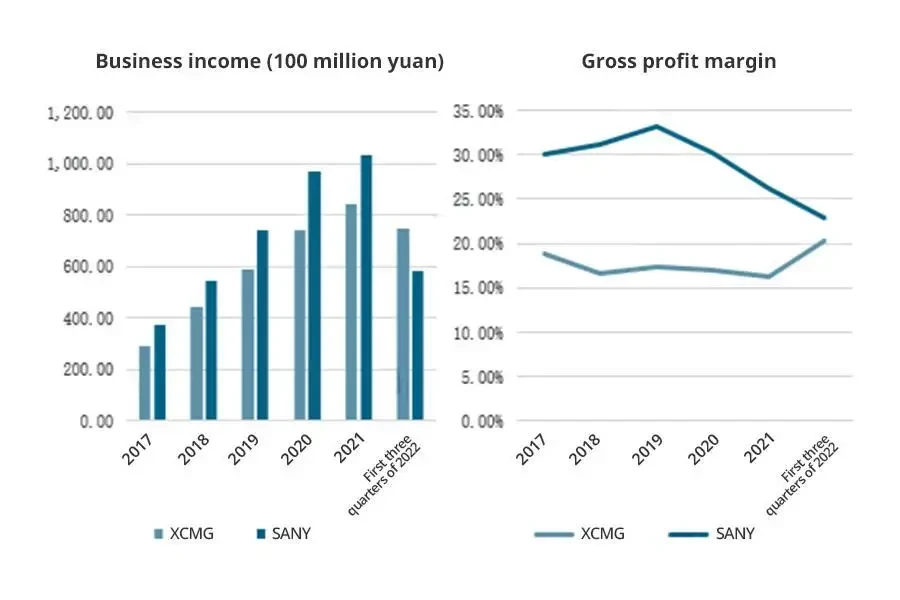

The construction machinery industry plays a crucial role in the manufacturing industry and has international competitive advantages in China. Currently, the construction machinery industry has a high level of maturity and fierce competition, with related enterprises mainly including XCMG, SANY, ZOOMLION, and so on. In the first three quarters of 2022, the operating revenue of XCMG was 75.054 billion yuan, with a gross profit margin of 20.22%. The operating revenue of SANY was 58.561 billion yuan, with a gross profit margin of 22.83%. Overall, the operating revenue of the two companies’ construction machinery maintained a good growth trend between 2017 and 2021, with a varying degree of decrease in gross profit margin from 2019 to 2021.

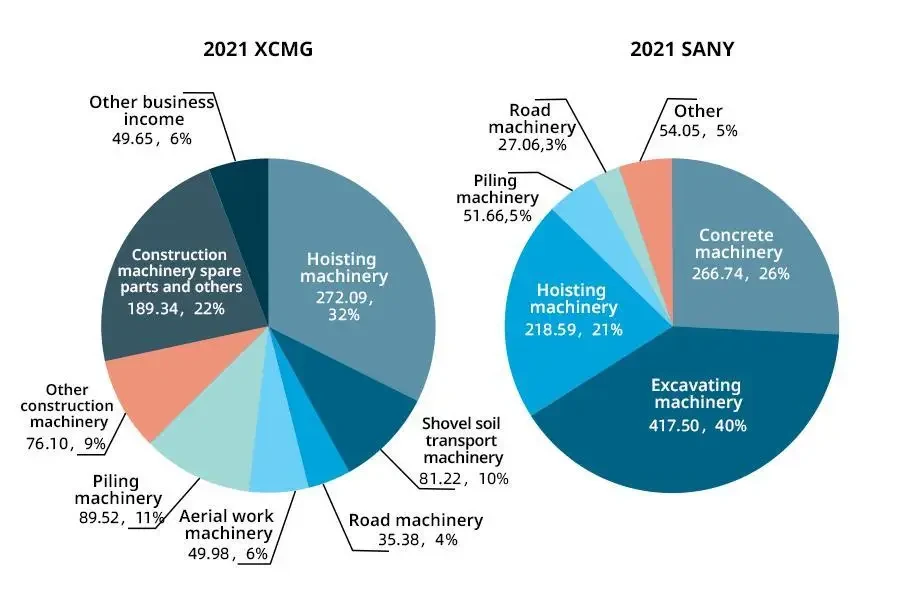

XCMG is mainly engaged in the research and development, manufacturing, sales, and service of lifting machinery, shoveling machinery, compaction machinery, road machinery, piling machinery, firefighting machinery, high-altitude operation machinery, and other engineering machinery and spare parts. The proportion of lifting machinery is the largest, accounting for 32%, with a revenue of 27.209 billion yuan. SANY is mainly engaged in the research and development, manufacturing, sales, and service of construction machinery. SANY’s products include concrete machinery, excavation machinery, lifting machinery, piling machinery, and road construction machinery. Among them, concrete machinery, excavation machinery, and lifting machinery account for a large proportion, accounting for 26%, 40%, and 21%, respectively, with operating revenue of 26.674 billion yuan, 41.75 billion yuan, and 21.859 billion yuan.

From the perspective of the production and sales of engineering machinery in the enterprise, the production and sales of the above two corporations have shown an overall growth trend between 2017 and 2021. In 2021, the output of XCMG reached 118,215 units, with sales reaching 110,842 units, and that of SANY reached 172,289 units, with sales reaching 172,465 units.

Development trend: The construction machinery industry will develop towards internationalization, greening, and digitization

1. Continued high overseas demand and broad prospects for industry development in the future

For the continuous improvement of technology in China’s construction machinery industry in recent years, related products have been favored gradually by overseas markets, and their penetration rate has gradually increased. In the context of sustained high demand in overseas markets, relevant enterprises are actively expanding overseas markets, and international marketing has entered an acceleration period. The influence of domestic-related manufacturers will continue to increase, and the export scale will also be in a growth state. This will enable the development of engineering machinery enterprises to transfer from the internationalization of research and development and production to the internationalization of brand and management systems. It can be seen that the industry has broad prospects for development in the future.

2. Green development is an inevitable trend for the industry’s future development

Since 2022, the construction machinery industry has implemented the concept of green development, carried out technological transformation with the goal of intelligent manufacturing and green manufacturing, comprehensively promoted new environmentally friendly coating technologies, seized the opportunity to switch emission standards, and actively promoted industry transformation and upgrading. At present, green development mainly refers to improving the energy efficiency of products, promoting resource recycling, and reducing product emission standards. Promoting these three aspects of development can enhance the market competitiveness of enterprises greatly and inject vitality into their long-term development. In addition, as non-road mobile machinery such as excavators and loaders switches from the “State III” emission standard to the “State IV” emission standard, green development plays a crucial role in the construction machinery.

3. Digitalization empowers the industry to enter a new stage of high-quality development

The report of the 20th National Congress of the Communist Party of China pointed out that the focus of economic development should be on the real economy, promoting new industrialization, and accelerating the construction of manufacturing, quality, aerospace, transportation, network, and digital China. It can be seen that digitalization is a new track for the development of the future industrial machinery industry, playing a role in promoting China’s transition being from strong to powerful. Therefore, relevant enterprises should promote industrial intelligent manufacturing and complete business digital transformation, drive innovation vigorously in manufacturing capabilities and business models, promote profound changes in industrial ecology, form, and format, and enter a high-quality development stage of comprehensive innovation and upgrading.

Source from Chyxx

Disclaimer: The information set forth above is provided by chyxx.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.