Introduction to the Crisis

The global freight market, a lifeline for e-commerce and various industries, is currently navigating turbulent waters due to significant disruptions in major shipping routes. The Red Sea, a vital artery in international trade, has seen a halt in operations from leading shipping companies following disruptions caused by local armed forces. This crisis, compounded by ongoing challenges in the Panama Canal, is creating a ripple effect across global shipping logistics.

Latest Developments in the Red Sea Crisis

Amidst a marked increase in maritime conflict in the Red Sea, international authorities have called for a cessation of hostilities impacting naval commerce. The situation has resulted in a drastic reduction of container ship passage through a key maritime gateway, coinciding with a notable increase in detours via alternative major capes. Economic forecasts from global financial institutions suggest that the turmoil poses risks to the international economic landscape, potentially triggering energy price hikes, stymied growth, and inflationary pressures. The crisis is impacting critical trade channels, heightening the risk of supply constraints and inflationary snags. Military responses by prominent Western nations targeting the insurgents are sparking debate over their potential effects on the crisis. Freight costs on pivotal trade routes have surged considerably, alongside oil prices, while tanker traffic slows. An influential tanker association has recommended vessel rerouting, underscoring the crisis’s reach. The United Nations, emphasizing the Red Sea’s historical and cultural significance, has highlighted the urgent need to preserve global supply lines and prevent regional conflict escalation.

Impact on the Freight Market and Industry Perspectives

The suspension of shipping operations in the Red Sea has sent shockwaves through the freight market. This critical route, bridging the Mediterranean Sea and the Indian Ocean, is pivotal for around 12% of global trade. The current disruptions have forced a costly rerouting of ships, primarily around the Cape of Good Hope, leading to extended travel times and escalated operational costs.

Recent data from Freightos Terminal, a leading logistics data platform, illustrates the volatility of shipping costs in light of these disruptions. The Freightos Baltic Index (FBX), which tracks global container freight rates, has shown a 4% increase in costs, signaling a trend towards rising expenses in ocean freight. Regional variations are notable, with routes from China/East Asia to North America’s West Coast experiencing a 5% decline, potentially due to decreased demand or increased competition.

Industry experts are closely monitoring the situation. Data analysis firms specializing in maritime and air freight, such as Xeneta, warn of the potential closure of the Suez Canal. While currently deemed unlikely, such an event could double shipping costs, depending on the extent and duration of the disruption.

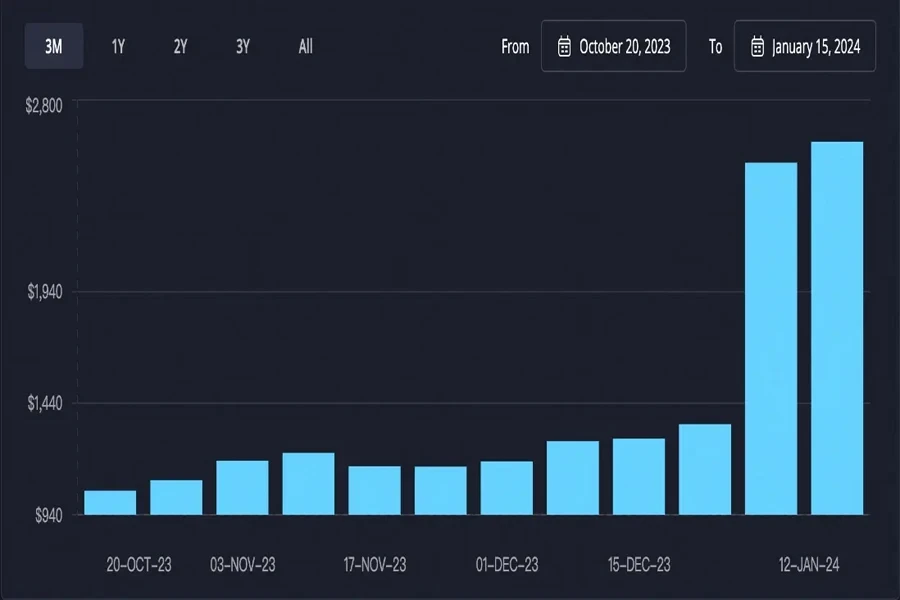

The Freightos Air Freight Index (FAX), reflecting global air cargo rates, also shows a fluctuating trend, indicating that air freight might not be immune to the pressures affecting maritime routes. As seen in the 3-month period leading up to January 2024, air freight rates experienced fluctuations between $2.25 and $2.75, underscoring the unstable nature of shipping costs during this period.

Linerlytica, a container market analysis firm, reports an increased likelihood of disruptions in the Red Sea, potentially affecting up to 30% of the container ship fleet. This exacerbates the strain on global supply chains, potentially leading to significant increases in shipping costs.

Long-term Implications for E-Commerce and Industries

The ongoing crisis in the Red Sea, coupled with the challenges in the Panama Canal, is reshaping the landscape of global shipping, e-commerce, and a wide array of industries including apparel, beauty, electronics, and sports goods. This situation is compelling companies to critically reassess their logistics and supply chain strategies. The need for alternative routes and suppliers is more pressing than ever, potentially leading to a significant reconfiguration of global trade routes and a reevaluation of dependence on maritime chokepoints.

- Monitoring the Crisis Progress: It’s crucial for businesses to stay informed about the evolving situation. Platforms like Freightos, along with media outlets such as Bloomberg, CNBC, and Reuters, offer valuable insights. Subscribing to services like Logistic Market Updates on Alibaba Reads can provide timely updates and analyses, helping businesses make informed decisions.

- Diverse Logistics Modes: In response to the crisis, diversifying logistics modes has become a necessity. Combining sea, air, rail, and road transportation can optimize shipping routes, offering more flexibility and potentially reducing transit times. This multimodal approach is vital in adapting to the current unpredictable shipping environment.

- Bolstering Inventory Levels: To buffer against delays caused by the crisis, businesses are increasing their inventory levels. This strategy is essential to maintain a steady supply chain and meet customer demands, despite the longer transit times and unpredictability in shipping schedules.

- Embracing New Technologies: The adoption of advanced technologies like AI and blockchain is becoming increasingly important for efficient supply chain management. These technologies can provide real-time data, predictive analytics, and enhanced tracking capabilities, enabling businesses to anticipate delays and reroute shipments more effectively.

As the global shipping landscape continues to evolve, the resilience and adaptability of these industries will be key in navigating and potentially reshaping the future of global trade and e-commerce. In response, companies are not only redesigning their supply chains but also rethinking their entire approach to global commerce. The stakes are high, and the maritime and air freight data from platforms like Freightos Terminal will continue to be a vital tool for those seeking to steer through these uncharted waters.