Although online shopping has become more popular, many people still wonder what payment methods their favorite platforms accept—and Temu is no different. The good news is that Temu gives users more payment options than most online stores, making it easy to choose the most convenient option. So, what payment options are available on Temu? This article will examine the different ways to pay for your Temu orders.

Table of Contents

8 Payment methods you can use on Temu

1. Credit & debit cards

2. Temu credit

3. Apple Pay

4. Google Pay

5. Cash App Pay

6. PayPal

7. Venmo

8. Buy Now, Pay Later services

Wrapping up

8 Payment methods you can use on Temu

1. Credit & debit cards

Most people have a credit or debit card in their wallet, so it’s no surprise Temu supports them. The platform accepts Visa, Mastercard, Discover, American Express, JCB, Diners Club, and Maestro, which covers the gamut worldwide.

Credit cards are a favorite because you earn cashback, miles, or other rewards. Plus, credit card issuers tend to have strong fraud protection. If you spot a strange charge on your statement, it’s usually straightforward to dispute it.

On the other hand, using a debit card ensures you only spend what’s in your account, so there is no risk of piling on debt. But keep an eye on your balance because if your account dips too low, your payment might decline, or you might face overdraft fees.

Pros

- Broad acceptance

- Fraud protections (especially on credit cards)

- Rewards and incentives (some credit cards)

Cons

- Potential interest if you carry a credit card balance

- Possible overdraft with debit cards if you’re not watching your bank balance

- Easy to overspend if you’re not careful

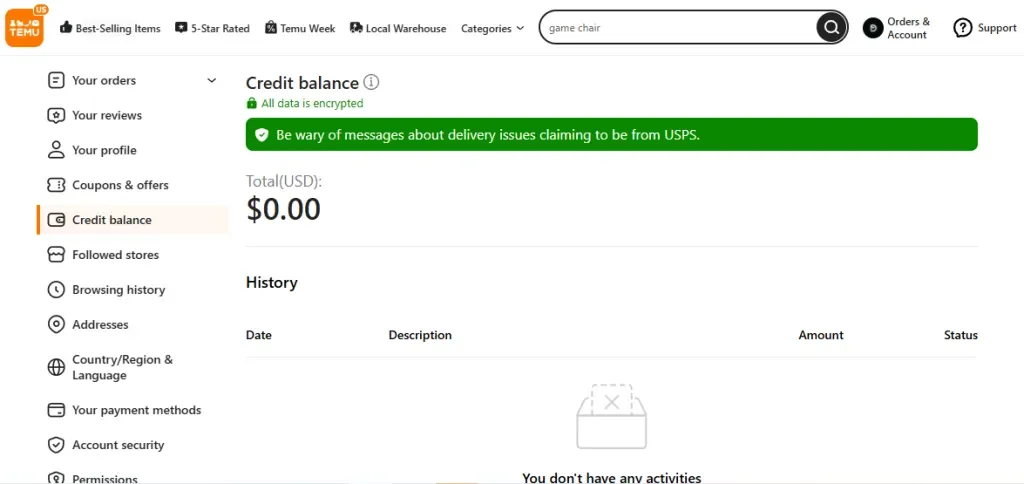

2. Temu credit

Temu Credit is store credit you can apply toward future orders on Temu. You can get it through refunds or promotions. For example, if you return an item and opt for credit instead of returning the money to your bank, you’ll have those funds in your Temu account.

Who chooses Temu credit?

- Frequent buyers: If you shop in Temu often, having your refund instantly available as credit is handy instead of waiting a few days for your card or bank to process.

- Budget-minded folks: Some people limit their spending on one site by using only store credit.

Points to note

- Check validity: Sometimes, store credit might expire after a certain period or have conditions for usage.

- No direct cash-out: Typically, you can’t convert store credit back to real money unless specified, so commit only if you’re sure you’ll use it.

3. Apple Pay

If you own an Apple device (iPhone, iPad, or Apple Watch), Apple Pay is a great way to streamline your Temu checkout. You just set up your card in the Wallet app, then at checkout, choose Apple Pay. A quick Face ID or Touch ID confirmation, and you’re done (no need to type in card details each time).

Why people like Apple Pay

- Security: Apple Pay uses tokenization, meaning Temu never sees your card number.

- Speed: One or two taps and your purchase is through.

- Privacy: Apple Pay keeps your transaction data minimal and doesn’t share it with third parties.

Minor drawbacks

- Only for Apple device users.

- You need to ensure your bank supports Apple Pay. Although most do, it’s still worth checking.

4. Google Pay

Google Pay is Android’s version of Apple Pay—and they’re quite similar, too. You load your card in the Google Pay app, then check out on Temu with minimal hassle (Tap, confirm, done).

Key highlights

- Fast: Like Apple Pay, it cuts down your checkout time.

- Secure: It also uses tokenization.

- Convenient: If your phone is already set up, you can finalize the purchase with a few taps.

Potential drawbacks

- You need an Android phone that supports NFC (for in-person) or at least the latest versions for in-app usage.

- Some banks may still be rolling out Google Pay support in certain countries.

5. Cash App Pay

Cash App started as a peer-to-peer payment service, allowing for things like splitting a pizza bill with friends. Over time, it branched out into paying retailers, too. So, if you have a balance in your Cash App, you can use that for Temu.

Benefits

- You won’t need to enter card details. If you have money in the Cash App, you can pay with a few taps.

- It’s handy if you want to keep your main bank account info away from third parties.

Things to watch for

- The charge may go to your linked bank or card if your Cash App balance is low.

- It is not as commonly used for online shopping as PayPal or other wallets, so there could be a slight learning curve.

6. PayPal

PayPal remains a giant in the digital payment space. Many prefer it because they don’t share your bank details directly with Temu; they just use their PayPal login.

Pros

- Buyer protection: If something goes wrong (e.g., the item never arrives or is way off from the listing), PayPal might help you get a refund.

- Speedy checkout: Once logged in, you’re only one click away from completing your purchase.

- Widely recognized: PayPal is often near the top of an online store that supports external payments.

Cons

- If you’re shopping internationally, watch for PayPal’s currency conversion fees.

- Occasionally, PayPal might freeze accounts if it detects suspicious activity, which can be frustrating if you rely on it.

7. Venmo

In the U.S., Venmo (owned by PayPal) is known for sending money to friends with a dash of social flair (like adding emojis to payment notes). But many retailers, including Temu, now allow you to check out with Venmo.

Pros

- It’s a familiar payment method if you have already used Venmo with friends.

- It’s also fast. You log in, pick the bank/card source in your Venmo, and confirm.

Cons

- You can only use Venmo in the U.S., so it may not be an option if you’re elsewhere.

- Transactions might appear in your Venmo feed (unless you adjust privacy settings).

8. Buy Now, Pay Later services

Temu also accepts many BNPL providers, allowing users to enjoy a more flexible shopping experience. The basic idea is the same across each platform: you can break your payment into smaller installments and usually pay back with zero interest, not exactly the same as COD.

1. Klarna

Klarna offers a “Pay in 4” and “Pay in 3” plan, so you can split your order amount into four or three, depending on what you can handle. Then, you’ll pay each installment every two weeks and enjoy zero interest if you pay on time.

Pros

- Zero interest if on time.

- Soft credit check only, so there is minimal impact on your score (depending on region).

Cons

- Late fees if you miss a payment.

- It could lead to overspending if you’re not mindful.

2. Afterpay

Afterpay also offers “Pay in 4” payment plans, spreading your payments over four installments. You’ll also pay each installment every two weeks. Again, there is no interest unless you miss payments. The difference is that Afterpay offers a monthly (6 and 12 months) payment plan for orders over $400 with interest.

Pros

- Afterpay is super popular and easy to set up.

- The brand encourages you not to overspend if you pay promptly.

Cons

- Late or missed payments can result in fees or being locked out of future Afterpay usage.

3. Affirm

Affirm can offer more than four installments—sometimes, you can get up to 12 months or more, but depending on the plan, you might pay interest. Since Affirm’s motto is transparency, they’ll always tell you their interest upfront.

Pros

- Flexible repayment durations.

- Clear about interest and fees.

Cons

- If you choose a longer plan, you might rack up interest.

- Affirm sometimes does a more thorough credit check, potentially affecting your score.

4. PayPal Pay Later

Since PayPal is a big player, it launched its BNPL service in some regions. If you already have a PayPal account, you can choose the pay-later plan at checkout to stretch your payment.

Pros

- It links to your existing PayPal account.

- Buyer Protection still applies to an extent.

Cons

- Not available in every country.

- Like other BNPLs, missing payments can result in fees.

Wrapping up

Temu has gone out of its way to give shoppers various payment methods. Whether you swear by your credit card’s rewards, prefer the straightforwardness of a debit card, or love the simplicity of Apple Pay, the platform has you covered with many options. The buy-now-pay-later options (Klarna, Afterpay, Affirm, and Pay Later) are also available if you want to break down payments. And if you prefer mobile payments, you can always use PayPal and Venmo.