According to GlobalData’s The Cashless World report, the path towards the adoption of cashless payments has become very different between markets. Key findings discussed in the report include:

- In developed markets where customers are well accustomed to the use of payment cards the focus is still chiefly on these card transactions.

- In developing markets, on the other hand, payment cards have not been widely adopted so the consumers are leapfrogging straight from cash to mobile payments.

- On aggregate the speed of this transition to a cashless economy has been swift. However, in some countries, such as the US and Japan, the transition has been much slower due to cultural, demographic and regional factors that limit the rate at which cash is abandoned. As such we should not expect a significant part of the world to go cashless anytime soon.

- Markets with smaller populations can learn from the cashless progression of countries like Sweden and adopt some of the steps they have taken. Linking up a national ID, bank account, and mobile phone number as part of a mobile payment system is a smart and efficient way of implementing a wider national cashless payment system.

- In markets where there is a large financially unserved segment, mobile wallets have proved an efficient way of providing banking and payments facilities.

- In such markets, internet infrastructure is crucial to ensuring financial inclusion for this segment of society, which will in turn increase the cashless payment rate in the market.

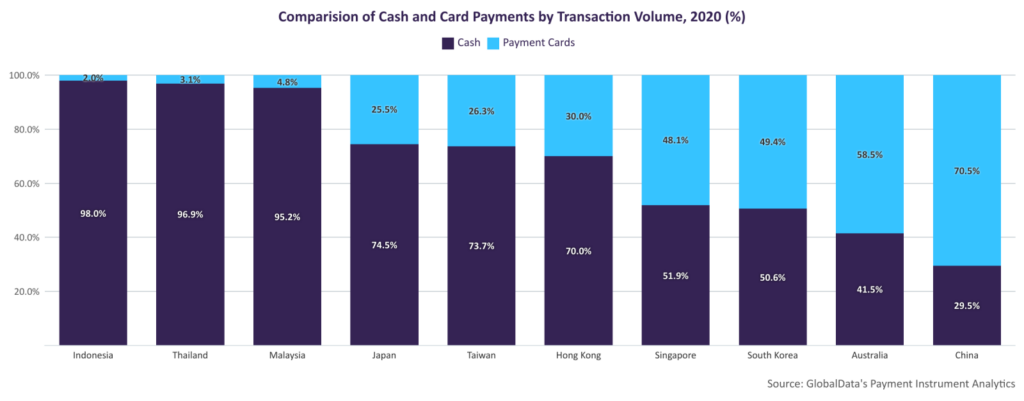

In some APAC markets (as seen above) consumers still have a strong preference for cash, while in others consumers are accustomed to non-cash payments. In most other cases, the cashless payment journey is being limited by aspects of the payment environment, such as the lack of proper digital payment infrastructure or the lack of internet connectivity.

For most developed Western economies, the cashless payment environment has been in place for a few decades now. Yet even in this region, adoption varies significantly between countries. Once again, this means a one-size-fits-all strategy is not viable. For example, Germany is similar to Japan: a risk-averse nation that still favors cash. Based on our Payment Instrument Analytics, cash accounted for 46.8% of overall payment transaction volume in 2020, compared to a 14.4% share for payment cards. In contrast, the shares are essentially reversed in the UK: cards accounted for 56.2% of transaction volume while cash accounted for 16.0%.

Source from Global Data

Disclaimer: The information set forth above is provided by Taiyang News independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.