Many industrial machinery companies have adopted new technology to increase their productivity. Even though the new technology comes with plenty of benefits and different solutions to the industry, there are still challenges to be faced. The good news is that major trends are driving industrial machinery forward.

In this article, we are going to focus on the top trends that are driving industrial machinery. Additionally, we will look at the market share, size, demand, and expected growth rate of industrial machinery.

Table of Contents

Demand and market share for industrial machinery

Top trends driving industrial machinery

Conclusion

Demand and market share for industrial machinery

The demand for industrial equipment has rapidly increased over the years. This is because the technological development surge has greatly impacted industrial machinery manufacturing, bringing numerous benefits to businesses. Some of these technologies include artificial intelligence, 3D printing, and data analytics. The result has been higher productivity, increased profit margins, and low operating costs.

According to the Business Research Company, the global industrial machinery market size was valued at USD 461.89 billion in 2021. The revenue grew to USD 500.97 billion in 2022 at a compound annual growth rate (CAGR) of 8.5%. It has further been projected to expand at a CAGR of 5.8% to USD 626.81 billion by 2026.

Regionally, the Asia Pacific registered the largest share in the industrial machinery market in 2021. Western Europe followed it closely behind.

The industrial machinery segments include:

– Construction machinery and related equipment

– Agriculture and food machinery

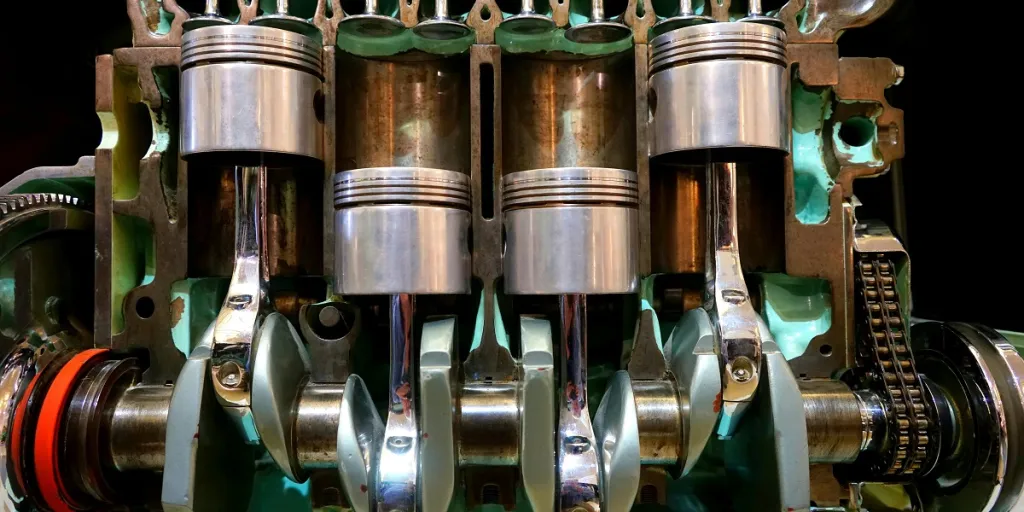

– Aerospace and automotive machinery

– Mining and industrial process machinery

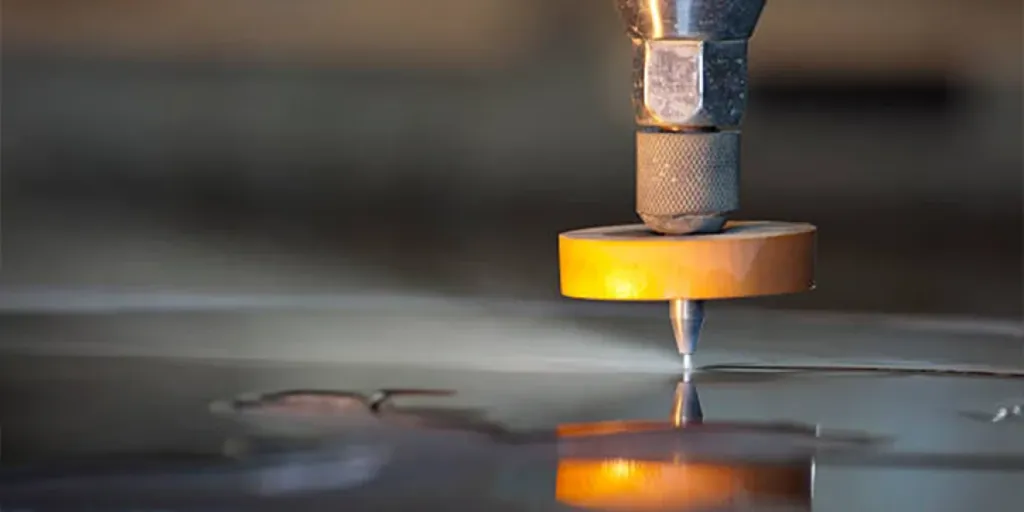

– Metalworking and material handling machinery

Top trends driving industrial machinery

1. Smart machines

The industrial internet of things (IIoT) is being embraced by most machinery suppliers. The manufacturers now have the edge to access massive amounts of data generated by the machines. Most smart machines can now collect information on variables within their area of operation. For instance, smart agricultural tractors give information on current crop prices, weather conditions, and terrain types. Also, buyers have the advantage of knowing the condition of the machinery, and if damaged, they can order spare parts from the information provided.

In 2023, the smart machines market size is valued at USD 87 billion according to PMR. It was further predicted to expand at a CAGR of 20.1% from 2023 to 2033. Regionally, the South Korean market for smart equipment is expected to increase at a CAGR of 20.5% over the same period. The growth is ascribed to the evolving technology connectivity and machine learning which has positively impacted many industries.

2. Consumer-driven customization

With the constant change in buyers’ preferences, manufacturers are more focused on differentiated, customized, and personalized products. Companies now design new industrial equipment that supports a wider variety of product mixes. The machines are also unique and flexible in both the software and hardware components. This has ensured compatibility with frequent and rapid changeovers.

Dash Research revealed a 65% increase by 2026 in market size for customer optimization and personalization services. This would mean USD 11.6 billion, increasing from USD 7 billion in 2020. The growth will be driven by the development of processes and systems to support the expected level of personalized experience.

3. Hyper automation

This is the installation of automated and electrical controls on industrial machines. Automation engineers gather data from machine performance to comprehend machine behavior and general operation. As such, they have and will continue building new generation machines with improved qualities. The high-performance machines manufactured are faster and more productive.

The global hyper-automation market size was USD 548.2 million in 2021, as reported by Blueweave Consulting. This number will expand at a CAGR of 22% to reach USD 2,132.8 million by 2028. This is due to the increased adoption rate of automated methods of production.

4. Supply chain management

Over recent years, supply chains of industrial machinery manufacturers were hit by severe disruptions. For instance, global stress that resulted from the pandemic negatively impacted the movement of products. This resulted in delayed orders due to the shortages of materials.

However, suppliers are adopting more resilient distribution channels. They have digitized the procurement systems by integrating seller and buyer software platforms for data availability and transparency. Meanwhile, the supply chain has been diversified to include different distributors with a broader range of products. Also, the distribution channels have been shortened to locally source raw materials for manufacturing machines instead of depending on a worldwide supply network.

Globe Newswire reported a global supply chain management market size of USD 16.64 billion in 2021. This value was forecast to increase at a CAGR of 10.8% from 2021 to 2030. The expansion was pegged to digital technology advancements, shipment information transparency, and improved supply chain processes that enhance visibility for end-users.

5. Inventory management

Industrial machinery manufacturers have reduced costs and improved machine efficiency. This has been enabled by the just-in-time inventory management and minimization strategies. To manage the demand, manufacturers have resolved to increase the breadth and depth of their inventories. This enables them to cope with fluctuating demand and disruptions in supply chains. Also, there is a push to partner with proactive suppliers who have diverse product catalogs, short lead times, and deep inventories.

Inventory management software and strategies had a global impact in 2021, recording a market size of USD 1.53 billion, according to Data Bridge Market Research. This value is expected to hit USD 2.56 billion by 2029 at a CAGR of 6.62% during the forecast period. Inventory management techniques will be used to track inventory levels, sales, orders, and deliveries to facilitate the operations of global solution providers.

6. Internet of business

<alt=“A mechanic examining a machine in a lab”>

There has been stiff competition among industrial machinery manufacturers. This has resulted in the inclusion of the internet of business concept in the manufacturing and supply processes. Buyers can now order industrial equipment through e-commerce platforms that operate globally. They can also observe the machines to obtain vital maintenance data. The information shows the machines’ current condition, potential warning alerts, and activation of necessary repair protocols. Efficiency has been achieved due to faster and clearer insight into machinery performance and production areas.

According to Market Research Report, the global IoT market size was valued at USD 300.3 billion in 2021. It was projected to reach USD 650.5 billion by 2026 at a CAGR of 16.7% during the period of forecast. The growth is mainly fueled by easy access to low-cost and low-power sensor technology.

Conclusion

The trends above show how industrial machinery companies have developed their newly manufactured equipment. These recent innovations have transformed businesses and enabled them to adapt to new challenges faster. Several industries have greatly benefited from the machinery developments that remain key in future manufacturing. Some of these industries include automotive, agriculture, and construction. To acquire industrial machinery with the latest technology installed, visit Alibaba.com.