The Russian government has continued to support the development and growth of the machinery market to overcome economic sanctions from the West. This support has been through subsidy policies that engender the automobile market, geared to increasing machine tool consumption.

Nevertheless, the decline in crude oil prices and a slump in the global economic recovery from the pandemic, regional conflict with Ukraine, and overwhelming sanctions negatively affect machinery consumption in Russia.

Besides importing machinery, Russia also exports its mechanical engineering tools. Machine exports are one of the country’s non-energy and non-resource exports, second in magnitude to farming.

This article addresses industrial machinery markets in Russia, covering agricultural, mining, and construction machinery.

Agricultural machinery in Russia

Fertile agricultural land covers around 220 million hectares of Russian soil, almost 20% of the fertile global land. However, 87% of this land is not cultivated, showing that the agricultural machinery industry has the potential to grow in Russia.

In the second quarter of 2022, the agricultural sector contributed 638.90 RUB Billion to the GDP, a significant increase from the 448.70 RUB Billion contribution in the first quarter.

However, Russia still has insufficient agricultural equipment and machinery, hindering its ability to increase production. To enhance agricultural production, the government encourages farmers to purchase cutting-edge technology.

The intense emphasis on boosting farm yield propels the demand for mechanization. Farm equipment manufacturers reap big from government incentives. They can promote domestic production and exports of agricultural machinery.

Despite state incentives, the Industrial agriculture machinery market in Russia still faces several challenges, including high credit costs, high tractor costs, and geopolitical uncertainties. Some farmers are apprehensive about investing their capital in tractors or new machines.

Growth in agricultural machinery import in Russia

Recently, Russia has invested heavily in new cutting-edge agricultural machinery and equipment to supplement the country’s machine manufacturing deficit.

Foreign manufacturers can export their state-of-the-art equipment to the hands of Russian farmers. The Russian agricultural machinery import market is valued atUS $1.2 billion, waiting for importers to exploit.

Tractors take the largest share of US $741m, while harvesting machinery like combine harvesters take US $505m. And the remaining US $427m goes to other equipment like greenhouse equipment, seeders, ploughs, harrows, etc.

The future of the agricultural machinery market in Russia

The Russian agricultural machinery market is expected to soar to US $5.28 billion at a compound annual growth rate (CAGR) of 4.26% in 2024. Several factors are linked to this growth, including:

- Farmers’ adoption of advanced technologies to meet soaring food demand

- New machines replacing traditional farming techniques

- High demand for improved productivity, operational efficiency, and adoption of mechanization.

Russian crop companies, private farmers, and agro-holdings are significant consumers of agricultural machines. It is projected that Russia will become self-dependent on food supplies by 2025.

Industrial mining machinery in Russia

Russia is rich in mineral resources, with many mining companies extracting precious metals, bauxite, iron ore, coal, and diamonds.

The country is the number one producer of rough diamonds in the world. It has 15% of the world’s coal reserves, placing it second place globally.

Russia is also the 2nd largest producer of platinum in the world. And it occupies the 3rd position in producing gold, iron ore, and lead. Companies also mine copper, nickel, cobalt, and other precious gems.

These mining opportunities mean that Russia needs more mining equipment. Statistics show that the country imports over 50% of its mining machinery.

This provides promising business opportunities for mining equipment manufacturers in and outside Russia.

Growth in mining machinery imports in Russia

Several mining machines are in high demand in Russia. For instance, electric vehicles have high growth potential in the industry because they reduce carbon footprints and enhance safety for miners.

Some companies also design underground work equipment like mini loaders with lithium-ion batteries for continuous operations and high mobility.

Coal mining machinery is highly needed, followed by metal and mineral mining equipment.

The future of the mining machinery market in Russia

The Russian mining machinery market is expected to grow at a compound annual growth rate (CAGR) of 6% from 2022-2027.

This projected growth is propelled by factors such as:

- Increased demand for electric machinery for underground mining

- Increased demand for mineral fertilizers to promote agricultural yield in the country

Construction machinery in Russia

The Russian government has several constructions undertaking, from roads to residential buildings. Therefore, construction machinery is often in high demand in the country.

However, the country’s conflict with Ukraine threatens the gains made in the industry. Additionally, sanctions from Europe and the withdrawal of some major construction players have hurt the industry.

Russia needs to expand its road network, thus increasing the demand for equipment such as road rollers, loaders, excavators, and trucks.

Growth in the construction machinery imports in Russia

Although the Russian construction industry has faced numerous challenges like rates, increased material costs, and the pandemic, the industry has kept growing.

Private organizations are the big investors in the country, contributing to large construction works. Russia is the 3rd leading importer of construction machinery, providing business opportunities for foreign manufacturers.

The future of construction machinery in Russia

The Russian machinery market is projected to grow at a compound annual growth rate (CAGR) of more than 2% from 2023 to 2026.

This growth is propelled by a government plan to invest in infrastructure, renewable energy, and residential building projects. However, the Russian-Ukraine crisis may affect these projections if the stalemate lasts longer.

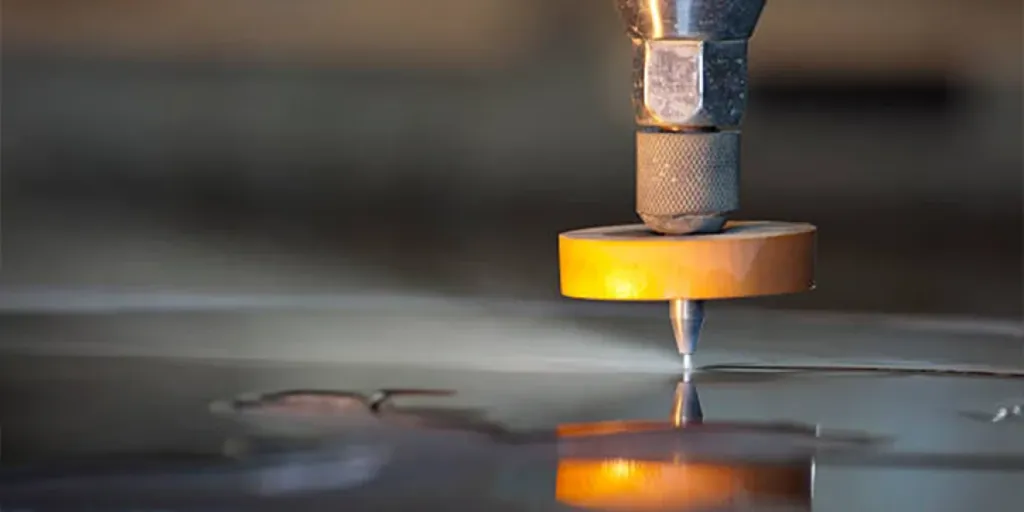

Metal processing machinery

Russian manufacturing and other industries rely heavily on metal processing machinery to help build metal components for several applications.

Technological advancements, including automation and the Internet of Things, are rapidly changing the metal fabrication industry.

Metal processing is a huge market, allowing fabricators to implement unique strategies to produce quality materials at a reduced cost.

The processing includes milling, welding, stamping, forming, machining, grinding, and finishing. The final products or components are applied across many industries in the country.

Growth in the metal processing machinery imports in Russia

Every operating industry in Russia needs metal components to replace the machine and other equipment parts. The industry is the backbone of manufacturing, mining, and construction, thus providing business opportunities for investors looking for a stable niche.

Although Russia manufactures some machinery needed in metal processing, it also imports several machines to supplement its own. The metal processing machinery industry is a suitable investing opportunity.

The future of metal processing machinery in Russia

The Russian market size for metal processing machinery is estimated in billions of dollars with a single-digit compound annual growth rate in the foreseeable future. Metal fabrication equipment is projected to increase as Russia moves towards industrialization.

Food machinery

The agro-food industry is rapidly expanding in Russia, leading to an increased import volume of food equipment. Russia is a food hub, with the government concentrating on the agricultural sector to shield its citizens from food crises.

Russian government’s emphasis on food production fuels the development and investment in the food equipment industry. This includes storage and handling equipment, cooking equipment, and food and beverage preparation equipment.

The growing hospitality and tourism industry often consumes this equipment, including hotels, restaurants and commercial kitchens. Most food factories also demand temperature-controlled storage facilities to keep perishable food items fresh, contributing to the development of the food machinery industry.

Growth of food machinery imports in Russia

Food machinery manufacturers have a viable market in Russia if past statistics are something to go by.

For instance, in 2020, Russia’s import of industrial food preparation machinery amounted to US $792, making the country the 2nd largest importer of these machines in the world. These imports came from Netherlands, Germany, Italy, Poland, and Lithuania.

The sanctions from some European nations due to the Ukraine conflict could temporarily affect food machinery growth, but the trend will return to normalcy when it ends.

The future of food machinery in Russia

The world’s food machinery market is projected to grow from $31.83 billion to $39.16 billion at a CAGR of 5.31% from 2022-2026.

The Russian population is growing, and its dynamics are changing, contributing to the development of automated food machinery to meet demands. The future is promising for importers and exporters of food equipment in Russia.

Packaging machinery market

Russian packaging machinery market is among the largest in the world, but it is still expanding to meet the growing demand.

As the country gradually expands its local pharmaceutical and food production, the packaging machinery market also expands. Companies use packaging to protect their products and inform their buyers.

Growth of packaging machinery imports in Russia

Increased demand for high-quality packaging in the country has created business opportunities for packaging equipment and machinery manufacturers. The demand is huge that native companies cannot satisfy, providing a thriving market for importers.

Several countries are exporting their packaging machinery to Russia for better rewards. The industry will likely continue to grow into the foreseeable future, allowing investors to reap positive investment returns.

The future of packaging machinery in Russia

Packaging machinery will likely expand in Russia as factories and companies produce goods and services. New automated machines are in high demand as companies look to reduce labor force investment.

As Russian agricultural and manufacturing industries continue to grow, the future for packaging equipment will look bright. These factories will demand high-quality packaging materials.

Conclusion

Although Russia is embroiled in a conflict with Ukraine, its industrial machinery market is expanding. From Agricultural machinery to mining, construction, metal processing, food, and packaging machinery, Russia offers an excellent investment opportunity for importers and entrepreneurs. There is a high demand for these machines in the country, promising high returns on investments.