Recently, Temu officially launched in Thailand on July 29, marking its entry into the third market in Southeast Asia. This comes a year after Temu entered the Malaysian and Philippine markets.

Temu’s global growth rate has been astounding. According to 36Kr, Temu’s GMV reached approximately $20 billion in the first half of 2024, surpassing its total sales for 2023. As of July this year, Temu has entered over 70 countries and regions worldwide.

However, Temu does not seem to be using an aggressive strategy in the Southeast Asian market. Momentum Ventures’ data shows that last year, Temu’s GMV in Southeast Asia was $100 million, far below TikTok Shop’s $16.3 billion.

Temu’s development in the Southeast Asian market appears slow but aligns with the region’s realities. The demand for low-priced goods in Southeast Asia is high, a field where Temu excels, and where platforms like TikTok, Lazada, and Shopee are highly competitive. Temu does not have a significant price advantage compared to other platforms.

Southeast Asia’s young population and low e-commerce penetration rates have led many platforms to establish an early presence. The diverse economic levels and logistical infrastructure across Southeast Asian countries necessitate tailored strategies.

High Discounts Continue

Despite slow progress, Temu continues to offer significant discounts. Upon launching in Thailand, Temu introduced opening discounts of up to 90%. Currently, the website provides various cross-border goods with global reviews and ratings.

According to Momentum Ventures’ “2024 Southeast Asia E-commerce Report,” Thailand is the second-largest e-commerce market in Southeast Asia, following Indonesia, with a growth rate second only to Vietnam, showing a 34.1% year-over-year increase. Meanwhile, Indonesia remains the largest e-commerce market in Southeast Asia, contributing 46.9% of the region’s GMV.

Temu has not yet entered Indonesia, and given the competitive landscape, Thailand offers limited room for growth. In 2023, Thailand’s e-commerce market was dominated by Shopee (49% market share), Lazada (30%), and TikTok Shop (21%).

To address these challenges, Temu has developed its own logistics system to fulfill orders from different locations. Sellers can transport goods by truck from Guangzhou to Bangkok, with door-to-door delivery taking less than five days, shorter than sea shipping but slightly more expensive.

A five-day delivery cycle is a significant efficiency improvement for Temu. However, platforms like Shopee and Lazada, which have long been established in the Southeast Asian market, have built their logistics systems and significantly improved logistics efficiency.

The address systems, road planning, and transportation tools vary significantly across Southeast Asian countries. Indonesia, with its 17,508 islands, and the Philippines face inter-island shipping issues. Vietnam and Thailand also have severe urban traffic congestion problems. Additionally, inadequate infrastructure such as roads and railways, coupled with low last-mile delivery efficiency, are logistical challenges. For established e-commerce platforms, improvements have been limited, with most small parcels using international logistics. Temu will face numerous challenges as it continues to expand in the Southeast Asian market.

Payment issues are another challenge for Temu. Its primary payment methods are international credit cards and PayPal, but credit card penetration in Southeast Asia is not as high as in China, Japan, Korea, or North America.

TikTok’s “Global Consumer Trends White Paper Southeast Asia” shows that in 2023, cash on delivery accounted for 2% of global e-commerce transactions. Southeast Asian countries have a higher proportion of cash on delivery for e-commerce payments than the global average, with Indonesia at 11%, the Philippines at 14%, and Vietnam at 17%.

In comparison, Shopee supports Street Payment while Lazada offers cash on delivery, better aligning with local consumer habits.

Challenges Beyond Low Prices

Temu and Pinduoduo have successfully captured Chinese and Western markets by focusing on low prices and tapping into lower-tier market users. However, these strategies seem less effective in Southeast Asia.

While the strategy of offering low prices remains effective, it is not a new tactic in Southeast Asia.

Shopify’s report on Southeast Asian consumer behavior and e-commerce strategies indicates that with the rapid development of e-commerce in the region, price has become one of the primary considerations for consumers when shopping. With inflation leading to reduced consumer spending, 83% of Southeast Asians are cutting unnecessary expenses, and 39% plan to choose cheaper products.

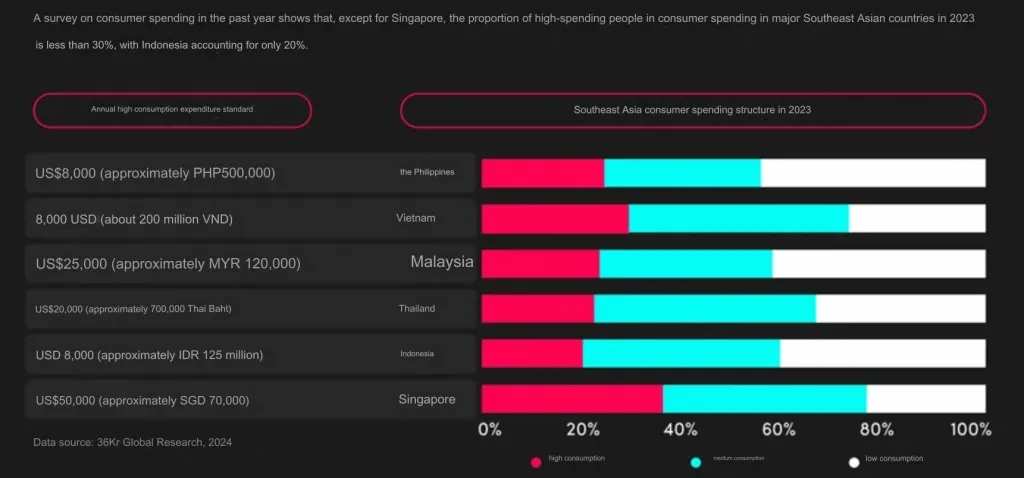

Most Southeast Asian countries have higher growth potential in per capita GDP compared to developed countries like Europe and the United States. Coupled with the impact of inflation, Southeast Asian consumers are increasingly valuing cost-effectiveness and have high price sensitivity.

Lazada, positioning itself similarly to JD.com and Tmall in Southeast Asia, has already adopted a full managed model, becoming the first e-commerce platform in Southeast Asia to do so. It mainly targets highly cost-effective products. Unlike platforms like TikTok and Temu, Lazada’s full management model includes both cross-border and local sellers, who can choose between self-operation and full management for cost-effective, high-volume products.

Shopee also conducts various discount activities, constantly lowering product prices. Comparing the women’s clothing section on Shopee Philippines, many items are priced at one peso with free shipping. Similar products that do not participate in the promotion rarely exceed 120 pesos (just over $2); in comparison, Temu’s similar products range from 160 to 200 pesos, offering no significant advantage.

For Southeast Asian consumers, there are too many e-commerce platforms offering low-priced products. Temu’s low prices are lost in the “cost-effectiveness” flood.

Furthermore, the current Southeast Asian e-commerce market is in a state of chaos. TikTok Shop has rapidly overtaken competitors, and Shopee holds a significant market share. Temu is already several steps behind these platforms.

Momentum Ventures’ “2024 Southeast Asia E-commerce Report” shows that last year, the region’s e-commerce platform GMV reached $114.6 billion, with Shopee leading at 48% market share, followed by Lazada at 16.4%, and TikTok and Tokopedia each holding 14.2%, ranking third.

Moreover, last year, TikTok acquired a majority stake in Indonesia’s largest e-commerce platform Tokopedia, and their combined market share reached 28.4%, making TikTok Shop the second-largest player in Southeast Asia.

Besides market share growth, Southeast Asia’s young population structure means a high penetration rate of social media, with high acceptance of live-stream and social e-commerce, and significant influence from Key Opinion Leaders (KOLs). Statista data shows that social media has become one of the main shopping channels for Southeast Asian consumers, with only 4% of Vietnamese consumers having never used social media for shopping. TikTok has a natural advantage in e-commerce in Southeast Asia.

Additionally, traditional shelf e-commerce platforms like Shopee and Lazada are also adapting to the trend by incorporating live-stream e-commerce models in the Southeast Asian market. This presents another challenge for Temu.

Returning to Temu itself, its focus remains on the European and American markets. Last year, it heavily promoted the full managed model, and this year, it is fully pushing the semi-managed model, aiming to continuously increase its market share in Europe and America to attract more customers. Moreover, Temu’s return policy and low-price strategy in the European and American markets have already dissatisfied many sellers. How many sellers will be willing and able to participate in the Southeast Asian market remains unknown.

Written by Ziyi Zhang

Edit by Silai Yuan

Source from 36kr

Disclaimer: The information set forth above is provided by 36kr independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.