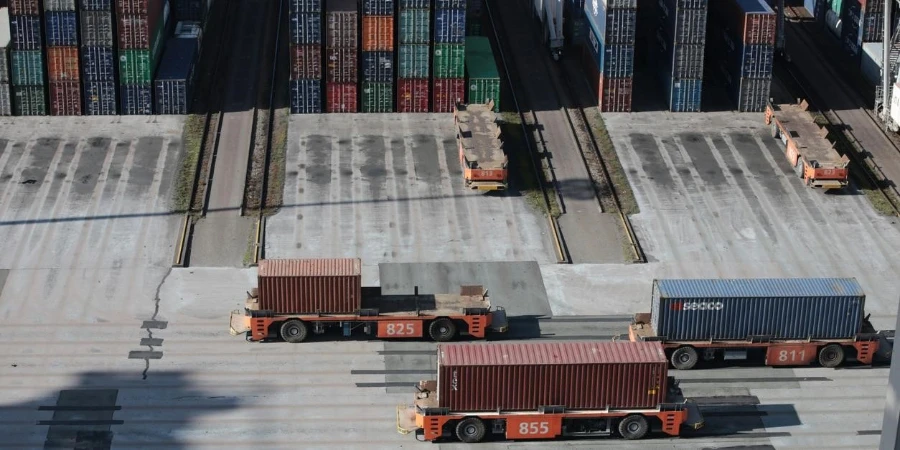

Ocean freight market update

China–North America

- Rate changes: After the spots rates being successfully pushed up by transpacific GRIs in the past few weeks, daily rates from China to the US west coast for this week dipped by about 10 percent, according to ocean freight indexes. Meanwhile, rates to the US east coast remained largely unchanged from last month.

- Market changes: Despite carriers announcing more blank sailings, effective ocean capacity is still at an oversupply on the transpacific eastbound lane according to analysts. Prior to most ocean contracts expiring by April 30, the GRIs implemented recently by transpacific carriers have reportedly motivated enough shippers to sign new contracts, which saw a noticeable increase. On the demand side, China’s exports continued to rise although at a slower pace.

China–Europe

- Rate changes: In the last two weeks, spot rates for China to North Europe and Mediterranean were overall stable, hovering around one percent when compared with mid-April.

- Market changes: COSCO ports reported declining throughput at terminals focusing on trade with Europe. However, the surge in Chinese car exports in Q1 (estimated to be up 58% YoY) is supporting the Pure Car and Truck Carrier (PCTC) demand, and a large portion of them were shipped to Europe through ports such as Antwerp-Bruges, overwhelming port operators.

Air freight/Express market update

Global Carrier Rate

- Rate changes: Global air freight rates resumed a downward trend in April after bouncing back modestly during March. According to TAC Index, the overall Baltic Air Freight Index dipped close to 1 percent during the first week of May. For China to North America, rates in different weight ranges slightly increased from two weeks ago, while those for China to Europe saw more mixed results, with most weight ranges staying steady except for the rate for 100-300kg shipments, which increased modestly this week.

- Market changes: Although the demand for air freight has been recovering in recent months, it seems to have softened from certain key sectors, such as pharma, fashion, high-tech, and automobile, compared with last year. At the same time, capacity in both dedicated freighters and bellyhold continues rising, as a result of the end of COVID. With demand falling and capacity rising, further market pressures are anticipated to drive air freight rates down. However, still strong demand in other sectors, especially e-commerce (and with a busy summer season coming), market rates could reach a bottom soon.

Disclaimer: All information and views in this post are provided for reference purposes only and do not constitute any investment or purchase advice. The information quoted in this report is from public market documents and may be subject to change. Alibaba.com makes no warranties or guarantees for the accuracy or integrity of the information above.