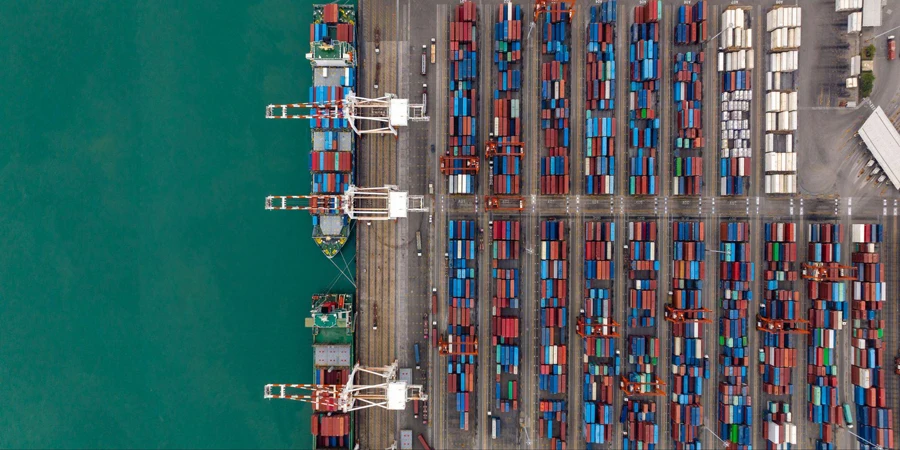

Ocean freight market update

China–North America

- Rate changes: Heading into the summer peak season, ocean freight spot rates increased on both the China to US west coast and China to US east coast lanes, with the former witnessing a greater increase percentage wise. Possible loading limitations on some US east coast services could add pricing pressure for shippers, but it’s also notable that effective capacity reportedly remains at an oversupply on the Trans-Pacific eastbound lanes.

- Market changes: With Canadian port worker strike entering its second week, reports of shipment diversion to US ports have emerged, which may have contributed to the rate increases from Asia to the US coasts. Some uptick in demand amid the start of the peak season may have also played a role, although industry associations (such as the National Retail Federation) are estimating a relatively modest volume increase for the summer months. Even if the volumes were to increase, ocean rates may still remain at current levels as more capacity is expected to be added from August.

China–Europe

- Rate changes: Rates from Asia to both North European and Mediterranean ports remain largely unchanged in the last two weeks, still significantly lower than the same time last year. While some carriers announced planned rate increases from later this month, whether it will succeed remains uncertain given the moderate volume increases.

- Market changes: Pricing on Asia to Europe lanes will continue to come under increased pressure with more capacity made available, where carriers have already added ships and launched new services, and within a month HMM will launch a new, standalone China-India-Mediterranean service using redeployed vessels from Trans-Pacific lanes.

Air freight/Express market update

China–US and Europe

- Rate changes: After a long sequence of rate declines which seemed to bottom out in May, rates on China-EU routes have rebounded and the discrepancy between spot and contract rates is narrowing. Similar trends were observed on China-US routes in the last two weeks, in particular for the 100-300kg range.

- Market changes: Demand for air freight is recovering slowly and the global macro outlook filled by mixed signals, with inflationary pressure persisting in markets like the UK, geopolitical concerns remaining elevated, jet fuel prices firming up, and inventory rundown still progressing. Close monitoring of market conditions to seek clearer signs of rate trends should continue into this summer.

Disclaimer: All information and views in this post are provided for reference purposes only and do not constitute any investment or purchase advice. The information quoted in this report is from public market documents and may be subject to change. Alibaba.com makes no warranties or guarantees for the accuracy or integrity of the information above.