The guitar market is an ever-changing one. Consumer preferences, digital sales channels, and technological innovations are always evolving, so staying ahead of the latest guitar industry trends is vital in order to stay competitive.

This article will look at the biggest trends that are contributing to the growing interest in the global guitar market in 2025/26.

Table of Contents

How popular is the guitar industry today?

Acoustic vs. electric guitars

Top guitar industry trends 2025/26

Eco-friendly materials

Smart guitars

Customized guitars

Fusion of genres

Social media sales

Final thoughts

How popular is the guitar industry today?

One of the biggest guitar industry trends that’s helping to drive up sales is a growing interest in people who want to learn how to play music. Because of this, the demand for both acoustic and electric guitars is on the rise. Consumers also have a higher disposable income than in past decades, meaning they can spend more money on musical instruments or on music education.

The guitar industry has witnessed steady growth in recent years. In 2024, the global market value of guitars was valued at over USD 19 billion. It’s projected to reach at least USD 31.72 billion by 2031, with a compound annual growth rate (CAGR) of 5.08% between 2025 and 2031. North America and Asia Pacific are set to have the largest market growth in the electric guitar market, as technological advancements, interests in live music, and influences from online platforms shape consumer behavior and become key market drivers.

Acoustic vs. electric guitars

Both acoustic and electric guitars are having a revival in the music industry. Acoustic guitars are the best-sellers among beginners and traditional musicians due to their rich and natural sound, as well as their simplicity. There’s high demand for them in genres such as folk and country, and it’s common to find them in schools as well for teaching purposes (especially in the United States).

Acoustic guitars rely on a hollow body to project sound, with tonewoods such as mahogany and spruce among the most popular choices. Steel strings are used for louder, brighter tones, whereas nylon strings are preferred for softer, warmer tones like those found in flamenco music.

Electric guitars, on the other hand, use magnetic pickups to amplify electric signals by converting string vibrations. These guitars have solid bodies to reduce feedback, and the technical specifications, such as the pickup configuration (ie. HH, SS), the scale length, and the onboard electronics (ie. active EQ) give them a wide tonal range.

Guitar enthusiasts and artists interested in all rock genres, metal, jazz, and more can use electric guitars to their benefit. The latest trends in the guitar world are showing that younger consumers and new players who are influenced by gaming and social media are among the leading buyers of electric guitars.

Top guitar industry trends 2025/26

There are many guitar industry trends worth noting, but some are having a bigger impact than others on market growth in 2025/26. Here are the top trends that businesses should be aware of if they want to increase their online sales or improve the product selection in their retail stores.

Eco-friendly materials

Like many industries across the globe, the guitar industry is putting a stronger focus on sustainability. This can be seen in the eco-friendly materials being used when engineering guitars, such as FSC-certified tonewoods and High-Pressure Laminate (HPL). Reclaimed wood is also a huge trend in the guitar industry as it offers a unique alternative to the traditional harvesting method.

Linseed oil and soy-based lacquers are increasingly being used to replace synthetic coatings, and even the knobs and pickguards are being replaced with eco-friendly materials such as bamboo and hemp.

Electric guitars are also seeing sustainable changes taking place. On top of using eco-friendly materials and energy-efficient manufacturing processes, many companies are using water-based paints and finishes.

Smart guitars

Smart guitars are here to revolutionize the guitar industry. These guitars incorporate advanced technology into the instruments themselves, with effects such as app integration and Bluetooth connectivity being two of the most popular features. The app integration allows people using the guitar to learn in real time, join in virtual lessons, and record themselves playing. This makes them appealing to all levels of players.

Key market players such as Yamaha Corporation, Fender Musical Instruments Corp., and Lava Music have all launched their own versions of smart guitars. These major brands are leading the way in the industry with their technology, customization options, and craftsmanship. In the coming decade, the guitar industry will see more manufacturers produce guitars with wireless connectivity to appeal to new guitar players and professional musicians looking to use modern technology in their music.

This type of technology is seen as the future of music education programs and, over time, it’s hoped that it will be incorporated into school curricula. Online music education and the use of online learning platforms have become more common in the past several years. Digital music tools are the way forward in the musical instrument industry, and there’s no better time than now for the key players to hop on board with this trend.

Customized guitars

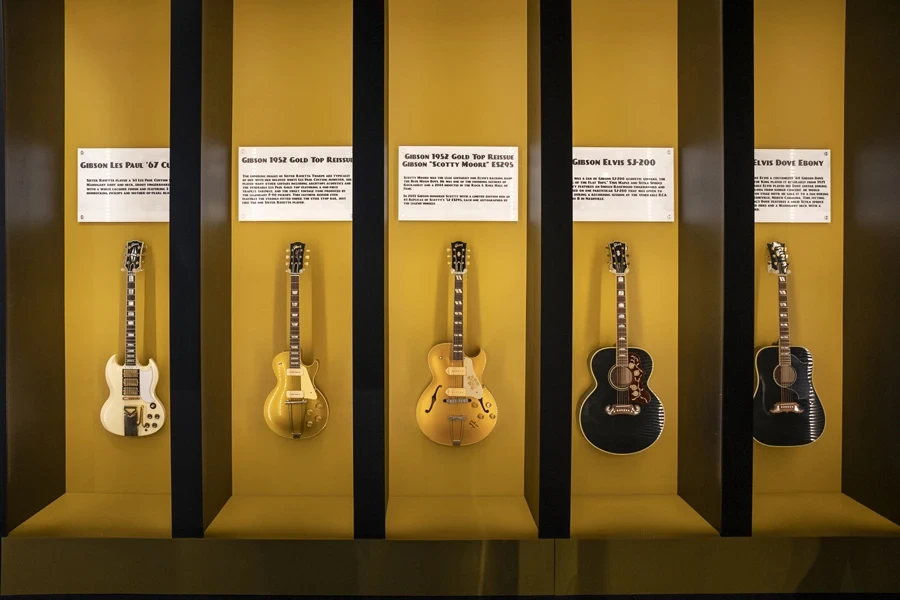

Customized guitars are only set to grow in popularity in 2025/26. More players are seeking guitars, especially electric guitars, that fit better with their personal style and sound preferences. This fairly new trend ranges from custom shop programs to boutique handmade guitars and modular designs from well-known guitar manufacturers such as Fender and Gibson.

Everything from the fretboard radius to the neck profile, hardware finishes, and inlay designs (and more) can be customized in today’s guitar industry. This customization process gives musicians a one-of-a-kind instrument that not only looks great but also sounds the way they want it to.

Fusion of genres

Guitars have become central to cross-genre styles such as bedroom pop, trap-metal, and jazz-hop. These new music genres are pushing boundaries beyond traditional and classical music, so it comes as no surprise that versatile gear is required. Artists are blending techniques and beats to create new sounds, and with this demand comes the need for tonal flexibility.

This means features such as coil-splitting, hybrid acoustic-electric builds, and multi-voice pickups are vital. For genre-fluid guitar players, modelers and pedals like the Strymon BigSky and the Line 6 Helix are must-haves if they want to get the sound right. Guitar players are now mixing sounds in a way that’s never been done before, and brands are actively producing gear that reflects this change in the guitar industry.

Social media sales

One of the most powerful driving forces behind guitar sales today is social media. Instagram, TikTok, and other social media platforms are helping to increase brand awareness and pique people’s interest in picking up a new instrument. Content creators, guitar influencers, and viral videos are all having big impacts on purchasing decisions. Brands are now heavily relying on social media to boost sales, and are slowly turning away from traditional forms of advertising.

Some of the best ways to show new models include live streams, making engaging reels and TikTok videos, and gear demos, along with affiliate links and discount codes for potential buyers. To help streamline the buying process, many of the top brands have invested in creator affiliate programs and shoppable content as well. And let’s not forget the power that a single hashtag can have, either.

Final thoughts

The latest guitar industry trends in 2025/26 are shaped by sustainability, innovation, and customization. From social-media sales and genre fusions to smart guitars, eco-friendly materials, and customized guitars, the guitar industry is reacting positively to the new generation of guitar players that are emerging. Staying competitive means embracing change, and that’s exactly what all the biggest brands are doing to stay connected to new and old clients.