1. Industrial chain situation

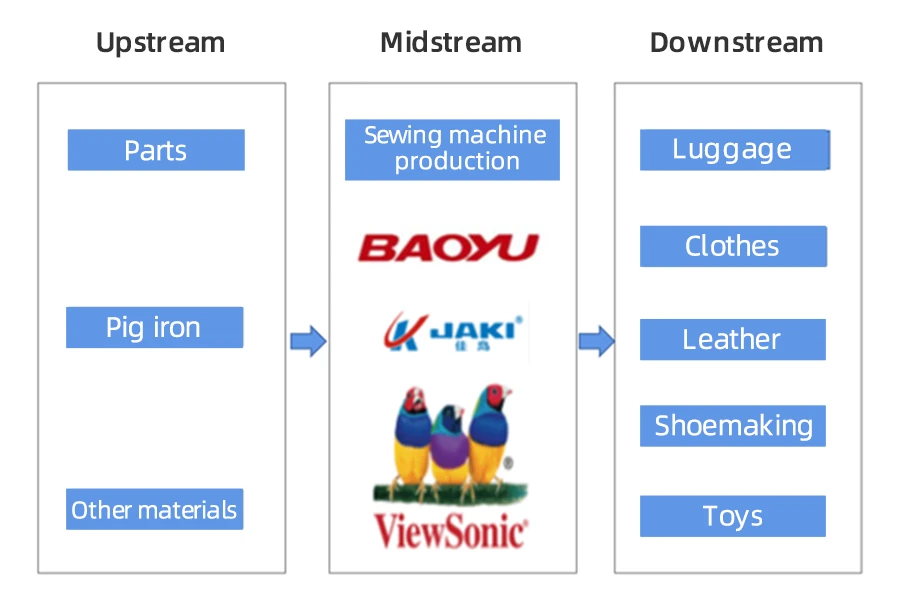

With the development of China’s light industry and textile industry, the sewing machine industry has experienced rapid growth. In recent years, the Chinese government has successively introduced policies to support the healthy development of the industrial sewing machine industry. In June 2021, the China Sewing Machinery Association released the evaluation index system and implementation plan for the “leading runner” standard evaluation of computer-controlled high-speed flat sewing machines for thin, medium-thick, and thick fabrics. This is aimed at promoting the transformation and upgrading of the sewing machine industry, improving the overall product quality of the industry, accelerating the structural adjustment of the sewing machine industry, and promoting healthy competition among sewing machine enterprises. From the perspective of the industrial chain, the upstream of the sewing machinery industry mainly consists of core component suppliers and raw material suppliers such as pig iron. The midstream is sewing machinery equipment manufacturers, while the textile and clothing industry is the primary downstream industry. In addition to this, sub-sectors such as luggage, leather, and toys are also major downstream customers of the sewing machinery industry products.

2. Upstream analysis

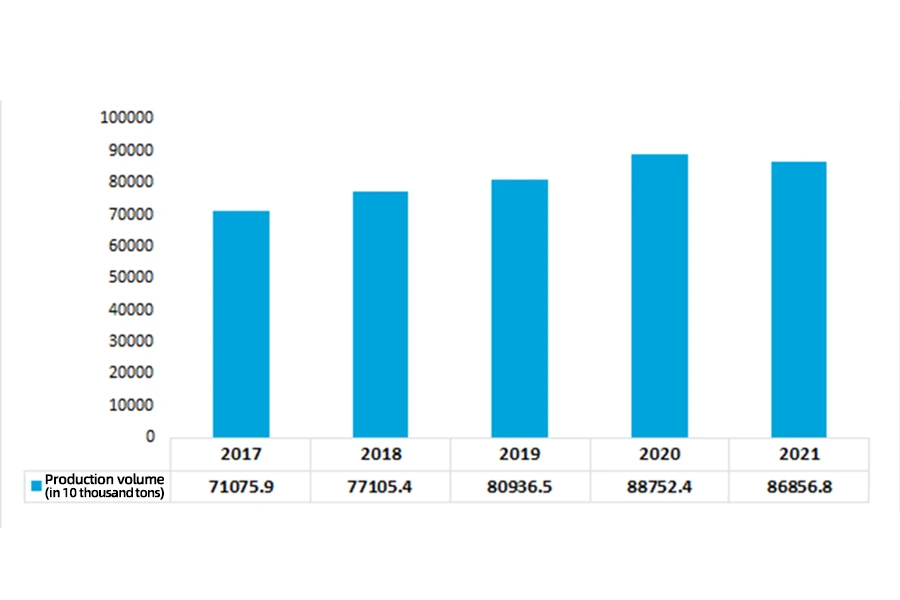

Pig iron is hard, wear-resistant, and has good casting performance, making it the main raw material for sewing machinery. In recent years, pig iron production in China has increased. From 2017 to 2021, China’s pig iron production increased from 710.759 million tons to 898.568 million tons.

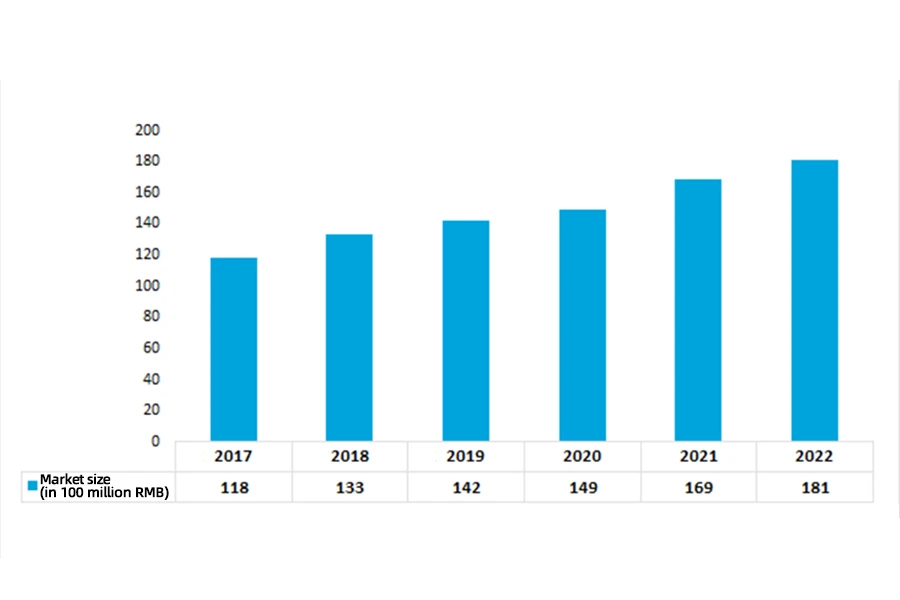

Servo motors are also a major component of sewing machinery. From 2017 to 2020, due to the rapid development of downstream industries such as industrial robots and electronic manufacturing equipment, the application areas of China’s servo motor industry have continued to expand, and the market size has maintained a growth trend. According to data, in 2019, the market size of China’s servo motor reached 14.2 billion RMB, a year-on-year increase of 6.77%, and it is expected to grow to 18.1 billion RMB in 2022.

3. Midstream analysis

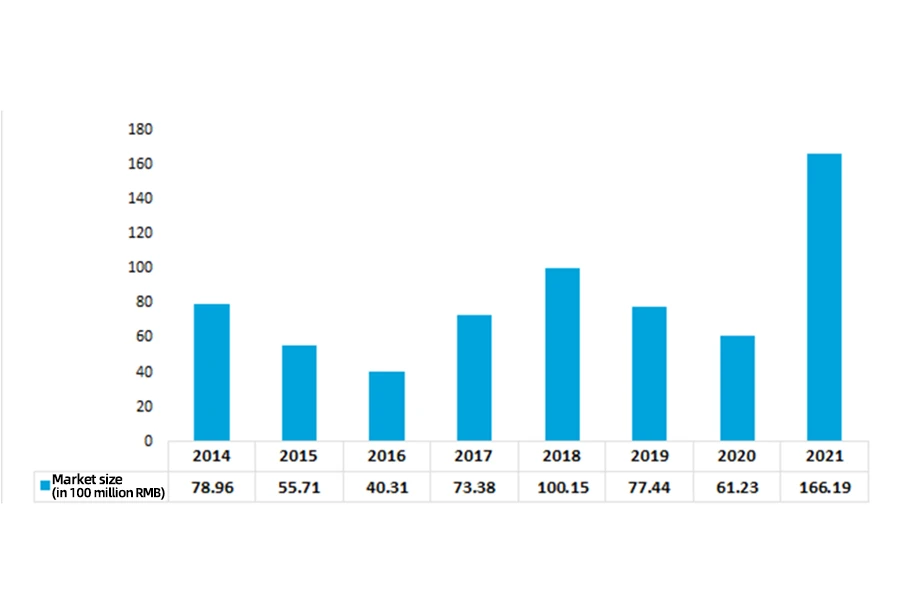

The textile industry is an important component of China’s national economy. In recent years, China’s textile industry has developed well, driving the healthy development of the industrial sewing machine industry. Data shows that the market size of China’s industrial sewing machines experienced explosive growth in 2021. The market size of China’s industrial sewing machines in 2021 reached 16.619 billion RMB, an increase of 6.123 billion RMB compared to 2020.

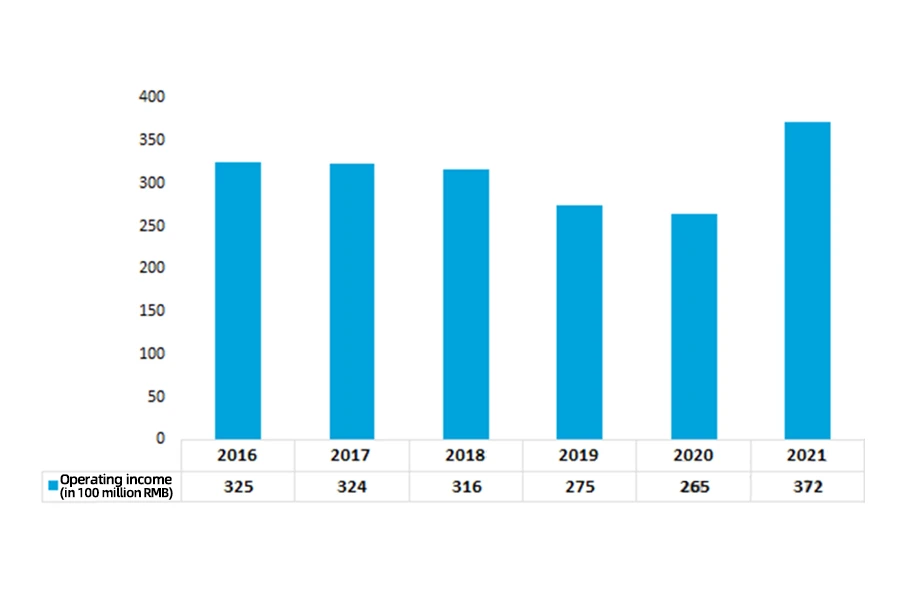

According to data from the China Sewing Machinery Association, in 2021, the operating income of Chinese sewing machinery enterprises above the designated size was 37.197 billion RMB, a year-on-year increase of 39.9%; the total profit of Chinese sewing machinery enterprises above the designated size was 2.448 billion RMB, a year-on-year increase of 46.6%.

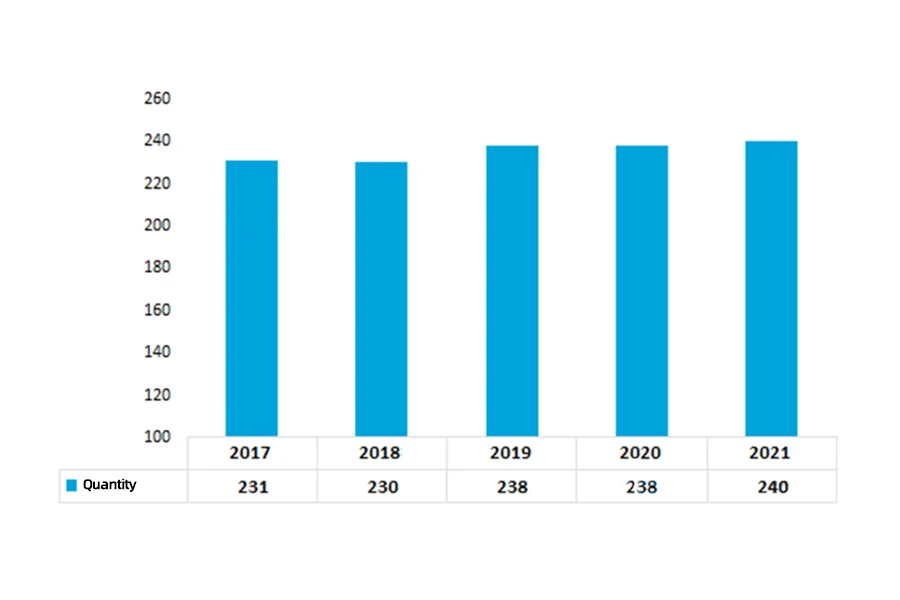

Developing the sewing machinery industry chain is relatively mature, and sewing machinery is key for the textile and clothing industry. In recent years, the number of Chinese sewing machinery enterprises above the designated size has remained stable with slight growth. Among them, the number of Chinese sewing machinery enterprises above the designated size was 240 in 2021.

4. Downstream analysis

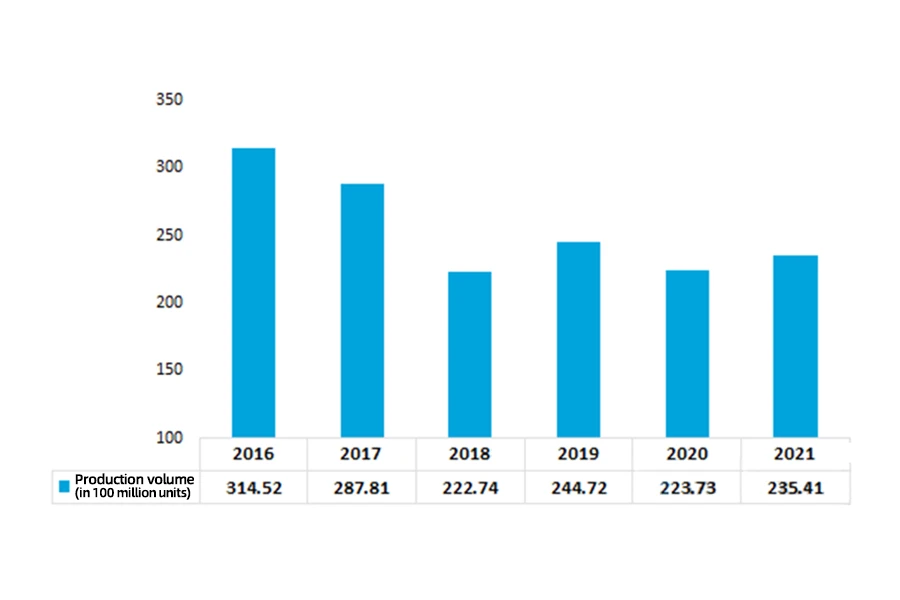

The downstream demand for sewing machinery is mainly concentrated in clothing, luggage, and other industries. With the strong promotion of positive factors such as the recovery of domestic and foreign market demand and the return of overseas orders, the production growth rate of China’s clothing industry has gradually stabilized, and the output has returned to the scale before the epidemic. In 2021, the output of clothing by Chinese enterprises above the designated size reached 23.541 billion pieces, an increase of 1.168 billion pieces from 2020, a year-on-year increase of 5.22%. Looking at the production of major categories of clothing that benefited from exports, the production of knitted clothing maintained rapid growth, with an increase of 10.86% and an average growth rate of 1.75% over the past two years, while the output of woven clothing increased by 4.85% year-on-year but declined by an average of 2.34% over the past two years.

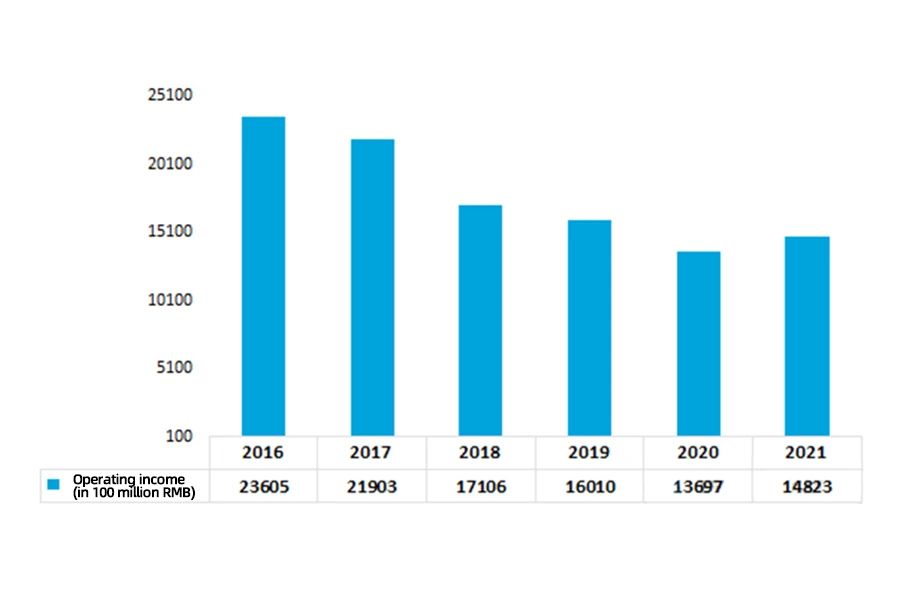

With the continued recovery of China’s clothing industry production in 2021, domestic sales have steadily improved, exports have maintained rapid growth, corporate efficiency has gradually improved, and profitability has slightly increased. In 2021, the operating income of Chinese enterprises above the designated size in the clothing industry reached 1482.336 billion RMB, an increase of 112.61 billion RMB compared to 2020, representing a year-on-year growth of 8.22%.

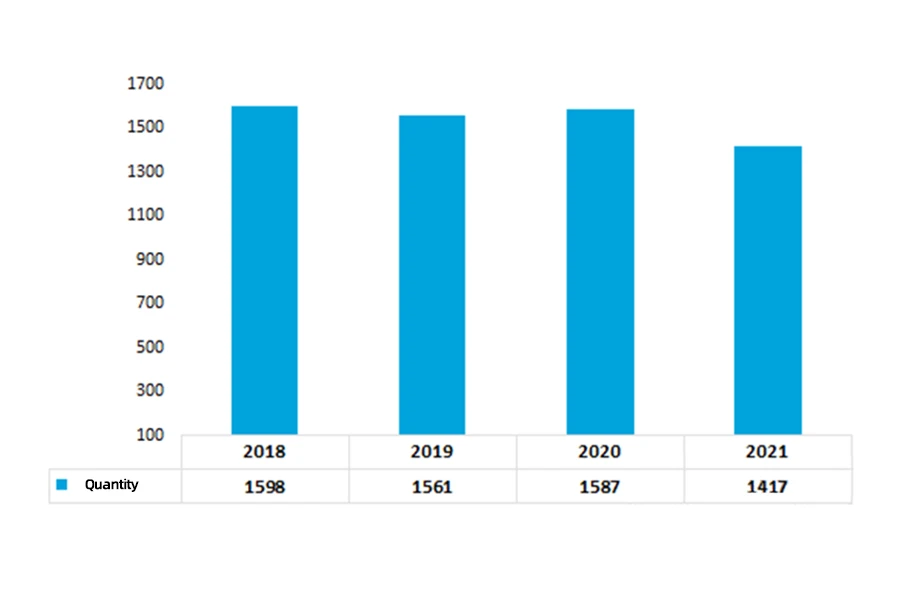

As for the pattern of China’s luggage industry, there is serious polarization between the two levels of the industry. Domestic brands occupy the mid-to-low-end market, while international companies dominate high-end products. Against a slight decline in demand, competition in the domestic mid-to-low-end luggage market has intensified, and the concentration continues to increase. Data shows that as of 2021, there were only 1,417 luggage enterprises above the designated size in China, a decrease of 181 compared to 2018.

Source from Intelligence Research Group (chyxx.com)