Overview of the mining machinery industry

Definition and classification of mining machinery

Mining machinery is specialized equipment for mining and processing solid minerals and stones, mainly including five categories: well-construction equipment, mining and rock drilling equipment, mine lifting equipment, crushing and grinding equipment, and screening and washing equipment. Mining machinery serves many industrial sectors, including ferrous and nonferrous metallurgy, coal, building materials, and the chemical industry. The sand and gravel aggregates produced and processed by mining machinery are applied widely in infrastructure construction fields such as construction, transportation, and water conservancy. To a certain extent, mining machinery reflects the level of scientific development and comprehensive utilization of national mining resources and has significant impacts on the development of the national economy.

- Well construction equipment:including drilling rig, flat tunnel boring machine, patio boring equipment, umbrella drilling frame, rock grabbing machine, etc.

- Mining and drilling equipment:Rock drill, mining drill truck, drilling equipment, charging and filling equipment, mining excavator, rock loader, mining loader, coal planer, coal miner, coal cutter, hydraulic support, etc.

- Mining hoisting equipment:Mine hoist, mining hoist winch, auxiliary mining winch, etc.

- Mineral crushing and grinding machinery:Mineral crushing machinery such as jaw crusher, rotary crusher, program crusher, roller press, etc. Mineral grinding machinery such as vibration mill, steel ball coal mill, roller disc coal mill, gravel mill, tube mill, vertical cement mill.

- Mineral screening and washing equipment:Mineral screening equipment, including vibrating screen. Mineral washing equipment such as grading equipment, magnetic separation equipment, flotation equipment, gravity beneficiation equipment, dehydration equipment, etc.

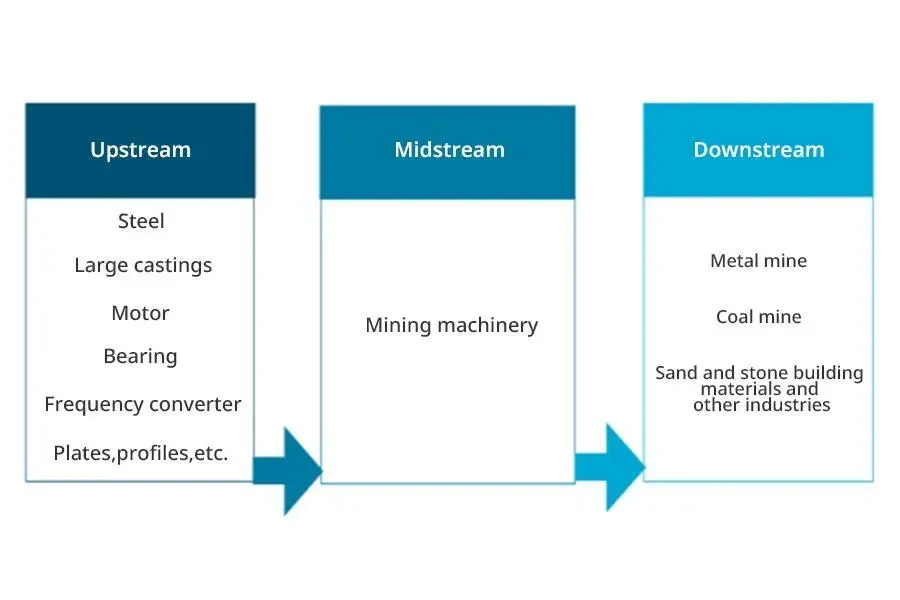

The mining machinery industry chain

The upstream products of the mining machinery manufacturing industry mainly include steel, large castings, motors, bearings, frequency converters, plates, profiles, etc. The cost of large castings, steel, profiles, and other components made of steel as raw materials accounts for a higher proportion of the total cost of raw materials. Therefore, the steel industry has a significant impact on this industry.

The downstream application fields of mining machinery are more extensive. With the continuous promotion of industrialization and urbanization in China, as well as the continuous investment in infrastructure construction such as construction, transportation, and water conservancy, the demand for stone and solid minerals in base industries such as sand and stone building materials, metallurgy, and coal has been continuously increasing, driving the rapid development of the mining machinery market.

Analysis of the development of upstream steel industry

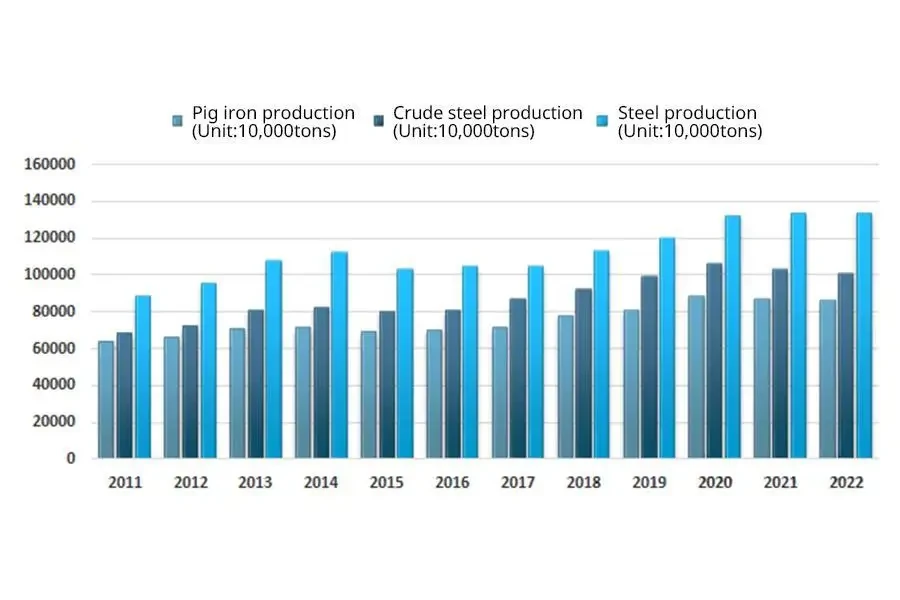

Steel is an essential material for national construction and the realization of the Four Modernizations, with a wide range of applications and varieties. China is the largest steel producer in the world. Throughout 2022, China produced a total of 1.013 billion tons of crude steel with a year-on-year decrease of 2.10%, a total of 864 million tons of pig iron with a year-on-year decrease of 0.80%, and a total of 1.34 billion tons of steel with a year-on-year decrease of 0.80%.

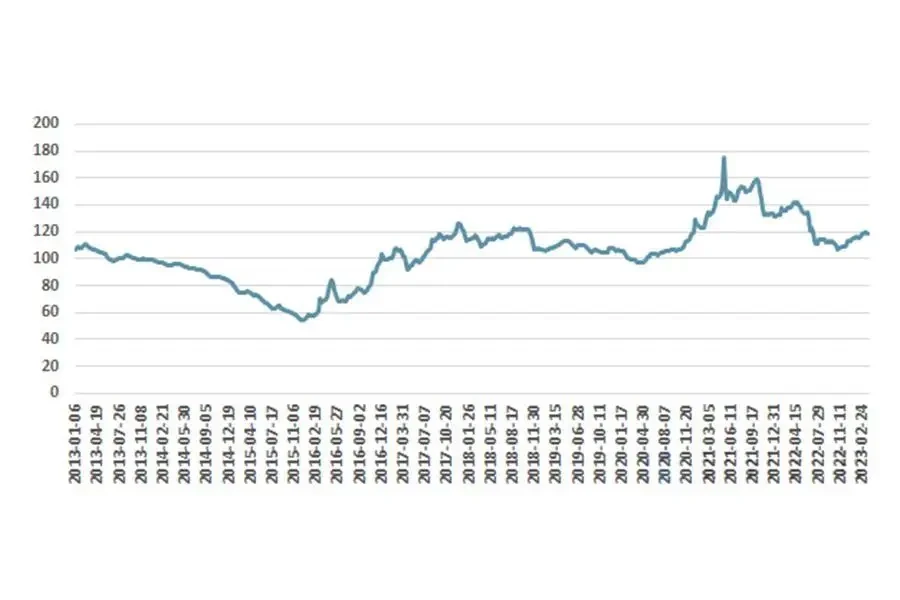

In recent years, the domestic steel market prices in China have rebounded since 2016 and have shown an overall fluctuating upward trend due to the influence of national macroeconomic regulation and economic cycles. Particularly after the outbreak of COVID-19, the supply structure of global bulk commodities and materials has undergone main adjustments. The change in the relationship between supply nd demand has led to a significant increase in the market price of steel in the second half of 2020 and remained high. The fluctuation of steel prices has challenged relevant enterprises to transfer production costs effectively.

Overall, the direct upstream industries of mining machinery belong to highly market-oriented and mature industries, with stable production technology, sufficient supply, and product quality meeting the needs of the industry. Therefore, the procurement demand for raw materials and components in this industry can be fully guaranteed, and there is no situation where production is affected by upstream supply shortages. In addition, upstream industries are typical of fully competitive industries, with low conversion costs, fierce industry competition, stable supply, and low bargaining power. Therefore, mining machinery enterprises have some bargaining power in the upstream supply chain, providing guarantees for their cost management.

Analysis of the development of the downstream mining industry

Influenced by the rising prices of international energy and major mineral products, as well as China’s policy of ensuring supply and stable prices of coal, iron ore, and other raw materials and primary products, fixed assets investment in China’s mining industry has continued to grow, which has also boosted the enthusiasm of private enterprises to invest in the mining industry.

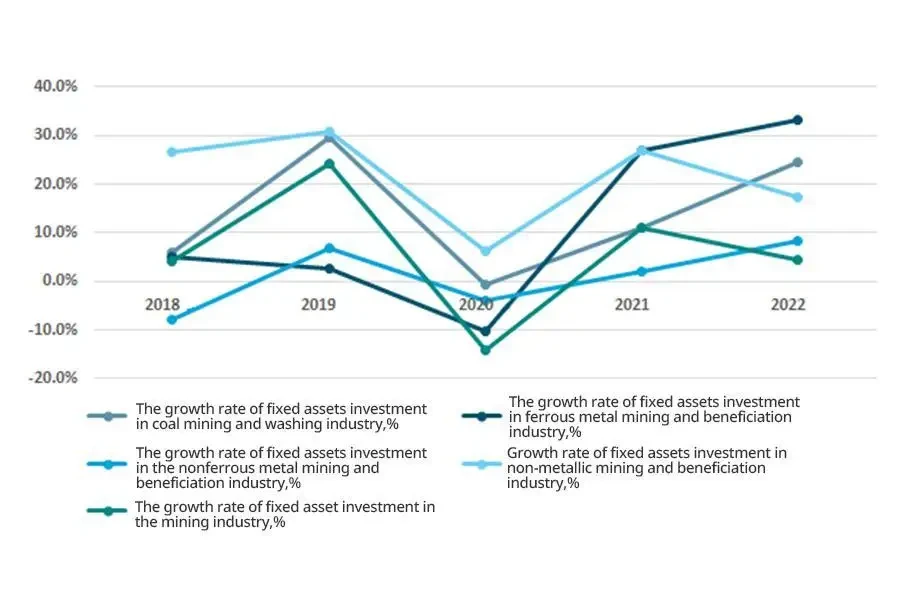

Investment in fixed assets in the mining sector continued to grow. The fixed asset investment in China’s mining industry in 2022 continued its growth trend in 2021, with a year-on-year growth of 4.5%. The fixed assets investment in the mining industry was affected by the policy of guaranteeing the supply of energy and people’s livelihood commodities. In 2022, the fixed assets investment in the coal mining and washing industry and the ferrous metal mining and beneficiation industry increased significantly by 24.4% and 33.3%, respectively. The growth rate of fixed assets investment in the nonferrous metal ore and non-metallic ore mining and beneficiation industry was also above 8%, up 8.4% and 17.3%, respectively.

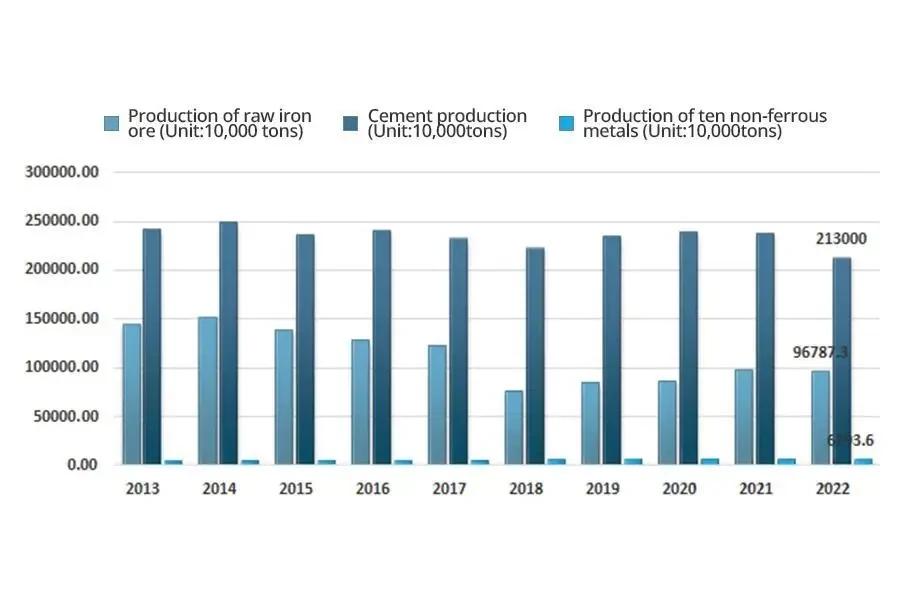

Influenced by the repeated COVID-19 in China and insufficient market demand, the growth rate of some mineral products production slowed down or decreased, but the overall production of mineral products was stable throughout the year. In 2022, except for a decrease in the production of mineral products related to infrastructure construction, including crude steel and cement, the production of other major mineral products will continue to grow.

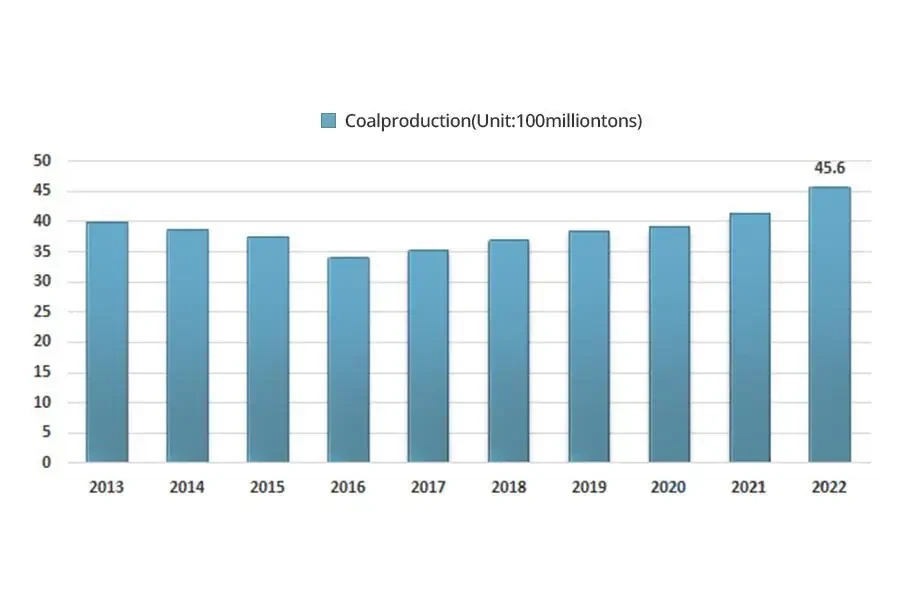

In 2022, the growth rate of coal production accelerated, with an annual output of 4.50 billion tons, an increase of 420 million tons, and a year-on-year growth of 9.0%, reaching a new historical high. Large enterprises, especially central corporations, have played an active leading role in fulfilling more than 25% of the coal supply in China.

Except for crude steel and cement, the production of other major mineral products is growing. In 2022, iron ore production in China reached 967.873 million tons, a year-on-year decrease of 1.0%. The cement output was 2,130 million tons, a year-on-year decrease of 10.4%. The output of ten types of nonferrous metals reached 67.936 million tons, a year-on-year increase of 4.9%. Among them, the output of refined copper reached 11.063 million tons with a year-on-year increase of 5.5%, and that of electrolytic aluminum reached 40.214 million tons with a year-on-year increase of 4.4%.

With the adjustment of COVID-19 protection measures, the national focus further shifts to economic development, and the demand for mineral resources in China further increases in 2023. Due to the increasingly complex international situation and the increasing difficulty in obtaining various resources from all over the world, we must unswervingly adhere to the domestic perspective. It is predicted that fixed assets investment in China’s solid mineral mining industry will still maintain a rapid growth trend in the future, which will drive the domestic demand for the mining machinery industry to expand continuously.

The business model of the mining machinery industry

The mining machinery industry has characteristics of strict production technology requirements, high difficulty in R&D innovation, and strong professionalism. To achieve a reasonable resource allocation, mid-to-high-end manufacturers have formed a business model of “independent R&D, core self-production, and partial external procurement”, which independently completes technology R&D, scheme and product design, core component production, and overall assembly. They finished other non-core components and non-core processes through external procurement and outsourcing processing.

The products and equipment in the mining machinery industry have several non-standard characteristics. Therefore, industry enterprises generally adopt a business model of “production based on sales, procurement based on production” and reserve appropriate raw materials and finished products in advance according to the price changes in the raw material market and the maintenance and update cycle of product equipment.

The sales in the mining machinery industry are based mainly on direct sales, supplemented by agency sales. Larger scale enterprises set up offices in the main sales areas to directly carry out sales, training, after-sales service, and other work for end customers.

Development history of the mining machinery industry in China

The production of mining engineering machinery in China started in the 1950s and has been developing for more than 70 years. It started surveying and mapping imitation, and manufacturers have expanded from a small number of state-owned enterprises such as Luoyang Mining Machinery Factory, Taiyuan Heavy Machinery Factory, Liugong, Xiagong, Hengyang Non-ferrous Metallurgical Machinery Factory, Fuwa and Guizhou Mining to complete machine and accessory manufacturers in various industries (mining, construction, forestry, municipal, etc.). After a hundred years of development and under the leadership of the CPC, mining equipment in China has developed from the era of “shoulder lifting and back carrying” to the era of automation and intelligence.

In the period of the Republic of China

According to historical data, mechanical equipment was used first for production in the mining industry in China in 1927. Then, Minsheng, a coal mining company, was established in Xin’an County, Henan Province. This company then introduced more advanced steam equipment, and the introduction of new equipment increased the daily production of the company’s No.1 well to 300 tons. For old China at that time, this was a mining company with relatively high mechanization.

In the early days of the founding of New China

According to incomplete statistics, local governments took over about 40 coal mining enterprises, 200 mines, and a few open-pit mines after the foundation of the People’s Republic of China. However, the mining facilities were rudimentary, and the technology was outdated. With the war’s destruction, these mines had been in a state of disrepair.

During the “1st Five-Year Plan” period, large-scale economic construction began, and China formulated a list of 156 key projects. Several machine factories related to mining equipment had been established, such as China First Heavy Machinery Factory and Luoyang Mining Machinery Factory.

In January 1954, the first mining machinery factory in China was approved officially by the National Planning Commission to settle in Luoyang, Henan Province, known as the Ancient Capital of the Nine Dynasties. In 1955, the construction project of the Luoyang Mining Machinery Factory began. Under the leadership of the Party, workers carried forward the spirit of hard struggle and work and completed the construction task of the factory in a relatively short period. In 1958, Luoyang Mining Machinery Factory developed the first 2.5-meter diameter double-drum winch to eliminate the long-term dependence on foreign equipment and fill a gap in the mining machinery manufacturing history in China.

On May 21, 1961, Taiyuan Heavy Machinery Factory successfully tested and produced the first 4-cubic-meter electric shovel, which has been used in the Pingzhuang Coal Mine in Chifeng, Inner Mongolia Today. In the development history of mining machinery and equipment, Taiyuan Heavy Machinery Factory has an irreplaceable position. In July 1965, Taiyuan Heavy Machinery Factory successfully developed China’s first 4-cubic-meter step-long-arm electric shovel based on its original model. In mid-June 1974, the factory successfully researched and developed the first mining long-arm electric shovel in China, with an arm length of 23.3 meters, a weight of 338 tons, and an hourly excavation volume of 400 cubic meters. In June 1977, the factory successfully tested and produced the first domestic WK-10 type of 10-cubic-meter electric shovel. In 1984, the factory successfully developed the second generation product WK–10A electric shovel, which won the second prize in the National Science and Technology Progress Award in 1985.

In the early 1970s, Chinese mining professionals experienced many advantages of comprehensive mechanized mining abroad, such as safety and efficiency. In 1977, the former Party Group of the Ministry of Coal Industry proposed that foreign fully mechanized mining equipment had enormous advantages when reporting to Deng Xiaoping, the then-national leader Comrade. At that time, foreign exchange was scarce, but China imported 100 sets of equipment from abroad at a price of up to $120 million per set. Later, China produced and manufactured 500 sets according to the imported equipment and added them to coal mining enterprises. So far, the manufacturing system was established for mining machinery preliminarily in China.

After the establishment of New China, manual mining has become history, and mechanized mining has opened a new era in China’s mining history.

The 1980s and 1990s

After the Third Plenary Session of the 11th Central Committee of the Communist Party of China, China entered a new period of reform and opening up, with economic construction as the center. From then on, the R&D level of mining equipment has embarked on a fast track of healthy development. Firstly, a good order has been reset and established to ensure the equipment research and development while also vigorously introducing advanced foreign technology and equipment. According to statistics, from the early stages of reform and opening up to 1987, there were 19 fully mechanized mining teams in the coal mining field in China, achieving a mechanization degree of 29%. The fully mechanized mining technology has entered a mature stage gradually. Over the past 10 years, a million-ton fully mechanized mining team has continuously emerged. By 1996, the number of fully mechanized mining teams with an annual output of over one million tons had increased to 72.

During the “7th Five-Year Plan” period, Chinese mining equipment manufacturers began to introduce, digest, absorb, test, verify, and transform foreign technical equipment under the leadership of the Party. In 1986, Taiyuan Heavy Machinery Factory began collaborating with foreign enterprises to produce the 2300XP electric shovel to meet the needs of domestic coal mine construction in China. This model has a working weight of 728 tons, a bucket capacity range of 16.8-34.4 cubic meters, and a standard bucket capacity of 19.11 cubic meters.

During the “8th Five-Year Plan” period, China continued to deepen reform and open up and accelerate modernization construction. China’s mining equipment enterprises seized this favorable opportunity and successfully developed a batch of advanced mining equipment. In 1994, the first domestic GPJ60/3 pressure filter manufactured by Shandong Energy Heavy Equipment Group Laiwu Coal Machinery Company passed the appraisal of the former Ministry of Coal Industry, making China the second country after Germany to produce pressure filters. In January of the same year, Luoyang Mining Machinery Factory agreed to join CITIC Corporation and establish CITIC Heavy Industries Co., Ltd. to adapt to the needs of market-oriented changes. So far, Luoyang Mining Machinery Factory has taken a crucial step in establishing a modern enterprise system and corporate reform, entering a new stage of development. It is the first transformation of Luoyang Mining Machinery Factory from a factory system to a company system in more than 30 years since its establishment.

Since the 21st century

With the continuous investment in infrastructure construction and real estate construction in the 21st century, there are great opportunities for the development of the mining machinery industry, and the industry has also accumulated a lot of wealth. Meanwhile, in this process, the mining machinery industry has also paid more attention to the re-manufacturing of foreign technology. According to the domestic investment in infrastructure and real estate, the mining machinery industry had also accumulated a certain amount of technology internally. China has become a major producer of mining engineering machinery.

With China’s accession to the World Trade Organization, mining equipment manufacturing enterprises have started restructuring models to adapt to the international competitive environment. Most equipment manufacturing enterprises actively promoted joint restructuring and core business mergers and acquisitions. As a result, mining equipment manufacturing enterprises in China have significantly improved their production scale, R&D capabilities, and product-supporting capabilities. For example, China Coal Mine Machinery Equipment Co., Ltd. has improved its “three-machines and one-frame” complete R&D and manufacturing capabilities through mergers and acquisitions of Fushun Coal Mine Motor Manufacturing Co., Ltd., Shijiazhuang Coal Mine Machinery Co., Ltd., and Xi’an Coal Mine Machinery Co., Ltd. In Shanxi Province, Taiyuan Heavy Machinery Group, as the leader, has integrated eight enterprises, including Taiyuan Mining Machinery Group and Shanxi Coal Mining Machinery Manufacturing Co., Ltd. to jointly establish “Shanxi Coal Machinery Complete Equipment Consortium”, focusing on developing complete sets of comprehensive coal mining equipment. Although other mining equipment enterprises have not taken the path of restructuring, they have gradually established a relatively overall R&D design system and production based on the original foundation. By introducing advanced technology and equipment, they have successfully developed over a hundred new efficient mining machinery and equipment, significantly improving the overall level of mining equipment in China.

Since 2010, with the promulgation and implementation of the Several Opinions of the State Council on Accelerating the Revitalization of the Equipment Manufacturing Industry, the technology of mining machinery has started to move towards independent design. Meanwhile, many excellent companies have emerged, such as XCMG Group and Sany Heavy Industry. These corporations have achieved breakthroughs in large-scale machinery design and are also a breakthrough in China’s mining machinery industry.

During the 40 years of reform and opening up, the mining equipment manufacturing industry in China has achieved simultaneous progress in traditional and high-end, domestic and foreign fields by increasing R&D investment, ensuring continuous breakthroughs in cutting-edge technology, and promoting the transformation and upgrading of enterprises. Here’s the development history of the mining machinery industry in China

- Budding stage: In 1927, the Minsheng Coal Mine Company, established in Xin’an, Henan, imported relatively advanced steam equipment from abroad at that time, and the introduction of new equipment increased the daily output of the company’s No.1 well to 300 tons, making it the first coal mining machinery used in China.

- Start-up stage: In the 1950s, China established the First Heavy Machinery Factory and Luoyang Mining Machinery Factory, producing the first batch of domestically manufactured mining machinery and filling a gap in the mining machinery manufacturing history of China. In the 1970s, China imported 100 sets of coal machinery equipment from abroad and re-manufactured according to the imported equipment. Then, it was a mining machinery manufacturing system preliminarily established in China.

- Development period: Chinese mining equipment manufacturers have started large-scale introduction, digestion, absorption, and transformation of foreign technical equipment, successfully developing the first batch of advanced mining equipment. Meanwhile, Luoyang Mining Machinery Factory and others have undergone corporate reforms.

- Rapid growth period: The continuous investment in infrastructure construction and real estate construction provides many opportunities for the development of the mining machinery industry, and the industry scale has achieved rapid growth. The enterprises have actively promoted joint restructuring, mergers, and acquisitions of core business work while increasing R&D investment, achieving simultaneous progress in multiple fields, ensuring continuous breakthroughs in cutting-edge technology, and enhancing the transformation and upgrading of the enterprises.

Analysis of the policy environment in the mining machinery industry

Competent industry department and management system

The administrative department in charge of China’s specialized equipment manufacturing industry is the Ministry of Industry and Information Technology of the People’s Republic of China. The China Heavy Machinery Industry Association, China Sand and Stone Association, and China Metallurgical and Mining Enterprise Association are self-regulatory management organizations in this industry and downstream. The mining machinery manufacturing industry follows a market-oriented development model, and government departments are only responsible for macro management and policy guidance without intervening in the production, operation, and specific business management of enterprises. The specific responsibilities of each regulatory body are as follows:

The administrative department in charge of the mining machinery industry is the Ministry of Industry and Information Technology of the People’s Republic of China. Its responsibilities include researching industry development plans, formulating industrial policies, guiding industry structure adjustment, industry system reform, regulations, and technical standards. Then, the mining machinery manufacturing industry is highly market-oriented, and government departments are only responsible for macro management and policy guidance. The production operation and specific business management of enterprises are implemented basically in a market-oriented manner.

The China Heavy Machinery Industry Association coordinates and guides the development of the industry. Its main functions include implementing national laws, regulations, guidelines, and policies, providing two-way services to the government and members, playing a bridge and link role between the government and enterprises, actively reflecting the wishes and requirements of members, safeguarding the legitimate interests of the industry and members, promoting the development of China’s heavy machinery industry, providing various services such as research recommendations, self-discipline management, information guidance, information services, and international exchanges.

The China Metallurgical and Mining Enterprise Association promotes the implementation of national guidelines, policies, and laws related to metallurgical production and construction. Moreover, it independently undertakes or participates in drafting and formulating industry development plans and standards and participates in discussions and revisions of national policies and regulations. It conducts research and analysis on the economic operation of the industry, undertakes to complete multiple major research topics, provides a basis for government decision-making, and lays the foundation for the formulation of national industrial policies and industrial planning. It conducts information statistics and communication, serves member enterprises, and reflects their demands.

The China Sand and Stone Association serves sand and stone-related enterprises and institutions, assisting the government in improving industry management, standardizing behavior and fair competition order, serving as a bridge and link between the government and enterprises to safeguard the legitimate rights and interests of the industry, improve the economic, technological, and management level of the industry, facilitate industry innovative development, and promote the sustained, orderly, and healthy development of the entire industry.

Major industry policies

The mining machinery manufacturing industry is one of the industries actively encouraged and supported by the government. In recent years, the Chinese government has issued multiple development plans or industrial policies to support the development of the mining machinery manufacturing industry.

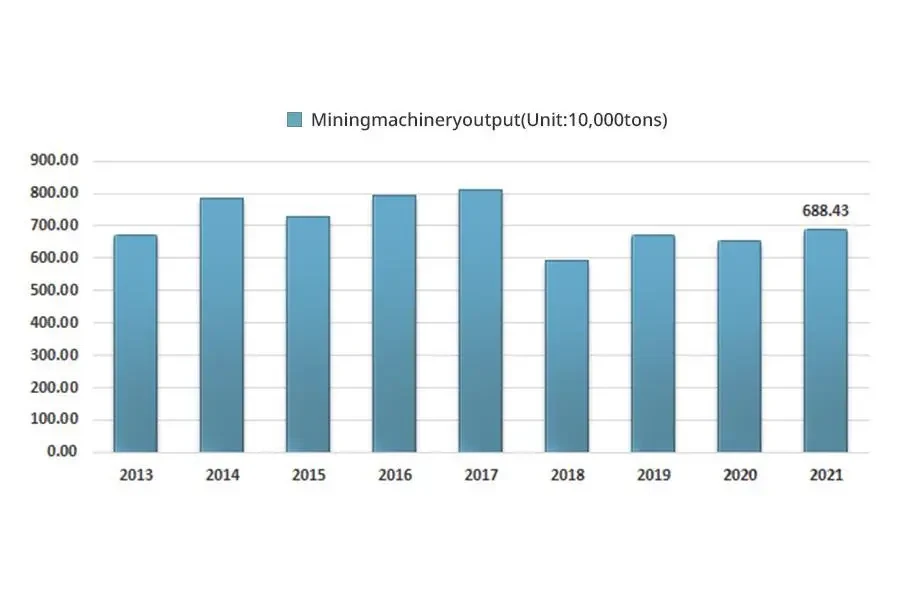

Analysis of the current development status of the mining machinery industry

From 2013 to 2017, the overall production of China’s mining machinery and equipment industry maintained a growth trend. From 2018 to 2020, due to the impact of supply-side reforms, the cost of the specialized mining equipment industry increased. Meanwhile, the new energy industry developed rapidly. The demand for the mining equipment industry was weak, and the overall output decreased. According to data from the National Bureau of Statistics, the output of China’s specialized mining equipment began to decline significantly in 2018, with an annual output of only 5.9253 million tons. By 2020, under the influence of COVID-19, the output of special equipment for mining in China was 6,536,000 tons, a year-on-year decline of 195,000 tons. The continuous rise in prices of coal and metal in 2021 has led to an increase in downstream expansion willingness, stimulating the growth of demand for specialized mining equipment. In 2021, the output of specialized mining equipment increased to 6.8843 million tons in China.

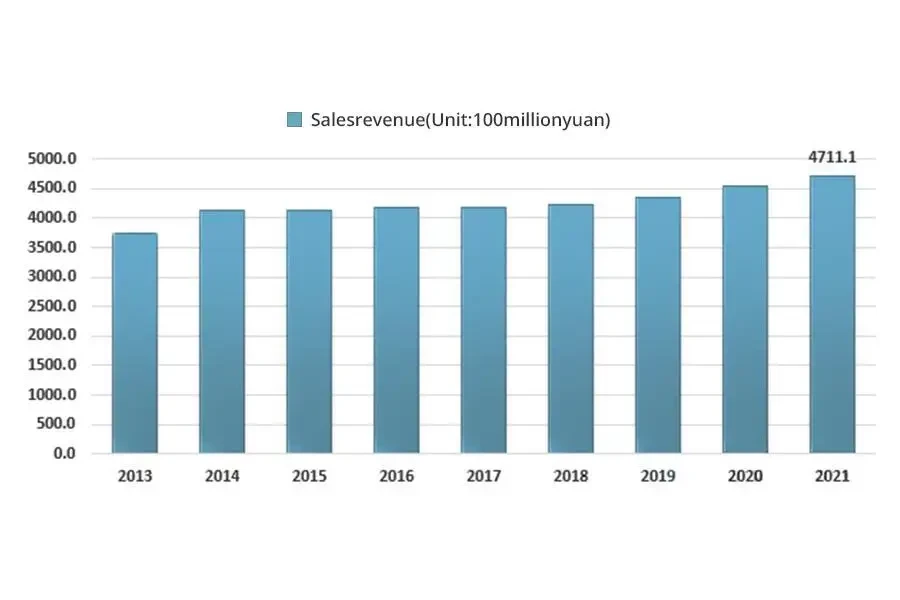

With the growth of domestic market demand in recent years, the scale of the domestic mining machinery manufacturing industry in China has increased steadily. In 2013, the sales revenue of China’s mining machinery industry reached 373.44 billion yuan. By 2021, the sales revenue of the domestic mining machinery industry reached 471.11 billion yuan.

Analysis of promoting and obstructing factors of the mining machinery industry

Analysis of promoting factors of the mining machinery industry

Reforming downstream supply and continuously strengthening market concentration in this industry

Since 2013, China has attached great importance to the development of a green economy and taken measures of “closing small mines and opening large mines”, gradually initiating supply reforms in sand and gravel mines, forcing small and micro mining enterprises with small production capacity and non-standard environmental protection measures to exit the market, attracting central enterprises with financial strength and high environmental standards, local state-owned enterprises, and some powerful private enterprises to enter the sand and gravel mining industry. In 2019, ten departments including the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Natural Resources, and the Ministry of Housing and Urban-Rural Development jointly issued Several Opinions on Promoting the High-quality Development of the Mechanical Sand and Gravel Industry, requiring that the production capacity of super large mechanical sand and gravel enterprises with an annual output of 10 million tons or more should reach 40% by 2025, the outdated production capacity, that does not meet emissions, energy consumption, water consumption, quality, and safety standards, should be eliminated legally. During this period, the number of registered sand and gravel mines in China decreased from 56,032 in 2013 to 17,351 by the end of 2022. The number and proportion of medium-sized, large, and ultra-large mining enterprises significantly increased, while the proportion of small and micro mines decreased year by year.

Promoting the implementation of “The Belt and Road Initiative” strategy, bringing new market increment

Cooperation in the field of mineral resources is a part of the Belt and Road Initiative and a key area to transform geographical proximity and resource advantages into economic growth advantages. The countries along the route of the Belt and Road Initiative have abundant mineral resources and are the main supply base for mineral raw materials in the world. Among them, the mineral resources in Central Asia are concentrated and rich. However, there are problems of relatively weak exploration and development capabilities. Infrastructure construction relies on the support of foreign investment and major equipment imported mainly from developed countries. Therefore, although having gained significant economic benefits through their resource advantages, these areas also face considerable pressure to reduce costs and increase efficiency. In the context of mining globalization, the countries along the route of “the Belt and Road Initiative” have a good foundation for mineral resources cooperation with China, and resource cooperation can further drive production capacity cooperation and economic connectivity, laying a development foundation for the construction of a regional community of shared future. Therefore, the mineral cooperation of countries along the route of “the Belt and Road Initiative” is the only way to achieve complementary advantages. Today, many countries along the route of the Belt and Road Initiative have realized that through the construction of “the Belt and Road Initiative”, they will be able to share the dividends of China’s reform and development and transform the regional advantages in resources, technology, and capital into market and cooperation advantages. For this reason, countries have shown a high enthusiasm for mining cooperation along the route. Therefore, domestic mining machinery manufacturing enterprises can “Go Global” and enjoy the dividends of openness and cooperation fully in the Belt and Road Initiative strategy.

The continuous rise in metal prices has led to an increase continuously in downstream production expansion willingness

In recent years, metal prices have shown a continuous upward trend. For black metals, iron ore prices have significantly increased in the past two years through fluctuations. From 2019 to June 30, 2022, China’s iron ore index increased from 254.10 to 440.88. For non-ferrous metals the trading prices of non-ferrous metals in China have been affected by international trade frictions since 2020, showing an overall upward trend. The price index of non-ferrous metals in China increased by 14.30% month-on-month in 2020 and 17.10% month-on-month in 2021. Under the upward trend of metal prices, domestic mining companies, willing to expand the output, can be stimulated fully, and the sustained investment willingness of downstream metal mining customers will be high, which will bring stable business sources to the industry and form a strong growth driver.

The downstream sand and stone building materials industry has stable demand and is expected to maintain growth

In the 14th Five-Year Plan, China clearly stated that it would coordinate and promote infrastructure construction. On March 5, 2021, Premier Li Keqiang of the State Council emphasized in his government work report that fiscal funds will continue to expand effective investment, actively work in promoting regional coordination of many projects, “two new and one key” construction, infrastructure shortcomings, and related projects that are conducive to ensuring and improving people’s livelihoods, and implement several major engineering projects such as transportation, energy, and water conservancy. Meanwhile, a series of measures such as national supply-side reform, green mines, illegal sand mining and punishment, and revision of environmental protection laws will stimulate the demand for machine-made sand and also drive market demands in the mining machinery industry, such as crushing and screening.

Obstructive factors in the mining machinery industry

Impact of energy structure transformation on the mining machinery industry

The large-scale development of industrialization has brought a golden period for the mining machinery manufacturing industry. But in recent years, the golden age of mining machinery development has gradually receded, with new energy occupying an important position in people’s lives and work. Although traditional energy is still the mainstream national energy demand, the demand for mining machinery is gradually slowing down.

The total amount of mineral resources is gradually decreasing

In addition, with the increase in mining efforts, the total amount of mineral resources in China is gradually decreasing. Many mining areas no longer require a large amount of mining machinery, and the existing mining machinery can still meet daily needs. For energy development, China has to focus on foreign countries to explore foreign mineral resources. Buying minerals for mining may be the future development trend, and the lack of domestic mineral resources does not have a high demand for mining machinery.

Macroeconomic downturn affects demand for mineral products

China’s economy has been impacted to a certain extent since 2020 due to the adverse effects of COVID-19, changes in the international economic environment, geopolitical conflicts, international oil price shocks, US dollar interest rate hikes, and the escalation of Sino-U.S. trade frictions. The economic growth forecasts of institutions such as the International Monetary Fund (IMF), the World Bank, and the United Nations, as well as forward-looking indicators of economic growth, all indicate that some economies in the world are facing the risk of economic recession in 2023. The traditional machinery manufacturing industry may be constrained to some extent, and the R&D and manufacturing of mining machinery will inevitably be affected. Since the economic crisis, the growth rate of mining machinery development has gradually decreased, and this state may continue until the world economy recovers.

The fluctuation of steel prices affects cost control in enterprises

The cost of large castings, steel, profiles, and other core equipment components mainly made of steel accounts for a higher proportion of the total cost of raw equipment materials, while iron ore is the key raw material for producing steel. Therefore, the price trend of iron ore and steel has a significant impact on the prices of upstream component products and indirectly affects the manufacturing cost of mining machinery. Since 2020, the fluctuation in prices of bulk commodities such as iron ore has brought some fluctuations to equipment manufacturing costs. It showed that the prices of raw materials such as iron ore and steel will continue to fluctuate significantly due to the short-term trade frictions between China and countries such as India and Australia, and the cost control of enterprises in the industry will face certain pressure.

Analysis of barriers mining machinery industry

Brand barriers

Due to the certain risks associated with downstream industries such as mining and coal, frequent equipment failures can have an impact on downstream customers. Therefore, downstream customers have high requirements for product performance, stability, failure rate, and after-sales service and have also formed the characteristics of high customer loyalty and willingness to repeat purchases in this industry. Mining machinery equipment brands can only accumulate a team of high-quality customers with stable cooperation after long-term and repeated market validation.

To ensure stable and sustained market share and expand market share, mining machinery enterprises not only need to have reliable quality control levels and strong batch delivery capabilities but also need to improve their technology development and after-sales service systems continuously. Due to the considerable time required to establish a good brand image and product reputation among downstream customer groups, it is difficult for new entrants to form a good brand image and market competitiveness in the short term, resulting in entry barriers.

Technical barriers

Mining machinery belongs to technology-intensive products. Due to differences in equipment application scenarios, material characteristics, environmental requirements, construction environment, and other factors, technical departments make corresponding designs and adjustments based on customer needs. The products have the characteristics of multi-disciplinary integration, complex processes, and high technical requirements. Forming the above-mentioned technological innovation capabilities requires continuous breakthroughs and improvements based on long-term market feedback and strong technological R&D capabilities. Equipment companies with weak technological innovation capabilities cannot form sustainable product upgrades, and it is hard to meet the ever-changing needs of customers during continuous cooperation, and they are disadvantaged easily in long-term market competition. Therefore, there are significant technological innovation barriers in the mining machinery industry.

The barrier to customization capability of complete production line solutions

For downstream customers, compared to a production line composed of scattered procurement of complete equipment from multiple manufacturers, there is a more specialized process plan and equipment configuration plan for the equipment production line directly provided by mining machinery manufacturers. The production line requires the design of a complete set of equipment to achieve optimal results in environmental protection, safety, energy consumption, cost, and output and to bring the maximum economic benefit to customers. New entrants often lack understanding and experience in downstream industries without the ability to customize complete production lines. And they cannot compete directly with enterprises with years of customization experience. Therefore, there are obvious barriers to the customization ability of a complete set of production line schemes in the mining machinery industry.

Talent barriers

The talent barrier in the mining machinery industry is reflected mainly in the high requirements for the professional abilities and composite backgrounds of production personnel, technical R&D personnel, sales personnel, and management personnel. Due to the refined production characteristics of crushing and screening equipment. Firstly, companies shall have skilled technicians with rich machining experience to be competent in complex production and processing processes. Enterprises need to spend a long time and cost to cultivate production personnel. Secondly, due to the high customization requirements for terminal products and diverse product varieties, upstream manufacturers can only stand out in the industry by possessing mature supporting R&D capabilities and fast design response capabilities. Therefore, the innovation ability and professional competence of technical personnel have become one of the core competencies of enterprises. Meanwhile, sales personnel of enterprises need to have a deep understanding of the principles and production characteristics of mining machinery equipment, accurately analyze and grasp customer needs, and help customers choose matching product combinations and specifications. Therefore, establishing and cultivating a composite sales talent team has become a top priority for talent management in companies within the industry. Finally, the production, R&D, and sales of mining machinery enterprises involve the coordination and management of various types of work and require the enterprises to reserve experienced management personnel for operation and management. Therefore, there are obvious talent barriers in the mining machinery industry.

Financial barriers

The mining machinery industry belongs to a capital-intensive industry. Mining machinery manufacturing enterprises need to invest a large amount of funds in the early stage to purchase production equipment with higher unit prices, including CNC machining centers, CNC boring and milling machines, and advanced R&D equipment. Meanwhile, they should buy or lease large land areas for daily production and operation. If new entrants cannot maintain the huge initial investment, it is difficult for them to survive and form competitiveness.

In addition, the scale effect is one of the main characteristics of the heavy machinery industry and a key factor for the sustainable development of enterprises. In the production process of sand, gravel, and ore, different types of mining machinery are required to meet various functional requirements in the production process. If it is difficult to achieve economies of scale and the diversified requirements of customers cannot be met, enterprises lack sufficient cash flow to expand production scale. From then on, the development of the enterprise will fall into a vicious cycle. Therefore, capital investment and scale effects constitute the main barriers to entry into the industry.

Analysis of industry competition pattern

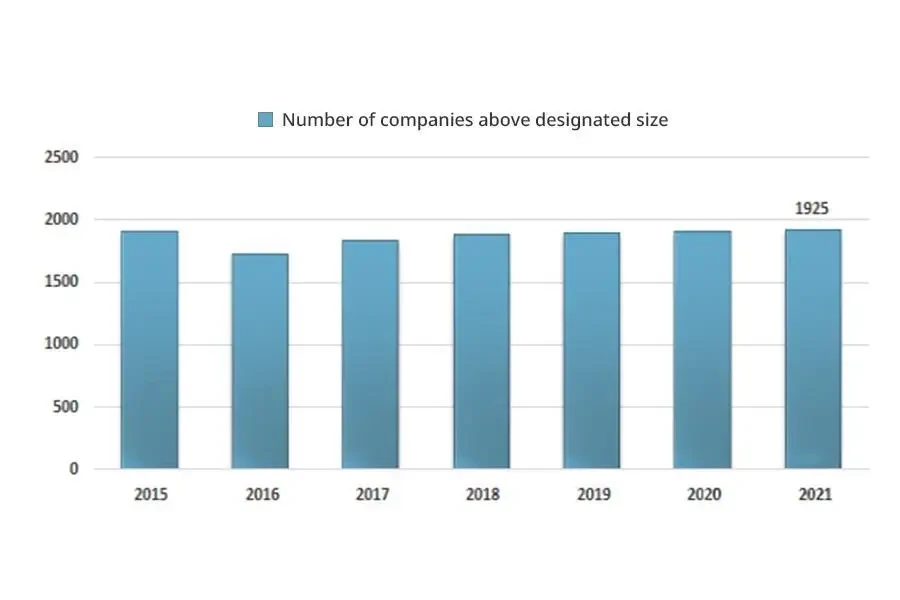

The regionalization characteristics of the domestic mining machinery manufacturing industry are relatively prominent, mainly concentrated in Jiangsu, Shandong, Henan, and other places. The domestic mining machinery industry has sufficient market-oriented competition, low industry concentration, and many enterprises in the industry, which are mainly small and medium-sized. According to national statistical data, there were 1,925 enterprises above the designated size in China’s mining machinery industry as of the end of 2022.

At present, China’s mining machinery and equipment can be divided generally into three levels: mid to low-end, mid to high-end, and foreign-funded high-end. Firstly, its market share is relatively large, and competition is fierce for the mid to low-end market. Secondly, the focus of enterprise development is mainly on capital scale, product services, and brand building, ultimately gradually expanding market share and gaining profitability beyond the industry level for the mid to high-end market. Finally, internationally renowned enterprises with foreign high-end brands, such as Finnish Metso, Swedish Sandvik, and American Terex, have formed a strong influence in domestic and foreign markets of China for many years with leading technological R&D capabilities and product services and have a group of high-quality customers with high stickiness.

At present, China’s leading mining machinery enterprises facing the middle and high-end market include CITIC Heavy Industries Co., Ltd., Northern Heavy Industries Group Co., Ltd., Taiyuan Heavy Machinery Group Co., Ltd., Zhengzhou Coal Mining Machinery Group Co., Ltd., China Coal Zhangjiakou Coal Mining Machinery Co., Ltd., Zoomlion Heavy Industry Co., Ltd., Sany Heavy Industry Co., Ltd., Taiyuan Heavy Industry Co., Ltd., Chengdu Dahongli Machinery Co., Ltd., Zhekuang Heavy Industry Co., Ltd., and Anshan Heavy Mining Machinery Co., Ltd.

Against the backdrop of continuously deepening national policies, such as the integration of small and medium-sized mines and the construction of green mines, China is constantly phasing out enterprises that do not meet environmental and quality standards, as well as poor safety conditions. It is reducing the investment in small mines and increasing the proportion of large and medium-sized mines, leading to a rapid loss of market share for many low-end domestic brands that compete and homogenize severely around small and micro mines. The market share of low-end domestic brands is gradually being squeezed by mid to high-end domestic brands. In recent years, the concentration of the mining machinery market has accelerated. Leading enterprises that have won through technological accumulation and competition are increasingly prominent in terms of brand effect, scale effect, and other advantages. Resources are further gathering towards leading enterprises, highlighting the constant strength effect of the strong.

Development trend of the mining machinery industry

The mining machinery industry holds a pillar position in the national economy and plays a significant role and contribution to economic construction. Whether viewed from the current market development status of China’s mining machinery industry or the global industry operation trend, the industry is in a historic window period.

With the current opening and construction of 5G in China, “Intelligence and Understatement” is the only way for the mining development. China should seize development opportunities, leverage strengths and avoid weaknesses, deepen “Intelligence and Understatement”, accelerate the process of intelligent mining construction, and promote China’s mining construction towards safety, efficiency, economy, green and sustainable development, enhancing industrial-level, innovation ability, and quality and efficiency.

China’s current R&D of mining machinery and equipment technology is moving towards high-end, standardized, and intelligent directions. In response to the national strategy of “Green Mines”, enterprises in the industry will promote the integration of energy-saving and environmental protection technologies and equipment. The increase in concentration in the downstream mining industry has also led to an increase in concentration in the mining machinery industry, with equipment upgrading towards “Large-scale” and “Intelligent”, and the mining machinery industry is transitioning from complete machines to complete sets. Due to the increasing importance of equipment aftermarket services, the industry’s business model has shifted from pure manufacturing to a comprehensive model of “Equipment Manufacturing+Services” to achieve better business efficiency.

Source from Chyxx

Disclaimer: The information set forth above is provided by chyxx.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.