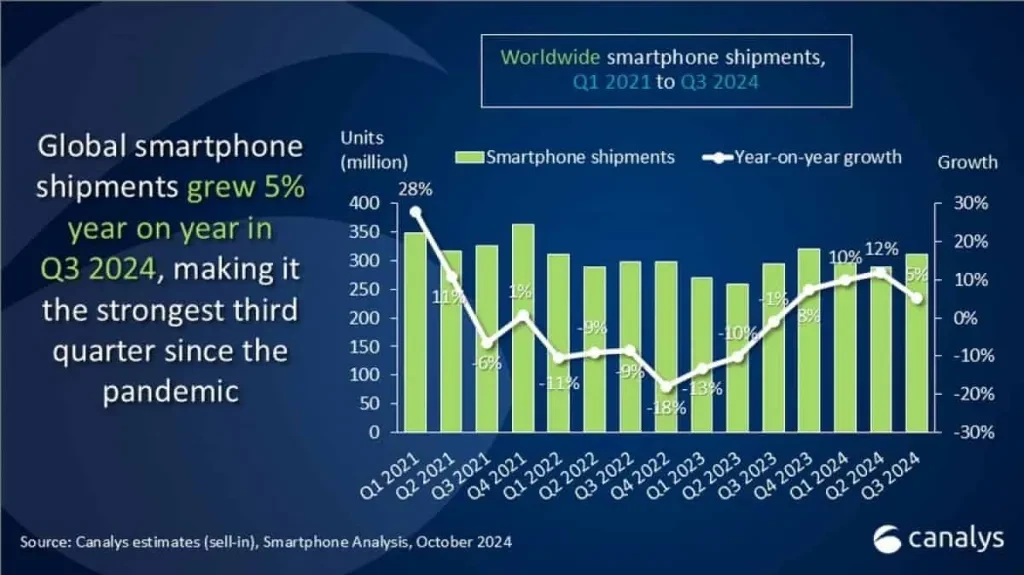

The global smartphone market is slowly recovering, showing its strongest third-quarter performance since the pandemic, according to a new report from Canalys. From July to September 2023, manufacturers shipped nearly 310 million smartphones, the highest numbers for this period since 2021. This growth signals a return in demand and reflects the strategies of top brands to capture more of the market.

Canalys Report: Samsung Leads in a Rebounding Q3 Smartphone Market

Samsung maintained its spot as the top smartphone brand, but its lead over competitors shrank. Apple came very close, just one percentage point behind, and Xiaomi followed in third place, only four points behind Samsung. Although Samsung streamlined its entry-level lineup, its market share still dropped by 2%. Apple, meanwhile, surged, driven by the popularity of its new iPhone 16 series.

Apple also grew its market share by introducing older models, like the iPhone 13 and iPhone 15, to the Indian market. Analysts predict Apple could overtake Samsung in the fourth quarter of 2024. Although the lead may be slim due to delays in Apple’s AI-driven updates.

Chinese brands Xiaomi, Oppo, and Vivo each took a unique approach to boost their shipments. Xiaomi focused on open markets and its branded stores. While Oppo rebranded its A3 series and found success in Southeast Asia’s $100-$200 price range. Vivo increased its reach with five mid-range models in its V40 lineup, which boosted its market presence across different regions.

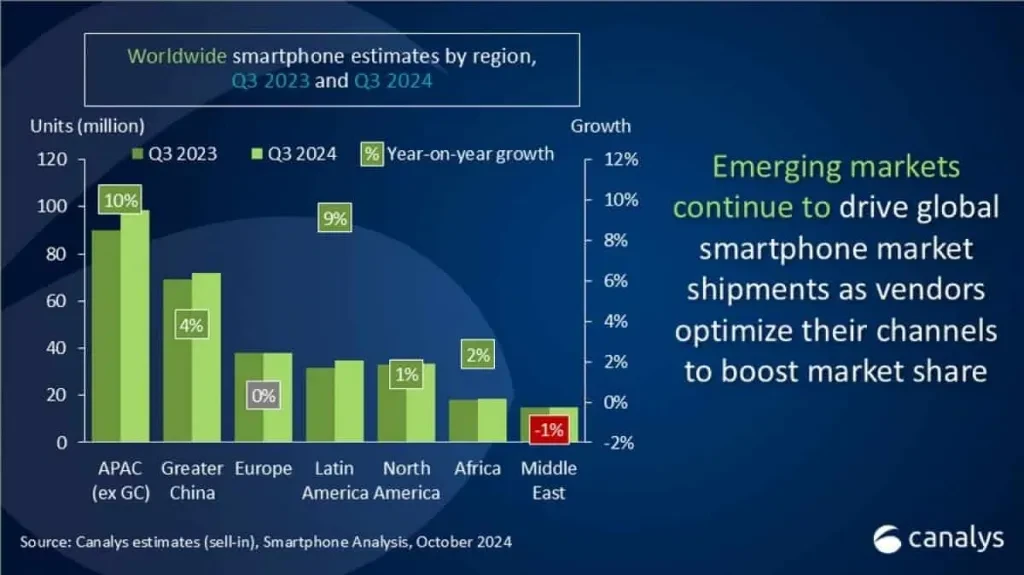

Smartphone shipments grew the most in Asia-Pacific and Latin America. Where demand outpaced the global market due to strong price competition and discounts on entry-level phones. While these affordable devices are essential for market volume, Canalys noted that inflation is limiting profitability for manufacturers.

Looking forward to 2025, industry experts are cautiously optimistic. They anticipate growth in the premium smartphone market in regions like the US, China, and Western Europe as AI-powered devices gain popularity. Brands like Vivo and Honor are also expanding their mid-range options, using strategies like pop-up stores and carrier partnerships to attract budget-conscious customers in the $100-$200 range.

As brands continue to adapt to consumer needs, the smartphone market is expected to keep growing, balancing affordability with advanced technology features.

Disclaimer of Gizchina: We may be compensated by some of the companies whose products we talk about, but our articles and reviews are always our honest opinions. For more details, you can check out our editorial guidelines and learn about how we use affiliate links.

Source from Gizchina

Disclaimer: The information set forth above is provided by gizchina.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.