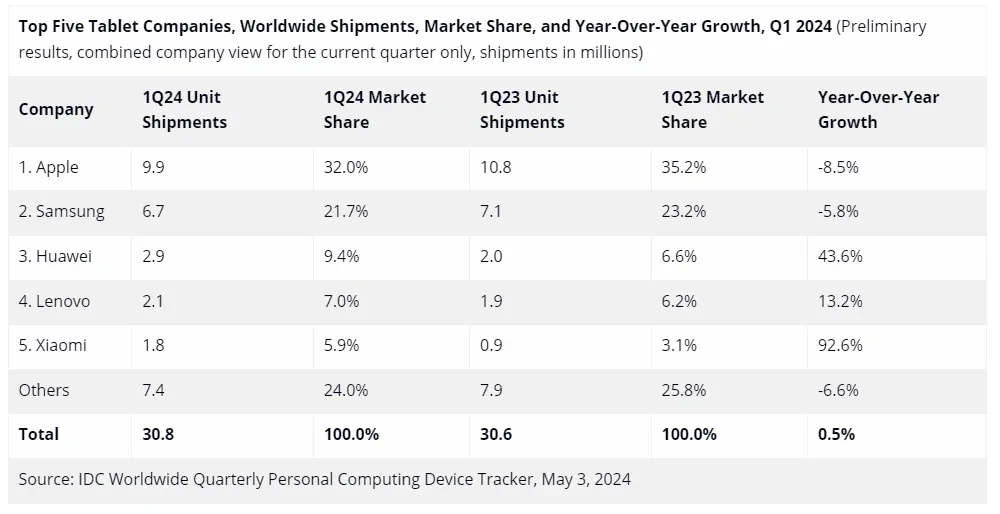

After a prolonged period of decline, the global tablet market showed tentative signs of recovery in the first quarter of 2024. According to preliminary data from the International Data Corporation (IDC), worldwide tablet shipments inched up by a modest 0.5% year-over-year, reaching 30.8 million units. This comes after a two-year slump that began in Q2 2021, largely attributed to market saturation.

A TENTATIVE REBOUND: THE TABLET MARKET IN Q1 2024

This slight uptick offers a glimmer of hope for an industry facing headwinds. However, it’s crucial to maintain perspective. The growth seen in Q1 2024 is unlikely to replicate the surge experienced during the pandemic. Additionally, the overall market size remains significantly lower than its peak.

SHIFTING TIDES: PREMIUMIZATION AND REFRESH CYCLES

Despite the modest growth, an interesting trend is emerging within the tablet market – a growing focus on premium devices. As consumers increasingly seek tablets for productivity purposes, they are gravitating towards models offering more powerful features and functionality. This shift towards the premium segment is a noteworthy development for manufacturers.

Furthermore, IDC analysts point to the beginning of a refresh cycle as a key driver of the Q1 2024 growth. This suggests that consumers might be holding off on purchases in anticipation of upcoming new models. Major players within the industry are likely preparing to capitalize on this refresh cycle by launching new products in the coming months.

A GLIMPSE INTO THE COMPETITIVE LANDSCAPE

The first quarter of 2024 saw established players maintain their dominance in the tablet market, but with varied fortunes. Apple, the industry leader, faced an 8.5% decline in shipments compared to Q1 2023. This can be attributed to both the current economic climate and the lack of new product launches during the quarter. Apple is expected to address these factors by clearing older inventory to pave the way for the introduction of new models in the second quarter.

Samsung, the second-largest player, experienced a 5.8% year-over-year decline in shipments. This could be due to the combined effect of aggressive promotional strategies employed by competitors and the absence of compelling new offerings from Samsung themselves. However, the company is currently focusing on enhancing the user experience of their tablets and promoting their premium products to regain market share.

HUAWEI, on the other hand, stood out with a remarkable 43.6% growth in tablet shipments, solidifying their third-place position. This surge can likely be attributed to the resurgence of their smartphone business, indicating a potential spillover effect within their product portfolio.

Lenovo, in fourth place, achieved a 13.2% increase in shipments. This growth was driven by the success of their Tab P series, which caters to the growing demand for detachable tablets that offer a more laptop-like experience. However, it’s worth noting that traditional slate tablets still dominate Lenovo’s overall shipments.

Rounding out the top five is Xiaomi, who experienced a staggering 92.6% year-over-year growth. This impressive performance underscores the company’s ability to penetrate markets beyond its home base of China. Xiaomi shipped an impressive 1.8 million units in Q1 2024, suggesting their aggressive expansion strategy is yielding positive results.

LOOKING FORWARD: CHALLENGES AND OPPORTUNITIES

While the Q1 2024 figures offer a cautious optimism for the tablet market, challenges remain. Competition from other devices, particularly laptops and smartphones, continues to limit the overall growth potential. Consumers are increasingly blurring the lines between these categories, making it difficult for tablets to carve out a distinct niche.

However, there are also opportunities for growth. Analysts like Anuroopa Nataraj of IDC believe that the increasing adoption of tablets within the education sector and the gig economy holds promise for the commercial segment. Additionally, the integration of Artificial Intelligence (AI) capabilities into tablets. Mirroring a trend already seen in other devices, could revitalize the market by offering enhanced functionalities and experiences.

In conclusion, the first quarter of 2024 presented a mixed picture for the tablet market. While a slight increase in shipments signaled a potential turnaround, economic headwinds and competition from other devices continue to be major concerns. The success of upcoming refresh cycles and the adoption of AI features will be key factors to watch in the coming quarters. The tablet market may be on the mend, but its path to sustained growth remains to be seen.

STRATEGIES FOR A RENEWED TABLET MARKET

The tentative recovery of the tablet market in Q1 2024 presents both challenges and opportunities for manufacturers. Here’s a deeper dive into potential strategies that can propel the industry forward:

1. DOUBLING DOWN ON DIFFERENTIATION:

- Feature Innovation: Manufacturers need to focus on features that differentiate tablets from smartphones and laptops. This could include advancements in stylus technology for improved note-taking and creative workflows, enhanced multitasking capabilities, and optimized operating systems for a more seamless tablet experience.

- Form Factor Experimentation: Exploring new form factors like foldable tablets or dual-screen designs can attract early adopters and cater to specific user needs.

- Software Integration: Developing a robust software ecosystem specifically designed for tablets can be a significant differentiator. This could involve fostering partnerships with app developers to optimize existing apps for the larger tablet screen. And creating tablet-specific applications that leverage the unique capabilities of the device.

2. EMBRACING THE PREMIUMIZATION TREND:

- High-Performance Hardware: Targeting the productivity market by offering tablets equipped with powerful processors, ample storage, and long-lasting batteries is crucial. This caters to professionals, students, and creative individuals who require a device that can handle demanding tasks.

- Enhanced Design and Materials. Investing in premium build quality with sleek designs and high-quality materials can elevate the user experience and justify a higher price point.

3. CAPITALIZING ON NICHE MARKETS:

- Education Sector: Developing tablets specifically designed for educational purposes, with features like learning management system integration, durability, and affordability, can tap into the growing demand within schools and universities.

- Gaming and Entertainment: Exploring partnerships with game developers and streaming services to optimize their offerings for tablets can attract a new segment of users seeking a superior entertainment experience.

- Enterprise Solutions: Tailoring tablets for business use through features like robust security protocols, device management capabilities, and integration with enterprise productivity tools can unlock opportunities within the corporate sector.

4. LEVERAGING AI AND EMERGING TECHNOLOGIES:

- Integration of AI Assistants: Incorporating advanced AI assistants that can offer enhanced voice commands, contextual suggestions, and proactive support can elevate the user experience and productivity potential of tablets.

- Augmented Reality (AR) Integration: Exploring the possibilities of AR within tablets could open new avenues for education, training, and even entertainment applications. Imagine using a tablet to visualize historical landmarks or complex structures in AR for a more immersive learning experience.

- Focus on Security and Privacy: As tablets become more integrated into everyday life, ensuring robust security features and a strong commitment to user privacy will be paramount.

CONCLUSION: A SUSTAINABLE FUTURE FOR TABLETS?

The tablet market’s future hinges on the ability of manufacturers to adapt and innovate. By focusing on differentiation, embracing premiumization, catering to niche markets, and harnessing the power of emerging technologies like AI and AR, tablets can carve out a sustainable space in the consumer electronics landscape. The tentative resurgence witnessed in Q1 2024 might just be the beginning of a renewed era for tablets, provided manufacturers embrace the necessary changes.

Disclaimer of Gizchina: We may be compensated by some of the companies whose products we talk about, but our articles and reviews are always our honest opinions. For more details, you can check out our editorial guidelines and learn about how we use affiliate links.

Source from Gizchina

Disclaimer: The information set forth above is provided by gizchina.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.