On 22 September 2022, the Bank of England (BoE) announced that the UK was in recession. The BoE raised interest rates by 0.5 percentage points to 2.25%, its highest level since 2008, to curb the UK’s rampant inflation.

The Office for National Statistics reported that the Consumer Prices Index increased by 9.9% over the year through August 2022. Rising food prices and energy costs are the largest upwards contributors to this inflationary pressure.

Many expect inflation to reach double figures by the end of the year. As a result, both consumer and business confidence have fallen to historic lows.

On 23 September 2022, Chancellor of the Exchequer Kwasi Kwarteng released The Growth Plan 2022, outlining the government’s response to the cost-of-living crisis, promising a ‘new era’ for the UK. In his mini-budget, Kwarteng targeted an annual GDP growth rate of 2.5% and announced several measures aimed at boosting the supply side of the economy.

Tackling energy prices

The government has already taken action to limit household energy bills at £2,500 per year for two years, starting on 1 October 2022. This follows a £400 grant for households for the six months through March 2023.

However, businesses had to wait until 23 September 2022 to find out their fate. Kwarteng, through the Energy Bill Relief Scheme, has effectively cut business energy bills in half.

Non-domestic energy users will pay £211 per megawatt hour (MWh) for electricity and £75 per MWh for gas, with the government paying the difference between these rates and the wholesale price for the six months through March 2023. According to PwC’s UK Economic Outlook for September 2022, this could reduce peak inflation by five percentage points.

Affected industries:

Tax cuts

From April 2023, the government will cut the basic tax rate from 20% to 19%, while scrapping the 45% additional tax rate of income altogether, leaving the top rate at 40%. Corporation tax was due to increase to 25% from April 2023, although this has now been cancelled, with the rate kept at 19%.

The government plans to introduce ‘investment zones’ across the UK, with various tax incentives over a 10-year period. Newly occupied business premises will benefit from 100% business rates relief and 100% Stamp Duty Land Tax relief. These measures are designed to stimulate investment in the UK and help to bridge the productivity gap with France and Germany.

Stimulating the property market

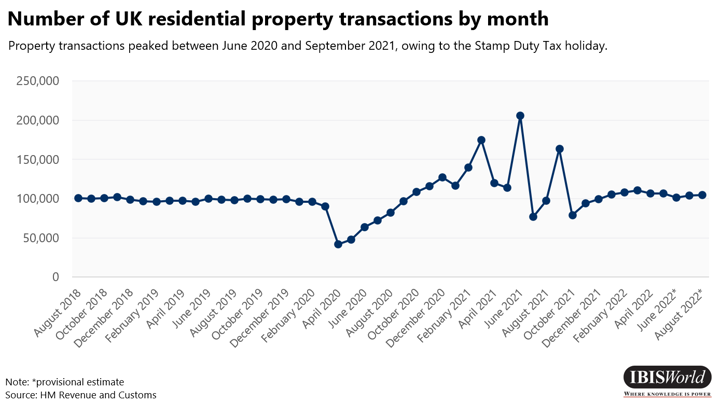

During the COVID-19 pandemic, a Stamp Duty Land Tax holiday was introduced to help first-time buyers get on the property ladder. Stamp duty is a tax homebuyers pay based on the value of the property they are purchasing; lifting this tax made buying a property cheaper, helping to stimulate demand; UK residential property transactions spiked between June 2020 and September 2021.

In the mini-budget, Kwarteng raised the threshold for paying stamp duty from £125,000 to £250,000, and from £300,000 to £425,000 for first-time buyers. This measure has been met with confusion, especially regarding its confliction with BoE policy.

The BoE has increased interest rates and is expected to do so again before the end of the year. Higher interest rates make borrowing more expensive. The government’s plan to stimulate demand for housing by raising the threshold for stamp duty directly contradicts this.

Uncertainty surrounding interest rates has led to banks and building societies such as Skipton and Virgin Money suspending mortgage offers for new customers.

Rising mortgage payments are expected to eclipse the benefit of the stamp duty cut, applying downward pressure on prices over the next year, according to mortgage brokerage Anderson Harris.

Affected industries:

Residential Building Construction in the UK

Freezing alcohol duty

The cost of producing alcoholic beverages has increased due to rising energy costs, with these additional costs being passed down to hospitality establishments like pubs and bars. As a result, retailers have had to increase their prices at the expense of demand.

This measure will reduce the price consumers pay for a pint of beer or cider by 7p and 4p respectively, and a bottle of wine or spirits by 38p and £1.35 respectively.

Since most of the price of an alcoholic beverage is tax, reducing duty paid on these drinks enables retailers to lower the price they charge. Typically, alcohol rates increase year on year based on the Retail Price Index. However, to protect businesses and boost consumer demand, the government has announced that from February 2023, alcohol duty will be frozen.

Affected industries:

Full-Service Restaurants in the UK

Effect on the economy

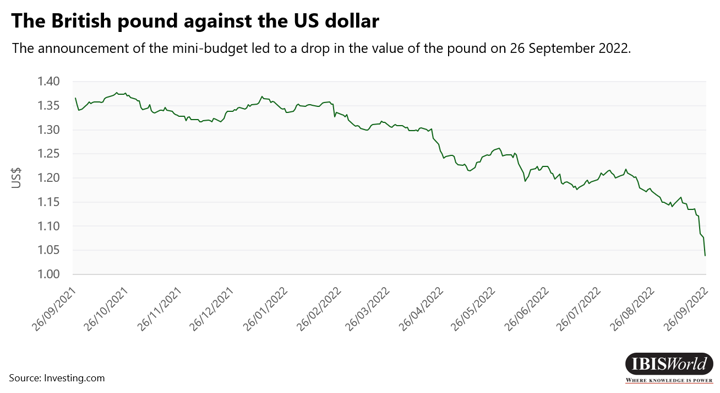

Following Kwarteng’s mini-budget, the pound fell to US$1.03 on 26 September 2022, an all-time low against the dollar.

UK government bonds were sold off sharply, with investors fearing that the energy subsidies and tax cuts announced in the budget would threaten the UK’s fiscal stability.

The Energy Price Guarantee for households and businesses is forecast to cost £60 billion over the six months through March 2023.

Public borrowing is set to reach £190 billion in 2022-23, representing the third highest figure since World War II, according to the Institute for Fiscal Studies (IFS).

It remains unknown how much The Growth Plan 2022 will cost, as Kwarteng did not allow the Office for Budget Responsibility to produce a forecast, leading to Shadow Chancellor Rachel Reeves expressing concern that ‘never has a government borrowed so much and explained so little’.

The IFS states that by ‘injecting demand into this high-inflation economy’, the government is ‘pulling in the exact opposite direction’ to the BoE.

While the mini-budget is expected to offer a temporary boost to the economy, its momentum is likely to dissipate long before it offers the growth the government is betting so much on.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.