In response to international industry demands, laser technology has advanced to offer high-performance laser engraving and cutting machines that cut production time in half. These machines use less power, have precise edge quality, and can work with various materials. Continue reading to learn about the latest industry laser trends and how to choose the most efficient machines for your needs.

Table of Contents

Global laser technology market

Trends in the laser machine industry

Developments of laser technology

Other developments of next-generation laser-cutting machines

Final words

Global laser technology market

In 2022, the global laser technology market was valued at USD 16.7 billion, and it is expected to grow at a compound annual growth rate (CAGR) of 8.9% to reach USD 25.6 billion by 2027. This laser technology provides high precision, productivity, and flexibility in industrial processing applications such as manufacturing.

Rising demand in the oil and gas, automotive, medical, and textile sectors is driving market growth. Furthermore, the superior performance of laser-based techniques over traditional processing methods is a significant factor driving market growth.

This article will assist readers in navigating the current laser machine trends that are dominating the market.

Laser welding

The laser welding machine market is projected to grow at a CAGR of 4.73% between 2021 and 2025 to reach USD 373.97 million by the end of the period. Laser welding is a method of joining different metals using a laser beam. This welding is done in two modes: conduction limited welding and keyhole welding.

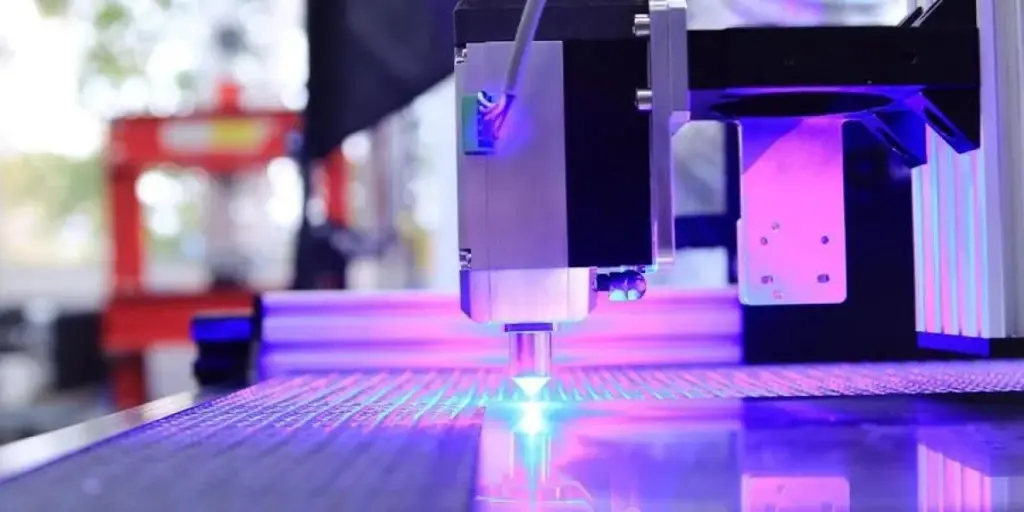

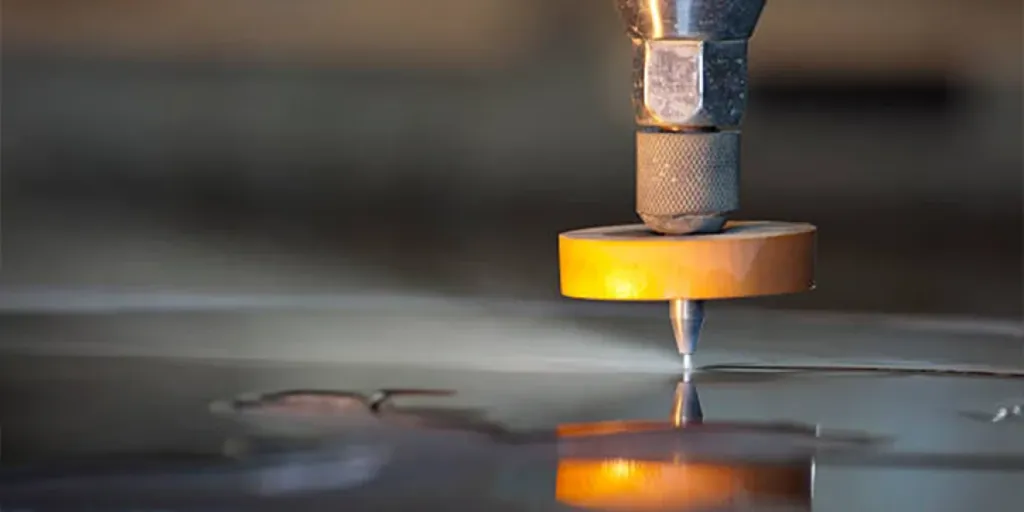

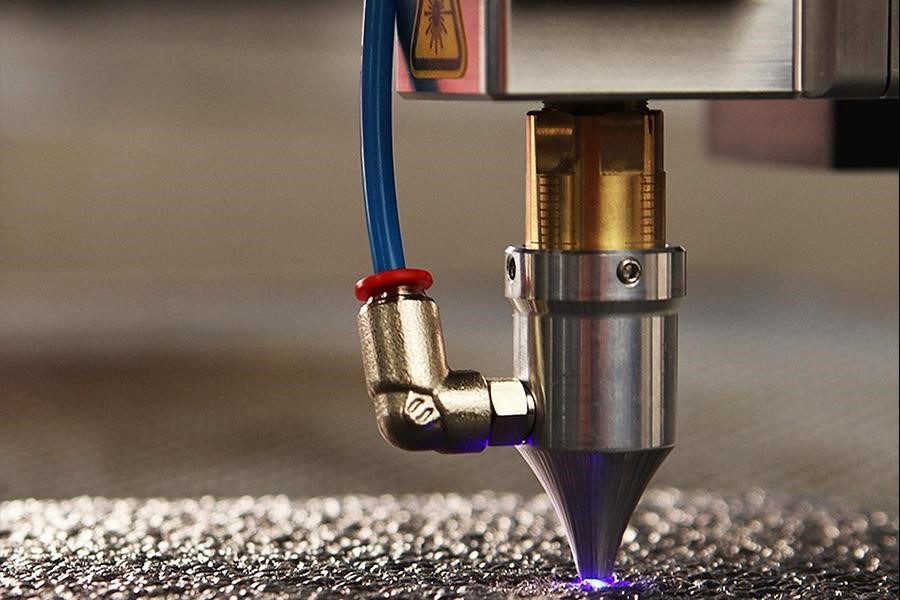

Laser cutting

The laser cutting machine market is expected to grow by USD 1.02 billion between 2020 and 2024. These machines use lasers to cut different materials from plastic to steel with absolute precision. They are essential tools widely used in many industries, including electronics and automotive.

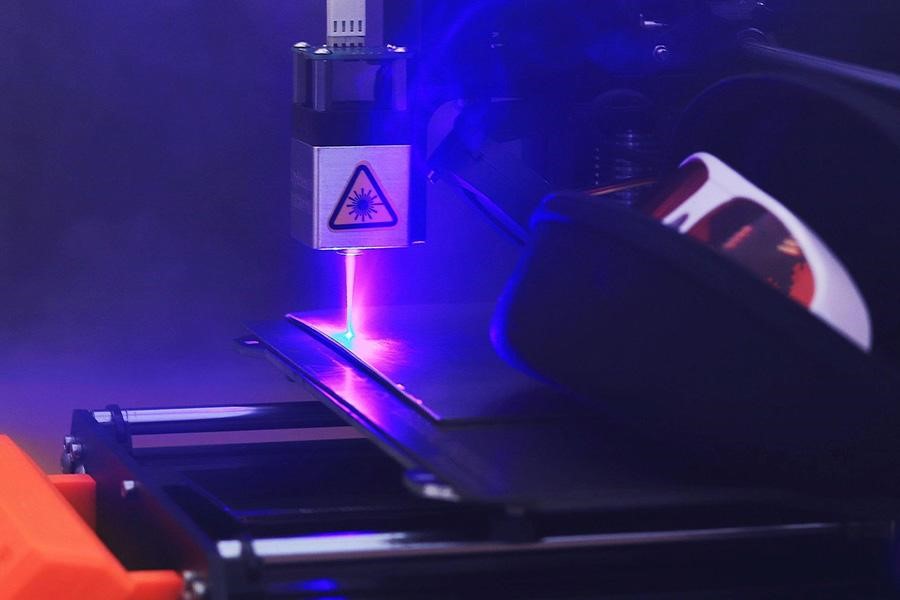

Laser engraving

Laser etching machines are used for engraving marks on various surfaces. Between 2021 and 2028, the global laser marking market is expected to grow at a CAGR of 8.0%. The Asia Pacific will be the largest market for these machines, followed by North America and Europe.

Laser cleaning

Laser cleaning or ablation refers to a technique wherein materials from a solid surface are irradiated with a laser beam. This cleaning market was valued at USD 587.18 million in 2021 and is expected to grow at a CAGR of 4.10% to reach USD 803.28 million by 2030.

Laser marking

In contrast to laser engraving, laser marking simply places information on a surface with minimal penetration. Compared to other marking methods, this system provides high readability and accuracy while being cost-effective. The laser marking market was valued at USD 2.9 billion in 2022 and is projected to grow at a CAGR of 7.2% to reach USD 4.1 billion by 2027.

Trends in the laser machine industry

The global laser machine market can be divided into the following categories: CO2 laser, fiber laser, and diode laser machines.

CO2 laser machine market

CO2 laser marking is appropriate for many non-metallic materials, including wood, plastic, acrylic, textiles, and stone. Furthermore, CO2 laser technology is heavily used in the pharmaceutical, food packaging, and electrical industries. This is because lasers are an excellent choice for cutting thicker materials with a faster initial piercing time and provides a smoother surface finish. However, lasers consume more power than fiber, resulting in higher operating costs.

The CO2 laser market is divided into three segments based on laser type, end-use industry, and geography. Among the segments, the CO2 gas laser segment shows the most promise, and the CO2 laser market is primarily driven by the automotive, manufacturing, defense, and healthcare sectors. Geographically, North and South America, Asia Pacific, Europe, and Africa have the most market growth potential.

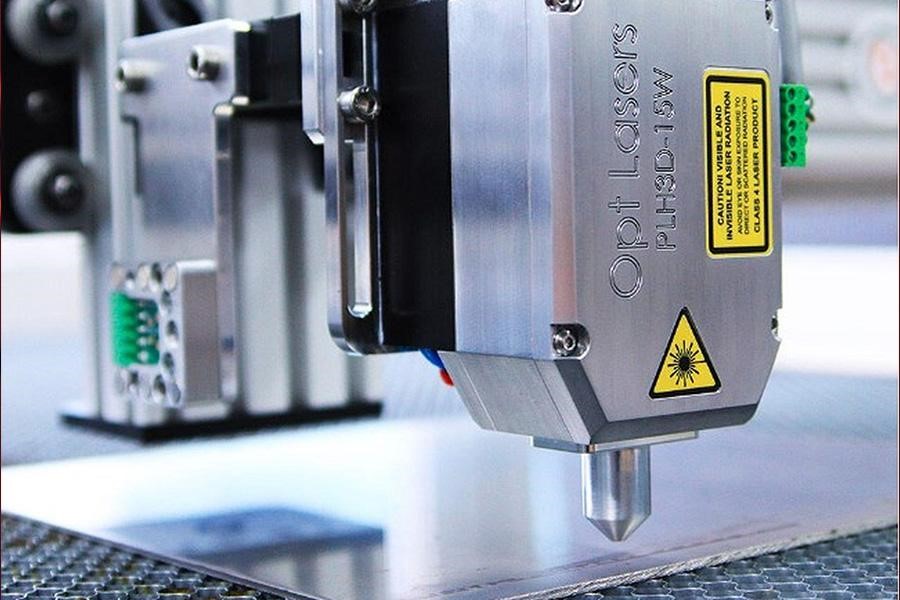

Fiber laser machine market

Fiber laser machines can perform engraving, etching, annealing, and high-contrast markings. Because of their small focal diameter, these lasers are best suited for marking data such as numbers and barcodes on metals. Fiber lasers are maintenance-free, have a longer service life, and have a smaller footprint than CO2 lasers.

Fiber lasers are seeing a demand for cleaning applications. Many industries use laser cleaning machines to help remove rust, paint, oxides, and contaminants on metals. Machines with high-power laser cutting capabilities ranging from 20 W to 6k W have higher price points.

The laser market is expected to grow at a CAGR of 10.9% between 2017 to 2023. North America and Europe have the highest potential for market growth, and the Asia Pacific, the Middle East, and Africa all have significant room for expansion.

Diode laser machine market

Diode laser technology is widely used in laser pointers, and it is fundamentally similar to light-emitted diodes. Although it was initially difficult for diode lasers to cut metal, technological advancement forever changed the industry. A direct diode laser (DDL) machine combines light from multiple diodes to form a single beam that is then directed at the surface of interest.

Diode lasers are more efficient than fiber lasers because they can be used on shiny surfaces such as copper and aluminum. Because the wavelength of the diode laser is easily absorbed by aluminum, the cutting speed is 100% faster. Furthermore, compared to fiber lasers, high-powered diode machines can work 10-20% faster on metals. And lastly, they provide better edge quality when dealing with denser materials.

Developments of laser technology

Every year, high-powered laser technology advances, and lasers of 6kW or higher have become more common compared to older versions of 4kW laser-cutting machines. The most significant benefit is that production time is reduced by half.

The following sections discuss the most critical developments in the laser-cutting market and their future and applications.

High-performance

Laser-cutting machines have single, double, or low-consumption nozzles. Single nozzles are the most common and are equipped with dependable but slow slicing methods with restricted tapering. As a result, single nozzles consume a lot of gas. Double nozzles can save up to 50% in gas compared to single nozzles. Low-consumption nozzles will provide the fastest and most efficient cutting method for businesses that use quarter-inch or denser materials.

Higher power generally improves efficiency and system performance. As a result, high-powered laser machines can slice at high speeds while augmenting more precise boundaries. They also improve laser performance by allowing for denser cutting scales. Each nozzle design is suitable for different materials and projects.

Productivity of laser cutting

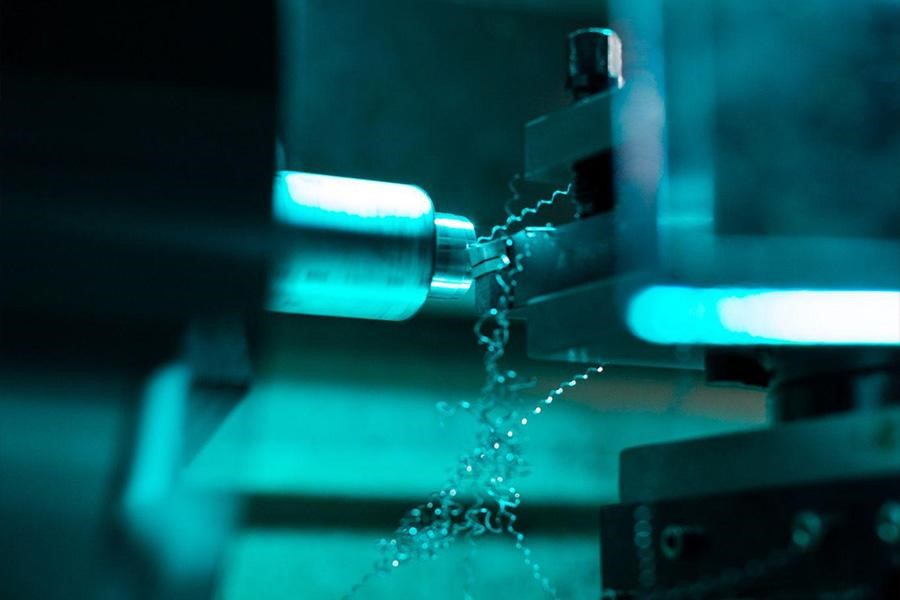

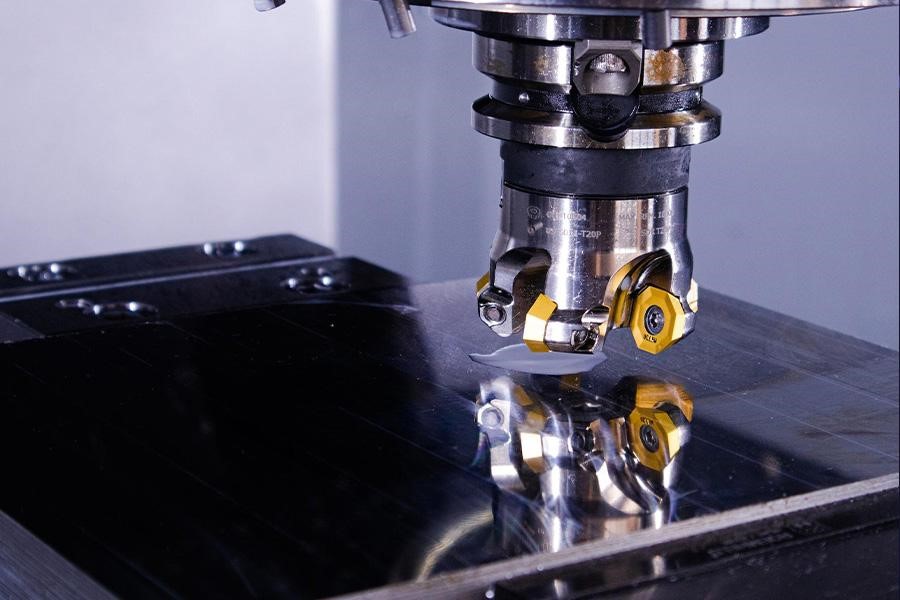

Laser cutting, drilling, marking, and welding are all functions of laser technology, and some models can even provide engraving for a more personalized experience. These machines can work with various materials, including wood, alloys, metals, ceramics, and polymers.

When it comes to customizing products for different businesses, laser cutting or printing is the go-to method, as it works well with various materials. Because of their ability to provide consistent shapes and sizes combined with 2D and 3D precisions, these machines have several applications in the construction industry. For example, laser cutting is an efficient option for customizing sheet metal fabrication for residential and non-residential use.

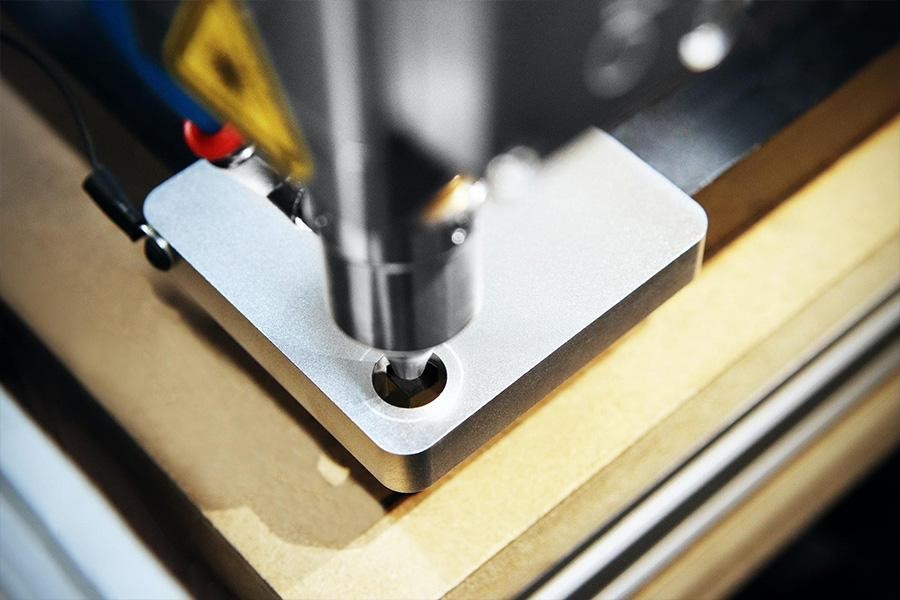

Reliability of laser automation

Several operations have been automated due to technological advancements, reducing the physicality of manufacturing facilities and increasing opportunities for laser automation. There are three types of material handling systems for laser cutting automation: a standalone machine with a shuttle table, a load-unload laser machine, and a laser machine with a flexible production system.

Furthermore, components such as cutting tables, scissors, labelers, or carts can be used individually in any automation system. This automation system can increase output and productivity while reducing reliance on workers. The automated testing cycles are also becoming shorter to keep up with rising demand while also providing an incentive for future development.

As CO2 and fiber lasers continue to dominate the market, the industry is looking for even more intense laser-cutting machinery. Machines with a high power range of 6kW and nozzles that reduce reliance on gas and production time are preferred today.

Other developments of next-generation laser-cutting machines

Adaptability: The latest G series laser cutting machine can be mounted to the foundation of the earlier plasma arc cutting machines. It can be installed and used on the original foundation, saving time and cost. Customers without an existing cement foundation can quickly install and move into the production state by choosing an optional bed base.

Bevel cutting: Bevel processing is a feature present in the G series laser cutting machine. V-shaped, C-shaped, Y-shaped, and K-shaped bevels are the most prevalent types used in the production of agricultural and construction machinery.

Enhanced safety: The G series laser machines have safety gratings on the back and front of the beam. When an object or a person enters the safe distance of the beam, an emergency system is immediately activated.

Active obstacle avoidance function: Laser machines can detect an impending obstacle and respond quickly to avoid collisions. This immediate reaction effectively resolves the issues of interference cutting and laser head collisions during the cutting process.

Final words

The laser machine market is constantly changing thanks to continuous advancements in technology. According to recent trends, CO2 and fiber lasers dominate the market due to improved performance, but external factors also contribute to their success.

Direct diode lasers will experience the highest CAGR in the future due to their advanced handling capacity, ease of servicing, and increased reliability while lowering operating costs. Their widespread use in ablation etching and heat-affect zone etching has also contributed to their growth.