A look back at some of 2023’s notable automotive sector corporate finance developments

BorgWarner restructures and Phinia debuts on NYSE

Why it matters? Supply chains in the automotive sector are starting to adjust for the energy transition – and big rise in electrification of vehicle markets – that is looming. Suppliers – especially the larger Tier 1s (such as BorgWarner) – are critically evaluating their product offerings and manufacturing footprints. Tier 1 suppliers such as BorgWarner want to be seen as ahead of the curve on EVs – by their OEM customers – and as key technology partners for future yet-to-be-fully-formulated EV supply chains.

In December 2022, BorgWarner announced its intent to spin-off the fuel systems and aftermarket segments (later named Phinia), consistent with its Charging Forward strategy. The IPO of Phinia was completed on 3 July, 2023.

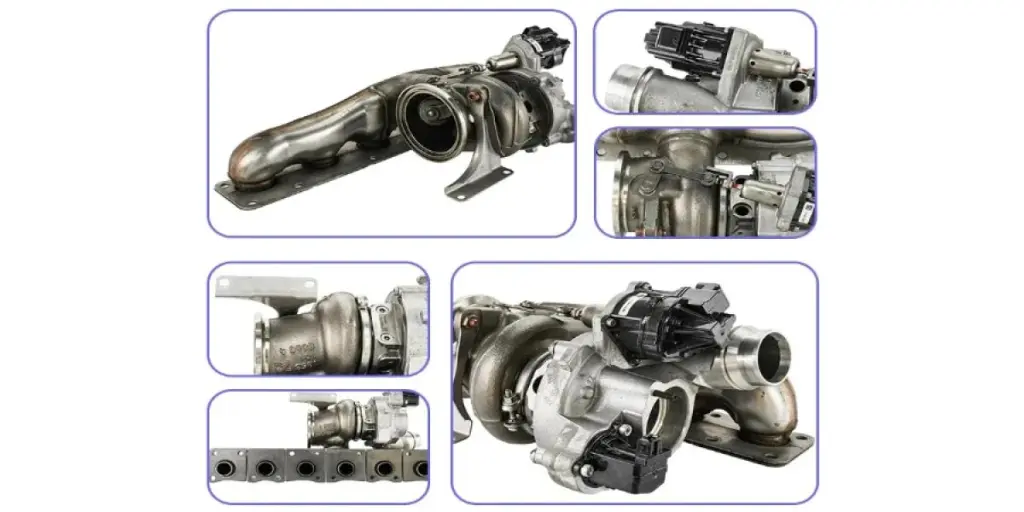

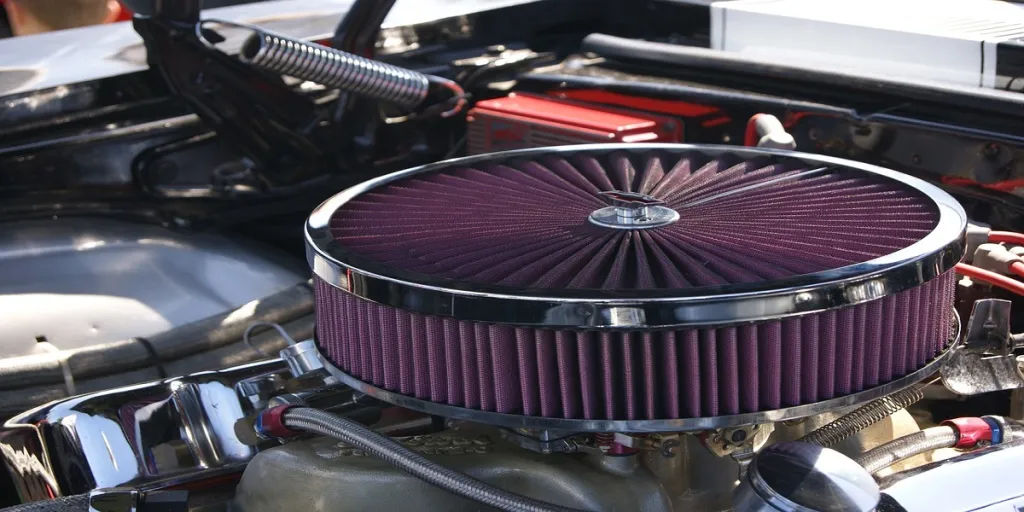

BorgWarner completed the spin-off of Phinia – its fuel systems and aftermarket business – on 3 July, 2023. With a market capitalisation of $1.4 billion at the time of writing, Phinia offers a variety of products for the automotive market. It specialises in fuel systems, starters, alternators and aftermarket distribution with customers in commercial vehicle, light vehicle and aftermarket end markets. Phinia’s expertise lays, in particular, in enhancing fuel efficiency for advanced ICE gasoline and diesel engine applications.

BorgWarner is aiming to specialise in EV business, targeting a goal of 25% of revenue from EVs by 2025 as part of its ‘Charging Forward’ strategy. BorgWarned says EV-focused M&A is tracking ahead of plan with the five acquisitions the company has made in the battery pack, e-motor, power electronics, and direct current fast charging spaces.

In August we spoke to Neil Fryer, PHINIA VP and General Manager – Aftermarket, to hear about Phinia’s next steps: Phinia eyes future after BorgWarner spin-off

Hyundai Mobis secures first overseas ‘Green Loan’

Why it matters: This is Hyundai Mobis’ first overseas Green Loan. While Hyundai Mobis issued green bonds domestically in 2021 to advance eco-friendly projects, this marks the first occasion they have utilized the Green Loan method for environmentally-friendly business investments abroad. Green Loans refer to funding methods for eco-friendly businesses, such as electric vehicles and renewable energy.

In November, Hyundai Group’s parts subsidiary Hyundai Mobis announced that it had secured an investment of $940m to establish a new electrification hub in North America, liaising with seven international financial institutions. According to GlobalData’s deals database, a credit guarantee from the Korea Trade Insurance Corporation, an export credit agency, further facilitated this.

The company said it has successfully achieved a low-interest, long-term financing (with a maturity of ten years) driven by the promising growth potential of the global electrification market.

Rivian plans a green bonds offering

And Valeo completed one in October

Sumitomo invests in Nano One Materials Corp

Why it matters: Cathode Active Materials (CAM) are one of the four main materials for batteries and also comprise the most expensive and significant component. Nano One possesses unique CAM production technology, called the One-Pot Process. This technology – it is claimed – reduces process complexity, resulting in fewer process steps and lower CAPEX and OPEX compared to current technology. Nano One’s One Pot technology will enable CAM production at a lower cost and environmental impacts than current technology, it is claimed. SMM could gain a significant competitive advantage in a key EV tech area.

In October, Sumitomo Metal Mining Co., Ltd (SMM) said it had reached an agreement to make strategic investment in Nano One Materials Corporation, a technology company with patented processes for the sustainable production of lithium-ion battery cathode materials.

The two companies will undertake joint development of manufacturing technology for battery cathode materials for electric vehicles (EVs), among other collaborative work. According to GlobalData’s deals database, the amount to be invested is 16.9 million Canadian dollars (approximately 1.9 billion JPY).

Infineon acquired 3db Access

Why it matters: The move strengthens Infineon’s connectivity portfolio in a key emerging tech area.

Infineon Technologies AG has announced that it has acquired the Zurich-based startup 3db Access AG (3db), a pioneer in secured low power Ultra-Wideband (UWB) technology that is already a supplier to major automotive brands. Infineon is acquiring 100 percent of the company’s shares. The parties have agreed not to disclose the amount of the transaction.

According to GlobalData’s deals database, the expertise of 3db in Ultra-Wideband technology accelerates Infineon’s IoT roadmap for leveraging the market opportunities of secured, connected devices. The combined strengths will enable UWB roll-out to address additional automotive, industrial and consumer IoT applications.

GM acquires gigacasting company

Why it matters: GM has jump-started its own push to make cars more cheaply and efficiently at a time when Tesla is racing to roll out a US$25,000 EV.

General Motors acquired Tooling & Equipment International (TEI) a company which helped Tesla with gigacasting, the process it pioneered to cast large body parts for cars in one piece. GM had turned to TEI around 2021 to test and produce underbody castings for its luxury $340,000 Cadillac Celestiq EV due in showrooms in 2024. As part of that programme, GM signed a guaranteed, long term contact and TEI invested in a new dedicated production line for the Celestiq at its base in Livonia.

Volkswagen takes 5% stake in Xpeng

Why it matters: The VW group has a significant presence in China’s conventional ICE vehicle market through JVs with SAIC and FAW but has struggled to keep up with the fast growing EV segment. Deeper links to local partners are a strategic pivot.

In August, Volkswagen said it will pay US$700m for a 5% stake in electric vehicle (EV) startup XPeng and it is planned the two companies will jointly develop two EVs to be sold as VW models in China by 2026. VW Group’s Audi unit has also signed a strategic agreement with JV partner SAIC. The partnerships in China aim to swiftly expand the VW Group’s product range with further models developed in China for the China market. The precise details of cooperation on future e-platforms are the subject of further negotiations between the partners.

Stellantis inks alliance with Leapmotor

Why it matters: There are big potential benefits for both. Leapmotor hopes to scale up its operations at home and allow it to join a growing number of Chinese automakers expanding overseas. Stellantis wants to tap into Leapmotor’s “highly innovative, cost efficient EV ecosystem” to help meet electrification targets under its core Dare Forward 2030 programme.

Stellantis said it would invest EUR1.5bn in a 20% stake in Chinese battery electric vehicle (BEV) startup Leapmotor, laying the foundation of a new strategic partnership designed to strengthen sales in markets worldwide, including China. The two companies have also agreed to set up joint venture called Leapmotor International in which Stellantis would hold a 51% stake and Leapmotor the remaining 49%. This joint venture, to be led by a Stellantis appointed CEO, would be exclusively responsible for the export and distribution of Leapmotor products overseas, including possible local production, with first shipments scheduled for the second half of 2024.

Saudi Public Investment Fund (PIF) ups stake in Aston Martin

Why it matters: The Saudi sovereign fund-backed Lucid Group signed a deal with the British luxury carmaker in June to help Aston Martin produce high-performance electric vehicles (EVs) from 2025. The agreement will establish a long-term strategic technology partnership that will elevate Aston Martin’s electrification strategy. A higher stake in Aston Martin reinforces the relationship. Saudi Arabia’s sovereign fund PIF is spearheading efforts by Riyadh to diversify the economy and reduce reliance on fossil-fuel exports.

In November it emerged that Saudi Arabia’s Public Investment Fund (PIF) has increased its stake – via Lucid Motors – in Aston Martin to 20.5 percent.

According to GlobalData’s deals database, the fund’s shareholding went up by 2.6 percentage points from 17.9 percent through Lucid Group’s holding, placing PIF ahead of Geely chairman and Chinese entrepreneur Shufu Li on Aston Martin’s shareholder list. Aston Martin chair Lawrence Stroll remains the top shareholder at the carmaker.

Mercedes-Benz acquires stake in btv technologies GmbH

Why it matters: An OEM positions for future lower risk on critical electronic parts. Deepening the partnership opens up opportunities for both partners. For Mercedes-Benz it is a further step in its sustainable semiconductor strategy. The agreement also offers new growth and business opportunities for btv technologies.

This one is notable for the element of supply chain risk-mitigation. In November, Mercedes-Benz AG said it is acquiring a minority stake in btv technologies GmbH, a service partner for electronic components in the automotive and consumer goods industries, thereby increasing the security of supply of semiconductors.

Mercedes-Benz has been working with btv technologies since 2021 and is now deepening its collaboration with the logistics partner, which it says has set new standards in terms of transparency, agility and cost efficiency with its “tak model” in supply chain management in the context of the global semiconductor shortage.

Details of the Mercedes stake in btv were not disclosed.

VW to invest in Pon e-bikes for lease

Why it matters: An interesting example of an OEM investing to dovetail operations with the aim of expanding its mobility offering to fleets – beyond cars and vans.

In September, Volkswagen Financial Services AG, a Germany-based subsidiary of Volkswagen AG, said it is planning to invest in Pon Holdings BV, a Netherlands-based specialist in bicycle leasing.

VW FS will acquire a 49 percent stake in Pons bicycle leasing subsidiary Bike Mobility Services (BMS). The Memorandum of Understanding (MoU) for this strategic alliance was signed at the IAA Mobility show in Munich. The goal is to expand together in the growing bicycle and e-bike leasing business in Europe and the US.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.