When the Xiaomi SU7 was released in early 2024, a Chinese blogger initiated a poll: Which company will be most impacted by Xiaomi’s entry?

The highest votes went to Xpeng.

At that time, Xpeng was somewhat unstable. The Xpeng X9 had passed its peak sales period, and the G6, G9, and P7i did not sell well, with monthly sales still in the low thousands. However, the MONA 03 and P7+ released in the second half of the year became instant hits, pushing Xpeng’s November sales to over 30,000 units for the first time. Additionally, these two models have over 100,000 undelivered orders, indicating that Xpeng will continue to see high sales peaks in the coming months.

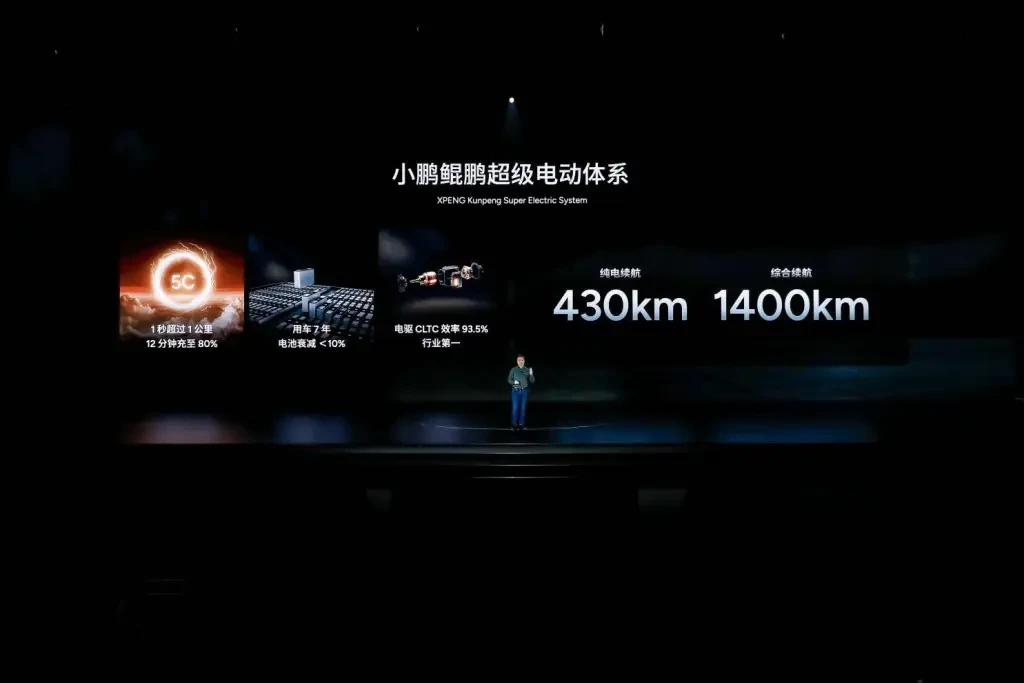

Moreover, at Xpeng’s Technology Day in November, the company announced the development of extended-range vehicles, introducing a product with a pure electric range of 430 kilometers and a combined range of 1,400 kilometers. Extended range has once again proven to be a sales booster for Chinese new energy vehicles.

Avita, which rarely broke 10,000 in sales, also reported 11,579 units sold in November, a year-on-year increase of over 180%, setting a new record. The previous peak was 10,056 units in October.

In 2023, Avita sold only 27,000 units with two pure electric models, averaging just over 2,000 units per month. After the release of the extended-range version of the Avita 07, Avita finally saw consecutive months of sales exceeding 10,000 units. With the addition of extended-range versions for the 11 and 12 models, Avita’s future sales look promising.

NIO has been relatively quiet. In 2024, NIO did not launch any new cars under its main brand, only adding the L60 under its second brand, and the third brand, Firefly, will debut at the end of this month during NIO Day. 2025 is expected to be a significant year for NIO’s product lineup.

Or rather, 2025 will be a decisive year for Chinese new energy vehicles.

Xpeng and NIO Aim to Double, Xiaomi Poised for Breakout

Recently, 36kr compiled the sales performance of major Chinese new energy manufacturers in 2024 and their internal sales forecasts for 2025:

NIO Group (NIO + L60) sold approximately 200,000 units in the first 11 months of 2024, with an estimated total of 230,000 units for the year. The 2025 sales target is 460,000 units, with the L60 brand aiming for 240,000 units.

Xpeng sold 150,000 units in the first 11 months of 2024, with an estimated total of 180,000 units for the year. The 2025 sales target is 350,000 units.

Li Auto sold over 440,000 units in the first 11 months of 2024, with an estimated total of 500,000 units for the year. The 2025 sales target is 700,000 units.

Leapmotor sold over 250,000 units in the first 11 months of 2024, with an estimated total of nearly 300,000 units for the year. The 2025 sales target is at least 500,000 units.

Xiaomi sold over 110,000 units in the first 11 months of 2024, with sales exceeding 20,000 units in both October and November. The estimated total for the year is over 130,000 units, with a 2025 sales forecast of 360,000 units.

As for the industry giant BYD, external analysis predicts a 2025 sales forecast of 5.5 million units, while the target for HarmonyOS Auto is likely set at 1 million units. Apart from BYD’s large base and the limited Chinese new energy vehicle market, which leaves no room for doubling sales, only Li Auto’s sales target seems realistic. While other new energy brands have generally set guidance for doubling sales, Xiaomi’s expectations are nearly double.

Additionally, as Chinese-made new energy brands rapidly develop and offer optimistic forecasts, 36kr has learned that the preliminary sales forecast for Mercedes-Benz and BMW in 2025 will continue to be adjusted down by 10-15%. This suggests that top luxury brands like BBA may become second-tier luxury brands, while brands like Li Auto and AITO will officially surpass them in sales.

The Battle of 2025: No Holding Back

As the most successful startup, Xiaomi Auto achieved a monthly sales figure of 20,000 units with a pure electric sedan priced over $27,400, marking a miracle in China’s new energy history. Despite the high-end, pure electric, and sedan keywords suggesting poor sales, the Xiaomi SU7 broke this curse.

What’s more alarming is that the Xiaomi SU7 seems to be a trial run for Xiaomi Auto, not their main strategy, as the “Ferrami” SUV follows the “Porschemi” sedan into the market.

According to the logic of the Chinese market, SUVs in the same class and price range sell better than sedans. Therefore, after the Xiaomi SUV is released in the first quarter of 2025, the goal of 30,000 monthly sales for Xiaomi Auto is not difficult. For Xiaomi, sales are not the issue; production and delivery are the challenges.

NIO’s actions in 2024 can be seen as a preparation phase, ready to leap in 2025.

The NIO flagship sedan ET9, released at the end of 2023, will be launched in 2025. While we don’t expect it to sell in large numbers, 2025 will indeed be a big year for NIO’s products.

Le Tao, which was highly anticipated, unsurprisingly faced production capacity issues again in 2024. The delivery of the L60 is not ramping up quickly enough, but Li Bin stated that improvements will be made by the end of the year and into 2025.

Additionally, Chinese First Financial revealed that Le Tao will launch mid-to-large 6-7 seat SUVs and large five-seat SUVs in 2025, targeting competitors like Li Auto’s L8 and L7, but at a lower price.

Another brand, Firefly, is expected to deliver in the first half of 2025. The starting price for the first model with a purchased battery is about $19,200, and the battery rental option is about $13,700. It’s uncertain if this model can replicate the success of XPeng’s MONA 03.

Although NIO’s goal of doubling sales seems exaggerated, considering NIO is fighting with three brands simultaneously and aggressively lowering prices, the task for each brand is not as daunting.

With four brands now under HarmonyOS Smart Mobility, AITO leads the pack. The AITO M8 in 2025 will succeed the AITO M9, helping AITO continue its sales peak. This product is considered the most important for HarmonyOS Smart Mobility in 2025.

Additionally, the Enjoy S9, despite facing the high-end, pure electric, and sedan challenges, performs well among similar products but lacks impressive absolute numbers. Therefore, it needs an extended range advantage to lower prices and boost sales.

The Zun S800 has already been unveiled, with a pre-sale price range of approximately $136,800 to $205,200, mainly targeting the high-end market. In 2025, Zun will also launch a second model, though it’s unclear if it will be an SUV or MPV, but it will likely be in the million-dollar RMB range (More than $137 thousand).

In 2024, Li Auto was quieter than NIO. The highly anticipated Maga did not continue the explosive success of the Li L series and was taught a harsh lesson by the pure electric market, delaying the launch of the Li pure electric M series. Additionally, the newly launched L6 became a sales pillar but lowered Li Auto’s average selling price.

The Li pure electric SUV, which didn’t launch in 2024, is expected to debut in 2025. The extended range L series will also be revamped, enriching Li Auto’s product line. However, as always, pure electric models don’t sell as well as extended range ones, so expectations for Li Auto’s pure electric sales aren’t particularly high. This may be why Li Auto’s 2025 target is relatively conservative.

At the beginning of the 2024, XPeng announced plans to launch 10 new models over the next three years, with two in 2024, namely the MONA 03 and P7+. In 2025, XPeng plans to introduce three new models and four major redesigns.

These three new vehicles are expected to include a B-class SUV, a C+ class six-seater full-size SUV, and a “land carrier” equipped with a vertical take-off and landing aircraft. Additionally, main models like the P7i, G6, G9, and X9 will receive updates.

The B-class SUV might be named G7, positioned above the G6, sharing a platform with the P7+. The C+ class six-seater full-size SUV will be XPeng’s first range-extended model, larger than the AITO M7 and Li Auto L8.

Overall, we can see that the product lineup for 2025 is stronger than 2024, especially with fierce competition in the SUV segment, and a significant increase in range-extended models.

Li Auto introduced the range-extended SUV combination years ago, but other brands have been slow to follow. As more brands adopt this popular combination, Li Auto’s original advantage may diminish.

The competition in 2025 is not just a slogan; it’s about brands entering each other’s core strengths and engaging in intense competition.

The End of Expansion, Entering the Final Stage

Geely Group, which has been developing multiple brands, began coordinating cooperation among its brands at the end of 2024, even merging organizational structures. The biggest change is the strategic integration of Zeekr and Lynk & Co, with Zeekr holding 51% of Lynk & Co’s shares, both under Zeekr Technology Group.

Additionally, Radar Auto, which makes new energy pickups, is integrated into Geely Auto Group, and Geometry Auto merges into the Galaxy brand. This indicates Geely is in a consolidation phase, integrating various brands from the expansion era to minimize resource waste.

With Zeekr and Lynk & Co under Zeekr Technology Group, their combined monthly sales exceeded 50,000 units, nearing 60,000 units (November sales: Zeekr 27,011 units, Lynk & Co 32,679 units). Reports suggest a 2025 combined sales target of 1 million units, marking a milestone in Geely’s premiumization process.

SAIC’s Roewe and Feifan are also undergoing adjustments. Feifan, originating from SAIC Roewe, aims for a high-end transformation in the new energy wave but has made little progress over the years. At the Guangzhou Auto Show, Feifan and Roewe decided to merge.

As Geely and SAIC make significant adjustments, many new energy brands are falling behind.

For example, Hechuang Auto, with ties to GAC and NIO, nearly collapsed in 2024. Originally a joint venture between GAC and NIO, it became Hechuang after NIO’s exit and Guangdong Zhujiang Investment Management Group’s entry.

However, Hechuang’s sales have been poor, hovering around 10,000 units annually, with only 110 units sold in October 2024. Hechuang Auto has laid off all employees at its Shanghai branch and owes severance pay, with only about 50 people left at its Guangzhou headquarters to maintain basic operations.

Neta Auto is also in trouble. Once the sales leader among new forces in 2022 with 152,100 units, it faced declining sales in 2023 and 2024: 127,500 units in 2023, and an estimated under 100,000 units in China for 2024.

Amid declining sales, Neta Auto is plagued by negative news, such as delayed vehicle deliveries, layoffs, unpaid wages, salary cuts, and factory shutdowns.

Recently, rumors surfaced about Neta CEO Zhang Yong’s resignation, but Neta officially denied it, stating Zhang is still in position and the company is operating normally.

However, with the rapid growth of the new energy market, Neta Auto’s declining sales suggest the brand is unlikely to survive future competition. Although Neta is doing well in Thailand, the market is too small to sustain a car company.

In 2024, we witnessed the fall of brands like HiPhi and Hechuang, with many others entering a countdown. As 2024 ends, we can conclude that the expansion era is over, and the final stage has begun. Those still in the game are either brands like NIO, Li Auto, and Leapmotor that emerged from competition, or brands backed by large enterprises and on a growth track, such as DeepBlue, Avita, and IM Motors.

Source from ifanr

Disclaimer: The information set forth above is provided by ifanr.com, independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.