Long ago, the mere mention of the Silk Road and Sahara trade routes immediately evoked images of importing activities.

Today, as time has progressed, international trade has evolved, introducing complex freight routes and methods that complicate the process, especially the multi-step involved in exporting and importing.

Such complexity can sometimes intimidate even seasoned importers who are venturing into new markets. Continue reading to uncover the steps involved in importing, the operational aspects, risk management, and the cultivation of strong relationships—all crucial for attaining success in imports.

Table of Contents

1. Understanding importing and why it matters

2. Steps of importing

3. Import operation management

4. Strategic risk and relationship management

5. Import success within reach

Understanding importing and why it matters

Since most countries cannot achieve complete self-sufficiency and require products from other nations or regions, importing emerges as the primary and most direct solution to these deficiencies.

Advances in technology and industrialization have significantly accelerated the evolution of importing activities. These developments have broadened their scope beyond merely addressing shortages to enhancing global competitiveness, accessing new markets, reducing costs, and offering superior quality products.

The growth of importing activities not only highlights economic expansion but also promotes job creation and fosters innovation. Importing also further diversifies consumer options, granting access to an extensive array of global products otherwise unavailable locally. Additionally, it indirectly supports cultural exchange and understanding by bringing products from diverse cultures into new markets, thereby promoting global commercial integration.

To gain the most out of the benefits of importing, it is crucial for importers to follow best practices and seek expert advice when needed. Next, let’s proceed to the key steps essential for the preparation of successful importing operations here.

Steps of importing

First of all, it’s essential to recognize that import procedures are not identical, as they vary based on factors like the type of traded goods, the countries involved, current regulations, and the commercial agreements between buyers (importers) and sellers (exporters) in an import transaction.

Though primarily based on the U.S. framework, the outlined steps here offer a broad overview applicable to many importing scenarios, despite potential variations due to different national regulations or requirements. For a comprehensive guide on importing into the U.S. instead, refer to this link for a detailed exploration.

Researching and planning

By any standard, importing is a business activity that warrants dedicated, long-term planning and thorough research before initiation, particularly when it involves bulk quantity orders, imports from a distant or unfamiliar country, and pricey products or those requiring subsequent training or expertise for operation.

The initial planning and preparation begin with fundamental aspects such as product identification and sourcing, extending to market research and profitability analysis. In addition, it is crucial to consider other essential importation-related factors, including currency exchange and insurance, which may vary based on negotiations with manufacturers and suppliers, at this stage. These elements can be varied based on agreements made during the negotiation process, affecting the overall terms of trade, payment methods, and risk management strategies.

In other words, all the most basic yet essential questions, such as the selection of goods for importation, the justification for their importation, and the strategy for their procurement, must be addressed and prepared at this early phase.

Finding and vetting suppliers

Once the preliminary planning is solidified, it’s time to shift the endeavor to identifying and vetting a reputable supplier from the source country. The criticality of this step cannot be overstated, as it forms the bedrock for future dealings, shaping the entire agreement in terms of product excellence, pricing structures, and delivery timelines.

It is therefore imperative to rigorously assess potential vendors for their product quality and production capacity. Verifying their credentials and references, requesting samples, and arranging for quotations that encompass both initial trial orders and potential voluminous purchases in the future are paramount in the supplier selection process.

A very experienced supplier can often impart valuable insights into the importation process, especially since some products have rather standard import requirements and procedures universally. This is also the juncture suitable for composing the official sales/import agreement and establishing the groundwork for forthcoming financial arrangements, customs mandates, and necessary documentation.

Investigating their online presence and scrutinizing all relevant critiques to gauge their credibility is one of the most clear-cut ways to help gain some insights into their credibility. A distinguished online marketplace will often go the extra mile to highlight verified or professional suppliers, aiding in the selection of dependable partners.

Complying with import and export regulations

After confirming the product and supplier, it’s crucial to delve into relevant import regulations, including necessary permits and licenses. The specific import laws greatly depend on the product type and the importing country. For instance, importing and selling devices in the U.S. that emit radio frequencies require obtaining certification from the Federal Communications Commission (FCC) to prevent interference with other devices.

Moreover, the source country plays a significant role in determining applicable import laws, influenced by international trade policies and existing free trade agreements based on the product’s country of origin. In the U.S., Customs and Border Protection (CBP) is tasked with determining the country of origin, among other data elements, for enforcing customs duties and tariffs. Importers are obligated to accurately declare goods’ details to both the importing and exporting country authorities. Non-compliance with the source country’s export laws can implicate exporters in legal challenges.

In a nutshell, it’s paramount for businesses to familiarize themselves with and adhere to all import and export restrictions, prohibitions, quotas, licenses, permits, certifications, and standards pertinent to their products or services. Ensuring compliance with trade agreements, treaties, and conventions that facilitate trade relations between countries is essential (and often grants preferential treatment). Consulting with relevant authorities, agencies, and experts for guidance on import/export rules and procedures is advisable to navigate the regulatory landscape effectively.

Preparing and managing documentation

With all necessary permits, licenses, and certifications required by relevant authorities and laws in hand, the next focus should shift to preparing and organizing vital documentation for the import process. The compilation of important necessary paperwork, including the commercial invoice, packing list, certificate of origin, and various types of bills of lading, is crucial. These documents, which must be submitted to the relevant authorities, provide critical details about the shipment, aiding entities like the CBP or Customs in the efficient administration and oversight of the import process.

It is the responsibility of importers to ensure the accuracy, completeness, and consistency of these documents, which must correctly represent the physical goods being imported. It is therefore advisable for the importers to conduct a detailed verification process before filling out these documents, comparing the commercial invoice, packing list, certificate of origin, and bill of lading directly against the imported goods to guarantee documentation integrity.

This rigorous approach is not only useful for meeting regulatory demands but also for clear, straightforward communication with Customs officials in case an inquiry is raised by the latter. Overall, diligent documentation review facilitates a seamless customs clearance, reduces the likelihood of importation delays, and emphasizes the importer’s dedication to upholding compliance and ensuring quality control.

Financing the import process

To be precise, this is not exactly the final step in importing but is addressed last here because it encapsulates all prior efforts, providing importers with an overview of the approximate total costs. Importers have to ensure that they have sufficient funds to cover the entire import process.

This includes the product prices as indicated by the supplier’s total quotation, freight charges, and insurance premiums from freight forwarders or carriers. Additionally, an initial estimation of customs duties, taxes, and specific importing fees, such as warehousing fees, handling charges, and processing fees necessary for customs clearance, should be taken into consideration and prepared accordingly too.

In terms of funding sources and payment modes, generally, importers can tap into a variety of sources and payment methods to finance and settle payments for their operations. From personal capital and bank loans to letters of credit, or advance payments from customers, all these arrangements ensure that exporters receive payment, including through the importer’s banking institution to secure the transaction. Strategic planning and selection of financing methods are vital for managing the costs associated with the import process effectively.

Import operation management

When it comes to the actual implementation of the import process, effective handling of duties and taxes, alongside simplifying freight forwarding and customs procedures are the core of the management of import operations for efficient, compliant, and cost-effective transport and clearance of goods.

Navigating duties and taxes

Navigating the complexities of customs regulations and accurately fulfilling duties and tax obligations necessitates meticulous preparation and verification of documents such as commercial invoices and customs bonds. For instance, importers in the United States must indicate an Importer of Record, or “IOR”, number on the CBP entry forms in order to kick off the import process. It’s often simply an IRS (Internal Revenue Service) business registration number, which is essentially the Employer Identification Number (EIN) for company imports or for anyone who hasn’t registered a business with the IRS or doesn’t own a business, a social security number (SSN) is suffixed too.

Moreover, accurately determining the goods’ Tariff Classification is essential for calculating the correct duties and taxes for items imported into the United States. This process falls under the Harmonized Tariff Schedule of the United States (HTSUS), which determines if an item is subject to duty or eligible for duty-free entry. The completion and submission of necessary entry documentation, including the commercial invoice and Importer Security Filing for ocean shipments, followed by the payment of assessed duties and taxes, are critical steps in the importation process.

Thankfully, despite complex permits and tax requirements for importing, many countries’ authorities provide extensive online resources to assist importers. For instance, the CBP and USA.gov offer detailed guides on importing into the United States. These resources offer insights into duties and taxes and clarify the steps and documentation needed for compliance with U.S. customs.

Streamlining customs and freight forwarding

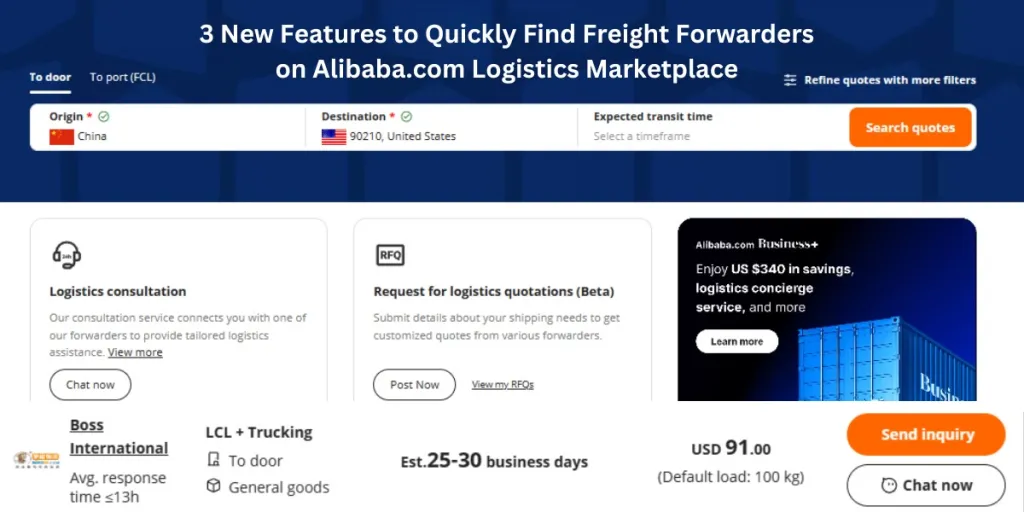

Despite the availability of multiple resources and tools such as electronic data interchange (EDI), online platforms, and digital signatures that importers can use to expedite and streamline the import process, the most efficient way to simplify freight forwarding and customs clearance is by hiring professional and trustworthy freight forwarders and customs brokers.

These experts can manage the transportation, storage, and delivery of imported goods or services, and facilitate customs formalities and inspections. With their extensive industry experience, they alleviate logistical burdens and speed up the import process, ensuring compliance and the timely release of goods.

Strategic risk and relationship management

On top of meticulous import operation management, adopting proactive strategies to mitigate potential risks can safeguard businesses against unforeseen challenges. This approach also includes an emphasis on the importance of cultivating strong, collaborative relationships with key partners and suppliers to secure long-term success and sustainability in trading.

Mitigating import risks

Mitigating import risks, particularly through insurance, shields businesses from the financial repercussions of transit-related damages or losses. Importers should employ a holistic risk management approach, including diversifying sources and regularly assessing market dynamics, to minimize dependencies and adapt to changes effectively. Comprehensive insurance coverage, tailored to the specific needs of the import operation, ensures protection against a wide array of transport risks.

For example, while often associated with exporters, Marine Insurance is in fact beneficial for importers as well. It covers goods from the moment they leave the exporter until they reach the importer. This insurance protects against loss or damage throughout the journey. Its flexibility allows it to be tailored for all transit phases, offering peace of mind to importers.

The significance of marine insurance is underscored by the prevalent use of sea transportation- as the most used mode for trade into the US and between the EU and the rest of the world. In 2021, it accounted for more than 41% of the total volume of traded goods imported into the U.S. In 2022, 74% of the volume of goods traded between the EU and the rest of the world was transported by sea.

On the other hand, importers dealing with suppliers in politically unstable countries can benefit from Political Risk Insurance. This insurance protects against losses from government confiscation, political violence, or currency inconvertibility. International Product Liability Insurance is another type of insurance that offers a safety net for instances where imported goods fail to meet regulatory standards and are detained or rejected at the border due to non-compliance with local laws and standards.

Building strong supplier and partner relationships

In the pursuit of establishing trusting relationships with partners and suppliers, freight forwarders serve as key intermediaries. They significantly ease communication and logistical arrangements, aiding in the creation and sustenance of strong, mutually beneficial relationships with suppliers. This, in turn, bolsters the reliability of the overall supply chain. Their expertise in logistics enables them to adeptly navigate complex regulations and procedures, mitigate risks, and boost the efficiency of the import process.

In essence, importers can utilize freight forwarders not only for their logistical expertise but also view them as strategic partners, as they are instrumental in fostering and maintaining robust relationships with suppliers to effectively navigate the complexities of global trade.

Import success within reach

Achieving an attainable successful import begins with a strategic approach to importing, encompassing thorough planning, research, and understanding of the import landscape. This includes a thorough investigation into potential product identification, market research, consumer demands, and the logistics of sourcing from reputable suppliers. Ensuring compliance with import laws and meticulously preparing all required documentation are steps that must be confirmed and consistently implemented. Carefully executed, these preparatory actions can avoid pitfalls and streamline the import process, thereby contributing to the overall success of the venture.

The management of import operations, including the adept handling of duties and taxes, as well as the simplification of freight forwarding and customs clearance further enhances operational efficiency. Furthermore, the establishment of strategic relationships and effective risk management practices, such as leveraging insurance and fostering trust with key partners, are also essential in securing an attainable successful import. These strategies not only minimize potential risks but also promote a stable long-term import operation.

Visit Alibaba.com Reads regularly to gain more insights on navigating the import complexities. Discover strategies that pave the way for an attainable successful import and stay ahead in the competitive world of international trade.

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.