Filing taxes can be stressful for any business owner, but it can be incredibly challenging for Amazon sellers. Sales tax for Amazon sellers can be more complex than it is for other business owners.

The tax filing season for partnerships, S corporations, and limited liability companies (LLCs) taxed as a partnership is March 15, 2024. On the other hand, individual sellers, sole proprietors, C corporations, and LLCs taxed as corporations must file their taxes by April 18, 2024.

Understanding Amazon seller taxes can be overwhelming for first-timers. But all your questions can be answered in this extensive guide that’ll help you prepare for the tax filing season.

Amazon sales tax

If you sell any physical item, you must calculate, add, and collect sales tax for every item sold. Whether you use Fulfillment by Amazon (FBA) or ship orders directly from your warehouse, you may have to collect sales tax in the states you’re shipping orders to.

Sales tax varies by state, so keeping track of them when you sell in multiple states can be challenging. The general rule to remember is that if your business operates in a particular state—remotely or in a store—or you sell a taxable product, you’re responsible for collecting sales taxes.

Explaining sales tax nexus

Each state defines sales tax nexus differently. Generally speaking, a sales tax nexus is when your online business has a significant presence in a state where collecting sales tax is required.

As an FBA seller, you may have a sales tax nexus in any or all of Amazon’s corporate offices and fulfillment centers. This includes all US states.

Amazon FBA is responsible for collecting and remitting sales tax for all states, but it would be best to verify that their system is correctly set up for your store. Amazon may charge sales tax for your untaxable items without the proper system configuration.

Each state collecting sales tax has varying rules about tax licenses and permits. If you have a sales tax nexus in any state, ensure that you’ve taken care of all the necessary permits and licenses. This will make tax filing easier and quicker.

Determining taxable products sold on Amazon

A product can be taxed at a lower rate or not at all, depending on where it’s bought. In states with no sales tax, consumers can purchase products without paying sales taxes. Meanwhile, some states tax items at a lower rate depending on their category. Food items, clothes, and other essentials are often taxed lower than other goods.

Amazon collects and pays taxes on goods sold through its platform. However, you can set individual tax rates for particular categories and states. You can review your seller account’s settings to ensure that your items are appropriately taxed.

How to file taxes

It’s crucial to note that while Amazon collects and remits sales tax for you, it doesn’t file your income tax. You must take care of the necessary tax paperwork, such as your sales tax reports, the 1099-K tax form, and the 1040 Schedule-C to file your income tax.

It will be best to hire an accountant to help you file your income tax. Not only do accountants handle all computations, but they can also identify tax refund opportunities.

Now, let’s discuss how to file your taxes as an Amazon seller.

Access your sales tax report

Go to the Reports section of your Seller Central account and find the Tax Document Library. Head to the Sales Tax Reports and click Generate Tax Report.

The system will generate three tax reports, namely:

- Sales Tax Calculation Report – a report showing the sales tax amount you must pay

- Marketplace Tax Collection Report – a report showing all taxes Amazon has automatically collected and remitted

- Combined Sales Tax Report – a report that covers data from the two documents above

All reports allow you to file and pay taxes accordingly, so you may choose any of the three.

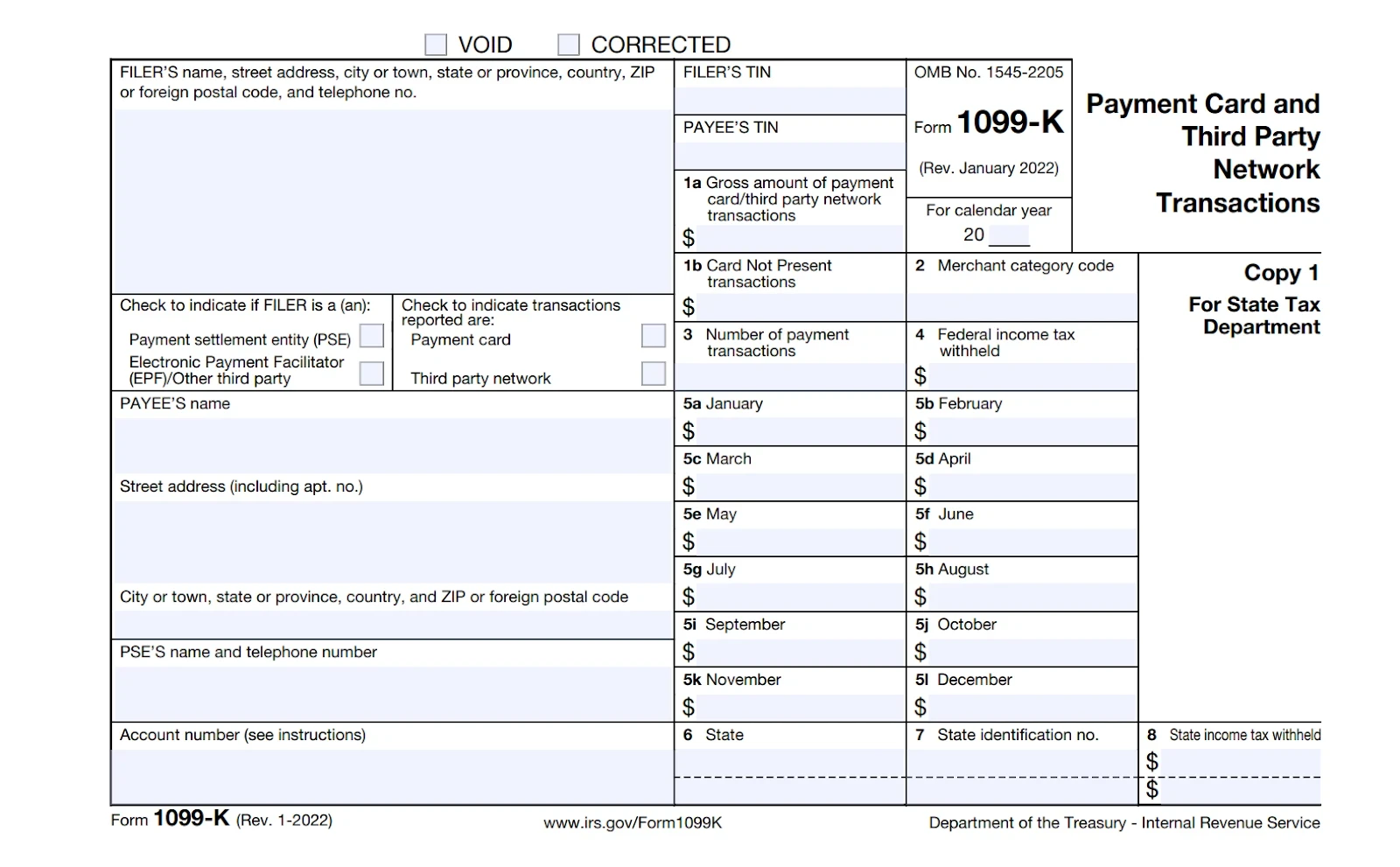

1099-K form

Amazon issues the 1099-K form to provide your gross sales data (monthly and annual) to the IRS. It also covers sales tax and shipping costs. Amazon will issue you this form if you have more than $20,000 in total sales and over 200 transactions.

If you’re an individual or professional seller who meets these requirements, you don’t have to fill out the 1099-K form; Amazon will do it on your behalf. It will send the filled-out form to you and the IRS. Note that if you have at least 50 transactions, you must still provide your tax status to Amazon.

You can provide this information through your Seller Central account. Carefully check every detail you enter to avoid mistakes, like misspelled words or incorrect or incomplete Tax Identification Numbers. This is crucial because errors in your entries could put your seller status at risk.

How to download the 1099-K form

If you meet the 1099-K requirements, Amazon should send the form to your email address. If you have yet to receive one but are certain that you meet the requirements, you can find the 1099-K form on your Seller Central account.

Click on the Reports menu, then select Tax Document Library. You’ll find the 1099-K form there, and you can download it. You can also contact Seller Support to receive the form.

How to address 1099-K form errors

It’s possible to see some mistakes in the 1099-K form that Amazon filled out for you. Follow these steps if you need to adjust some entries:

Step 1 – Double-check your total gross sales for 2023. The amount should cover all the products you’ve shipped for the entire year. If you sold an item on December 31, 2023, but didn’t ship until January 2, 2024, its sales shouldn’t be counted.

Step 2 – If you need to recalculate your unadjusted gross sales for 2023, print a date range report. Click Reports on Seller Central and pick Date Range Reports. Click Generate a statement.

Step 3 – In the popup menu, select Summary as the report type and Monthly or Custom as the report range. Specify the exact range.

Step 4 – Click on Generate. You may have to wait an hour, so ensure that you’re not in a rush when completing this process.

Step 5 – When the date range report has been generated, review the entries carefully and add the amounts in the columns to recalculate your unadjusted gross sales for 2023.

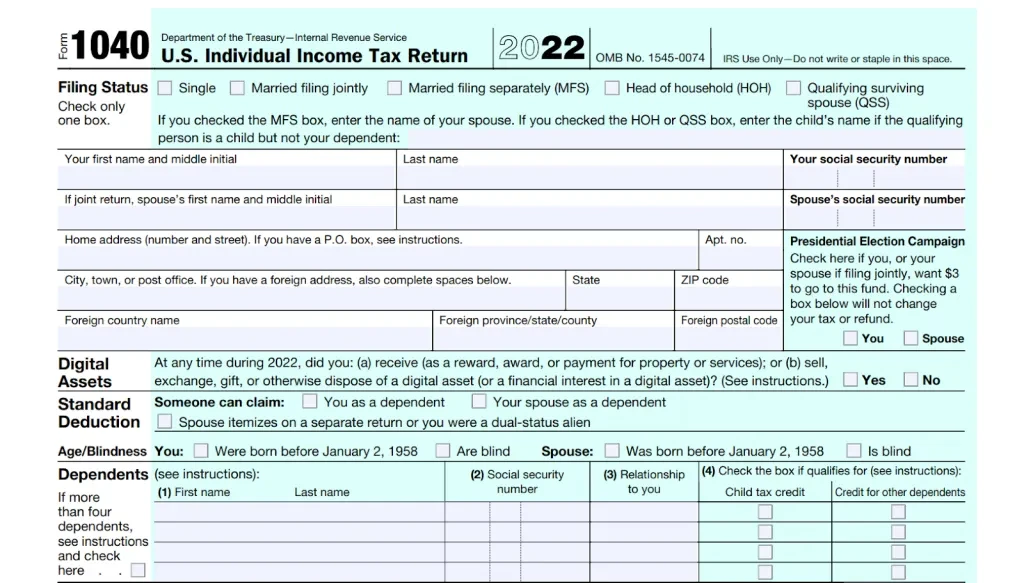

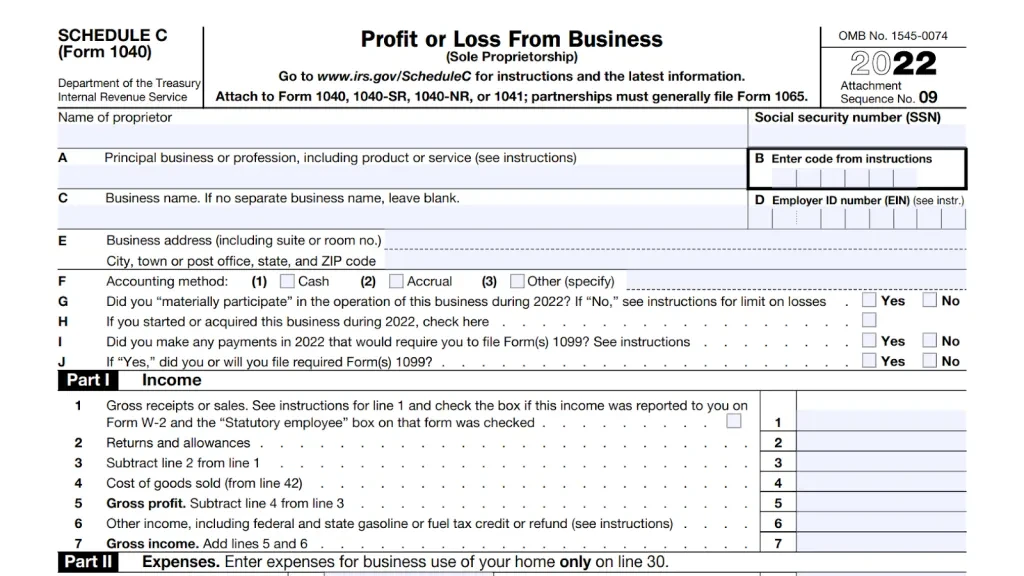

(For sole proprietorships or solo LLC owners) Fill out Schedule C (1040 Form)

While you can open an Amazon store without a business license, some states may require it. If you’re a sole proprietorship or solo LLC owner with a business license, you must file Schedule C along with Form 1040. Schedule C reports all business-related income and expenses, while Form 1040 is the standard IRS form used to file annual income tax returns. You may skip Schedule C if you have a different legal structure or if your Amazon store doesn’t have a business license.

But if you run a larger sole proprietorship or LLC with employees, offices, and significant expenses, you most likely need one. Therefore, you must file Schedule C.

Review your state’s requirements to ensure that you’re operating legally and filing your taxes correctly. Note that you must report your income to the IRS even if you don’t have a business license.

Identifying tax deductibles

You can claim deductibles on expenses like shipping, supplies for your home office, and other operating costs. Gather all the receipts from your relevant business activities to quickly identify your deductibles.

Below are the potential deductibles:

- Amazon seller fees

- Cost of goods sold (COGS), including manufacturing costs or wholesale prices

- Shipping-related costs

- Home office expenses, like computers, furniture, and office supplies

- Mileage

- Subscriptions

- Accounting, tax, Point of Sale (POS), and/or inventory management software fees

- Donations, like unsold or unsellable items donated to charities

- Advertising costs, like for ads, business cards, brochures

- Salaries and benefits

- Professional fees, such as payment for attorneys, accountants, copywriters, web designers, or business consultants

- Education costs related to eCommerce or online businesses

What happens if you don’t file taxes on time?

If you file your taxes late, the IRS may apply a late-filing penalty or failure-to-file penalty, which could be 5% of the tax you owe for each month or part of the month your filing is late.

If your tax return is over 60 days late, you may have to pay the penalty of at least $435 or the amount of tax you owe, whichever is smaller. The failure-to-pay penalty costs 25% of your tax bill at max.

Filing and paying your taxes on time is crucial to avoid penalties and secure your Amazon business. Even failing to provide your tax status to Amazon can put your seller status at risk.

You may be eligible for tax relief or penalty reduction if you meet certain requirements. For example, it’s your first time filing late or you have a valid reason for missing the deadline. You can review the IRS website to discover how to apply for penalty relief.

You won’t be penalized if you file for taxes late but don’t owe anything. If you’re owed a refund, you may have only three years to claim it. The deadline for claiming refunds for this year was on July 17, 2023. If you’re owed a refund for this year, make sure not to miss the deadline for claiming it.

How to get a tax extension

A tax extension grants you six more months to finish your tax return. If you don’t file your 2023 taxes by March 15 or April 18, you can request a tax extension (Form 4868) on the date applicable to your legal structure. If you don’t file the form by Tax Day, your only option is to file and pay your taxes as soon as possible to minimize your penalties.

You can submit Form 4868 online or by mail on the tax-filing deadline. If you filed the form on April 18, 2023, your tax filing deadline is October 16, 2023.

It’s essential to note that the tax extension doesn’t give you more time to pay your tax bill. Instead, it only pushes your filing deadline. If you’re unable to pay your tax bill, the IRS offers payment plans that allow you to pay off your balance in increments over time.

The tax extension is helpful if you’re missing important tax documents and need more time to gather them. Nonetheless, the IRS still expects you to submit an estimated tax payment by Tax Day. Aim to settle at least 90% of your tax bill by the deadline to dodge late payment penalties.

If you’re expecting a tax refund but need more time for filing, it’s still best to file a tax extension.

Making Amazon tax filing easier with marketplace management platforms

Keeping track of taxes on top of sales and expenses can be stressful. Thankfully, you can explore solutions that make the process more manageable.

Here are some of the best marketplace management platforms that help monitor your Amazon finances more easily:

Threecolts

Threecolts offers various solutions for managing your Amazon, eBay, or Walmart stores. It comes in handy during the tax filing season since it has features like sales tax rate and taxpayer support. SellerBench, one of Threecolts’ solutions, detects lost or damaged inventory and incorrect fees, helping you generate accurate reports and only pay what you owe.

You can receive a weekly invoice that covers everything you can recover, with details on how to get your money back. Using SellerBench can give you 3x more money than other solutions, and the best part is you only pay for the software once you receive your funds.

Jungle Scout

Jungle Scout is a marketplace management platform focused on Amazon. It offers a software suite designed for every type of Amazon seller.

To help monitor the financial health of your business, Jungle Scout offers a sales analytics tool. It acts as the financial command center for your Amazon business. The tool uses artificial intelligence to analyze your profit overview data, such as sales, COGS, seller fees, and more. It pulls up a detailed report with valuable insights and tips on improving sales.

You can see current and historical sales, helping you calculate your gross sales for a particular tax year. The tool can also help identify deductibles by documenting expenses, including advertising, salaries, and shipping costs.

Helium 10

Helium 10 works as a Chrome extension that calculates FBA profitability. While it’s not focused on taxes, it can help identify potential deductibles, such as manufacturing costs and fulfillment fees.

You can also identify refunds with Refund Genie, one of Helium 10’s Amazon seller tools. Refund Genie automatically checks FBA inventory reimbursements and gives you a refund estimate in seconds.

Should you use an accounting software?

Using accounting software can also make tax filing significantly easier. It’s best to have both an accountant and accounting software because the former can double-check the software’s calculations, ensuring that you’re paying the correct taxes.

Here are some highly recommended accounting software for Amazon sellers:

QuickBooks

As one of the most popular accounting software solutions, QuickBooks offers all the tools to correctly compute and file your taxes. It calculates every deduction by letting you snap a photo of all the receipts from your expenses. QuickBooks matches receipt images to their corresponding transactions and sorts them into tax categories, helping you stay organized without heaps of paperwork.

You can also calculate your mileage, which is another deductible. QuickBooks easily sorts mileage from business and personal trips, helping LLCs and corporations get tax cuts.

Xero

Xero is another popular accounting software with extensive features for financial reporting, claiming expenses, paying bills, and more. Like QuickBooks, Xero lets you take photos of your receipts to quickly reimburse your expenses and identify potential tax deductions. You can also track and claim your mileage.

Xero manages and calculates sales tax rates; you can set up as many sales tax rates as necessary. The calculations are automatically done for you, and you can compare Amazon’s calculations to Xero’s work to ensure that you’re always collecting the right amount of sales tax.

Wrapping up

While you still have plenty of time before the tax filing season, start organizing the necessary paperwork early. Even if eCommerce and accounting tools can automatically calculate your taxes now, it doesn’t mean they’re entirely foolproof. That’s why, alongside using reliable software solutions, working with an accountant is ideal. They handle the complex calculations for you and ensure your compliance.

Using marketplace management platforms like Threecolts is also beneficial not only during the tax filing season but all year round. When you can track your profitability, expenses, and financial reports anytime, you can easily identify and address any factor that can impact your taxes. Become a wise Amazon seller and utilize the right tools to ease your burden during the tax filing season.

Source from Threecolts

The information set forth above is provided by Threecolts independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.