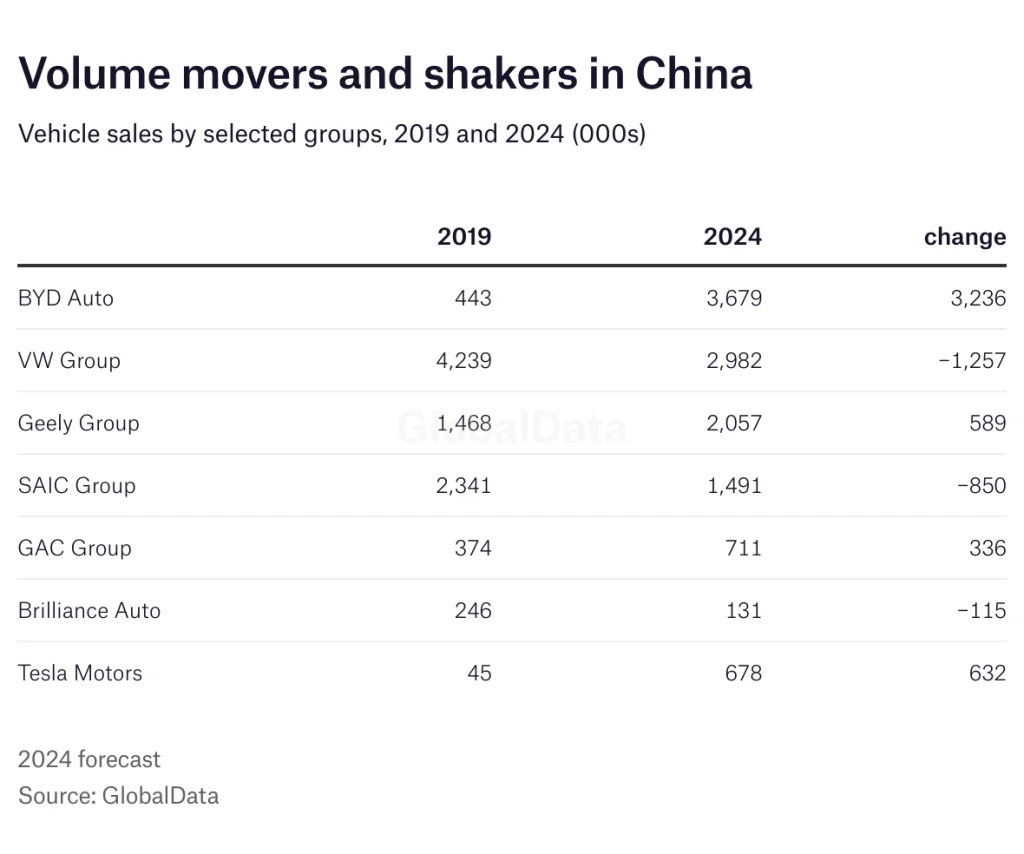

Chinese OEMs such as BYD Auto and Geely, which transitioned to NEVs early, are strong performers.

China’s automotive industry went into reverse in recent months, with global sales by the country’s automakers falling by 5% year-on-year in each of July and August, and 2% in September according to analysis of passenger and commercial vehicle wholesale data compiled by the China Association of Automobile Manufacturers (CAAM). This is increasing pressure particularly on many long-established local manufacturers and foreign joint ventures.

Overall vehicle sales in the first nine months of 2024 were still up by just over 2% to 21.571 million units from 21.069 million in the same period of last year. Light passenger vehicle sales rose by 3% to 18.679 million units while commercial vehicle sales fell by 2% to 2.892 million units. Overall volumes were supported by a 27% increase in exports to 4.312 million units, including a 12% rise in new energy vehicles (NEV) shipments – comprising mainly BEVs and plug-in hybrids electric vehicles (PHEVs), to 968,000 units. Domestic sales, on the other hand, fell by 5% to 17.259 million units from 18.183 million, including 7.392 million NEVs.

The Chinese government stepped up its market stimulus measures earlier this year in response to flagging consumer spending – which slowed GDP growth to 4.7% year-on-year in the second quarter from 5.3% in the first quarter. At the end of July the Chinese government doubled the one-off CNY10,000 (US$1,400) subsidy introduced in April to CNY20,000 for buyers trading in old ICE vehicles for qualifying new EVs. Regional governments have their own stimulus programmes, while the central bank continues to encourage lenders to reduce downpayment requirements on vehicle loans and reduce interest rates.

The performances of the individual vehicle manufacturers have diverged significantly this year, with companies such as BYD Auto and Geely which transitioned to NEVs early on outperforming strongly. BYD, which is now entirely focused on NEVs, saw global sales increase by 32% to 2,747,875 units YTD, including a 105% jump in overseas sales to 297,881 units.

Geely group’s nine-month sales across all brands globally increased by 21% to 2,319,664 units, while Great Wall Motor’s sales were slightly lower at 853,813 units – underpinned by a 53% surge in overseas sales to 324,244 units and GAC Group reported a26% sales decline to 1,335,050 units.

Competition has increased significantly in all market segments in the last year, including BEVs, with deep discounting by dealers and ever cheaper models coming onto the market. Margins and earnings are coming under significant pressure, resulting in manufacturers stepping up their overseas expansion.

Some of the larger state-owned groups, including SAIC Motor Corporation and GAC Group, have reported steep sales declines this year. While this is explained in part by some very poor performances by their foreign joint ventures, their wholly-owned vehicle operations are also struggling to keep up with the transition to NEVs.

Shanghai-based SAIC Motor’s global sales plunged by 35% to 313,260 units in September and by 22% to 2,649,333 units year-to-date (YTD), with sales lower across the group despite a 15% increase in NEV sales to 748,027 units. Overseas sales were down by 12% at 739,207 units. SAIC-GM-Wuling’s deliveries declined by over 5% to 840,009 units, while SAIC Volkswagen’s dropped by 7% to 772,091 units and SAIC-GM reported a 61% plunge to 278,485 units.

SAIC-VW and SAIC-GM both sold over two million vehicles annually at their peak just 7-8 years ago, double current volumes. VW’s other major joint venture, FAW-VW, has fared even worse this year – with an estimated 17% decline so far. Guangzhou-based GAC Group, which has joint ventures with Honda and Toyota, has reported a 26% decline to 1,152,424 units.

Foreign brands have also been slow to transition to NEVs and to meet growing local demand for smart, connected vehicles. Escalating trade wars between China and major trading partners such as the US and the European Union (EU) are clearly not helping local sentiment towards foreign brands. Domestic brands now account for over 63% of total passenger vehicle sales in China, up from just 36% in 2020.

Restructuring among foreign joint ventures is picking up momentum as manufacturers are faced with fast-rising overcapacity, particularly in their ICE vehicle operations, amid plunging earnings.

It has emerged that SAIC-VW is looking to shut down its second plant in just over two years, in Nanjing, with more closures expected to follow. Japanese manufacturers Honda and Nissan are currently in the process of cutting capacity in China, while Mitsubishi withdrew entirely from vehicle manufacturing in the country last year.

Hyundai, which has yet to recover from the political fall-out between China and South Korea in 2016, has already closed a few plants in the last several years with more likely to follow. At its peak, Hyundai Motor sold over 1.6 million vehicles in annually in China. Its main Beijing Hyundai joint venture’s sales in 2024 are down 26% year-on-year.

Ford and GM are also operating at a fraction of their capacities in China and it looks to be only a matter of time before significant restructuring is announced, while Jeep’s joint venture in China went bankrupt in 2022.

Tesla is the main exception, with shipments from the company’s Shanghai plant falling by just 3% to 675,758 units YTD, with the brand’s retail sales in China rising by 6% to 460,200 units. All this despite surging competition from local automakers.

Leading overseas automakers, particularly German companies such as VW Group, Mercedes-Benz and BMW, have stepped-up investments in local R&D operations and are strengthening partnerships with local technology companies such as Baidu, ByteDance and Tencent, as they look to meet demand local for smart, connected and autonomous vehicles. VW recently acquired a stake in XPeng and plans to launch two models in 2026 based on its partner’s G9 BEV platform.

As competition from Chinese automakers continues to rise both in China and overseas, global automakers are increasingly looking to use China as a low-cost production base for next generation models. This is being driven not only by the increasingly sophisticated needs of the Chinese market, but also for global markets including Europe, as they look to make full use of the country’s advanced technologies and low-cost supply chains.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.