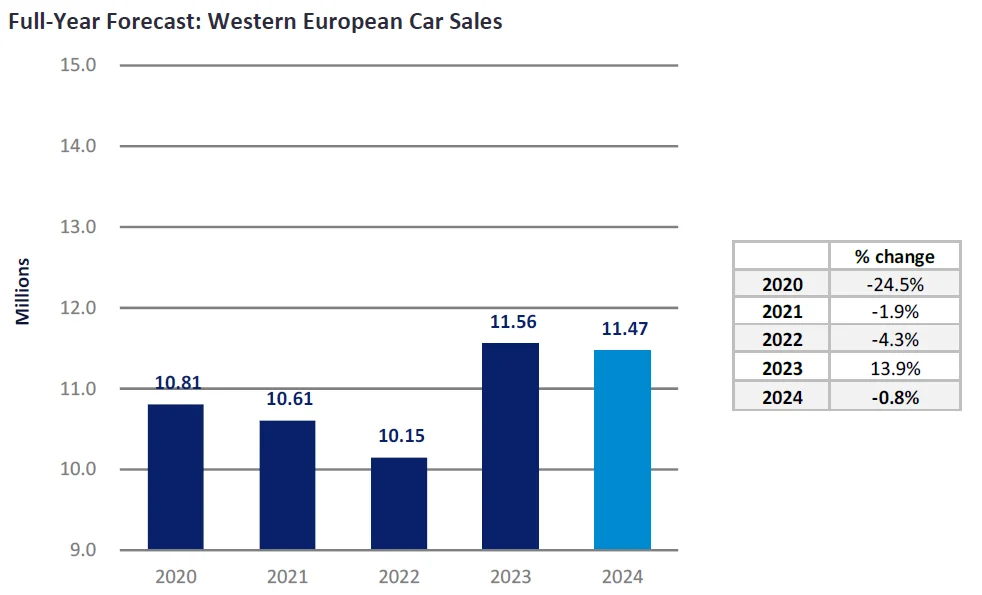

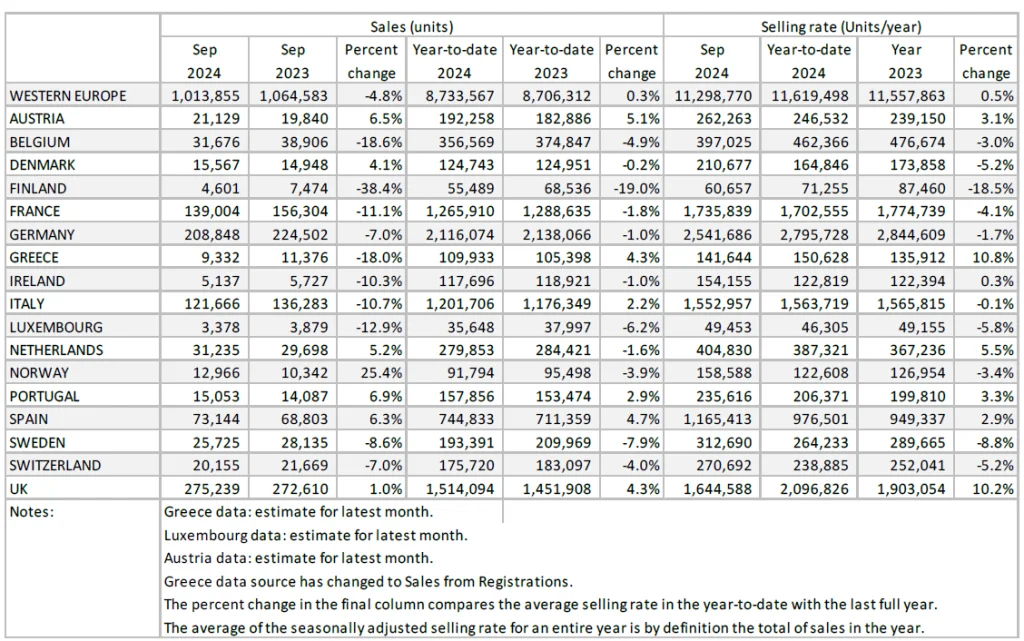

Year-to-date (YTD), the Western European car market is now flat on last year (+0.3%).

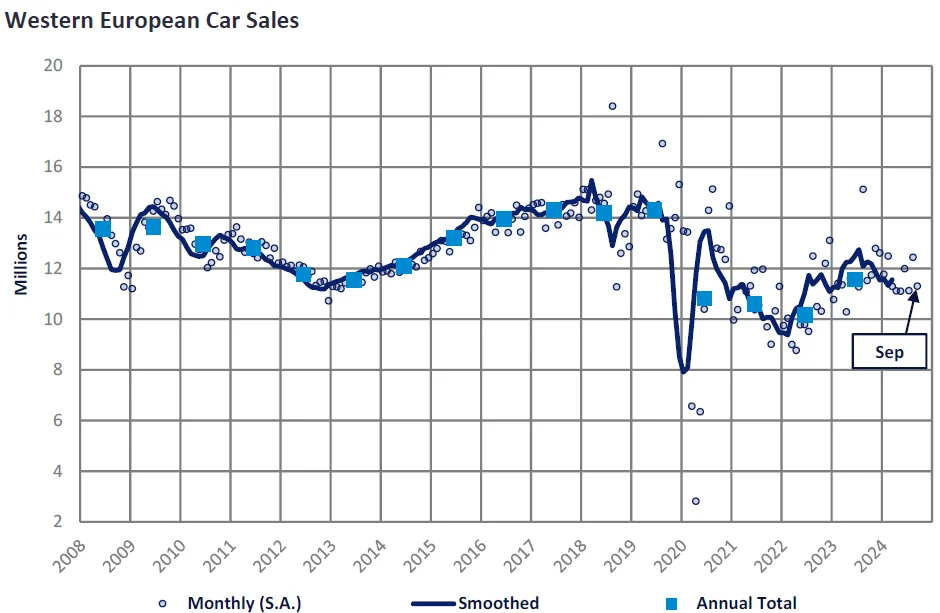

The Western Europe PV selling rate decreased to 11.3 million units/year in September, from well above 12 million units/year the previous month. In year-on-year (YoY) terms, sales volumes were down 4.8% — September 2023 being a relatively strong base for comparison as improved supply supported the fulfilment of backlogged orders. Sales in Germany remained disappointing as consumer confidence struggles. In what is a seasonally strong month for the UK, the selling rate fell back from recent levels, though YoY growth was in positive territory.

Year-to-date (YTD), the Western European market is now flat in comparison to last year (+0.3%). The big picture within the industry remains the same. Strong vehicle pricing, high interest rates, and a lack of incentives, continue to restrict sales. Some improvement is expected moving in 2025 as monetary policy easing supports broad economic expansion.

Commentary

The PV selling rate for Western Europe fell to 11.3 mn units/year in September. Our outlook for the full year remains subdued, and these incoming figures cement our expectation that the market will not pass 2023’s result. We continue to assume improved market activity in 2025 as the economy picks up, and a more favourable vehicle pricing evolution for consumers. Geopolitical issues, as well as political and economic uncertainty, provide downside risk.

The German PV market registered 209k units in September, a 7% decline YoY. The selling rate fell further by 6% MoM to 2.54 million units. Year-to-date sales are now 2.1 million units. Weaker consumer confidence, a staggering economy and a lack of incentives currently continue to have negative effects on the automotive market. Italy’s PV market fell again in September as new car registrations were down 10.7% YoY to 122k units. The selling rate fell by 11% MoM to 1.55 million units. The broader economic challenges in Italy, coupled with difficulties in production, further contributed to the downturn in car sales. The French PV market declined 11.1% YoY to 139k units. The selling rate remained broadly flat at 1.74 million units/year. This is the fifth consecutive month that PV sales have fallen in France in comparison to last year. A lack of subsidies and political uncertainty, especially regarding the fiscal deficit, continue to dampen consumer confidence.

The UK PV market registered 275k units September, a 1% increase YoY. The new number plate number month of September is traditionally a bumper month along with March. This was the best performance since 2020; however, was still nearly 20% lower than pre-Covid September 2019. Private consumer demand fell, while fleet purchases continued growth seen in previous months. YTD sales have reached 1.51 million units, a 4.3% increase YoY. Private BEV demand remains down YTD and highlights concerns regarding the future mandated targets. The Spanish PV market registered 73k units in September, a 6.3% increase YoY. Additionally, the selling rate increased by 23% MoM to 1.17 million units/year. Year-to-date sales are now 745k units, a 4.7% increase YoY. The increase in registrations this month saw car rental companies as the main driver of this growth. Despite this, the private channel has performed well.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.