The F1 2024 season concluded with the Abu Dhabi Grand Prix, where Norris crossed the finish line first, securing the team championship for McLaren.

After 26 years, McLaren lifted the trophy once more.

However, fate seems to mix a touch of bitterness with joy. While the racing division basks in victory, McLaren’s automotive business faces challenges, leading to another change in ownership—

Abu Dhabi’s CYVN Holdings and Bahrain’s sovereign wealth fund, Mumtalakat, have reached an agreement. CYVN will acquire McLaren’s automotive business and a non-controlling stake in McLaren’s racing division.

Before this milestone, CYVN and Mumtalakat began discussions about a partnership back in October 2024. CYVN claims that beyond financial support, they can bring advanced engineering technology to McLaren, especially in the electric vehicle sector.

Interestingly, CYVN is currently NIO’s largest shareholder, having invested $3.3 billion in 2023, acquiring a 20.1% stake. Through collaboration with CYVN, NIO successfully entered the Middle East and North Africa markets. Additionally, both parties plan to establish a high-end R&D center in Abu Dhabi focused on smart driving and AI.

On one side is the symbol of electric power, and on the other, the legacy of ultra-luxury sports cars. The “oil barons” are making strategic moves.

McLaren: A Legacy of Wealth

McLaren is a legendary brand, but for a long time, their focus wasn’t on making money. For them, racing seemed to be the only serious business.

This mindset was set by the founder, Bruce McLaren, who was not only an outstanding engineer but also an exceptional racer. Like Lotus, McLaren’s team achieved remarkable success in F1 from the 1960s to the 1970s, creating the legendary figure Ayrton Senna.

Despite McLaren’s immense success in racing, they were slow to mass-produce civilian cars—until 2011.

That year marked a significant moment for McLaren as it became an independent supercar manufacturer, with its first creation being the McLaren MP4-12C, incorporating numerous F1 technologies.

As a crucial model for McLaren’s return to the civilian car market, the MP4-12C featured rare carbon fiber monocoque technology for its price range and offered good value. Yes, the term “value for money” can also be found in the ultra-luxury brand segment. Compared to competitors like the Ferrari 458 and Lamborghini LP570-4, the MP4-12C had a lower starting price—around $463,000.

Over three years, McLaren produced approximately 3,500 MP4-12Cs, enhancing the brand’s market recognition and providing essential financial support for the development and production of subsequent models.

McLaren is not a publicly traded company, so its financial data is not very detailed. However, according to official McLaren data, the MP4-12C brought McLaren three consecutive years of profitability after its release. In 2015, McLaren’s revenue reached £450 million, and based on the price-to-sales ratio, McLaren’s valuation at that time was £1.65 billion.

Having tasted commercial success, McLaren wanted to create another car like the MP4-12C. Thus, in 2015, the McLaren 570S was born.

The McLaren 570S can be seen as the successor to the MP4-12C. This new car offers even better value for money, with a starting price of around RMB 2.55 million in China. In terms of performance, the new car is also superior.

More importantly, the McLaren 570S adopted a new family design style, inheriting the iconic crescent-shaped front and rear light clusters from the flagship P1 model, making it a “mini P1.” Who wouldn’t love getting more for less?

Sometimes, repeating a design isn’t a bad thing. Customers indeed responded well, and the 570S, along with the subsequent 720S, significantly boosted McLaren’s global sales, especially in the Chinese market, where sales increased by 122.5% year-over-year.

McLaren’s upward momentum continued until 2019. That year, McLaren delivered 4,806 new cars worldwide, a 43.9% increase year-over-year, setting a new record. Meanwhile, although the McLaren F1 team was still at a relatively low level, its revenue in the first half of the year also increased by 9.2%, reaching approximately $92 million.

On the surface, things looked good, but McLaren’s financial records had already sown the seeds of trouble.

Cash-Strapped McLaren: Selling Property, Cars, and Making SUVs

Unlike other supercar brands, McLaren does not have the financial backing of a large automotive group, such as Ferrari with Fiat or Lamborghini with Volkswagen. Going it alone means lower risk resistance.

At the end of 2019, the pandemic broke out, and McLaren, without a safety net, quickly fell into trouble. Affected by supply chain issues, McLaren sold only 307 cars in the first quarter of 2020, compared to 953 in the same period in 2019; the company’s revenue also plummeted from £284 million to £109 million.

McLaren responded quickly, announcing the layoff of 1,200 people, about 25% of its total workforce. Additionally, their F1 team cut 70 related jobs.

“Due to the delayed start of the Formula 1 season, resulting in reduced bonuses, the racing department’s revenue decreased by £4.4 million compared to the first quarter of 2019,” McLaren revealed in a press release at the time. Data shows that in 2020, the McLaren F1 team’s revenue accounted for only 10.9% of McLaren Group’s total revenue.

In the main business of car sales, both the 570S and 720S were entering the final stages of their life cycles. The former was already lagging behind contemporaries like the Ferrari F8 Tributo and Lamborghini Huracán in performance, while the latter was directly discontinued due to supply chain issues, with no successor model in sight.

With the racing department not making money and car sales losing money, what could be done?

McLaren first turned to its home country. As a proud British company facing financial difficulties, it applied for a £150 million loan from the UK government. The government, however, was skeptical and concerned about the potential inability to recover the funds. Ultimately, the loan was not approved, prompting McLaren to look to its major shareholder, Bahrain’s Mumtalakat Holding Company.

In July 2020, McLaren announced it had secured a £150 million loan from the National Bank of Bahrain (NBB). This loan was primarily internal financial support from its major shareholder, Mumtalakat, which holds a 56% stake in McLaren and a 44.06% stake in the National Bank of Bahrain.

Moreover, with the funds in hand, McLaren made a surprising move—selling its building.

In September 2020, then-CEO of McLaren, Zak Brown, confirmed that the McLaren Group would sell its iconic Technology Centre (MTC) in Woking, UK, for £170 million and continue to use it through a long-term leaseback arrangement. Brown viewed this as a necessary financial restructuring measure.

“Most companies in the world do not actually own the real estate they lease. We have a lot of cash tied up in that building, which is not a very efficient use of funds.”

Alongside selling the building, McLaren also sold some classic cars housed within it to shareholders, raising an additional £100 million in liquidity.

After selling its headquarters and classic cars, McLaren managed to stabilize its situation temporarily. They then turned their attention to the next issue: the development of successor models to the 520S and 720S had been delayed for a long time due to financial constraints.

While money can be borrowed, catching up on the lost development time during the borrowing period would require even more funds, which McLaren no longer had.

Finally, after a year’s delay, McLaren officially launched the successor to the 520S, the Artura, in 2021—a supercar that lagged behind its contemporaries in several aspects.

In 2022, former Ferrari Chief Technology Officer Michael Leiters took over as CEO of McLaren Automotive. Upon taking office, he candidly stated that the company had launched “immature products” before his tenure. To turn things around, Leiters proposed two solutions. First, he drew on his experience at Ferrari—reducing production.

Despite McLaren’s global sales reaching only 2,137 units in 2023, Leiters still believed further production cuts were necessary to maintain high residual values for the vehicles. He noted that Ferrari had achieved good market performance through this strategy.

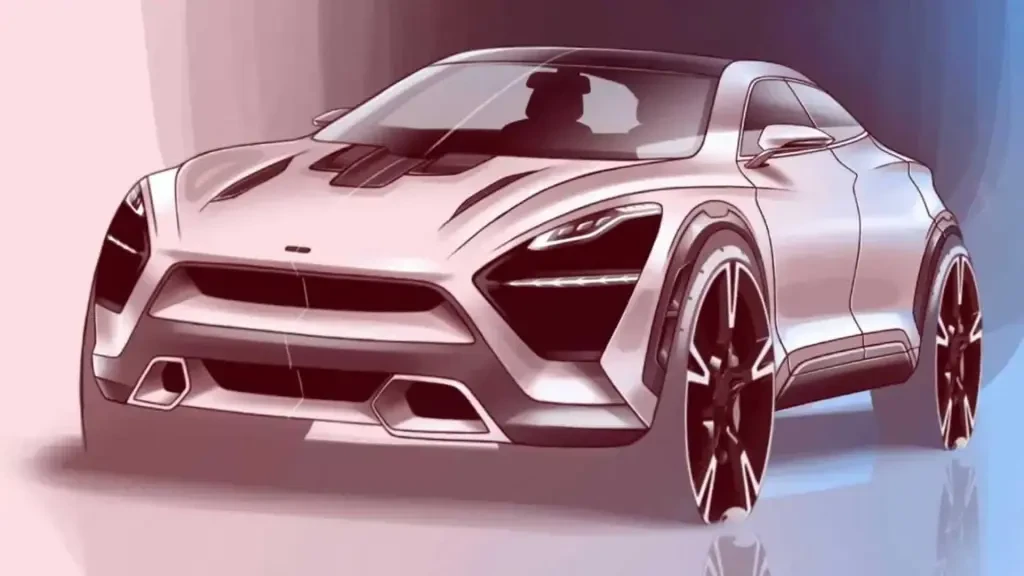

The other solution he brought from Ferrari was to expand the product lineup, specifically by manufacturing SUVs.

Interestingly, Ferrari’s Purosangue was completed under Leiters’ leadership, and before joining Ferrari, he was responsible for project management of the Porsche Cayenne. It seems that manufacturing SUVs is a viable path for supercar manufacturers.

In June 2024, Leiters stated in an interview that McLaren’s SUV would be a performance model, likely featuring a plug-in hybrid system. He also mentioned that McLaren might seek technical collaboration in developing this SUV. McLaren’s Global Communications Director, Piers Scott, has also suggested, “BMW might be an option.”

In fact, McLaren has frequently used BMW’s power systems over the years. For example, the McLaren F1 supercar from the last century used a BMW-designed 6.1L V12 engine, and the current Artura supercar uses a power battery provided by BMW.

Moreover, unlike other ultra-luxury brands that hesitate in the electrification field, McLaren, under Leiters’ leadership, has shown great interest in electrification. Entering the electric ultra-luxury sector might be the reason why “oil tycoons” bought McLaren.

Source from ifanr

Disclaimer: The information set forth above is provided by ifanr.com, independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.