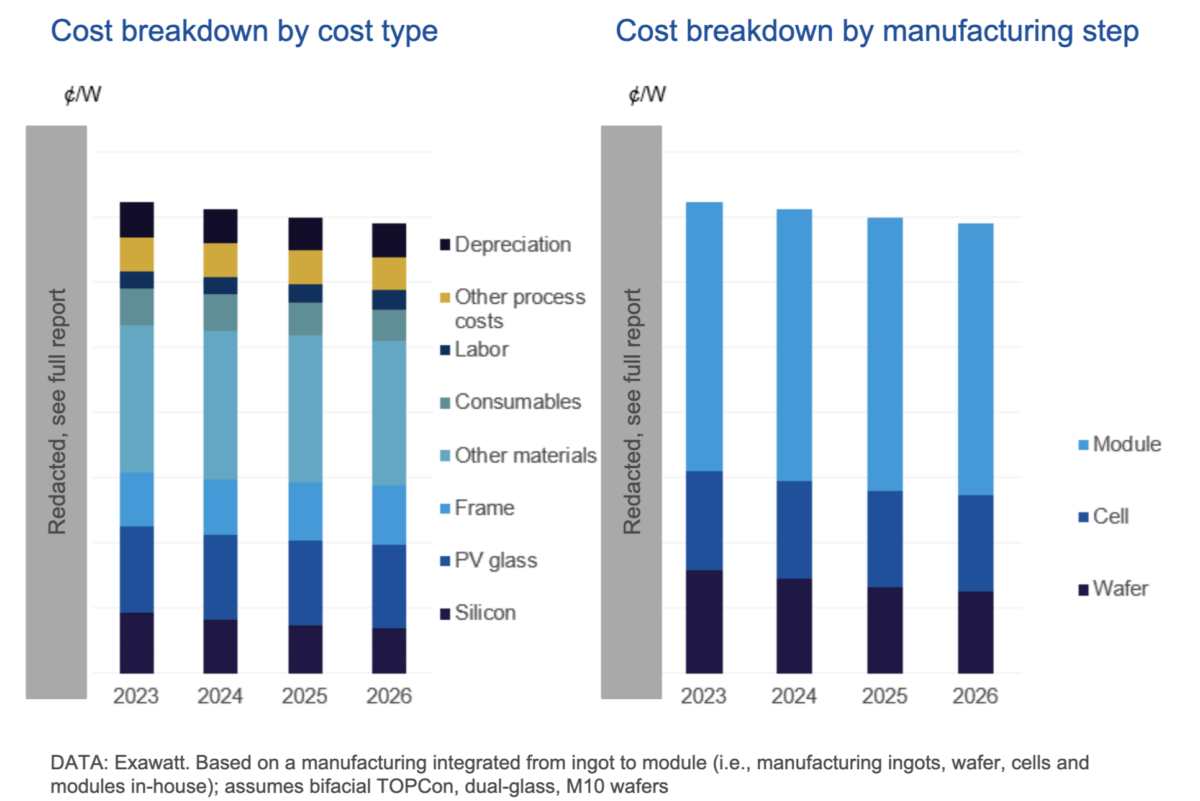

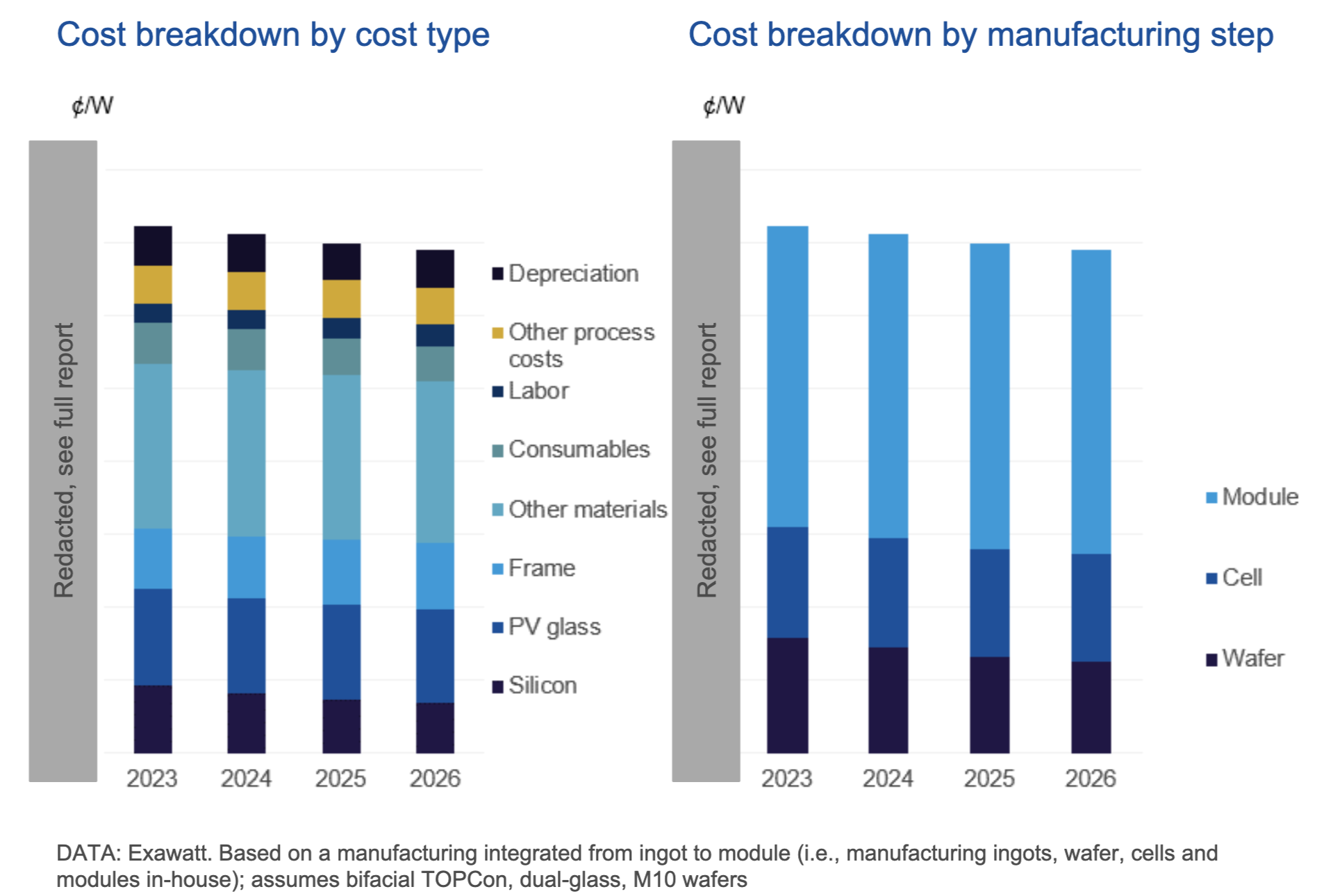

PV manufacturing analysis is revealing that module prices can not “sustainably” fall significantly in 2024 without producers selling below cost. UK-based analysts Exawatt delivered the development last week, in a trend observed by Australian market participants.

With a global PV oversupply cycle in full swing and price declines of more than 40% having rocked the market in 2023, it appears likely that significant reductions should not be expected to continue this year. Solar manufacturing advisory Exawatt reported that while inventory levels remain high, further cost reductions would likely represent manufacturers selling below cost.

Exawatt presented some of its price and cost analysis in a webinar last week. During the event, the head of PV for Exawatt, Alex Barrows, said that there remains little scope for significant cost reductions from solar module manufacturers in the near term.

“Our fundamental cost modelling allows us to look at where ‘sustainable pricing’ can go. In the near term it looks like spot prices have largely stabilised. Potential oversupply could push prices down even further, but ‘sustainable’ cost reductions in the medium term look fairly difficult,” said Barrows.

The Exawatt analyst noted that with materials and consumables comprising approximately 80% of PV module production cost, there is little room for further cost reduction in the short term. As such, prices will have to stabilise if manufacturers are to avoid selling at a loss.

Barrows observed that prices for polysilicon, the primary raw material in crystalline silicon module production, are relatively close to the cost of production at present. He said with prices at USD7.5kg for the polysilicon used for p-type ingot and wafer production and USD9 for poly used for n-type – and production costs averaging USD6.5/kg, there is little headroom for further declines.

“There’s a little bit of room for further cost reductions but not much,” said Barrows.

Rami Fedda, the co-founder of wholesaler of Solar Juice, noted that polysilicon prices have turned a corner – after a period of massive declines. Fedda said that poly prices had increased “for the first time in many months. This is usually the first sign of where panel prices are heading.”

Fedda made the call in Solar Juice’s first video news update for the year, posted today, in which he predicted module prices would stabilize in the second quarter of 2024. He added that the annual production shutdown in China over the Lunar New Year of two weeks, might be extended to three to four weeks, given the oversupply market dynamic.

While module buyers very well may welcome cheaper modules being available, Exawatt’s Barrows warned that distressed manufacturers may sacrifice quality in an attempt to cut costs.

“If you’re a module buyer, one of the key things to look out for is that module suppliers will be at risk of exiting the market this year. And they will be under a lot of pressure to cut costs by reducing the quality of materials they are using – backsheets, encapsulants, junction boxes.

“Low cost [could mean] potentially lower quality options,” Barrows warned.

The Exawatt team hosted the webinar last week to promote its subscriber Solar Technology and Cost Service, that it delivers along with quality assurance providers PVEL. Exawatt was acquired by commodity business intelligence provider CRU in April 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.