Both potential buyers and original equipment manufacturers (OEMs) have encountered obstacles that have hindered the widespread adoption of BEVs.

The global battery electric vehicle (BEV) market has faced numerous challenges, and Europe is no exception. Both potential buyers and original equipment manufacturers (OEMs) have encountered obstacles that have hindered the widespread adoption of BEVs. On the consumer side, high prices, rising interest rates, and uncertainties surrounding battery technology have made internal combustion engine (ICE) vehicles more appealing. Affordable gasoline prices, insufficient BEV charging infrastructure, and a wider range of ICE models to choose from further complicate the situation. Perhaps most importantly, at the core of these issues lies the pricing of BEVs.

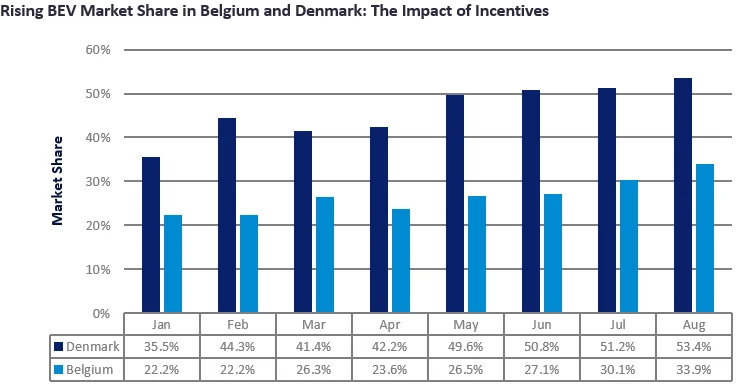

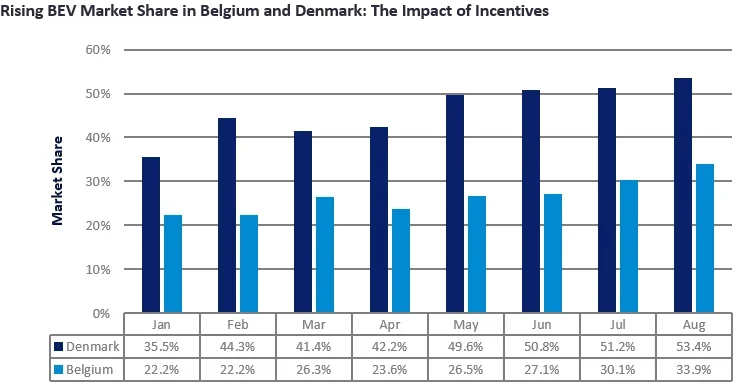

In a stagnant 2024 market, it has become increasingly evident that effective incentives are crucial for the successful performance of the BEV market in Europe. The contrast between countries that have implemented incentives and those that have not is stark. Here, we explore the successes and failures of various European countries in promoting BEV adoption.

Success Stories

Norway: The Model of Electrification

Norway leads the world in BEV adoption, with an impressive 94% of new passenger cars registered in October 2024 being electric. The Norwegian government’s tax policies favour BEVs, exempting them, if they are priced below NOK500,000 (EUR44,000), from the 25% VAT applicable to car sales. Additionally, Norway has invested heavily in EV charging infrastructure and allows EVs to use special lanes, further incentivising their adoption.

Denmark: Heavy Investment in EV Incentives

Denmark’s government has made significant investments in EV incentives and infrastructure, yielding excellent results in 2024 that continue to improve throughout the year. Currently, there is a tax-free allowance on electric vehicles that will be kept in place for 2024 and 2025. In October, battery electric vehicles improved their market share to 62%. Municipalities are also introducing zero-emission zones, which are expected to boost sales further.

Belgium: Regional Bonuses Drive Adoption

Belgium has seen a surge in BEV registrations, particularly in Flanders, where 78% of the 64,404 new battery electric cars registered in the first half of 2024 were recorded. This success is partly due to the many leasing companies in the region and the regional bonus awarded to individuals who register a 100% electric car worth a maximum of EUR40,000. The increase in registrations by Flemish individuals in 2024 is 157% compared to the first half of 2023.

Struggling Markets

Germany: A Decline in BEV Registrations

Germany has experienced a significant drop in BEV registrations, with a notable 37% decrease in July 2024. The reduction in government financial incentives for BEV purchases has made these vehicles too expensive for many buyers. While the government improved tax write-offs in the 2025 Budget for company cars, including models priced up to EUR95,000, this measure primarily benefits luxury carmakers and does not address the broader market.

Sweden: The Need for Policy Instruments

Sweden’s BEV sales have declined by 18% so far in 2024. The removal of the climate bonus has contributed to higher prices, which is the main reason consumers are postponing the switch to electric cars. Although the charging infrastructure is less of a concern, adequate charging infrastructure for those in residential buildings still poses problems. The results seen in 2024 indicate that policy instruments and incentives are needed to rejuvenate the vehicle fleet.

Ireland: A Crucial Stage for the BEV Transition

In Ireland, BEV sales were down 25% year-to-date to October 2024 and have declined for nine consecutive months. The government needs to signal the importance of BEVs to consumers. Budget 2025 introduces new incentives, including a BIK (benefit in kind) relief of EUR45,000 for employees choosing electric company vehicles and a BIK exemption for home EV chargers.

Netherlands: High Purchase Prices Hinder Adoption

In the Netherlands, the high purchase price of electric cars remains a significant barrier, with 71% of people finding them too expensive. Although there was growth in the market share of electric cars earlier in the year, sales have levelled off due to fiscal uncertainty and a lack of future policy for BEV use.

Outlook

Looking ahead, the introduction of affordable BEV models in 2025 is set to play a pivotal role in the market dynamics. According to GlobalData, all carmakers plan to launch new models to meet the 2025 targets, including many new mass-market models from segments A to C. Among these, seven affordable models with prices starting below €25,000 are expected to be available in 2025 and will be crucial for carmakers’ CO2 compliance. GlobalData expects these affordable models to account for a growing proportion of total BEV sales. The vast majority of these models will come from Renault and Stellantis, as both will have several affordable models available in 2025.

Moreover, these affordable BEV models are in high demand. The European Commission has published a survey via its European Alternative Fuels Observatory (EAFO) portal showing that 57% of respondents would like to buy an electric car, but the cost of BEVs is seen as the main barrier. Across Europe, we expect to see an improvement in BEV sales in 2025 as cheaper models are released by OEMs. This should support markets where sales are struggling, such as Sweden and Germany.

Conclusion

The comparison between countries with and without BEV incentives highlights the critical role of government support in driving their adoption. Norway, Denmark, and Belgium have demonstrated that well-implemented incentives and infrastructure investments can lead to significant increases in BEV sales. In contrast, Germany, Sweden, Ireland, and the Netherlands illustrate the challenges faced when incentives are reduced or absent. As Europe continues its transition to electric mobility, the importance of effective incentives cannot be overstated.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.