Whenever a buyer or seller wishes to move their goods internationally they will need to find the right freight forwarder to handle the move for them, under the terms and conditions that suit them best.

There are many stages in the shipping process from pick up at origin to delivery at destination, and it is important for all parties to be totally clear on where responsibilities lie at each stage of the shipping process. This article will explain all of the terms of trade defined for shipping to show where responsibilities lie in each case, so that buyers and sellers can be clear on their obligations when arranging shipments.

Table of Contents

What are the Incoterms® 2020 terms of trade?

What is not covered by the Incoterms® terms of trade?

Incoterms explained in detail

Key points to remember

What are the Incoterms® 2020 terms of trade?

The terms of trade used for international shipping transactions are defined by the International Chamber of Commerce (ICC) and set out the responsibilities of buyers and sellers for the sale of goods in international transactions.

According to the ICC, Incoterms® were established in response to the needs of international trade. With different practices around the world, and different legal interpretations of responsibilities, there was a desperate need for a common set of rules and guidelines. The Incoterms rules are global and common to all countries. The ICC defined international commercial terms, Incoterms, clarify the tasks, costs, and risks to be carried by buyers and sellers throughout these transactions.

The ICC defined international commercial terms, Incoterms, clarify the tasks, costs, and risks to be carried by buyers and sellers throughout these transactions.

Is there an Incoterms 2023 update?

The Incoterms® 2020 are the latest updates of these rules, which are grouped into two categories of international trade terms that are used in the shipping industry. Most of the terms apply to the industry in general, while some apply only to the ocean shipping industry.

All Incoterms explained

There are seven for all mode(s) of transport, and four specifically for sea or inland waterway transport. The Incoterms® 2020 rules are slightly different from previously used terms. This newly consolidated set of terms is shown here.

Note: where a term says (insert place of delivery) this means that a shipping contract will define the terms and the destination within that term. These are explained further here.

- EXW Incoterm – Ex Works (insert place of delivery)

- FCA Incoterm – Free Carrier (insert named place of delivery)

- CPT Incoterm – Carriage Paid to (insert place of destination)

- CIP Incoterm – Carriage and Insurance Paid To (insert place of destination)

- DAP Incoterm – Delivered at Place (insert named place of destination)

- DPU Incoterm – Delivered at Place Unloaded (insert of place of destination)

- DDP Incoterm – Delivered Duty Paid (insert place of destination)

There are four Incoterms® 2020 rules intended specifically for Sea and Inland Waterway Transport:

- FAS Incoterm – Free Alongside Ship (insert name of port of loading)

- FOB Incoterm – Free on Board (insert named port of loading)

- CFR Incoterm – Cost and Freight (insert named port of destination)

- CIF Incoterm – Cost Insurance and Freight (insert named port of destination)

Each term carries specific responsibilities for both the buyer and the seller of the goods.

In all contracts between the buyer and the seller, the seller agrees to provide the goods as stated in the sales contract. The buyer agrees to pay the price as provided for in the contract of sale. The terms will then outline such details as: who arranges and pays for pick up, export documentation, shipping, insurance, customs clearance and handling charges, local delivery, and who pays applicable duties and local taxes.

The terms of trade have a direct impact on the amount of duty and local taxes paid, so when clearing the shipment through customs it is essential that the terms of trade are declared for the correct duties and taxes to be applied.

In general the terms of trade describe the moment that the responsibility for the goods passes from the seller to the buyer.

What is not covered by the Incoterms® terms of trade?

Incoterms clarify the responsibilities of all parties to a sales transaction. As noted above, Incoterms would normally be incorporated in the contract of sale. However:

- they do not address all the conditions of sale

- they do not detail the goods being sold, nor show contract price

- they do not make reference to the payment details as negotiated between the seller or buyer

- they do not state at what point ownership of the goods passes from the seller to the buyer

- they do not specify which documents must be provided to the buyer, by the seller, to facilitate customs clearance processes at destination

- they do not address liabilities for any failure to provide the goods as defined in the contract of sale, nor dispute resolution mechanisms

Incoterms explained in detail

This section looks more closely at each of the Incoterms and clarifies where the responsibilities lie in each case. Some of the terms are similar enough to be covered together, as they differ mainly by the type of carrier rather than in the terms themselves. This section covers the following terms.

• Ex Works

• Free Carrier (also Free Alongside Ship and Free on Board)

• Carriage Paid To… (also Cost and Freight)

• Carriage and Insurance Paid To… (also Cost, Insurance and Freight)

• Delivered at Place, Delivered at Place Unloaded

• Delivered Duty Paid

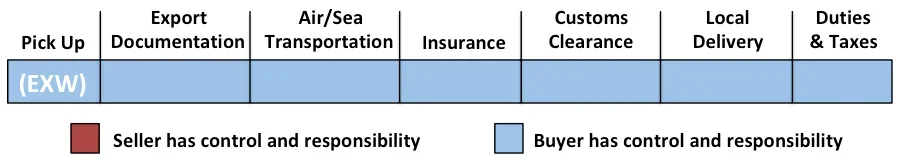

Ex Works

Ex Works is a term of trade meaning that the buyer pays the transport charges from the seller’s factory to the destination. These terms therefore represent the minimum obligation for the seller.

These terms should not be used when the buyer does not have the ability to undertake the export formalities. In such circumstances, the Free Carrier (FCA) terms should be used.

The buyer, not the seller, is responsible for pick-up. The seller must simply place the goods at the disposal of the buyer at the named place of pick-up on the date or within the period stipulated.

The buyer bears all the costs and risks that are involved in transporting the goods from the seller’s premises to the desired destination.

The buyer must obtain, at his own expense, any import license or other official authorisation and undertake all customs formalities for the importation of the goods and, where necessary, for their transit through another country.

The buyer is responsible for paying all customs duty and taxes.

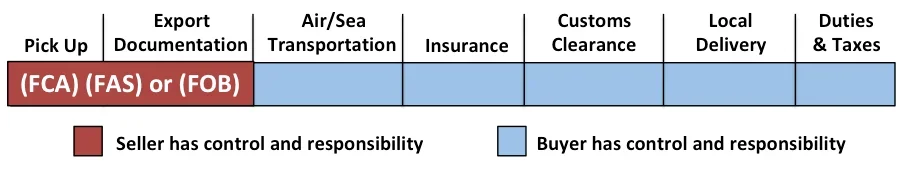

Free Carrier, Free Alongside Ship or Free on Board

Free Carrier (FCA) means that the seller fulfills his obligation when he has handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the named port. This means that the seller is responsible for all export documentation: Commercial Invoice, Bill of Lading and Certificate of Origin (if required).

You may also hear the terms “Free on Board” (FOB) and “Free Alongside Ship” to describe this process. By strict definition, according to Incoterms®, FOB and FAS can only be used for sea or inland waterway transport. When sea freight is not a practical alternative, the FCA term is the correct term, although FOB is the term most frequently used to describe this process, whether by land, sea, rail or air transport modes.

There are slight differences between the three, as FCA and FAS do not require the seller to load the goods onto the ship (or aircraft). FOB requires the seller, not the buyer, to load the goods onto the ship.

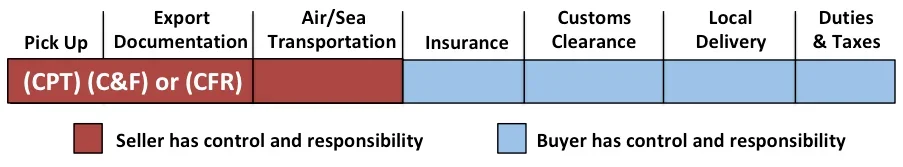

Carriage Paid To, or Cost and Freight

Carriage Paid To…(CPT) states that the cost of the goods, pick up and delivery to port, export clearance, and the ocean or air freight to the named overseas port of import, are the responsibility of the seller. Under these terms, the seller declares the price for the goods, including the cost of transportation, to the named point of disembarkation.

The cost of insurance is left to the buyer’s account, although it should reflect the cost of goods as stated. The buyer must obtain any import license or other official authorisation. He must carry out all custom formalities for the importation of the goods. He is responsible for any transport through to another country, and for delivery duty and taxes.

You may also hear the term Cost and Freight (C&F or CFR). C&F is an older term. However, as with Free on Board (FOB), Incoterms defines these terms as applying only when sea and inland waterway transport are used. In reality, CFR is the most common term used across the industry to describe this process, for both air and ocean freight.

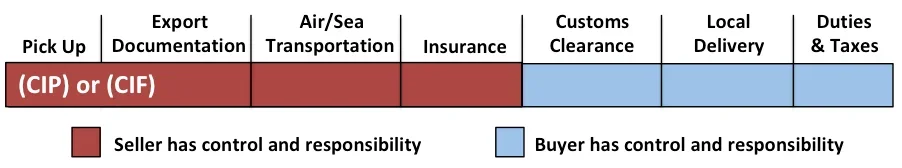

Carriage and Insurance Paid To, or Cost Insurance and Freight

Carriage and Insurance Paid To…(CIP) means that the seller has the same obligations as those under CPT with the additional responsibility that the seller has to procure cargo insurance against the buyer’s risk for loss of, or damage to, the goods during carriage. The seller takes out the insurance and pays the insurance premium.

The seller must obtain, at his own expense, cargo insurance as detailed in the sales agreement. The insurance must state that the buyer shall be entitled to claim directly from the insurer, and the buyer must be presented with the insurance policy or other evidence of insurance cover. The buyer should note that under the CIP terms the seller is only required to obtain insurance on minimum coverage (110% of the value of the shipment).

Cost, Insurance and Freight (CIF) is similar to CIP, however, as with Free on Board and Cost and Freight, Incoterms defines these terms as applying only when sea and inland waterway transport are used. Again, the reality is that the term CIF is more commonly used, whether air or ocean freight.

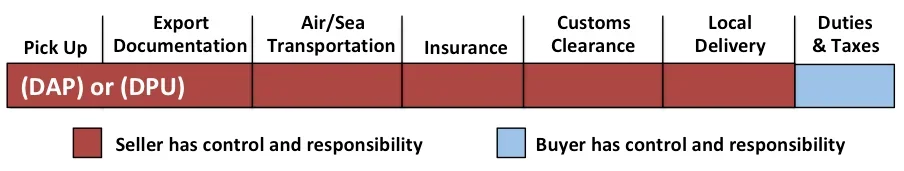

Delivered at Place, Delivered at Place Unloaded

Delivered at Place (DAP), or Delivered at Place Unloaded (DPU) define a complete origin-to-destination service, but with duties, taxes and other official import charges still to be paid. These terms replace the older term Delivered Duty Unpaid (DDU).

The seller has to bear the costs and risks involved in bringing the goods to destination (excluding duties, taxes and other official charges payable upon importation) as well as the costs and risks of carrying out customs formalities. The buyer is responsible for any duties or local taxes and takes responsibility for any delay in delivering due to his failure to pay these fees on time. DAP and DPU terms may be used irrespective of the mode of transport.

The seller fulfills his responsibilities to deliver when the goods have been delivered and made available at the named place, in the country of importation. In this case the term ‘available’ is important as DAP and DPU differ in meaning.

With DAP, the place is specified in the terms and could mean the buyer’s warehouse or another location, and the goods will remain unloaded (usually within a container) for the buyer to unload. That may require the buyer to use their own specialized equipment, such a crane or forklift.

With DPU, the seller is responsible for unloading and would therefore be the one to provide any unloading equipment.

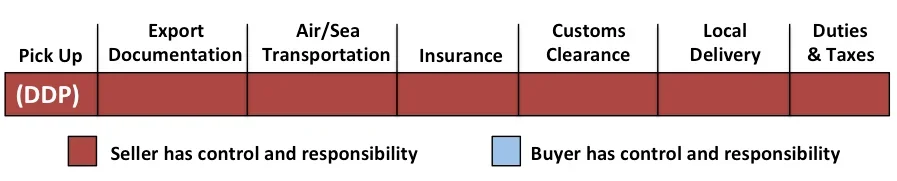

Delivered Duty Paid

Delivered Duty Paid (DDP) means that the seller fulfills his delivery obligations when the goods are presented in the named place in the country of importation. The seller has to bear the risks and costs, including duties, taxes and other charges of delivering the goods, fully cleared for import.

While Ex Works represent the minimum obligation for the seller, DDP represents the maximum obligation. Note that it may be agreed in the contract of sale that the buyer will pay for all goods, and after delivery reimburse the seller for any duties and taxes. In this way the seller manages the whole process, but recoups clearance charges later.

DDP was previously also known as Free In Store (FIS Incoterm) or Free Domicile, again meaning that all charges including clearance and delivery at destination are paid by the seller. These terms apply irrespective of the mode of transport.

Key points to remember

The ICC Incoterms® were established to define a common set of rules and guidelines for international trade. Although even today there are locally used terms of trade (for example, the US uses “Less Than Truckload” (LTL) for domestic trucking), the Incoterms rules are global and common to all countries. The Incoterms® rules were most recently updated in 2020 and thus Incoterms 2021, Incoterms 2022 and Incoterms 2023 remain unchanged.

A number of the terms relate to specific ocean freight situations, or specific types of shipment (such as heavy industrial equipment), where there are complications that need to be clarified in loading and unloading vessels.

However, the majority of shipments are smaller commercial items that may well be shipped in bulk, on pallets or full containers, and the logistics are more simple. In these cases, the responsibilities between seller and buyer are more straightforward, and one or other party will most likely cover the entire origin to destination shipment, with duty and taxes and perhaps local delivery the biggest points of negotiation.

For many buyers, they will want to enlist the services of a freight forwarder to advise on the best terms of trade, to manage the costs and details of shipping, and handle all documentation and customs clearance.

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.