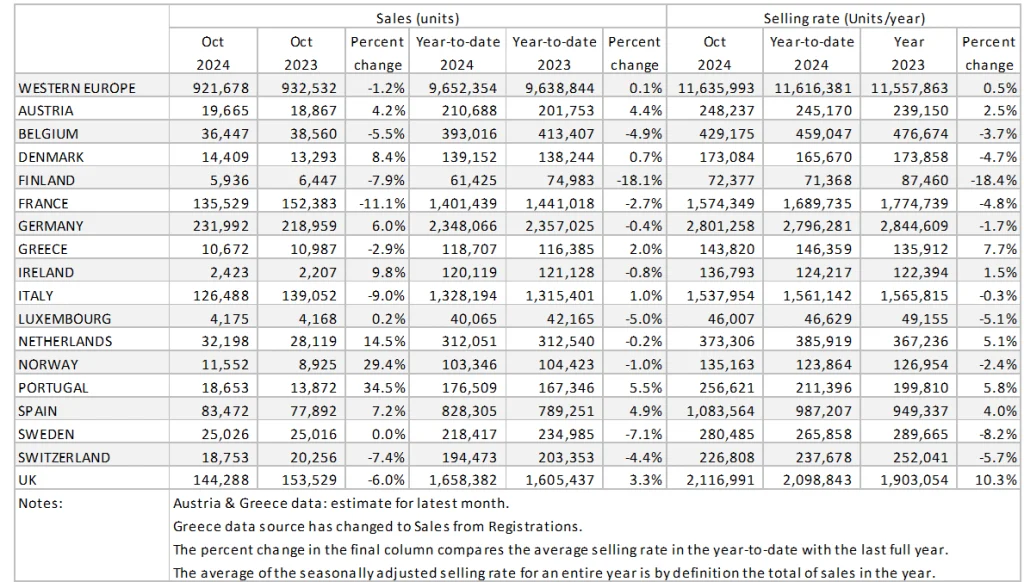

Year-to-date (YTD) sales remain broadly flat (+0.1%) in comparison to the previous year.

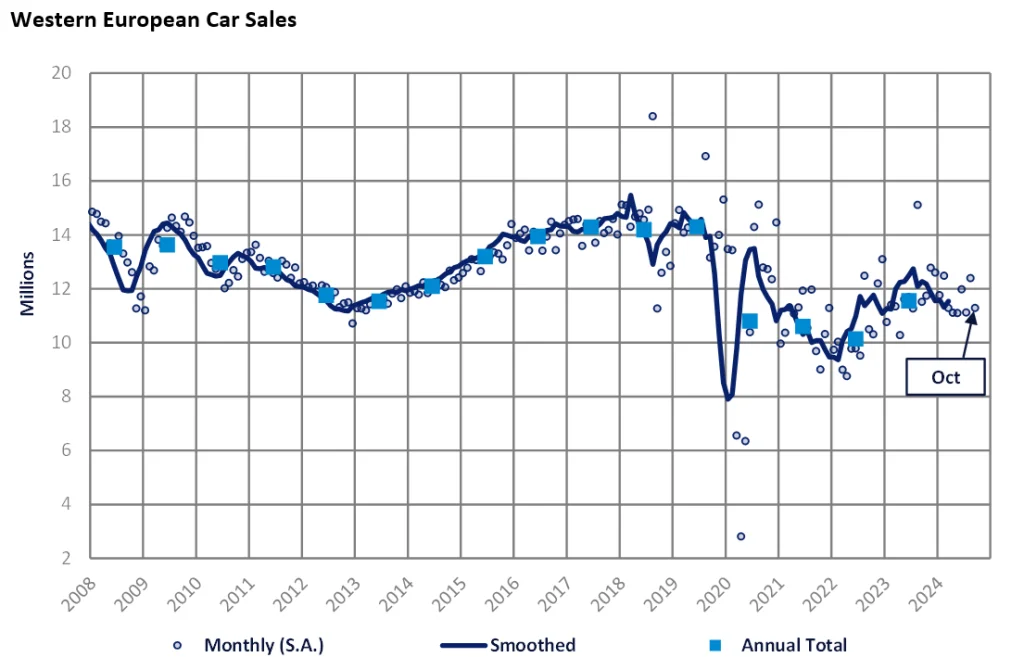

The Western Europe PV selling rate was 11.6 million units/year in October, a moderate improvement from September. In year-on-year (YoY) terms, sales volumes were slightly down (-1.2%). Germany and Spain saw positive results, while France, the UK, and Italy reported weaker YoY results.

Year-to-date (YTD) sales remain broadly flat (+0.1%) in comparison to the previous year. Ongoing economic and political challenges in the region are hindering consumer confidence, and new vehicle sales continue to struggle. While monetary policy easing and new model activity are expected to provide some relief in the market in 2025, the prevailing headwinds are likely to continue to act as a drag on vehicle sales.

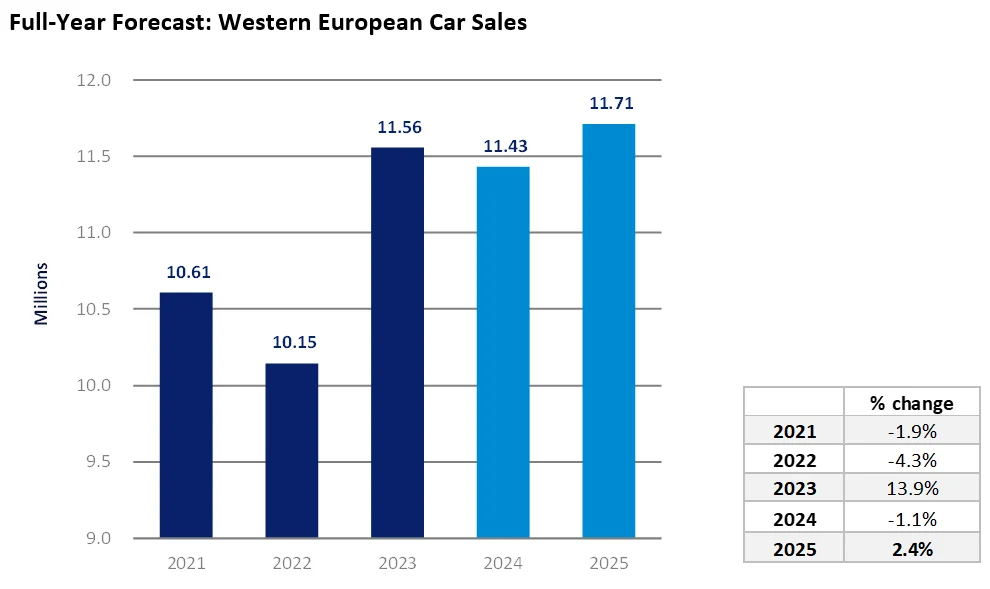

The PV selling rate for Western Europe improved to 11.6 million units/year in October though the evolution of YoY results over H2 has generally been unfavourable and we expect the 2024 market will fall short of 2023. We do anticipate a pick-up in market activity in 2025, supported by monetary easing measures that should boost the economy. Meanwhile, vehicle pricing should ease a little, helped by new models cranking up competition. However, ongoing geopolitical tensions, along with political and economic uncertainties, are expected to weigh on sales.

The German PV market registered 232k units in October, a 6% increase YoY. Furthermore, the selling rate improved MoM by 10%. YTD sales are now 2.35 millon units, down slightly by 0.4% YoY, though this is far from a strong base for comparison. Business registrations were the main driver of the positive result, up 10.8% YoY, whereas private new registrations recorded a decrease of 2.5% YoY. Italy’s PV market fell for a third consecutive month in October as new car registrations contracted 9% YoY to 127k units. The selling rate remained broadly flat at 1.54 million units. Higher energy costs have caused significant increases in the cost of production which has posed serious challenges to Italy’s supply chain. Furthermore, the broader economic challenges the country is facing such as high interest rates and broadly flat levels of private consumption have further contributed to the downturn in car sales.

The French PV market declined by 11.1% YoY to 135.5k units in October. The selling rate fell 9.3% MoM to 1.57 million units/year. This is now the sixth consecutive month that PV sales have fallen YoY. The absence of subsidies and ongoing political uncertainty, particularly concerning the fiscal deficit, continue to undermine consumer confidence. The UK PV market registered 144k units in October, a 6% decline YoY. The selling rate increased by 29% MoM to 2.1 millon units. YTD sales now stand at 1.66 million units, up 3.3% YoY. The Spanish PV market registered 83.5k units in October, a 7.2% increase YoY and a continuation of the trend of growth seen in September. YTD sales now stand at 828k units, a 4.9% increase compared to the same period last year. Purchases by individuals accounted for almost half of the sales volumes.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.