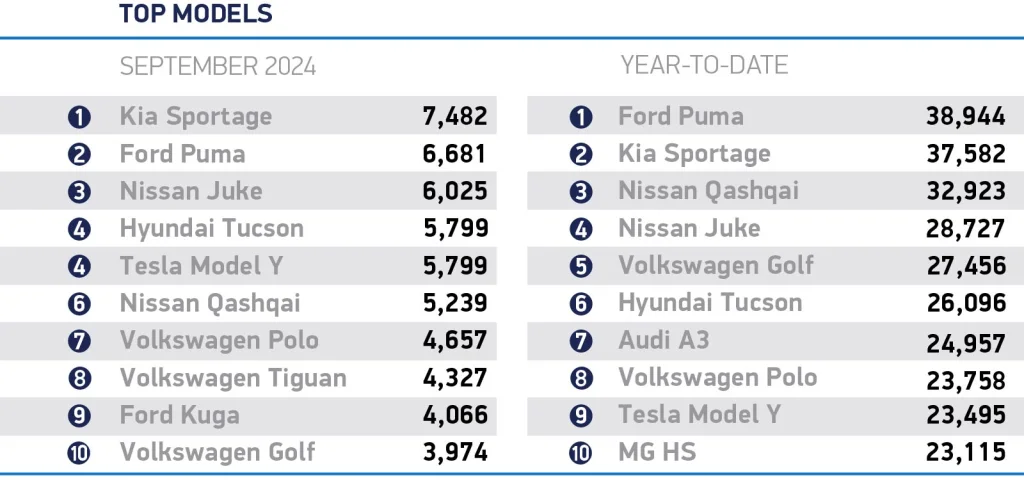

UK new car market up 1.0% in September as manufacturers looked to shift BEVs as zero emission mandate share target looms

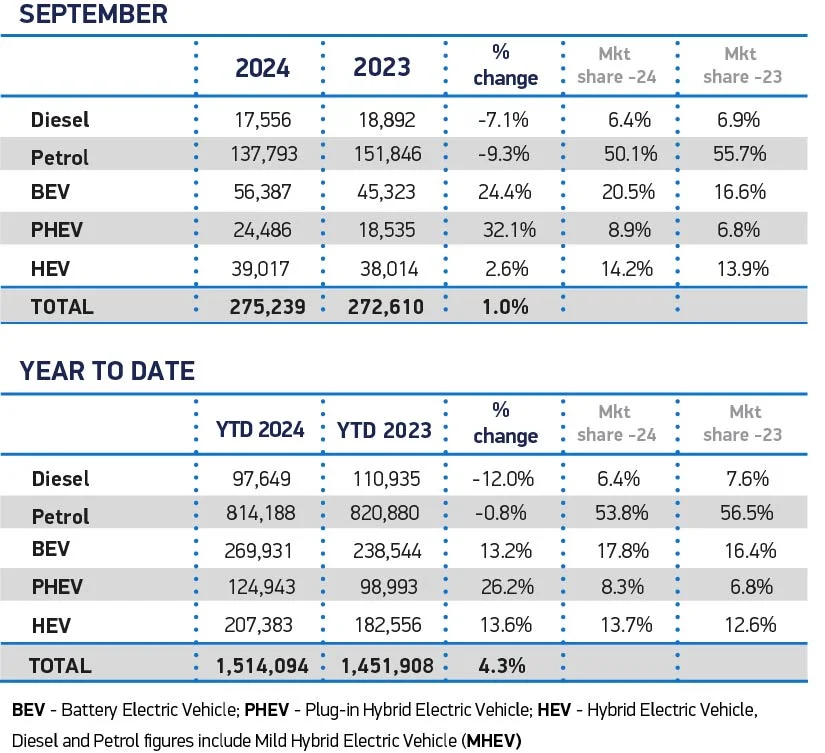

The UK new car market rose 1.0% in the key ‘74’ plate change month of September, to 275,239 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

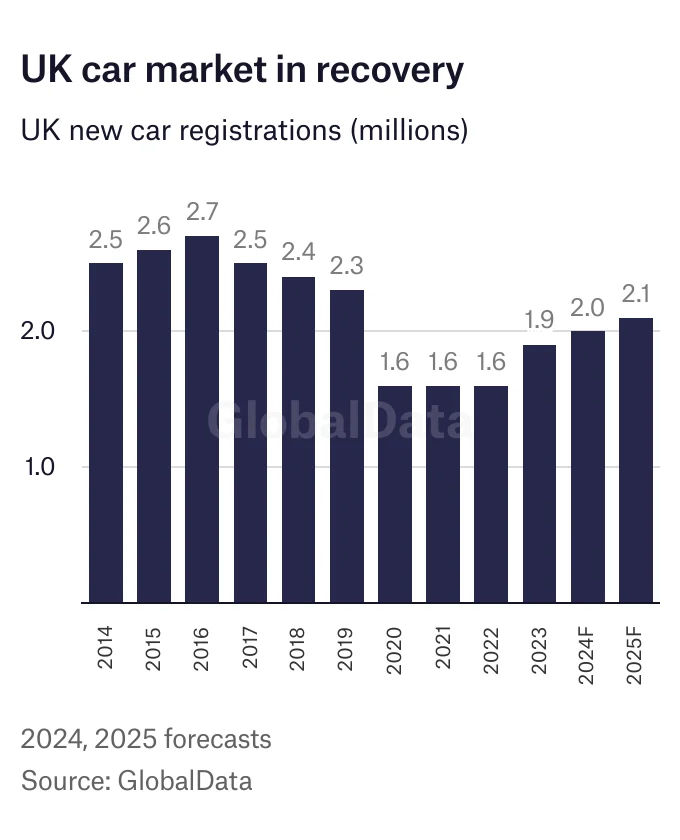

In what is traditionally a bumper month for new car registrations, second only to March, the performance was the best since 2020, but still almost a fifth off pre-Covid September 2019.

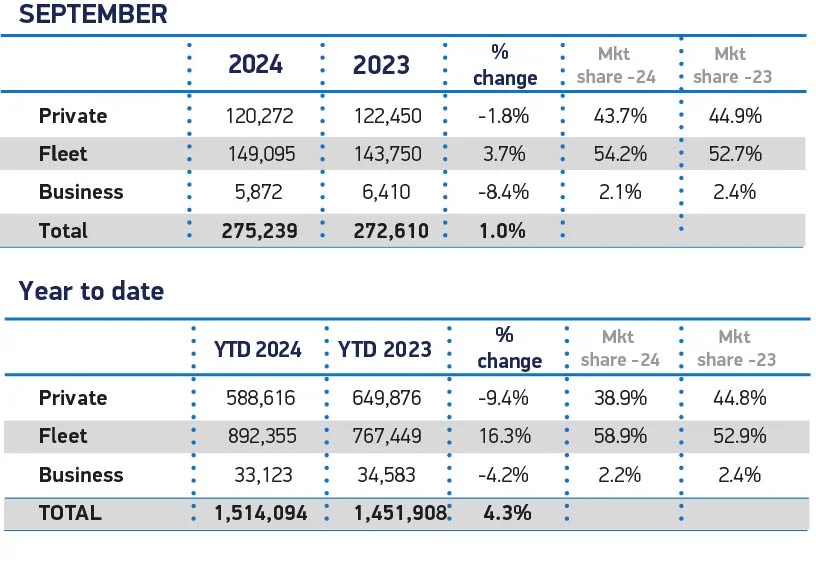

Growth was driven by fleet purchases, up 3.7% to 149,095 units and representing 54.2% of the overall market. Private consumer demand fell, by 1.8% to 120,272 units, accounting for 43.7% of registrations, while the smaller business sector saw volumes fall 8.4% to 5,872 units.

Uptake of plug-in hybrids (PHEV) grew faster than any other fuel type in the month, up 32.1% to take an 8.9% share of the market. Hybrid electric vehicle (HEV) registrations rose 2.6%, boosting market share to 14.2%, while petrol and diesel registrations declined by 9.3% and 7.1% respectively, although together they were still the choice of 56.4% of buyers in September.

Demand for battery electric vehicles (BEV) hit a new record volume for any month in September, up 24.4% to 56,387 units, achieving a 20.5% share of the overall market, up from 16.6% a year ago. This was not enough, however, to shift market share significantly, which edged up from 17.2% in the first eight months, to 17.8% from January- September. It is expected to reach 18.5% by the end of the year.

Fleets drove much of this growth, with deliveries rising 36.8% to account for more than three quarters (75.9%) of BEV registrations. Private BEV demand also rose, up 3.6% after unprecedented manufacturer discounting, but this was equivalent to just 410 additional registrations. Consumer demand for diesel grew at a faster rate, increasing 17.1% in September – a volume uplift of 1,367 units.

Year-to-date private BEV demand remains down 6.3% – underlining the scale of the challenge involved in moving the mass market to meet the mandated targets that were conceived in very different economic, geopolitical and market conditions. Previous assumptions of a market delivering steady BEV growth, cheaper and plentiful raw materials, affordable energy and low interest rates have not come to fruition, with the upfront cost of BEV models remaining stubbornly high. Added to this is consumers’ lack of confidence in the UK’s charging provision – despite recent investment and growth – which still acts as a barrier to BEV take up.

Under the UK government’s zero emissions mandate, volume manufacturers need to hit 22% BEV share this year or they could incur hefty fines.

BEV discounting

In an effort to offset this underlying paucity of demand, SMMT calculates that manufacturers are on course to spend at least £2 billion on discounting EVs this year. Given the many billions already invested to develop and bring these models to market, the situation is untenable and threatens manufacturer and retailer viability. For this reason, SMMT and twelve major vehicle manufacturers representing more than 75% of the market, have written to the Chancellor calling for measures to support consumers and help speed up the pace of the EV transition. These include:

- Temporarily halving VAT on new EV purchases to put more than two million new ZEVs (rather than petrol or diesel) on the road by 2028;

- Scrapping the VED ‘expensive car’ tax supplement for ZEVs, due next year, to avoid penalising buyers;

- Equalising VAT on public charging to match the 5% home charging rate, and mandating infrastructure targets to support those who cannot charge at home;

- Maintaining and extending the business incentives that are working, including Benefit in Kind which supports company cars and those on salary sacrifice schemes, and the important Plug-in Van Grant.

Mike Hawes, SMMT Chief Executive, said: “September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets. Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment.

“While we appreciate the pressures on the public purse, the Chancellor must use the forthcoming Budget to introduce bold measures on consumer support and infrastructure to get the transition back on track, and with it the economic growth and environmental benefits we all crave.”

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.